- Bitcoin’s rebound post-drop mirrors 2016 bull run patterns.

- RSI and Bollinger Bands suggest potential price correction or shift to the bullish trend.

As a seasoned crypto investor with a few scars from past market battles etched into my trading portfolio, I find myself drawn to the recent Bitcoin rebound post-drop. The patterns echoing the 2016 bull run have caught my attention and sparked a glimmer of hope in me. However, I remain cautiously optimistic, as the RSI and Bollinger Bands suggest potential price corrections or shifts to the bullish trend.

EUR/USD to Explode? Trump Trade Shocks Incoming!

EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastAs a researcher studying cryptocurrency markets, I observed an unprecedented decline on my own watch, specifically on the 5th of August. The value of Bitcoin [BTC] dipped dramatically, amounting to a staggering 16% drop – the steepest single-day fall since the FTX incident.

The significant drop we’ve seen is part of a larger selloff in the cryptocurrency market. Almost all alternative coins experienced losses in double digits as well, suggesting a serious contraction throughout the industry.

Bitcoin bounces back after the dip

Regardless of its recent significant drop, Bitcoin has experienced a robust comeback, demonstrating a striking resurgence by increasing by 8% over the last 24 hours and currently trading at approximately $54,791, according to CoinMarketCap.

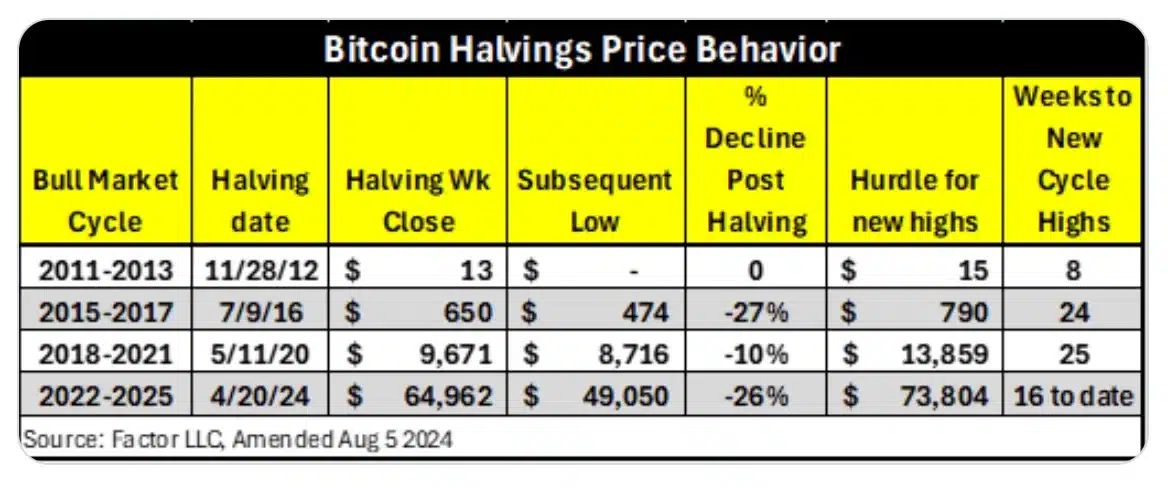

As an analyst, I find myself reflecting on the cautious sentiment surrounding Bitcoin’s current volatility. However, veteran trader Peter Brandt draws attention to a striking similarity: The recent downward trend in Bitcoin since its April 2024 halving echoes market patterns that preceded the 2016 bull run. This intriguing comparison serves as a potential beacon of hope for those who believe in Bitcoin’s long-term growth prospects.

Taking to X he noted,

“It’s worth mentioning that the current decrease in BTC‘s price post-halving seems to be mirroring the price trend during the bull market cycle from 2015 to 2017 following the halving event.”

For perspective, in 2016, Bitcoin dropped 27% from its halving price before soaring to new highs.

If it experiences a drop in price similar to the 26% decrease following its last halving, this trend could signal a possible opportunity for substantial growth ahead, much like the preceding bull market surge.

What are the technical indicators trying to tell us?

While Bitcoin’s price has recently risen, there are lingering worries since the Relative Strength Index (RSI) stands at 29, suggesting that sellers continue to outnumber buyers, maintaining control of the market.

After experiencing a significant 16% fall, Bitcoin moved into an area known as the oversold zone. Typically, when assets reach this oversold or overbought state, they tend to correct their prices.

The expanding Bollinger Bands indicate an increase in market volatility, possibly signaling a transition from a bearish to a bullish market condition.

Bitcoin’s on-chain metric analysis

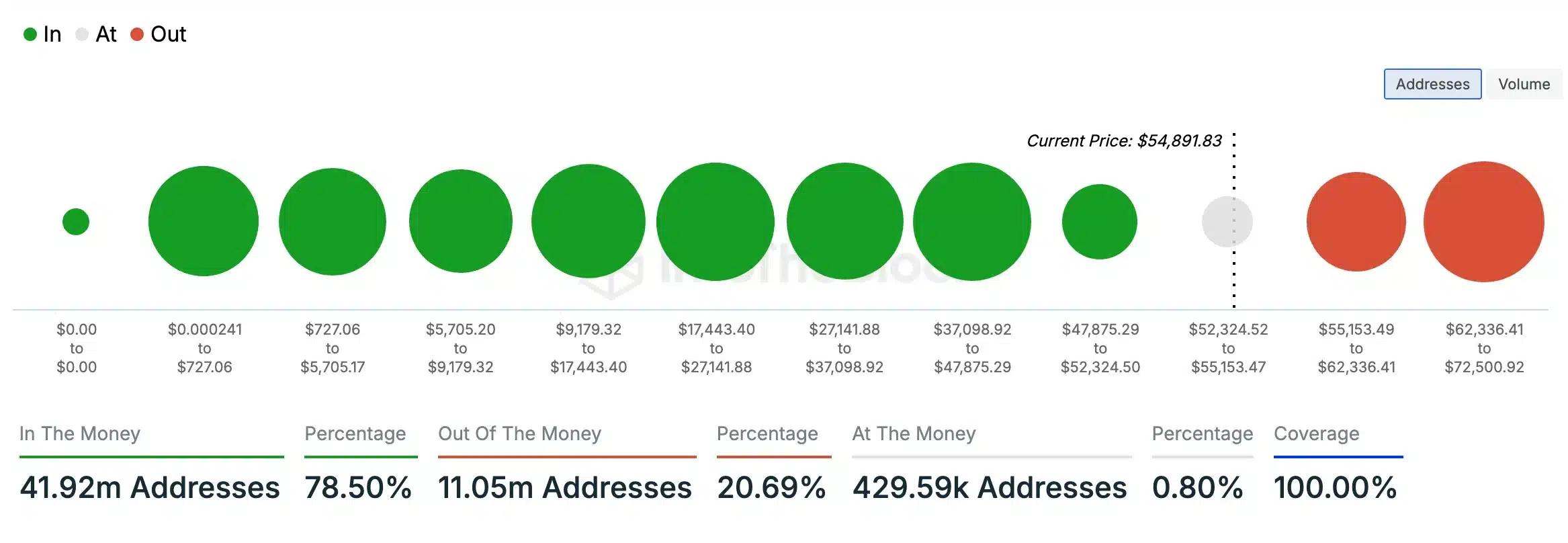

According to AMBCrypto’s analysis of IntoTheBlock’s data, it was discovered that around 78.50% of Bitcoin holders currently possess more Bitcoin than what they initially paid for, suggesting that most of them are experiencing a profit (at press time). This means they are in a favorable position, or “in the money.”

As a researcher, I’ve found that about one fifth (20.69%) of the Bitcoin holders are currently in a situation where the value of their tokens is lower than what they initially paid for them, which means they are “underwater” or “out of the money.”

As a seasoned cryptocurrency investor with years of experience under my belt, I find myself strongly convinced that Bitcoin (BTC) is gearing up for a bullish run. Over time, I have observed how this digital currency tends to surge following periods of market volatility and uncertainty. Given the current economic climate, I believe that BTC’s potential for growth is quite promising. It’s not just my opinion but also echoed by ‘The Bitcoin Therapist,’ who has a proven track record in accurately predicting market trends. While I can’t guarantee future results, I strongly recommend keeping an eye on Bitcoin as it may present a lucrative opportunity for investors seeking high returns.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-08-07 09:14