-

Bitcoin could remain bullish until it trades above $45k.

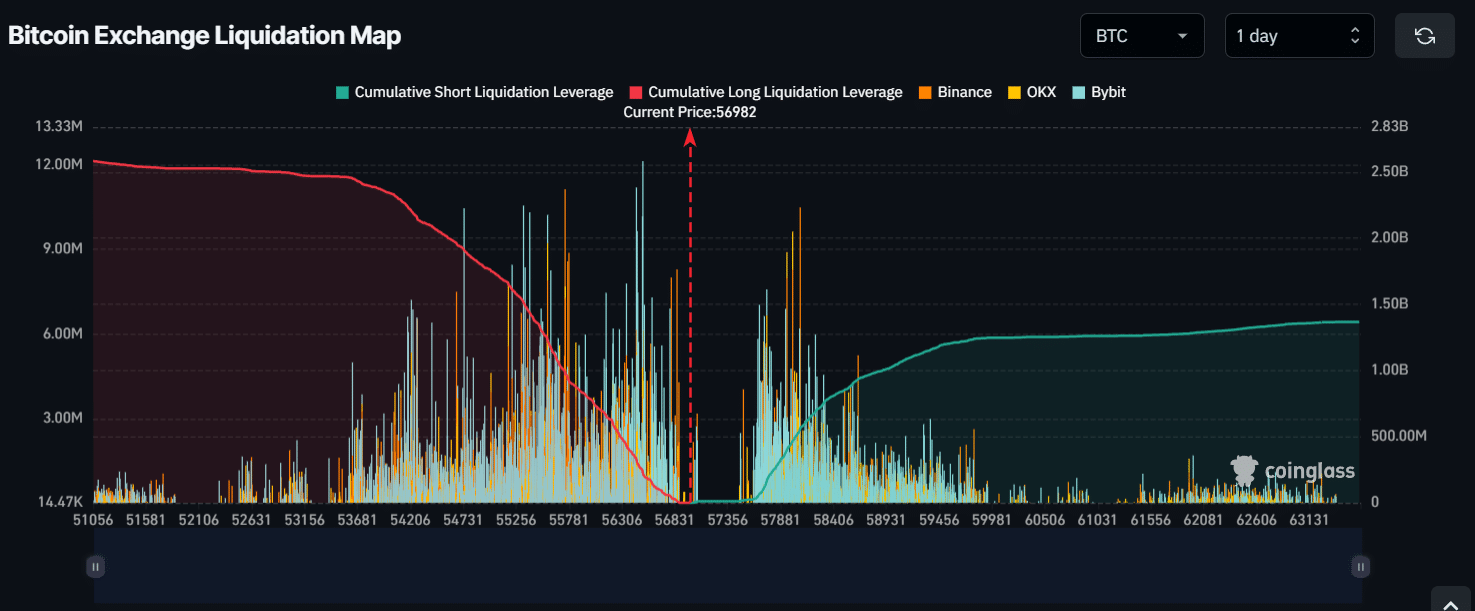

If BTC falls to the $54,700 level, nearly $2 billion worth of long positions will be liquidated.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by this current state of Bitcoin (BTC). While the bullish sentiment seems to be reigning supreme at the moment, with BTC trading above $57,200 and showing signs of recovery, there are some bearish indicators that cannot be ignored.

Following a dramatic drop in prices on the 5th of August, the market is currently showing signs of revival. Notably, top cryptocurrencies like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have observed substantial price increases over the past two days.

Amid this ongoing price recovery, Julio Moreno, CryptoQuant’s Head of Research, shared that Bitcoin was flashing a bear signal.

Bitcoin flashing bearish signal?

On platform X (originally Twitter), Julio recently posted an update stating that the bull-bear market cycle signal has turned bearish for the first time since early 2023.

Based on past records, this specific signal showed warning signs of a market downturn in both March 2020 and May 2021, much like it did before those crashes.

When re-sharing a tweet from Julio, Ki Young Ju, the chief executive of CryptoQuant, suggested that Bitcoin’s bullish trend might continue as long as its price exceeds $45k. In his own words, he highlighted this point on Twitter.

“While some signs suggest a downtrend, there’s a possibility they might bounce back. Let’s keep an eye on the current situation for about a week or so. If this persists longer, the threat of a prolonged bear market increases, and recovery could prove challenging if it lingers for more than a month.”

Currently, Bitcoin is being exchanged at a price higher than $57,200, and it’s seen a significant increase of more than 4% over the past day. Yet, surprisingly, the trading volume has decreased by approximately 38% within the same timeframe.

This massive fall in trading volume indicates a fear among traders and investors.

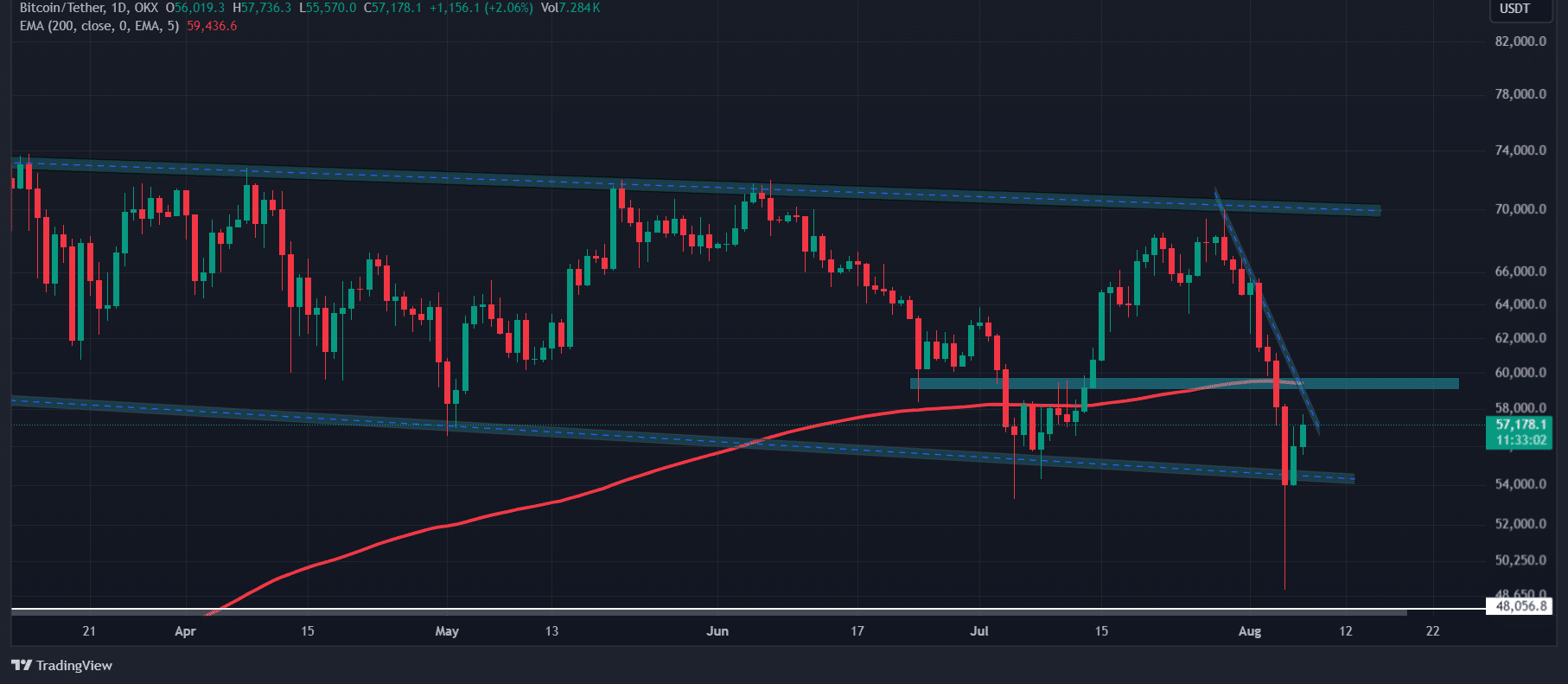

Bitcoin technical analysis

Based on professional assessments of technical trends, Bitcoin appears poised for a bull run that may push its price close to $60,000 over the next few days.

Approaching the $60,000 mark could prove significant for Bitcoin, as it encounters potential obstacles from a trendline and the 200 Exponential Moving Average (EMA), which might act as barriers to further price increases.

If Bitcoin (BTC) successfully surpasses its current resistance level, it’s likely that we could witness an impressive surge towards $70,000 over the next few days.

Currently, approximately $2 billion worth of long positions could potentially be liquidated if the price drops close to $54,700, which represents a significant liquidation point at the moment, given a shift in sentiment.

On the higher end, approximately $58,000 serves as a significant liquidation point. Should Bitcoin continue its upward trend without a change in sentiment, around $500 million worth of short positions may get liquidated if it reaches that level.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-08-07 22:15