- Solana’s hike positioned it at critical resistance levels, with potential for a bullish breakout towards $250

- Key support and resistance levels, along with derivatives data, pointed to a cautiously optimistic trend

As a seasoned crypto investor with battle scars from multiple market cycles, I’ve learned to read between the lines when it comes to price movements and technical indicators. Solana (SOL) has indeed shown promising signs of recovery, but we should never forget that the crypto market is as unpredictable as a roller coaster ride at an amusement park.

It appears that Solana (SOL) is leading the charge in the crypto market’s rebound after a notable dip on the price charts. At the moment of writing, Solana is exhibiting a bullish pattern, with its value hovering around $153.45 after a substantial increase.

This hike is significant for traders and investors monitoring key support and resistance levels.

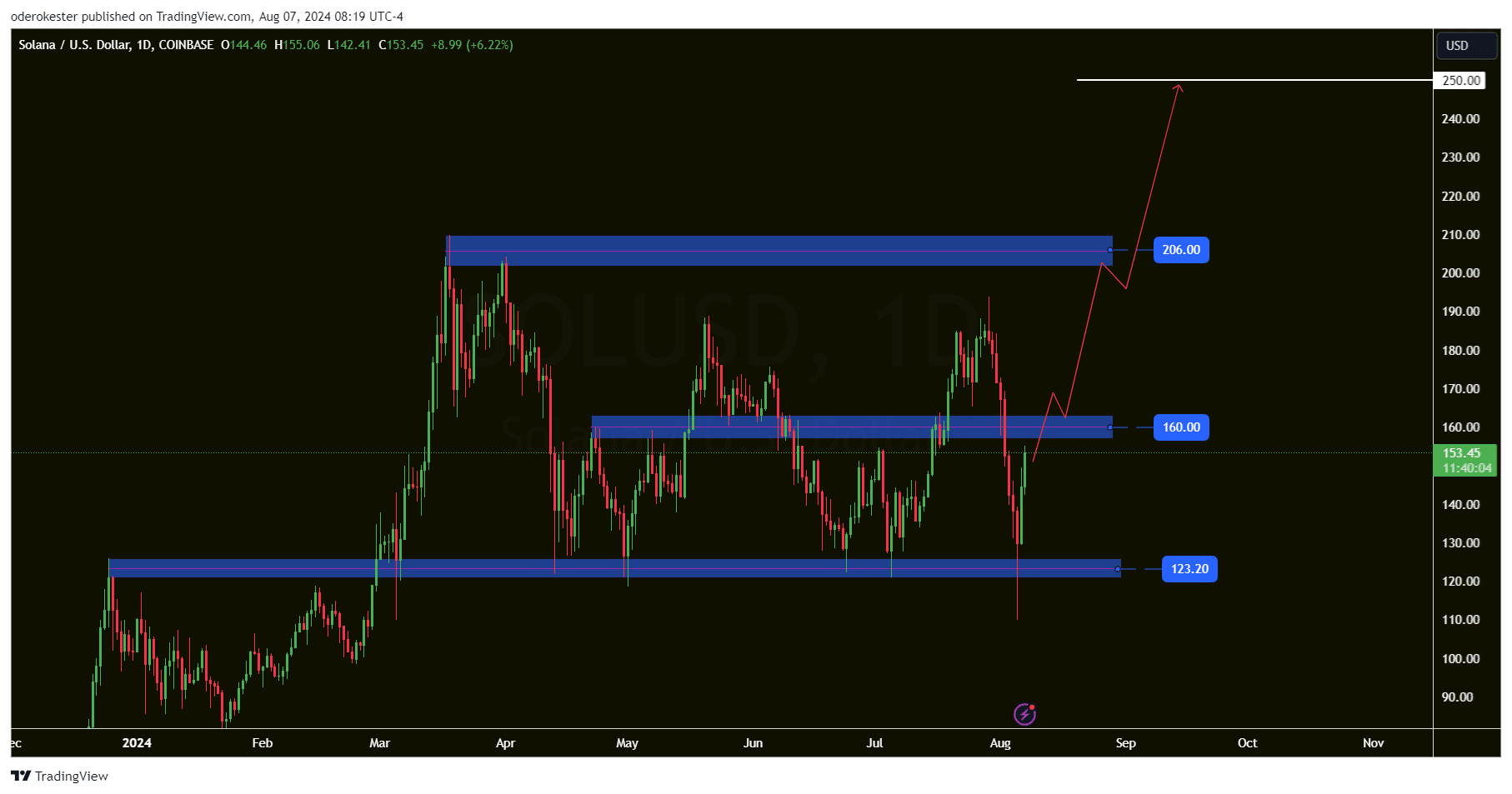

As a researcher, I’m keeping a keen eye on the price fluctuations of Solana (SOL). On the chart, three key points have been highlighted – $123.20 serving as a robust support level, $160.00 acting as an intermediate barrier for growth, and $206.00 marking a significant resistance point. These levels are instrumental in forecasting potential future price trajectories of SOL.

As a crypto investor, if Solana (SOL) maintains its upward momentum and surpasses the resistance at $160, it might encounter a hurdle around the $206 level. Should SOL manage to break through this barrier, it could suggest a robust bullish trend, potentially propelling SOL towards a target of $250.

In this situation, a continuous push from buyers and optimistic market feelings are crucial. It’s recommended that traders search for signs of increased trading activity (volume) during these price breaks, as this can confirm the robustness of the trend.

Technical indicators and market sentiment

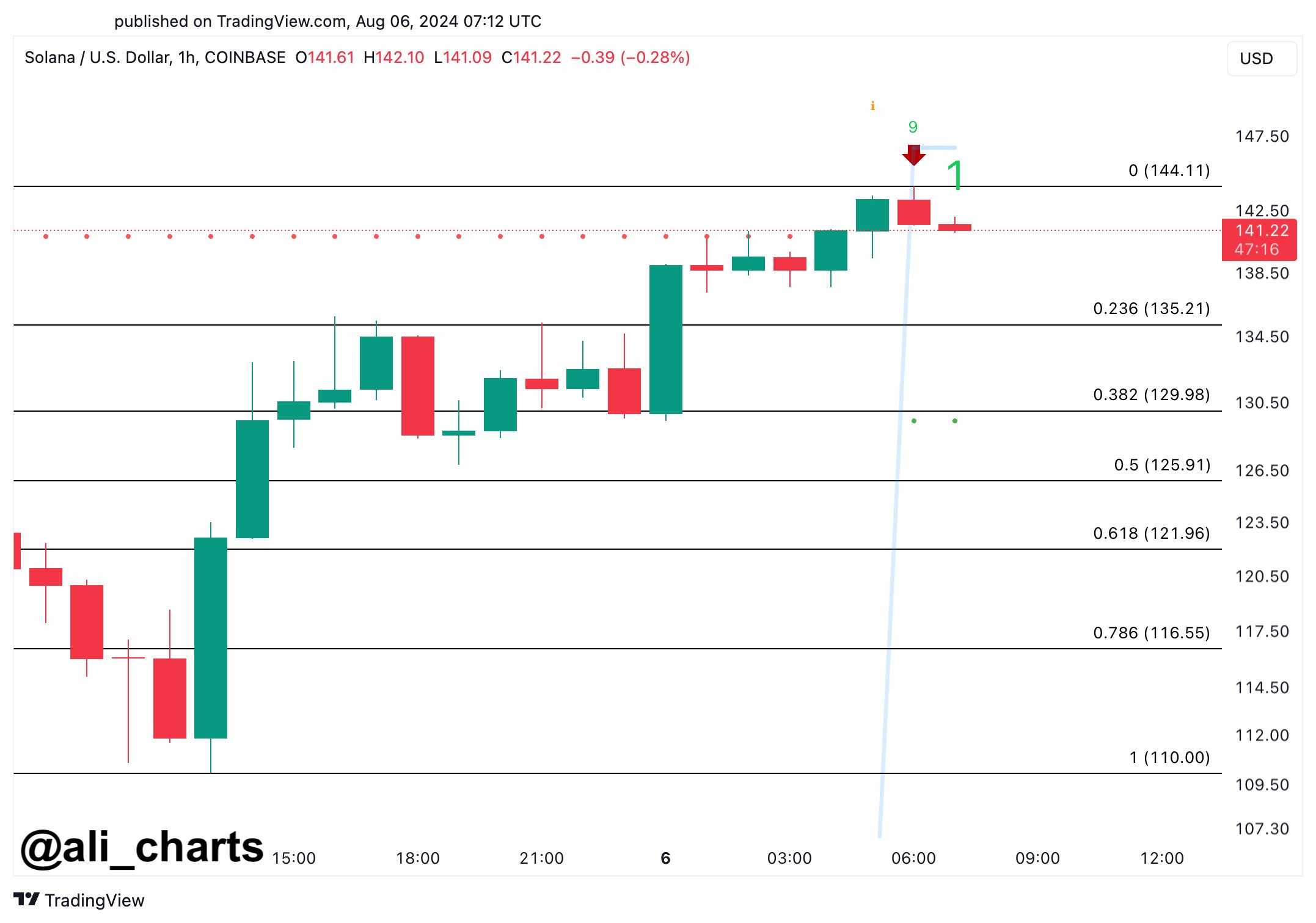

According to Ali Martinez’s comment on X,

“The TD Sequential indicator has triggered a sell warning on Solana’s hourly graph, hinting that there might be a drop in price towards $135 to $130. But if the critical level at $146 is breached, this signal could be negated, possibly pushing Solana’s price up to $150-$166.”

As a researcher, I’m observing that the Fibonacci retracement levels on our chart align with my current perspective. The 0.236-level at $135.21 and the 0.382-level at $129.98 could potentially serve as supportive regions. If the sell signal materializes as forecasted, these areas might encourage some price consolidation or a temporary pullback for traders to consider.

While SOL surpassing the danger threshold at $146 weakened the initial sell indication, it might suggest a favorable bullish trend instead. If this continues, the price could move upwards toward the $155 to $166 range.

If SOL doesn’t hold its present value and drops below $150, it might revisit the support at $123.20. Dropping below this support could suggest a downward trend, possibly leading to more decreases. Keeping an eye on these significant levels is essential for traders to make wise trading decisions.

As a researcher, I’m keeping a close eye on SOL‘s performance, given that its trajectory generally maintains a guarded optimism, dependent on its capacity to surmount the identified resistance points while sustaining its positive trend.

Derivatives data analysis

Solana’s derivatives data revealed mixed signals though.

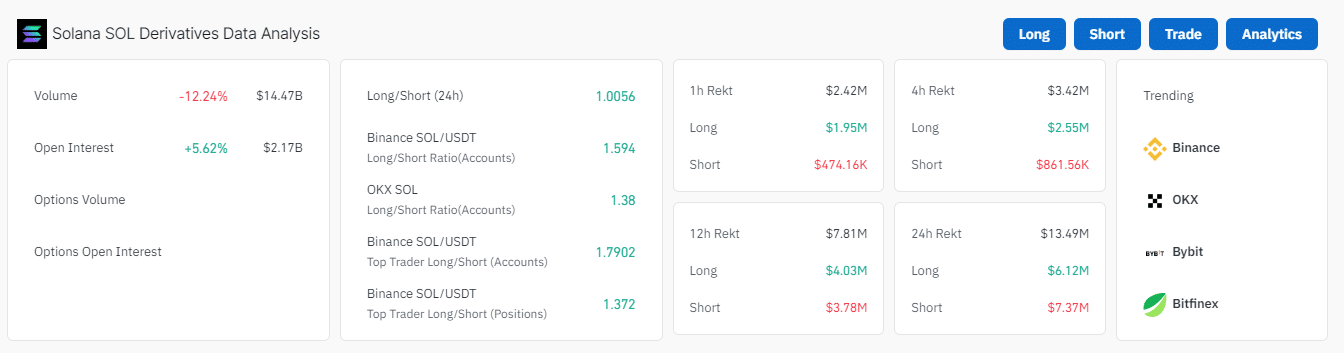

According to Coinglass data, the trading volume dropped by 12.24%, landing at approximately $14.47 billion, but the Open Interest increased by a significant 5.62% to reach around $2.17 billion.

Over a 24-hour span, a total of $13.49 million worth of positions were closed out, consisting of $6.12 million from long positions and $7.37 million from short positions. In the most recent 12 hours, there were liquidations amounting to $7.81 million, with $4.03 million coming from long positions and $3.78 million stemming from short positions.

In a span of 4 hours and an hour, the liquidated amounts stood at approximately $3.42 million and $2.42 million respectively, suggesting high trading intensity in both buy (long) and sell (short) orders.

Although there’s been a significant increase lately, market analysts still tread carefully, as per Ali’s prediction, Solana’s downturn may not have fully ended yet.

Therefore, it’s recommended that traders and investors stay updated with these latest events to ensure they make well-informed trades.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-08-08 11:04