- Solana ETFs approved in Brazil.

- Despite the approval of Solana based ETFs, the market remains bearish.

As a seasoned crypto investor with over a decade of experience in this dynamic and unpredictable market, I must admit that I have seen my fair share of highs and lows. The recent approval of Solana ETFs in Brazil has undoubtedly stirred excitement within the community, but as someone who’s learned to read between the lines, I remain cautiously optimistic.

For the past three months, there’s been great anticipation within the crypto market regarding the acceptance of Solana ETFs (Exchange Traded Funds). The initial applications for these Solana-based ETFs were submitted in Canada, followed by similar requests in the U.S. during June.

The green light for Ethereum ETFs has fueled optimism about the possibility of Solana ETFs as well. After much anticipation, the Brazilian Securities and Exchange Commission (CMV) has finally given the go-ahead to the world’s inaugural Solana-focused exchange-traded funds.

Brazil’s CVM approves Solana ETFs

After many months of waiting, the first SOL ETF ever was approved in Brazil.

As reported by the CVM (Comissão de Valores Mobiliários), the Securities and Exchange Commission of Brazil, the SOL ETFs are currently undergoing preparations for operation. However, they have not been officially approved by the Brazilian stock exchange yet.

In Brazil, the Solana-related Exchange Traded Funds (ETFs) will employ CME CF Solana dollar benchmark rates. These rates are developed by CF Benchmarks as part of their partnership with the Chicago Mercantile Exchange (CME).

Additionally, the Brazilian asset manager QR will provide the ETF, and Vortax will be the manager.

By greenlighting the first SOL ETF, Brazil has established itself as a global leader embracing cryptocurrencies. For the past three years, it has ventured into numerous investment opportunities involving Ethereum and Bitcoin, thus demonstrating a broad and innovative stance towards digital currencies.

Any impact on SOL price charts?

Although there’s positive news about Solana, its market hasn’t shown a positive response yet or displayed any substantial negative price fluctuations. At the moment, Solana (SOL) is being traded at $153, representing a 0.39 increase daily and an 8.95% decrease over the past week.

Trading volume has declined over the past 24 hours by 4.25% to $5.4 billion.

Similarly, AMBCrypto’s examination indicates that Solana (SOL) has seen a significant downward trend. Consequently, the recent increases have not yet reversed this overall direction.

Initially, at the current moment, the Chaikin Money Flow of SOL‘s (Solana) was less than zero. This implies that there has been substantial selling activity in Solana over the last seven days.

In simpler terms, when The Awesome Oscillator (AO) falls below zero, it indicates that the current market trend’s speed is slower compared to its previous trend, suggesting a downward or bearish momentum in the market.

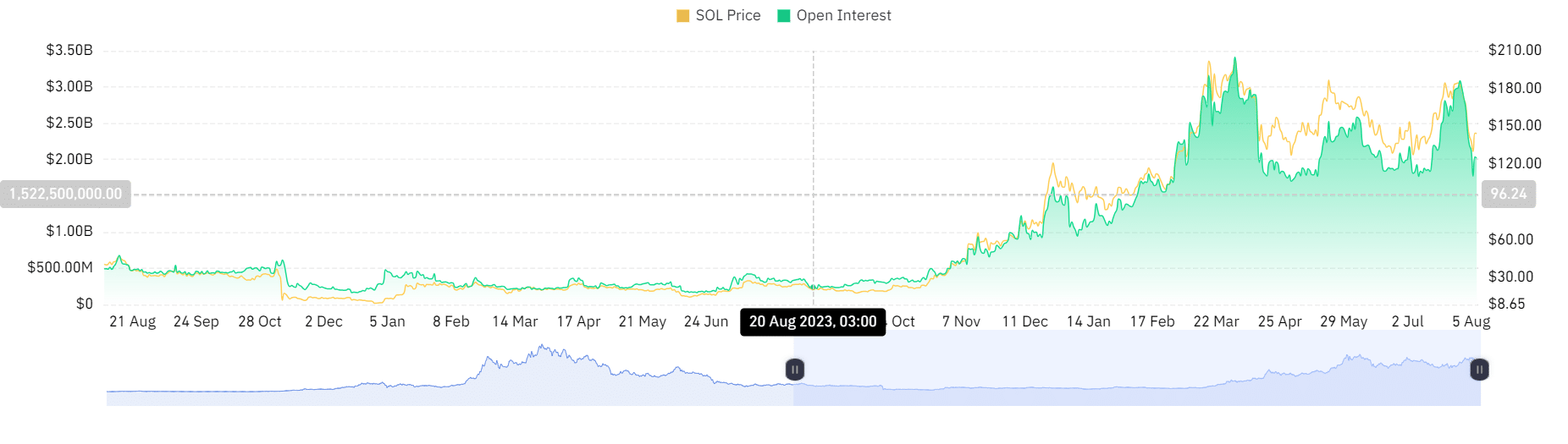

Upon closer examination, it appears that the total open interest on Coinglass has dropped significantly from $3.09 billion to $2.02 billion within the last week. This indicates that many investors are choosing to liquidate their existing positions without establishing new ones, which can be seen as a bearish sign in the market.

Realistic or not, here’s SOL’s market cap in BTC’s terms

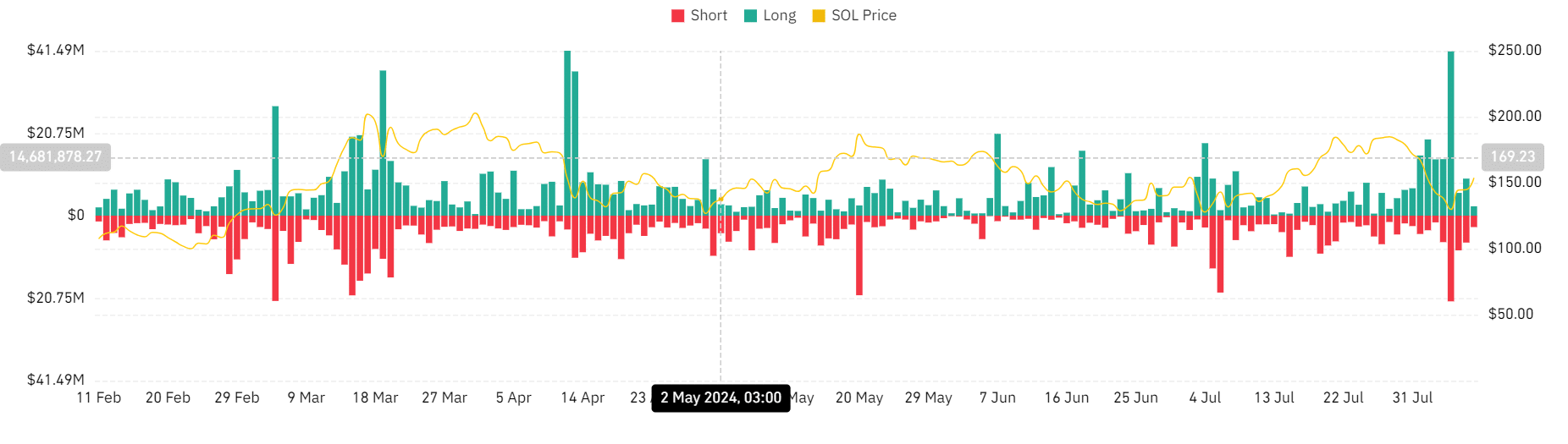

Over the last day, SOL registered a total liquidation amounting to approximately $21.19 million. Such a figure underscores substantial market turbulence, leading numerous investors to exit their investments.

Consequently, even though Solana Exchange-Traded Funds have been approved in Brazil, the market remains pessimistic about the altcoin.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-08-08 11:36