-

Japan’s ‘MicroStrategy’ is intent on buying more BTC for its reserves

Ongoing market dynamics might dictate widespread corporate adoption

As a seasoned crypto investor with a few gray hairs to show for it, I’ve witnessed my fair share of market fluctuations and trends. The news that Japan’s Metaplanet is aggressively buying more Bitcoin for its reserves brings a sense of deja vu, reminding me of MicroStrategy’s similar moves in the past.

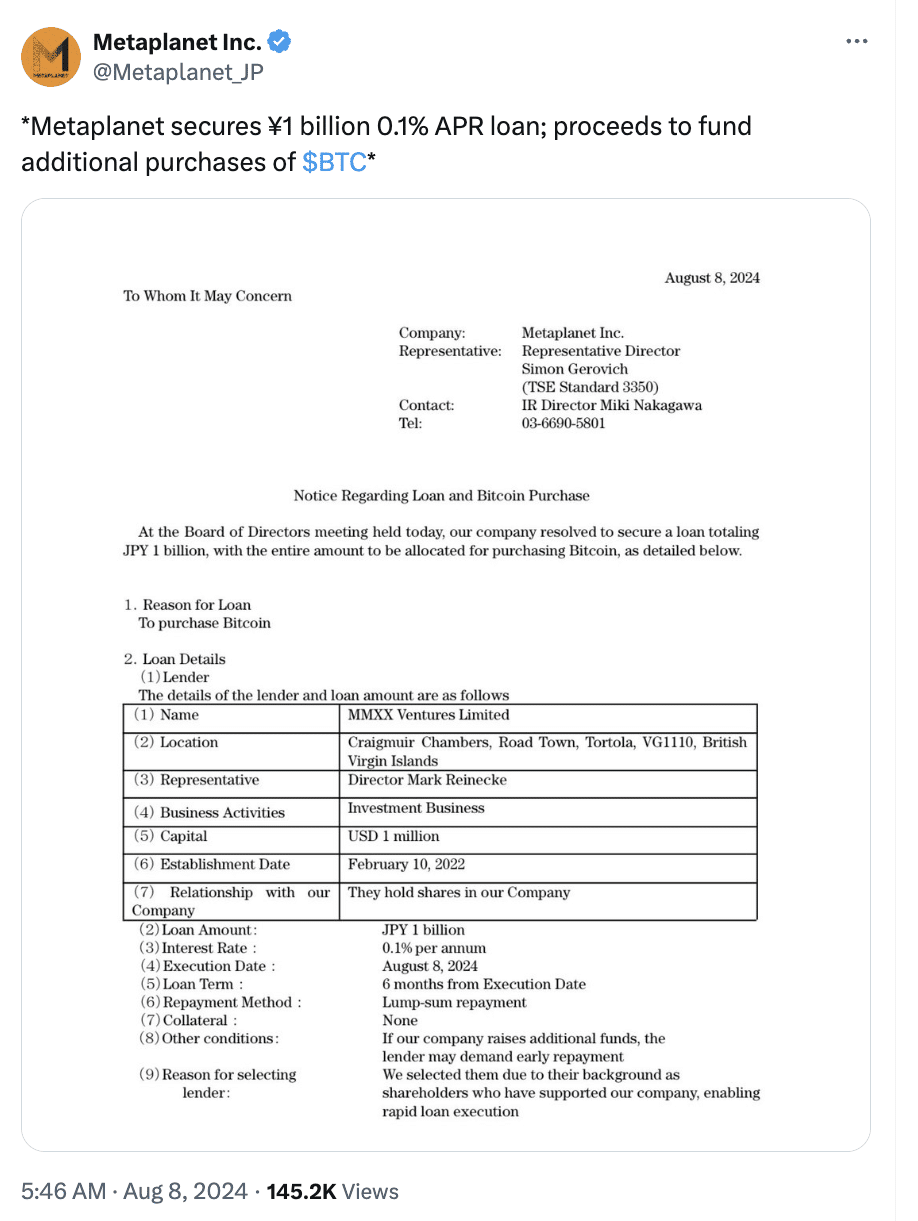

Metaplanet, a Japanese firm, received a JPY 1 billion loan from MMXX Ventures Limited, one of its main investors, for the purpose of buying more Bitcoin (BTC). With this funding, Metaplanet expects to acquire approximately 110 additional Bitcoins, thereby enhancing its digital currency assets.

Not the first step…

As a researcher, I’m observing that our recent actions are part of a strategic approach to bolster our Bitcoin reserves within the company. To illustrate, Metaplanet recently declared a Gratis Allotment of Stock Acquisition Rights worth JPY 10.08 billion, which serves as a means to effortlessly acquire more Bitcoins.

Furthermore, the business has become part of the ‘Bitcoin for Businesses’ program, placing it among an increasing number of organizations that consider Bitcoin a suitable option for holding reserves.

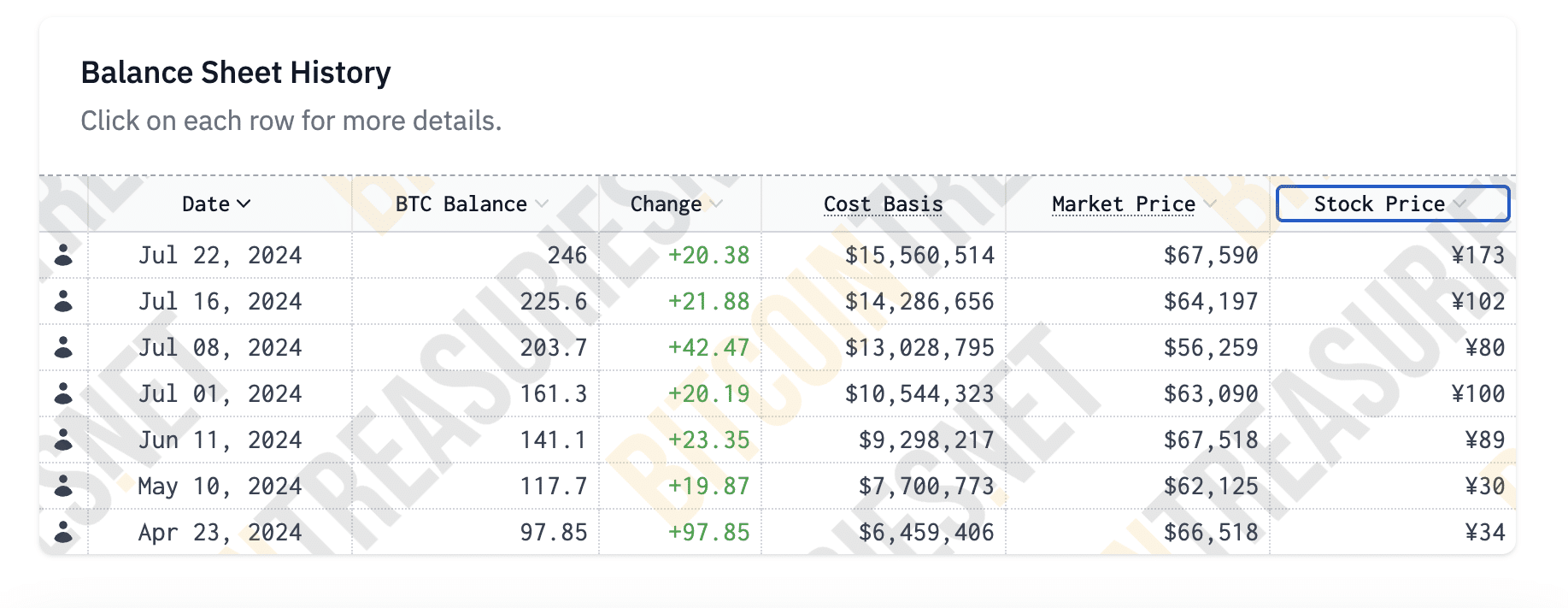

As an analyst, I’ve observed that Metaplanet currently holds around 246 Bitcoins, demonstrating their bold acquisition approach. This strategic move suggests a robust conviction in Bitcoin’s enduring worth and stability over the long term.

To boost its Bitcoin investments, Metaplanet intends to protect itself from inflation and expand its financial portfolio. By doing so, they capitalize on Bitcoin’s prospective high yields and its rising popularity as a valuable asset store.

The decision to dive deeper into Bitcoin and cryptocurrency is driven by several factors though.

As a crypto investor, I find the unique characteristics of Bitcoin particularly appealing. Its limited supply and decentralized system provide a shield against the ups and downs of traditional finance markets and inflation.

In addition, with central banks persisting in their loose monetary strategies, firms such as Metaplanet view Bitcoin as a protective measure against the erosion of currency value and economic turbulence.

A trend in the making?

Metaplanet’s daring actions might motivate other publicly traded companies to do the same. If more businesses decide to hold Bitcoins in their reserves, it could substantially influence Bitcoin’s market value. Moreover, this development could enhance Bitcoin’s reputation as a trustworthy and mainstream financial asset.

For example, consider MicroStrategy – this data analytics company has paved the way by transforming a significant amount of its liquid assets into Bitcoins. This action not only increased MicroStrategy’s share value, but also indicated a change in corporate perception towards Bitcoin.

Similarly, Tesla’s announcement of a major Bitcoin purchase led to a notable price surge too.

These actions can boost a corporation’s assurance when considering the use of Bitcoin, a digital currency that has faced criticism, particularly in terms of regulation and government approval, for quite some time.

Read More

2024-08-08 13:11