- Stellar Lumens rebounded swiftly from the range lows.

- Strong spot demand and bullish sentiment were key to the reversal.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The recent rebound of Stellar Lumens [XLM] from its range lows has caught my attention.

As a seasoned cryptocurrency investor with years of experience under my belt, I can tell you that the recent price fluctuations of Stellar Lumens [XLM] have caught my attention. Having witnessed numerous market cycles and trends, I’ve learned to read between the lines when it comes to digital assets.

As a seasoned investor with over two decades of experience under my belt, I’ve learned to spot trends and potential opportunities in the market that many might overlook. Recently, the prospect of a formation of a range for a particular asset has caught my attention. The recent gains could be partly linked to the SEC settlement with Ripple [XRP], a move that, given my past experiences, I believe could have far-reaching implications for the entire crypto market. Interestingly, XRP and XLM share similarities in their approach to solving cross-border payment issues – something that resonates deeply with me, given my global investment portfolio and extensive travels. This development has piqued my interest and I will be closely monitoring these assets for potential investment opportunities.

Exploring the Stellar Lumens range formation

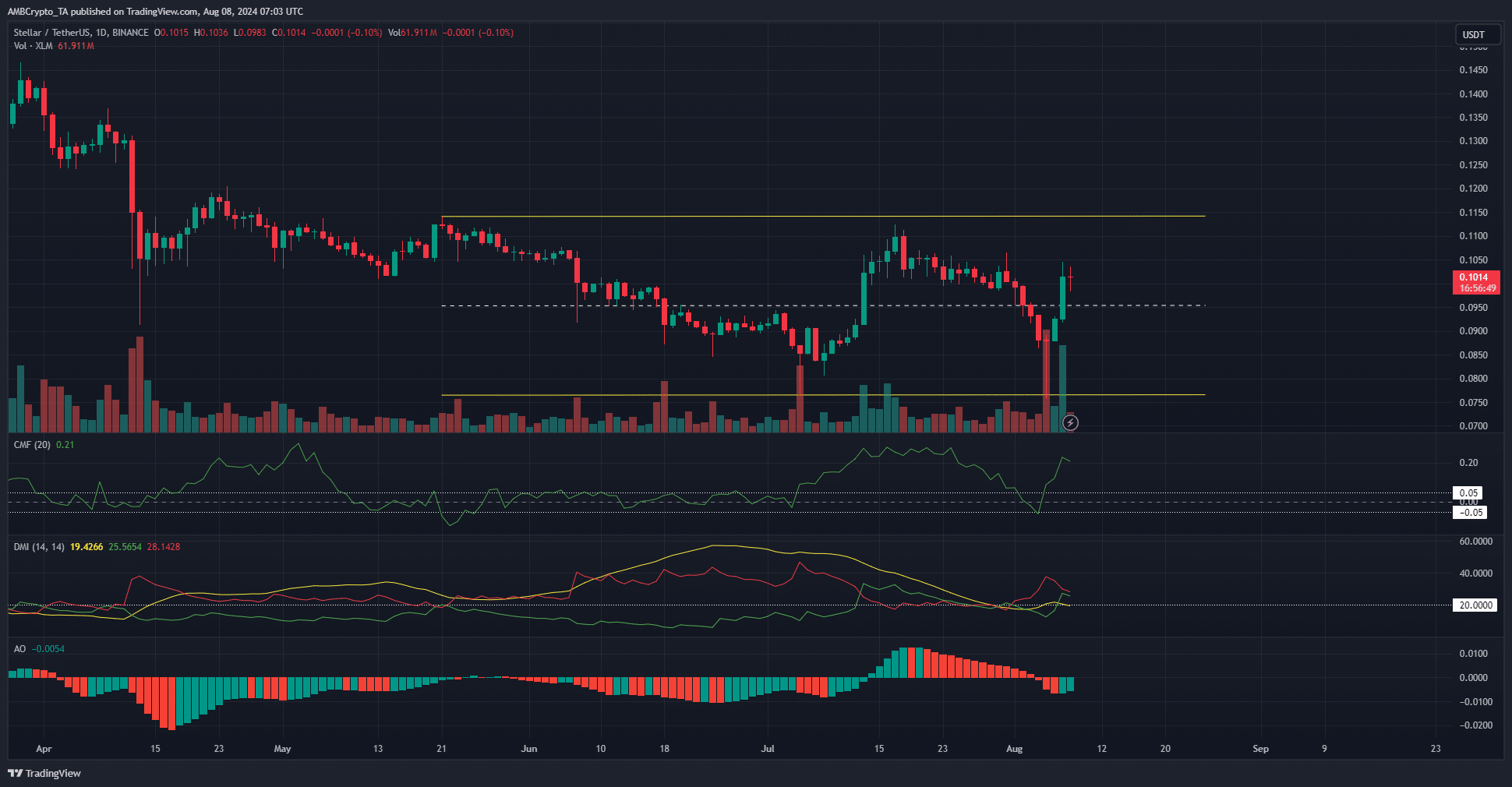

Over the past month, the price of the yellow range fluctuated between $0.0765 (minimum) and $0.1114 (maximum). During mid-June, the midpoint at $0.0954 functioned as a supportive level. However, in late June and early July, it acted as a resistance zone. Now that it has been surpassed, it is expected to serve as a source of support moving forward.

The Capital Movement Fund (CMF) rose by 0.21, indicating substantial investments flowing into the market, causing prices to escalate. Yet, the Discrete Market Index (DMI) didn’t demonstrate a definitive upward trend at the moment. This notion was further validated by the market’s price behavior.

To surpass the last minor peak of XLM at $0.1065 could signal a shift towards a bullish trend, although it remains uncertain whether we’ll break through the resistance levels. The Awesome Oscillator indicates that the momentum is still tentatively leaning bearish.

Sentiment and demand were taking a U-turn

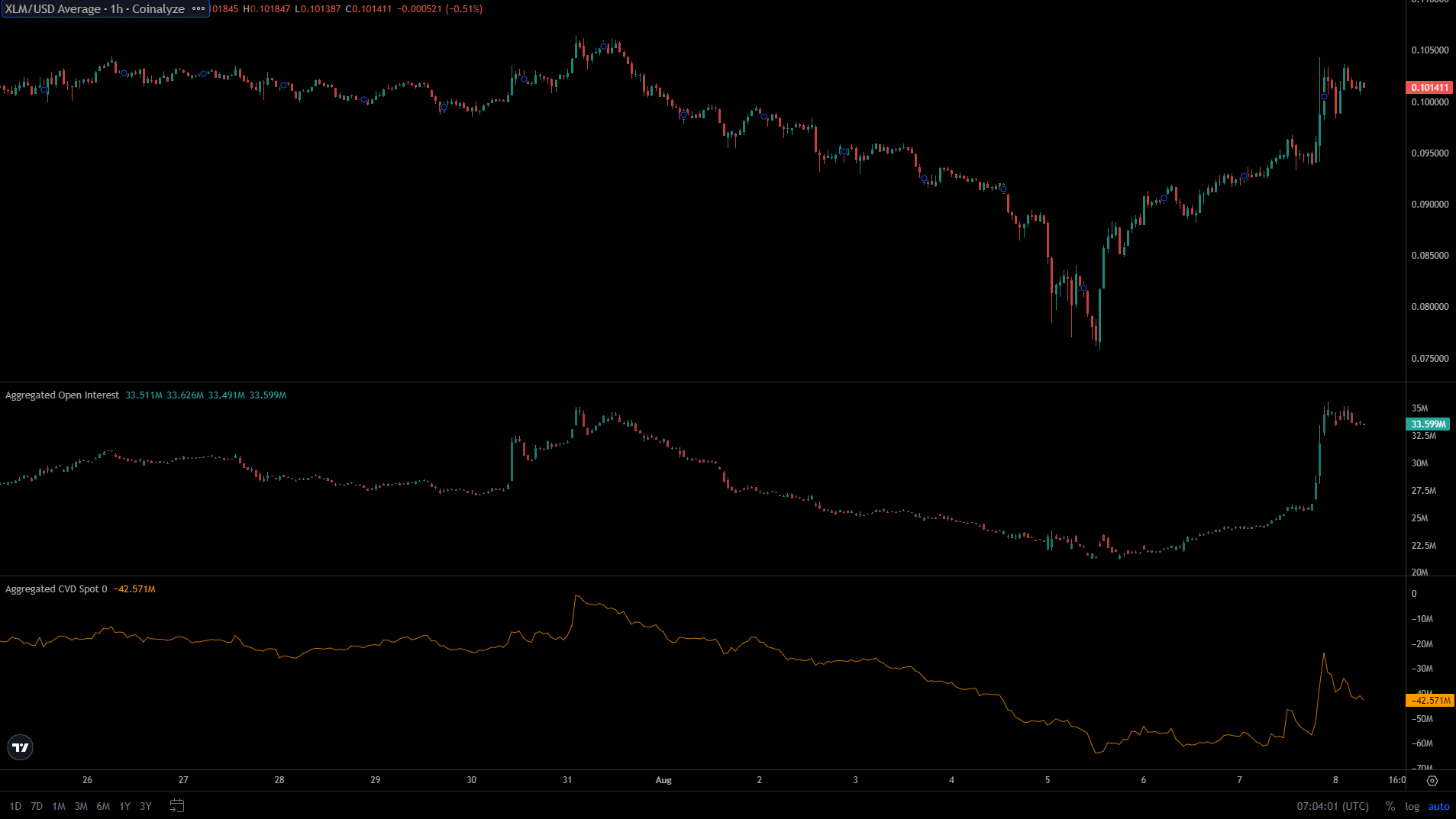

After the significant drop in cryptocurrency prices on Monday, the Open Interest has been steadily increasing. On the 7th of August alone, it surged from $25 million to an impressive $35 million, as prices managed to break through the temporary resistance at $0.095.

Is your portfolio green? Check the Stellar Lumens Profit Calculator

From my years of trading experience, I can confidently say that the recent market trends have shown a strongly optimistic outlook. Not only is the overall sentiment bullish, but I’ve also noticed that the spot CVD has been steadily climbing over the past three days, reflecting a consistent demand in the market. This upward trend aligns with my analysis and supports my positive outlook for the near future. I always find it reassuring when market indicators corroborate my own observations.

This could fuel a breakout past the $0.1114 range highs.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

2024-08-08 18:15