As a seasoned crypto investor who has witnessed the rise and fall of numerous digital assets, I must say that the integration of USDe stablecoin with Solana’s blockchain is a move that catches my attention. My investment journey spans over a decade, and I can confidently say that scalability and cost-effectiveness are two crucial factors in the success of any crypto project.

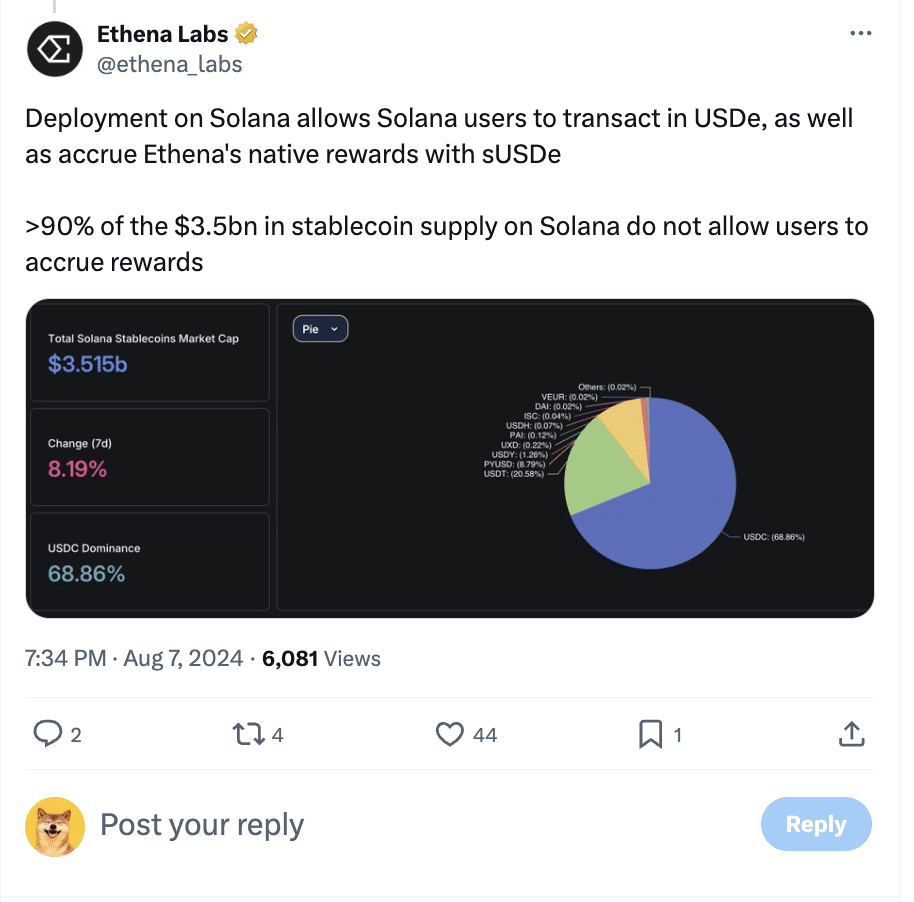

Today, Ethena Labs, creators of the USDe stablecoin, are making headlines following their integration with Solana’s blockchain on August 7th. This strategic decision enables USDe to take advantage of Solana’s fast and affordable infrastructure, resulting in a substantial improvement in the stablecoin’s performance capabilities.

In addition, the supporting asset for USDe (a stablecoin on Solana) is proposed to be Solana’s native token, SOL, subject to governance vote approval.

According to the DeFi project,

“Adding SOL as collateral could potentially trigger an extra inflow of $2-$3 billion in active trading contracts.”

This hike in scalability is crucial for the stablecoin market, as it provides more liquidity and stability, making USDe a more robust and reliable option for users.

Utilizing USDe on the Solana blockchain now expands its reach to various Decentralized Finance (DeFi) solutions within the Solana ecosystem. Examples include Kamino Finance, Orca, Drift, and Jito. Users are empowered to contribute liquidity to these platforms or employ USDe as security for margin trading operations.

In this manner, they can accumulate Ethena Satoshis (EthSats), which can later be exchanged for ENA tokens at the conclusion of each campaign. This feature offers users additional avenues to engage with the Decentralized Finance (DeFi) ecosystem, boosting their earning possibilities and involvement in the burgeoning DeFi market.

What does this mean for DeFi?

As a financial analyst, I’d describe Kamino Finance as a tool that empowers me to automate my DeFi investment strategies, maximizing returns with minimal effort. On the other hand, Orca is a versatile decentralized exchange, boasting an intuitive interface and seamless trading options, making it a go-to platform for efficient transactions in the digital asset space.

Instead, Drift specializes in a decentralized platform for derivatives trading, whereas Jito concentrates on delivering sophisticated trading instruments and analytical resources.

Including USDe on these platforms expands the choices for users, offering them a stronger and broader range of applications for their stablecoins within the Decentralized Finance (DeFi) sector.

The partnership between USDe and Solana represents a major achievement for Ethena Labs and the stablecoin sector. By utilizing Solana’s strengths, USDe aspires to offer its clients a more agile, streamlined, and multifaceted stablecoin option.

Introducing more liquidity and security resources into USDe strengthens its reliability and usefulness, making it a compelling choice for users interested in interacting with Decentralized Finance (DeFi) platforms built on Solana.

Read More

2024-08-08 18:47