-

Analysts predict the imperative $50K BTC support will hold.

Increased wallet activities on Bitcoin signals long-term bullish sentiment.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless bull and bear cycles. The current situation with Bitcoin is intriguing, to say the least. The $50K-$52K support level holding strong suggests a potential long-term bullish sentiment, but we must remember that prices rarely bottom out and stay there.

The idea that Bitcoin [BTC] has hit its bottom is not confirmed. For a true bottom, the price needs to revisit the support level multiple times.

Typically, prices don’t remain at their lowest point; instead, they tend to create a ‘double bottom’ pattern where they briefly revisit the previous low before rising. Alternatively, they might make a new higher low, indicating a potential price increase, or they could move horizontally for some time as investors accumulate assets.

If the price currently hovering around $50,000 to $52,000 typically holds in 95% of cases, then it may indicate that this is a strong support level. However, if this level doesn’t mark the bottom, there’s a chance the price could drop below it during this revisit.

However, if it is the bottom, the price should come back to this level with a slow pullback.

To trust that the market will make a favorable move, allow the price to gather strength by forming a supportive base. Traders and investors may now employ dollar-cost averaging, investing consistently over time, or wait for the price to verify this supportive base before making an investment.

Mayer Multiple is at the lowest level since 2022

In simpler terms, the Mayer Multiple compares the current price of Bitcoin with its average price over the past 200 days. This 200-day average serves as a widely recognized benchmark to help identify whether the market trend is generally upward or downward.

Right now, the Mayer Multiple is as low as it’s been since the base of the 2022 Bear Market. If you believe Bitcoin’s price will increase in the next 6-12 months, this could be an excellent moment to purchase. This phase presents a chance to invest at reduced prices.

Whales buy more BTC during the dip

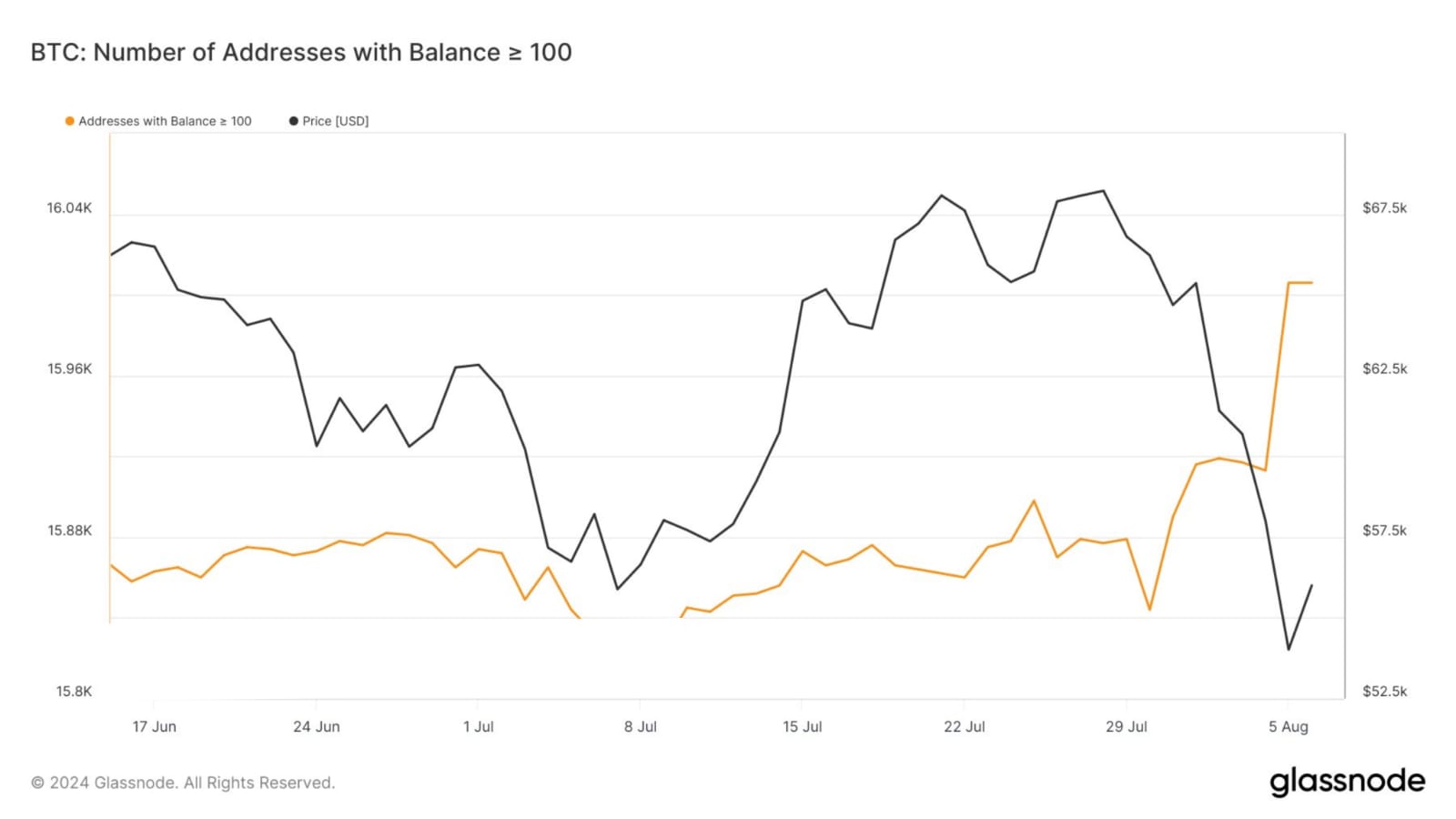

During the latest market downturn, the count of Bitcoin wallets containing over 100 coins increased from 15,913 to 16,006, indicating that significant investors took advantage of the dip to purchase more Bitcoin.

Michael Saylor, the ex-CEO of MicroStrategy and a significant Bitcoin investor, revealed that his Bitcoin holdings are valued at more than one billion dollars. According to Glassnode, this value peaked at its maximum in the year 2024.

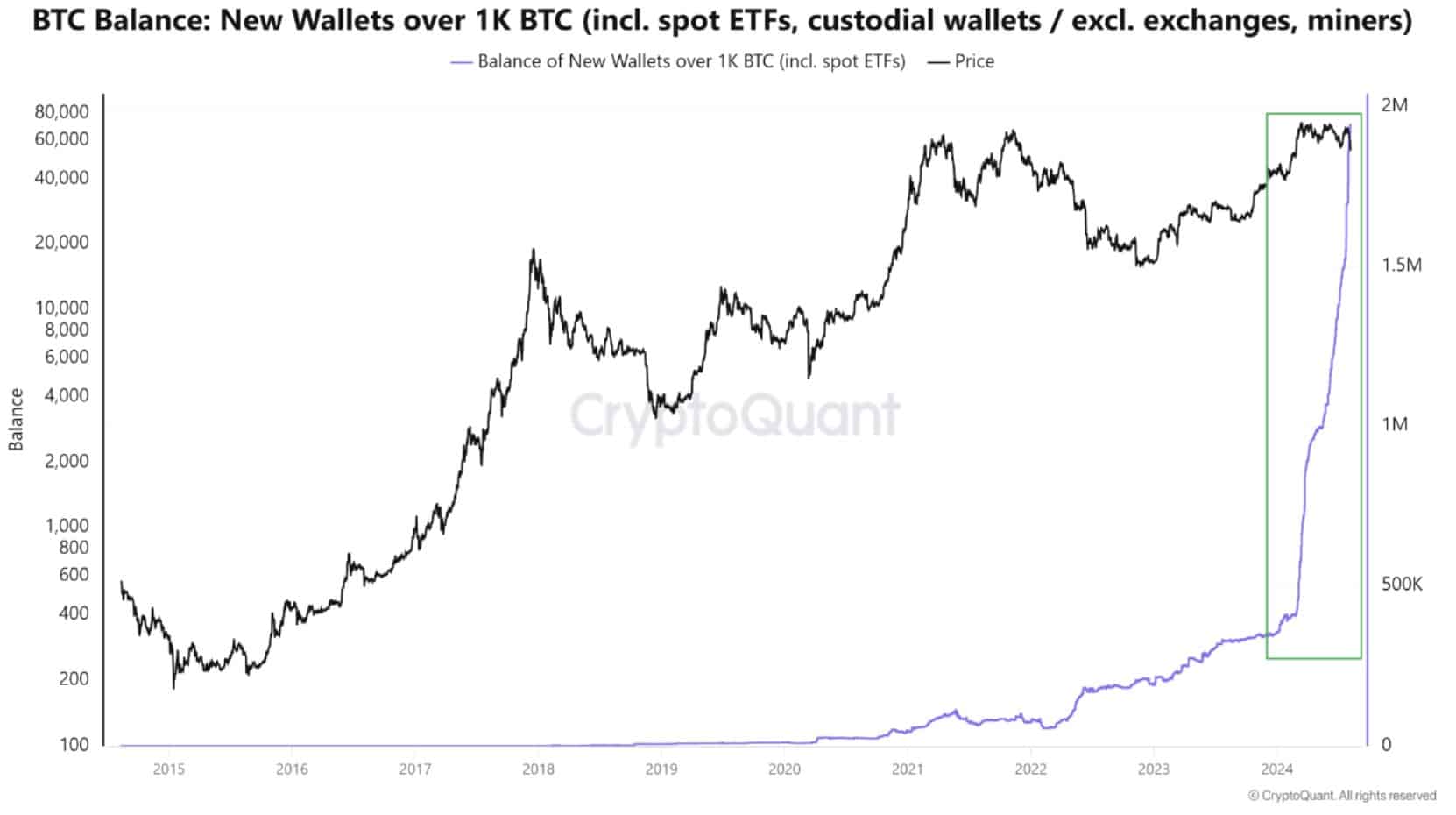

According to data from CryptoQuant, the launch of the Spot Bitcoin ETF has led to a record increase in the number of Bitcoin wallets containing more than 1,000 BTC.

It seems that this rise suggests that experienced, knowledgeable investors are actively purchasing more Bitcoin, whereas less experienced investors and traders appear to be offloading their Bitcoin in a state of worry or haste.

Read More

2024-08-08 19:03