- Litecoin’s price action signaled a lack of enthusiasm or low accumulation.

- On-chain data still supported growing accumulation as swing and retail traders exited.

As a seasoned crypto investor with a knack for spotting trends and interpreting data, I’ve seen my fair share of bull runs and bear markets. Litecoin [LTC], once hailed as silver to Bitcoin’s gold, has been treading on thin ice lately. Its price action suggests a lack of enthusiasm, but I believe that the recent accumulation trend hints at a potential comeback.

In previous discussions, Litecoin (LTC) has been referred to as the ‘gold’ equivalent of Bitcoin (BTC), similar to how silver is to gold in the physical world. But recently, this digital ‘silver’ seems to favor the bear market more frequently, with only occasional strong bullish surges.

Looking back at Litecoin’s past events from March 2024 onwards, there seems to have been a lack of strong optimism or bullish sentiment. This trend persisted even following the recent market downturn, and though it has shown some signs of recovery, the overall confidence remains relatively low.

A quick drop below $50 indicated that it had broken through a significant support line that hadn’t been breached since November 2022.

As a cryptocurrency investor, I noticed that the breakdown in support, coupled with a quiet period of accumulation, and an absence of significant price buzz, seems to suggest a rather subdued interest in LTC. However, considering how unpredictable the crypto market can be, could this low demand phase be just a temporary lull?

Our analysis revealed that Litecoin could soon find the necessary momentum for a strong comeback.

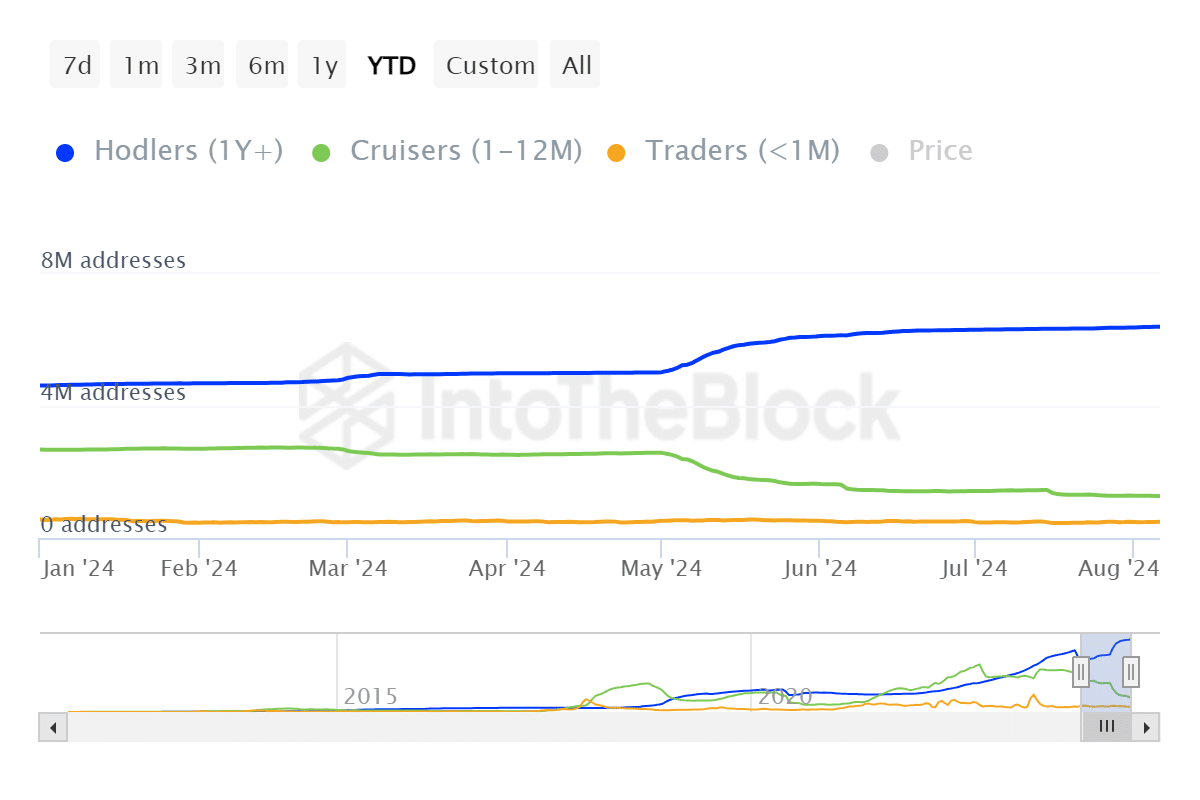

Litecoin holders shifting to a long term focus

In simpler terms, excessive short-term profiteering has been limiting the upward trend (bull market) in Litecoin. However, recent data on ownership suggests that this restriction may soon weaken or disappear.

In the past seven months, the number of HODLers has grown significantly, rising from approximately 4.62 million to over 8.16 million wallets by the 6th of August.

Over the course of time, there has been a significant decrease in the number of cruisers and swing traders. At the beginning of 2024, this figure stood at approximately 2.68 million. More recently, it has reduced to around 1.25 million addresses.

Retail traders had a more modest drop from 564,000 to lightly above 488,000 addresses. These changes indicated a growing focus on long-term HODLing as prices dip lower.

As an analyst, I noticed a decrease in the activity of both swing and retail traders, which could indicate a potential lessening of short-term selling pressure.

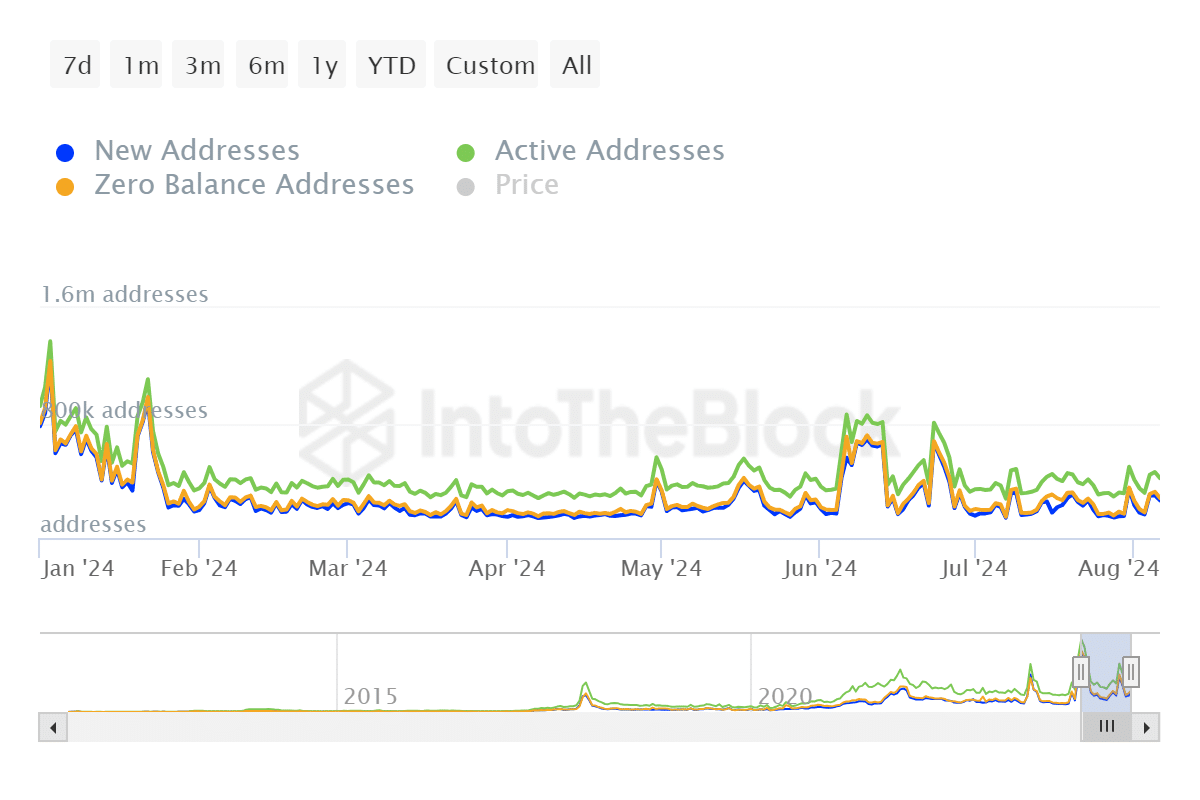

It appears that the number of newly created, actively used, and inactive addresses with no balance has decreased noticeably over the past few months as compared to the beginning of the year.

Despite some fluctuations, the number of active and newly created addresses has remained fairly consistent. In recent times, active addresses have exceeded 400,000, while an average of around 250,000 new addresses have been generated daily.

On average, there were around 225,000 wallets with no funds (zero balances), which is significantly less than the number reported at the beginning of the year, where over a million wallets were found to have no funds.

This could also signal that outflows are on the decline.

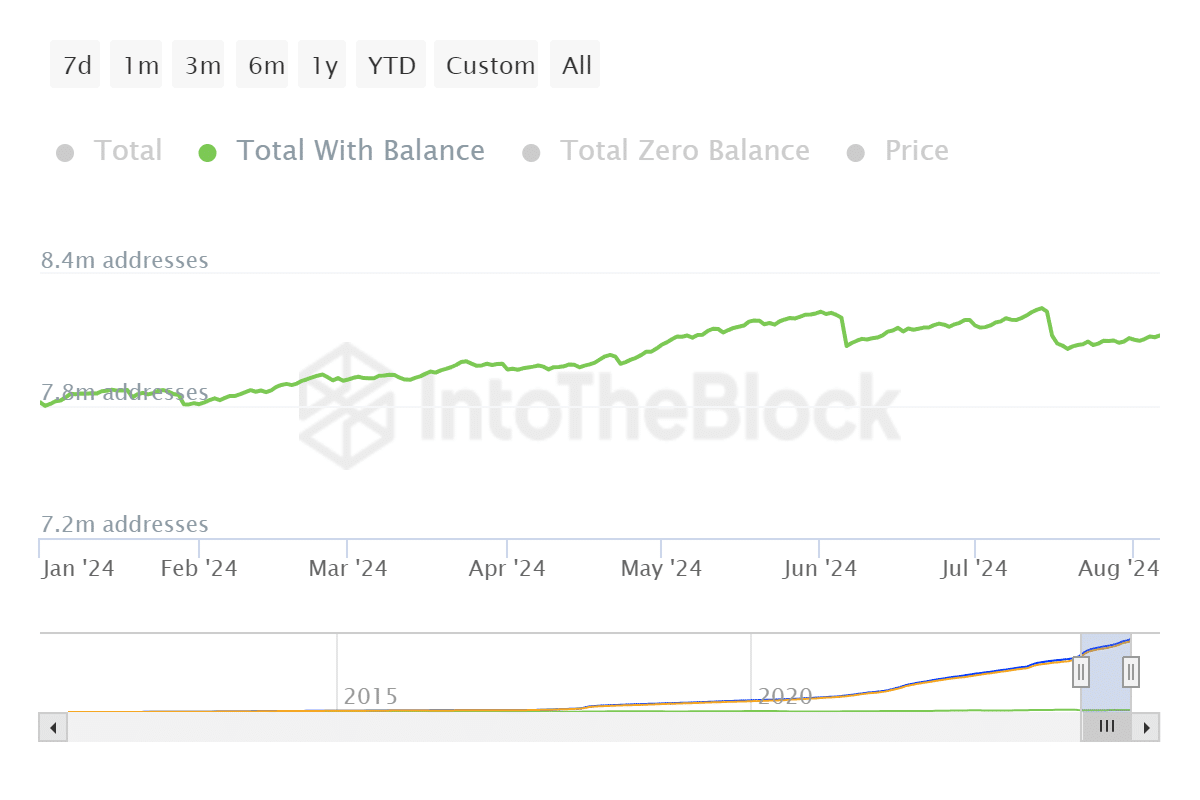

According to AMBCrypto’s analysis, there has been a generally increasing pattern in the total count of Litecoin wallets or addresses.

As of the beginning of 2024, Litecoin had a total of 7.82 million addresses. This number has since increased to 8.11 million as we speak, suggesting that the cryptocurrency is still expanding, though at a relatively modest rate.

Additionally, a lackluster response might stem from it being overshadowed by larger and more widely recognized alternatives such as ETFs (Exchange-Traded Funds) and meme-based cryptocurrencies.

An Exchange-Traded Fund (ETF) based on Litecoin hasn’t materialized as of now. Meanwhile, there’s a buzz surrounding meme coins that seems to be overshadowing Solana [SOL] in terms of popularity.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-09 07:03