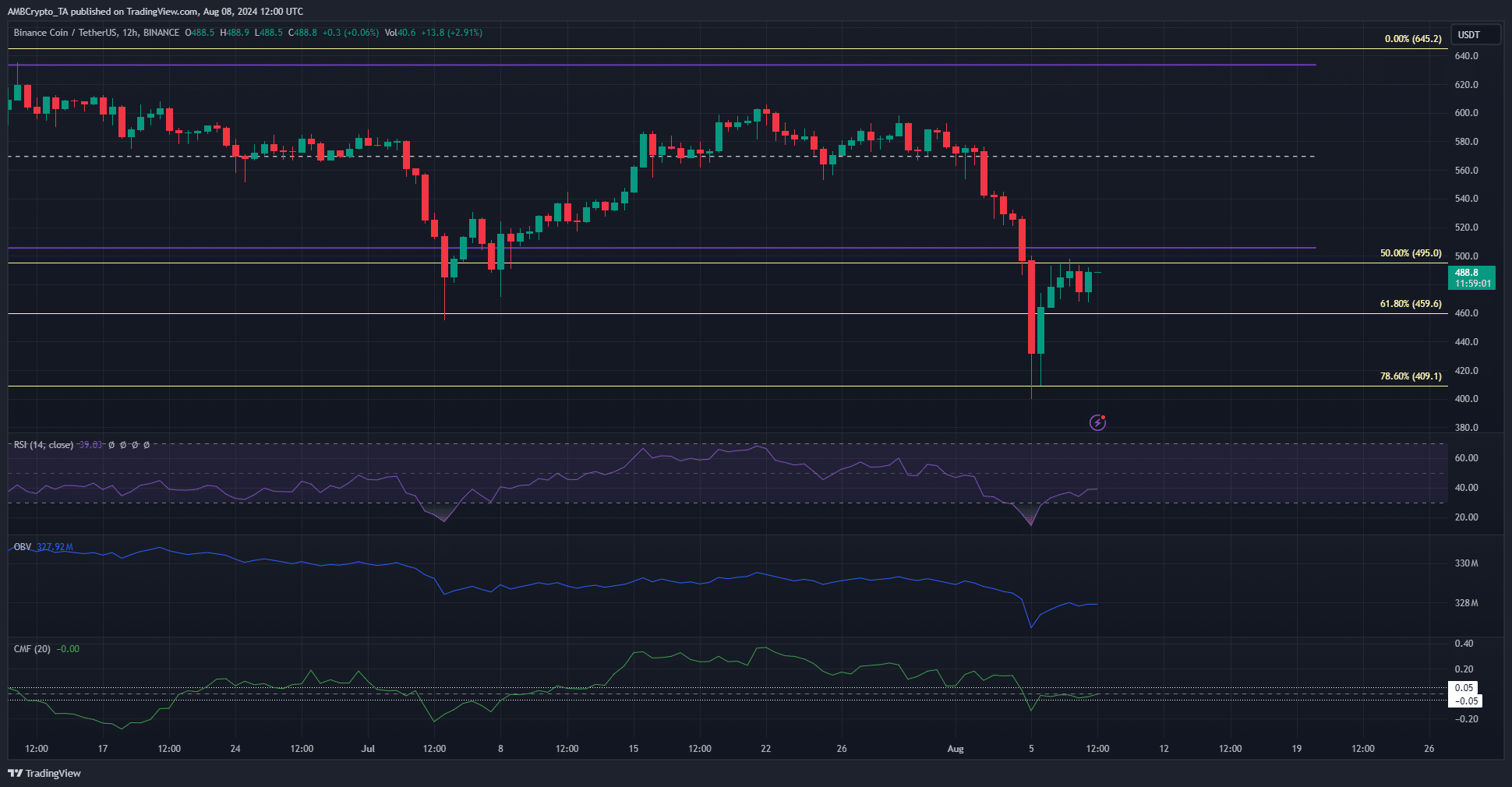

- Short sellers can enter a trade after a minor price bounce followed by a rejection.

- A sustained move beyond $514 would overturn the bearish thesis.

As a seasoned researcher with a knack for deciphering market trends and a deep-rooted passion for all things crypto, I must admit that the current state of Binance Coin [BNB] leaves me somewhat bearishly inclined. The recent influx of panic selling to centralized exchanges, including Binance, is a clear sign of market turmoil, as evidenced by the $5.37 billion in inflows since August 5th.

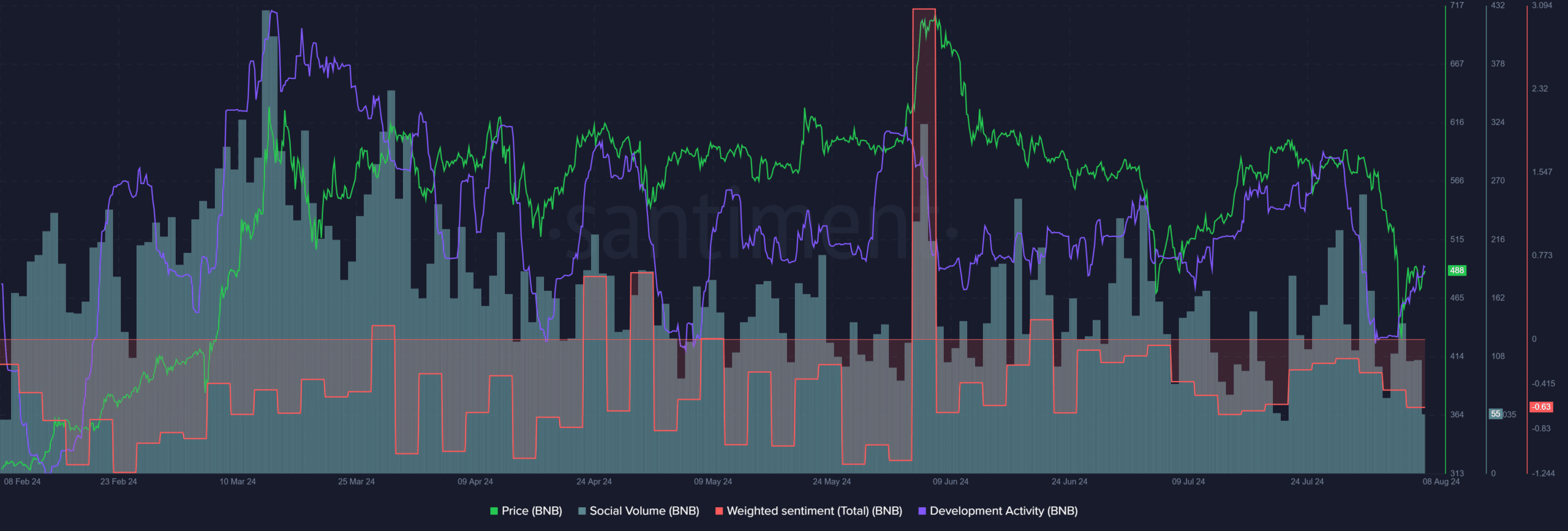

The cryptocurrency Binance Coin (BNB) was influenced by the widespread bearish attitude in the market. So far, it hasn’t shown signs of recovery, and its social media chatter continues to express pessimism.

Speculators were not convinced the exchange token was likely to make gains in the near term.

Examining the patterns of deposits into Binance and the movement of BNB prices suggested a downward trend, or in other words, a bear market scenario. Below are some strategies for traders to employ during the upcoming trading period.

Inflows reflect market shock and panic selling

According to data from DefiLlama, a total of approximately $5.37 billion has flowed into Binance, the centralized exchange, since the 5th of August.

It’s quite possible that these influxes stemmed from market anxiety and represented transactions intended for crypto selling purposes.

1. These developments suggest a downturn for the market, affecting even Binance’s exchange token, BNB. The ongoing legal issues Binance faces aren’t helping the bullish argument.

Over the last ten days, the Weighted Sentiment has been predominantly negative, and there’s been a noticeable decrease in social engagement. Although activity levels have generally remained steady since May, they’ve experienced a significant decline over the past fortnight.

This could concern investors.

1) In simple terms, the prices of these tokens fell below their lowest acceptable price level ($505), indicating a negative trend. Meanwhile, the On-Balance Volume (OBV) hinted at further declines, but the Chaikin Money Flow (CMF) was neutral. If the CMF drops back below -0.05, it could serve as a warning signal for potential buyers.

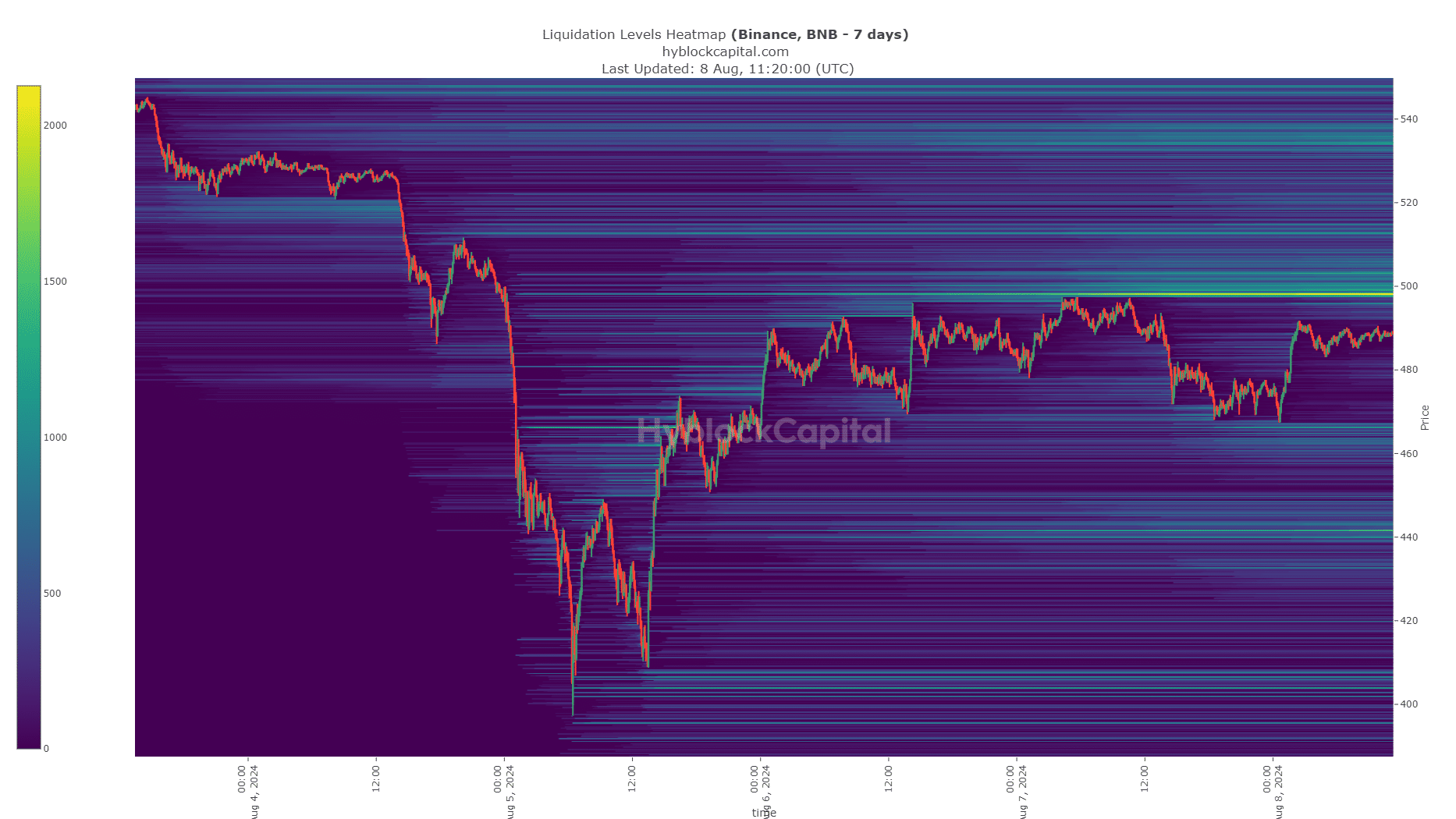

Gauging the potential for a short-squeeze

According to AMBCrypto’s analysis, over a three-day span, about 2.19% of traders held long positions on BNB, indicating that the majority of speculators had a bearish outlook. This could have triggered a short squeeze, as those who had bet against BNB might have been forced to buy it back due to its rising price.

The liquidation heatmap lends credence to this notion. A zone of market liquidity is noticeable around the price point of $497, extending up to $502. This liquidity might pull prices upward.

Read Binance Coin’s [BNB] Price Prediction 2024-25

In summary, the general feeling across social media platforms and Future markets leaned strongly towards pessimism. According to technical analysis, the range between $505 and $514 on the 12-hour chart indicated a bearish trend.

Therefore, traders can anticipate a bearish reversal from this zone.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-09 08:07