- Bitcoin’s dominance was set to surpass 60% at the time of writing.

- Bitcoin wallet activities saw a resurgence despite negative Funding Rates.

As a seasoned analyst with over two decades of market observation under my belt, I find myself intrigued by Bitcoin’s (BTC) current trajectory. The dominance reaching 60% is a significant milestone that harks back to the bull run of 2023 when BTC managed to maintain its position above its 50-day moving average, despite the death cross on the daily chart.

Bitcoin’s [BTC] dominance has steadily been increasing, with 60% at reach during press time.

In simpler terms, the short-term moving average (daily) has dropped below the long-term moving average (weekly), as indicated on the daily chart, but this crossover has not yet occurred in the weekly chart.

Starting from 2023, Bitcoin started to increase following this particular incident, surpassing its 50-day moving average and subsequently using it as a base for further growth.

In 2022, Bitcoin experienced a brief surge prior to the death cross, yet this momentum waned afterwards, much like what occurred in 2021.

In the year 2020, Bitcoin experienced a spike and entered what’s known as the “death cross,” followed by a short retreat, only to resume its upward trajectory, much like it did in the year 2023.

The power of the present action hinges upon Bitcoin maintaining its value above $60,000 and sustaining this level as a foundation. If it can’t, a gradual decrease could ensue, lasting until the Federal Reserve takes action.

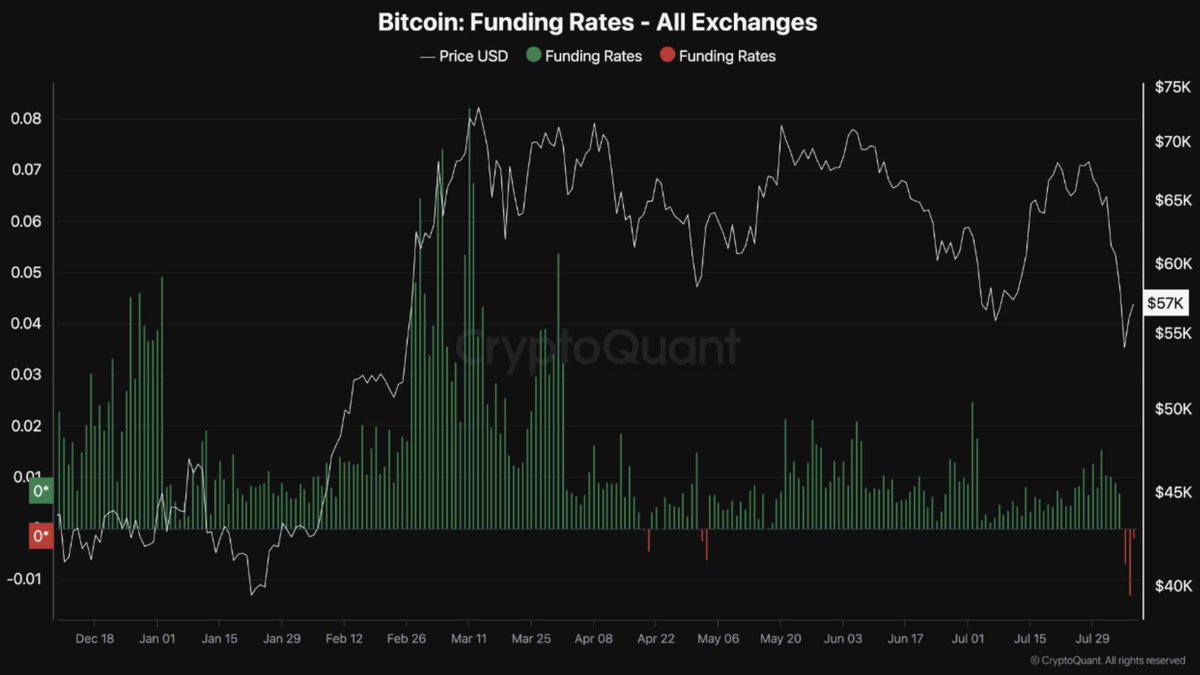

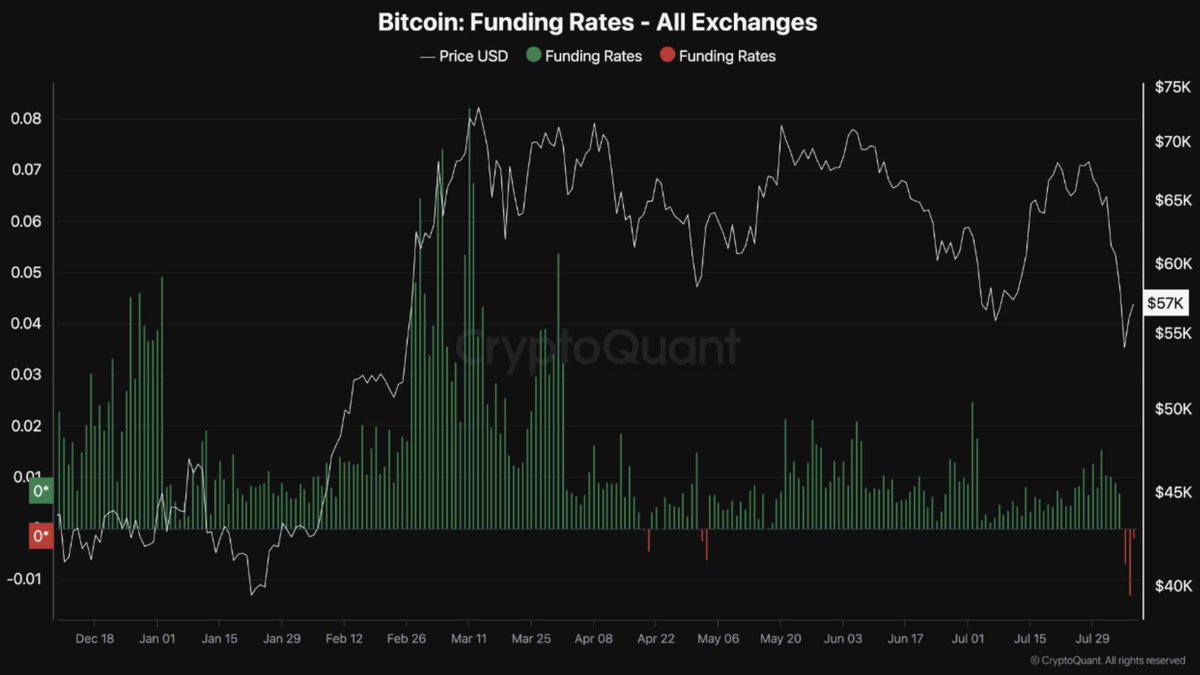

What does the negative BTC Funding Rate mean?

In the current bull run, Bitcoin has seen a significant drop of approximately 33%, marking its first substantial decrease. The Bitcoin Futures Rate (Funding Rate) has dipped back into negative territory, suggesting that it might be a good time for long-term investors to consider purchasing.

Major buyers such as Blackrock and MicroStrategy are increasing their Bitcoin holdings.

When the ISM index dips below 50, signifying a downturn in the business cycle, there’s an anticipated increase in Bitcoin’s influence within the financial market.

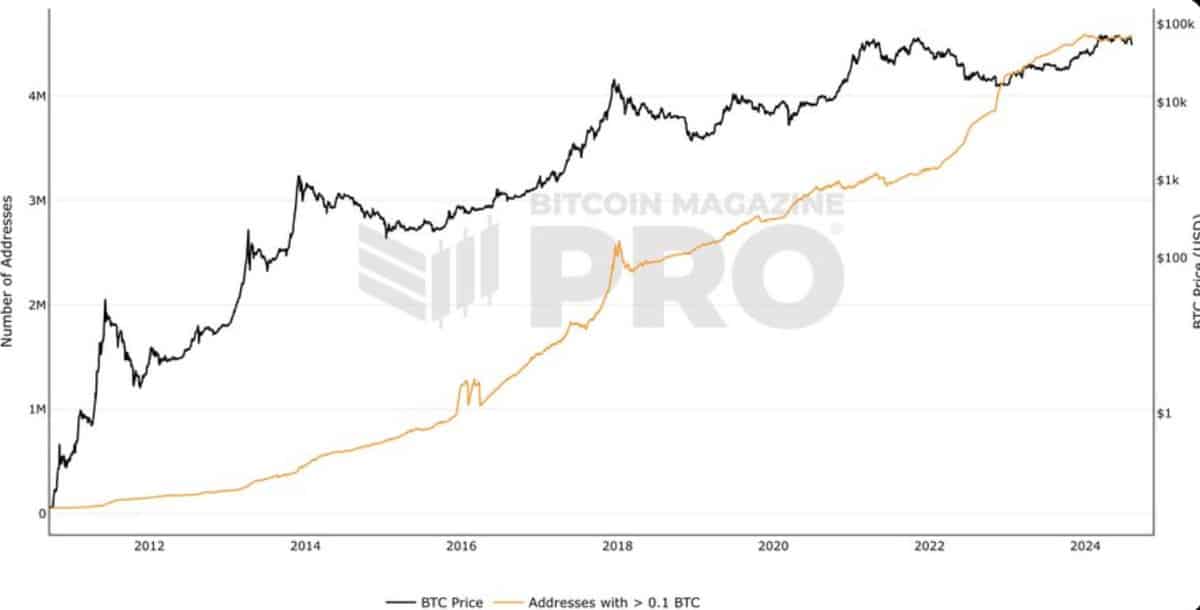

Bitcoin addresses holding more than 0.1 BTC hits ATH

The quantity of Bitcoin wallets containing over 0.1 BTC is consistently rising, suggesting both an upward trend in dominance and increased purchasing activity by large investors (whales).

Over the last month, they have amassed approximately $23 billion in Bitcoin, while long-term investors, who intend to keep their Bitcoin for an extended period, transferred around 404,448 BTC (equivalent to $22.8 billion) to their respective wallets.

This significant accumulation indicates a strong belief in Bitcoin’s future potential.

ETH/BTC rotates back up

After the recent market crash, Ethereum initially bounced back vigorously, only to relinquish these gains as Jump Trading persisted in selling off their holdings.

Looking at the decreasing Ethereum-to-Bitcoin (ETH/BTC) graph suggests that Bitcoin’s supremacy in the crypto market might persist, given that Ethereum is currently the second most prominent digital currency following Bitcoin.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-08-09 21:11