-

Global liquidity has surged ahead of a likely hike in U.S money supply

Given the historical BTC pump amidst the liquidity surge, is another rally likely?

As a seasoned researcher who has closely followed the crypto market for years, I find myself increasingly optimistic about Bitcoin’s prospects given the current liquidity situation. The surge in global liquidity, as evidenced by the breakout of the 4-year consolidation level, seems to be setting the stage for another BTC rally.

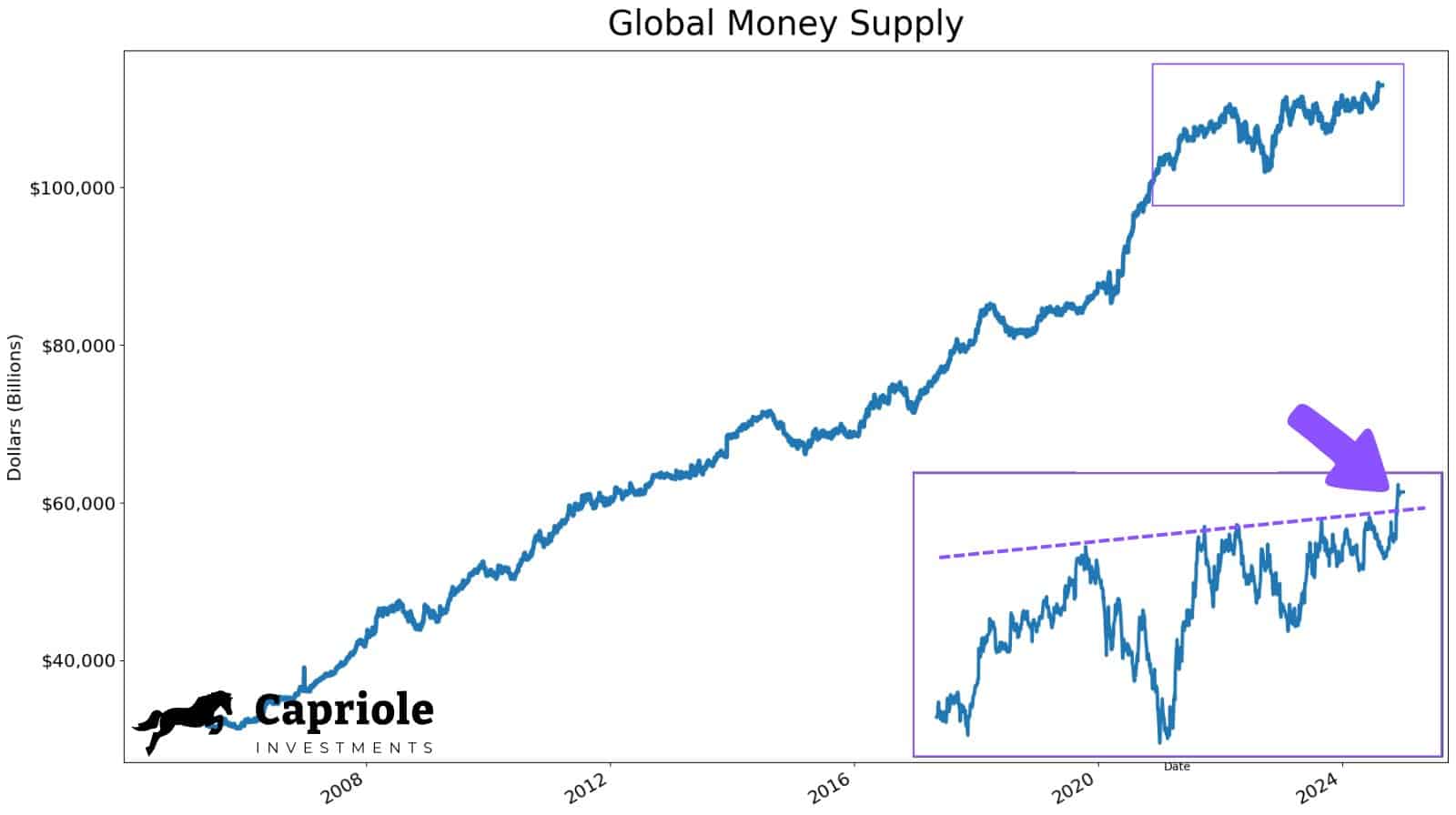

As a crypto investor, I’ve been noticing a highly advantageous macro environment for Bitcoin [BTC]. From a money supply (liquidity) viewpoint, things are looking particularly promising. In fact, according to Charles Edwards, Founder of Capriole Investments, the global liquidity has surged beyond a 4-year consolidation level now.

“The worldwide money circulation is significantly increasing, and we’ve just broken free from a substantial four-year stalemate. This leads me to ponder: what could this trend mean for Bitcoin?”

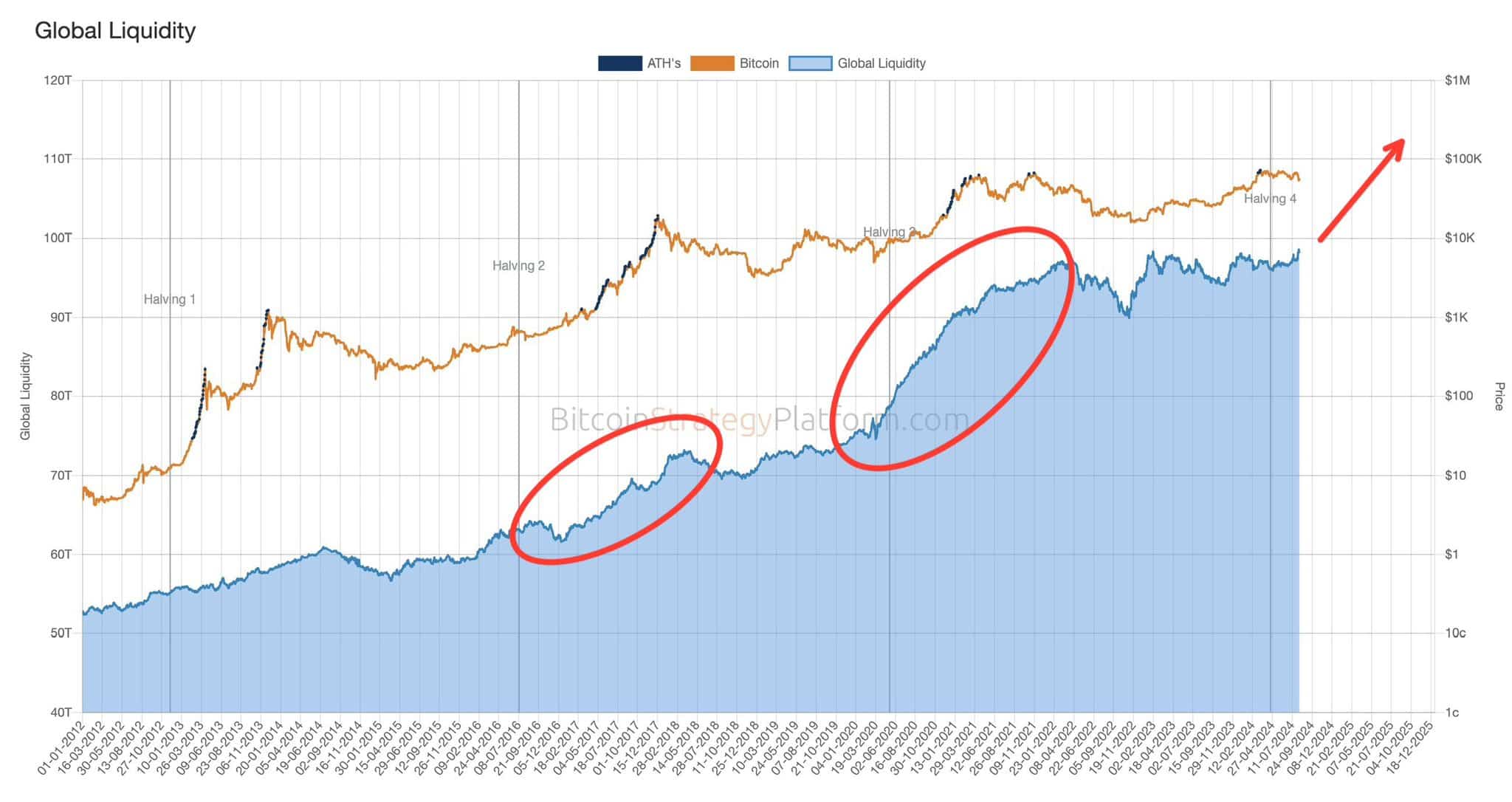

As a researcher studying Bitcoin, I’ve observed that it has a significant appetite for liquidity, often referred to as a ‘liquidity junkie’. In periods of increased global liquidity, this digital asset might be primed for upward momentum.

In 2017 and 2021, the peak market highs were observed around the same time when there was a surge in global financial resources, as pointed out by market analyst François Quinten.

“Global liquidity is about to spike up. So is #Bitcoin 💥”

U.S liquidity to fuel BTC prices

As a researcher, I find it unsurprising that we’re witnessing a significant increase in global liquidity lately. This trend can be attributed to the initiation of quantitative easing strategies by central banks, who have chosen to lower interest rates. Countries such as Canada and the U.K are among those that have implemented this monetary policy adjustment, contributing to the expanding liquidity around the world.

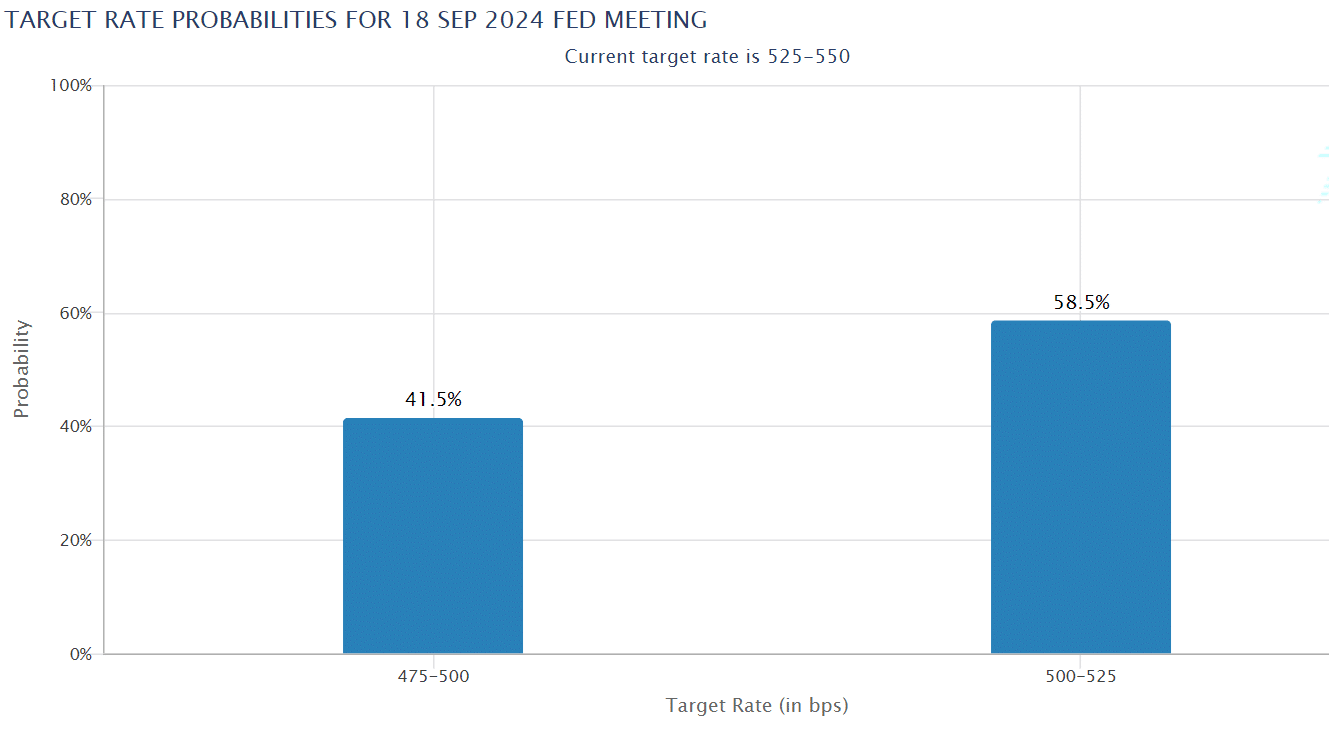

It’s anticipated that the U.S will initiate reductions in Federal Reserve rates by September, potentially boosting worldwide funds availability and influencing cryptocurrency values. Currently, market analysts predict a high likelihood of a 25-basis point and 50-basis point rate cut, with probabilities approximately 60% and 40%, respectively.

Put differently, traders are now highly convinced of a September Fed rate cut.

As a researcher, I’d like to highlight that, beyond the Federal Reserve rate cut, the U.S. is expected to inject liquidity through the issuance of over $300 billion in Treasury bills (T-bills) by the U.S. Treasury Department before the end of this year.

To clarify for those who might not be aware, Treasury bills (T-bills) serve as a tool the government uses to acquire funds to compensate for budget deficits that support overall spending. Essentially, an increase in the net issuance of T-bills leads to an enhancement of U.S liquidity.

Based on the statements made by Arthur Hayes, the current U.S. liquidity structure could potentially drive Bitcoin’s price up to $100,000, breaking its ongoing trend of moving sideways downwards.

“I expect that crypto will exit its sideways-to-downward trajectory starting in September”

In short, BTC could see massive price appreciation from September onwards.

Currently, as I’m typing this, Bitcoin, the most significant cryptocurrency, was being traded at approximately $60,800. Interestingly, there seems to be a temporary resistance or “sell wall” around the $63,000 mark for Bitcoin.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-14 23:06