- Ethereum layer 2s have been pulling off impressive transaction activity lately

- Improving stats could have a significant impact on Ethereum too

As a seasoned analyst with a decade-long career in the crypto space, I find myself consistently impressed by the evolution of Ethereum’s ecosystem. The recent surge in layer 2 transaction activity is a testament to the network’s scalability solutions and the growing demand for faster, cheaper transactions.

Although Ethereum hasn’t yet reached its previous record high price, it has achieved new peaks in other areas. Lately, the number of transactions on Ethereum’s layer 2 network has hit an all-time high.

As an analyst, I’ve noticed that the cumulative daily transaction count across various Ethereum Layer 2 networks has allegedly reached a record-breaking 12.2 million transactions, according to recent reports. Keep in mind, though, this data pertains solely to activity on these Layer 2 networks and does not include transactions made on exchanges.

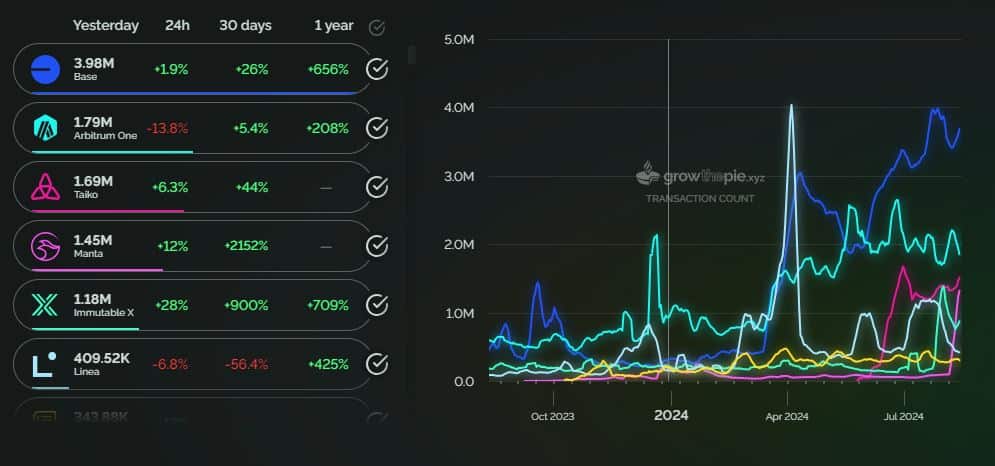

Based on data from Growthepie, the Base network had the most transaction activity in the past 24 hours. On average, it processed approximately 3.6 million transactions, nearly twice as many as reported by Arbitrum One.

1. Manta significantly improved the outstanding layer 2 performance, managing over 1.31 million transactions within the same timeframe.

In fact, its transactions have registered a spike since 5 August.

Are Ethereum’s layer 2s stealing the mainnet thunder?

The previously mentioned research uncovers something intriguing regarding the Ethereum layer 2 scene. It appears that many of the layer 2 networks currently thriving are relatively fresh on the block. Established players like Polygon and Optimism have been surpassed by newer entrants such as Base and Manta in terms of transaction volume.

Base was also the dominant Ethereum layer 2 network in terms of fees paid by users.

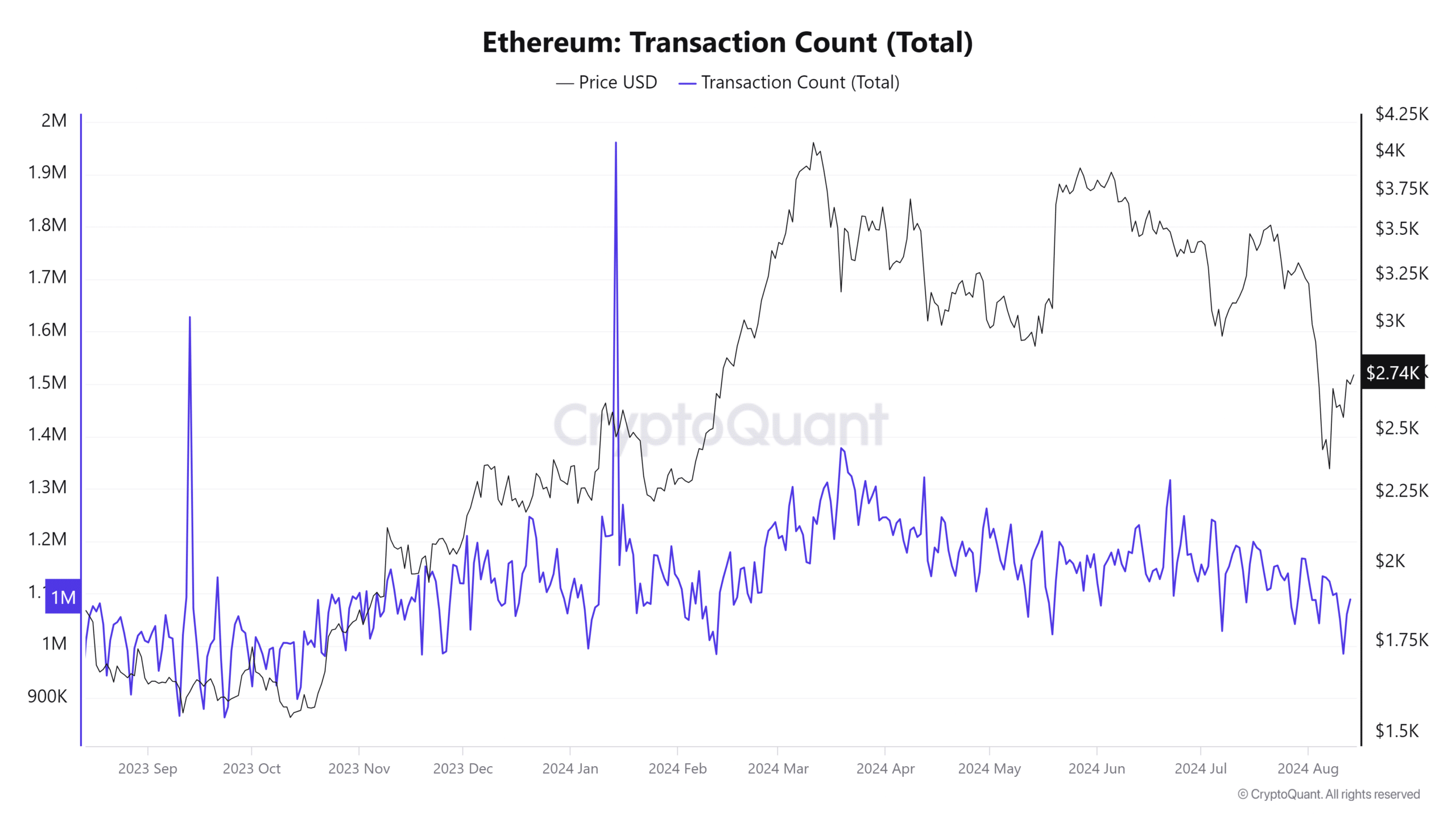

Over the past year, there’s been a significant increase in the use of recently trendy layer 2 solutions, as shown by rising transaction numbers and fees. Conversely, on a year-to-date basis, Ethereum mainnet transactions have generally decreased.

On January 14th, the number of transactions processed by the mainnet reached approximately 1,960,000 – marking its highest point. Conversely, on August 13th, it recorded around 1,080,000 transactions.

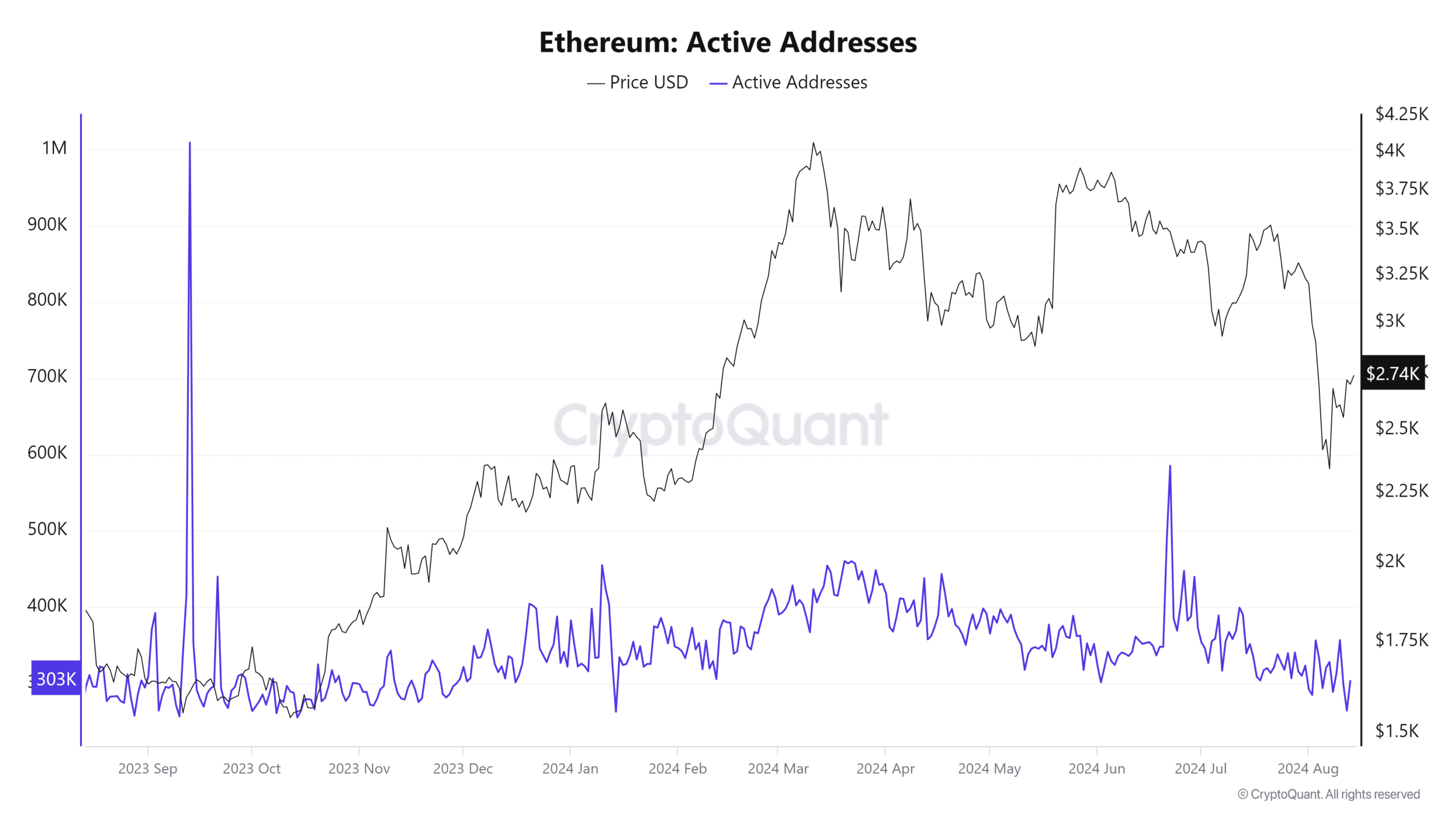

Additionally, we made correlations between the daily active addresses on the Ethereum mainnet and those of its Layer 2 networks. This correlation was established by examining peak activity levels over the past year as well as the most recent data from August 13th.

Over the past year, the Ethereum mainnet recorded its peak of 1,009,000 active addresses on September 13, 2023. However, in 2024, this number was surpassed only once, with a high of approximately 585,000 addresses seen on June 22. On August 13, there were 303,268 active addresses.

On June 23rd of this year, the total count of active Ethereum layer 2 addresses reached a high of approximately 2.52 million. Compared to August 13th, when it stood at about 1.54 million active addresses.

Essentially, what the data shows is that a significant amount of Ethereum’s transactions are occurring on its secondary networks, rather than on the main network itself.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-15 03:04