-

July’s U.S. CPI was softer than expected, at 2.9% against an estimated 3.0%.

The U.S. government’s $593M BTC move could have spooked the markets.

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies and financial markets, I find myself intrigued by the recent developments in Bitcoin [BTC]. The softer July U.S. CPI data might have brought relief to many sectors, but it seems BTC isn’t one of them.

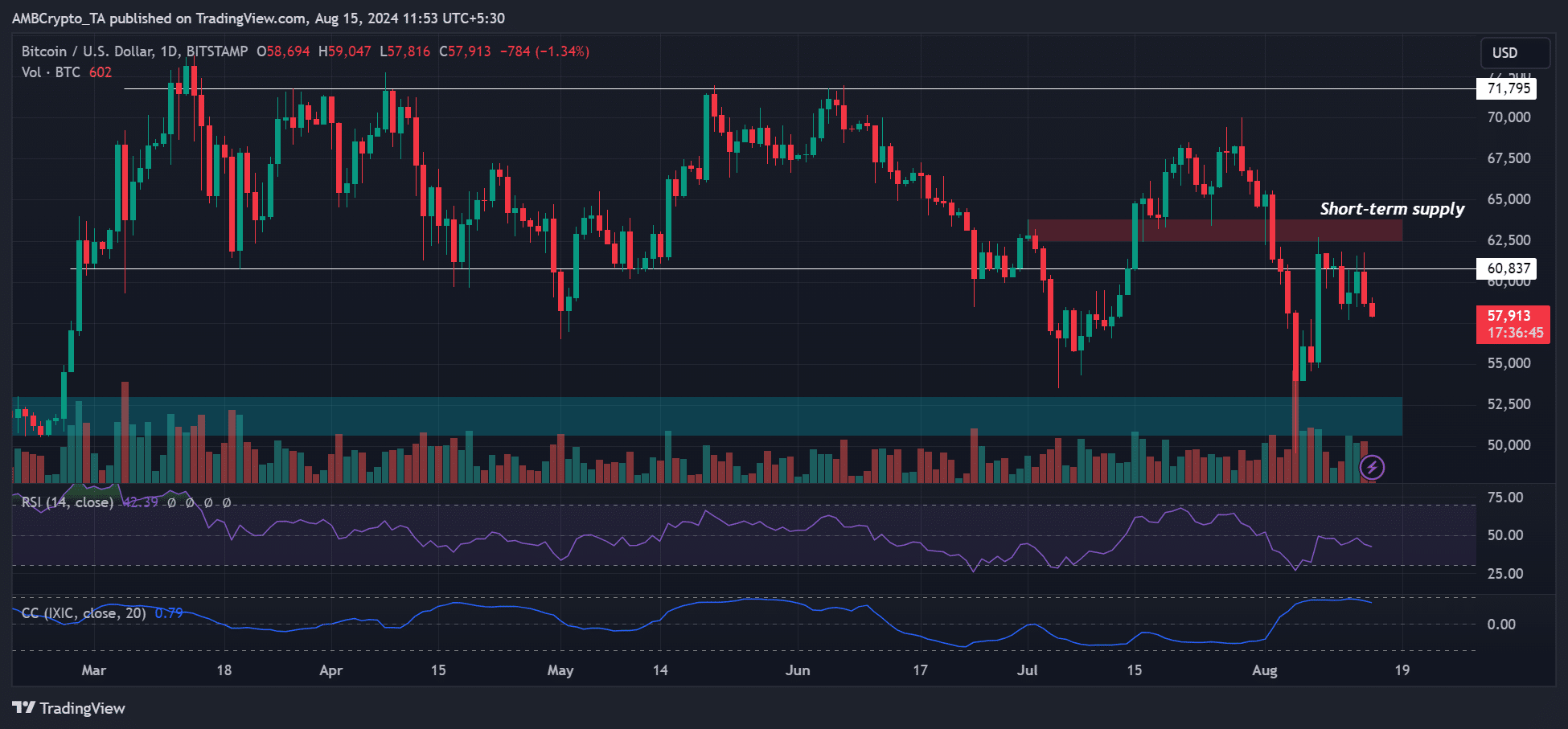

Despite a lower-than-expected U.S. CPI data for July, showing a 2.9% year-over-year increase instead of the anticipated 3.0%, Bitcoin [BTC] struggled to maintain its position above $60K.

Milder inflation figures triggered a modest rebound in the U.S. stock market, encompassing the technology-focused Nasdaq Composite (IXIC), signifying some relief.

Contrary to its close association with the Nasdaq Composite, Bitcoin (BTC) actually moved in the opposite way.

On the 14th of August, I saw a dip of 3% in my crypto investment, bringing the price down from $61,800 to $58,800. At the moment I’m writing this, it’s holding weakly above the $58k level.

The softer CPI data is still bullish for BTC

On the 14th of August, Bitcoin’s day-to-day trading showed little activity, but experts remained optimistic because they believed the CPI report had a positive impact on Bitcoin.

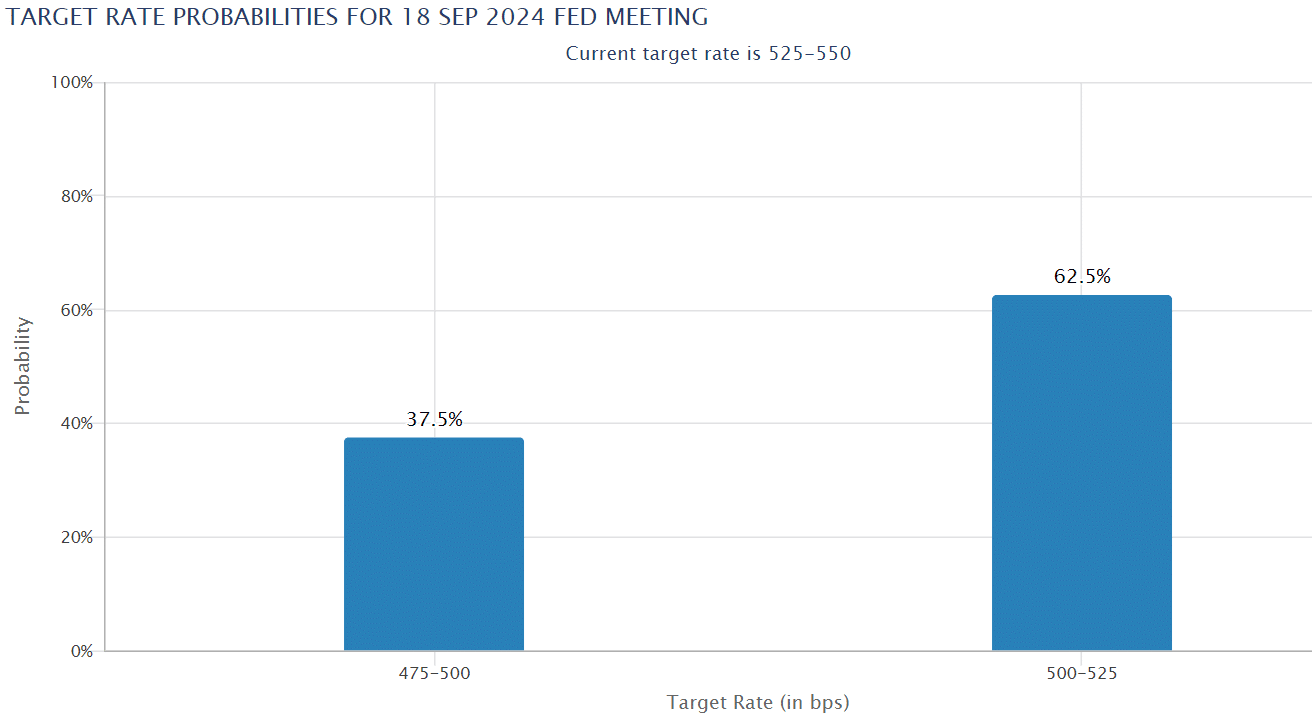

As a researcher, I’d like to share my interpretation based on Eliezer Ndinga’s statement. He, being the VP and Head of Strategy and BD at digital asset manager 21Shares, indicated to AMBCrypto that a lower Consumer Price Index (CPI) could potentially increase the likelihood of a Federal Reserve rate cut in September. If this happens, it might positively impact the crypto markets.

“Given that inflation is aligning with projections, there’s a higher chance that the Federal Reserve will only reduce interest rates by a quarter point. This potential move might bolster investments perceived as risky.”

Bitwise’s CIO Matt Hougan echoed the same outlook,

As a long-time investor with a keen eye for market trends, I can confidently say that the recent announcement by the Federal Reserve to start cutting interest rates in September has piqued my interest, particularly when it comes to Bitcoin. Historically, periods of low interest rates have often been favorable for riskier assets like cryptocurrencies, as investors seek out higher returns amidst a stagnant bond market.

Currently, when this is being penned down, it appears that 62% probability exists for the Federal Reserve to reduce rates by 0.25 percentage points (or 25 basis points) before September arrives.

$593M BTC move by U.S. spooks market again?

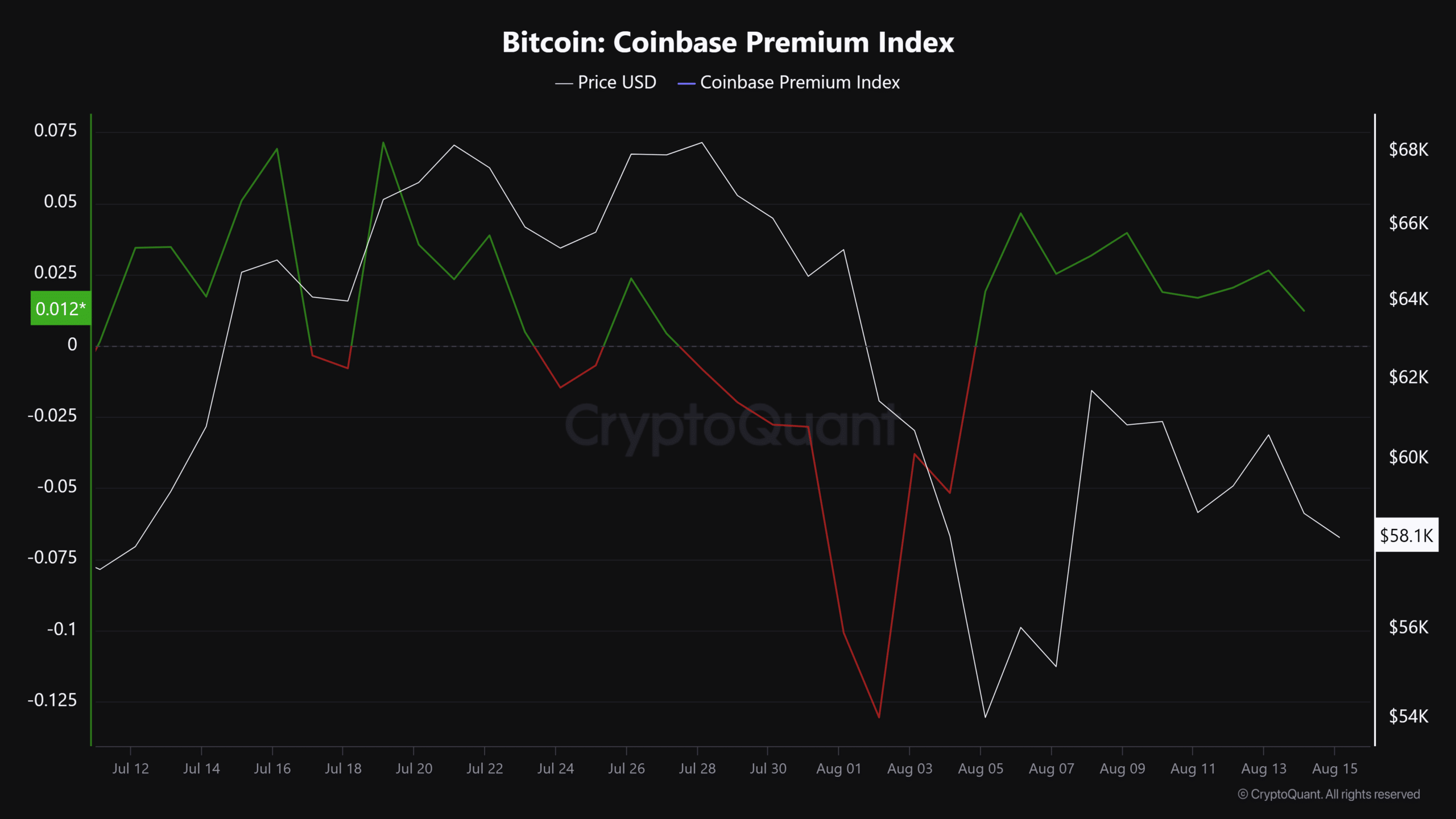

On Thursday, as reported by Arkham Intelligence, the U.S. government transferred approximately 10,000 Bitcoins, valued at over half a billion dollars ($590M), to another Coinbase Prime account.

Although it was said that this move was intended for custodial reasons, a comparable action taken by the U.S. government around two weeks back caused market unease and contributed to Bitcoin’s decline.

Consequently, FundStrat Insights suggested that the actions taken by the U.S. government might have lessened the anticipated rebound following the milder Consumer Price Index (CPI) figures.

During this period, the Coinbase Premium Index remained favorable as I was writing this, despite the slowing recovery trend. This implies that there was a modest interest in the leading digital asset among U.S. investors.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- SOL PREDICTION. SOL cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-15 15:24