- Ethereum nears critical resistance at $2,800, with bullish potential for a breakout towards $3,000.

- Positive adoption trends and exchange outflows suggest growing interest and reduced supply on trading platforms.

As a seasoned crypto investor with over a decade of experience navigating the digital asset market, I find myself cautiously optimistic about Ethereum’s current position. The bullish potential towards $3,000 is certainly intriguing, and the positive adoption trends and exchange outflows suggest that there may be more to this story than meets the eye.

As a researcher, I find myself closely observing the volatile landscape of Ethereum’s [ETH] price, which currently teeters on a potentially delicate balance. A market analyst’s insight hints at the likelihood of an adjustment or correction in this digital currency’s value.

Based on Ali’s analysis as a market expert, Ethereum appears to be developing a “rising wedge” pattern, which typically suggests a bearish trend in the market.

Ali noted,

“If Ethereum appears to be creating a ‘rising wedge’ pattern, it might signal a temporary dip leading up to a potential increase towards around $2,350.”

He also mentioned that if Ethereum successfully closes at a price above $2,800, it might change the pessimistic perspective.

Currently, Ethereum is being exchanged for approximately $2,615.66. This represents a modest 0.14% rise compared to the previous day’s trading.

Over the last week, there’s been a drop of approximately 2.86% in the value of Ethereum, causing some apprehension regarding its near future performance in the market.

At the moment, I’m observing that Ethereum’s current market capitalization hovers around $314.79 billion. Over the last 24 hours, there has been a trading volume of approximately $15.46 billion for this digital asset.

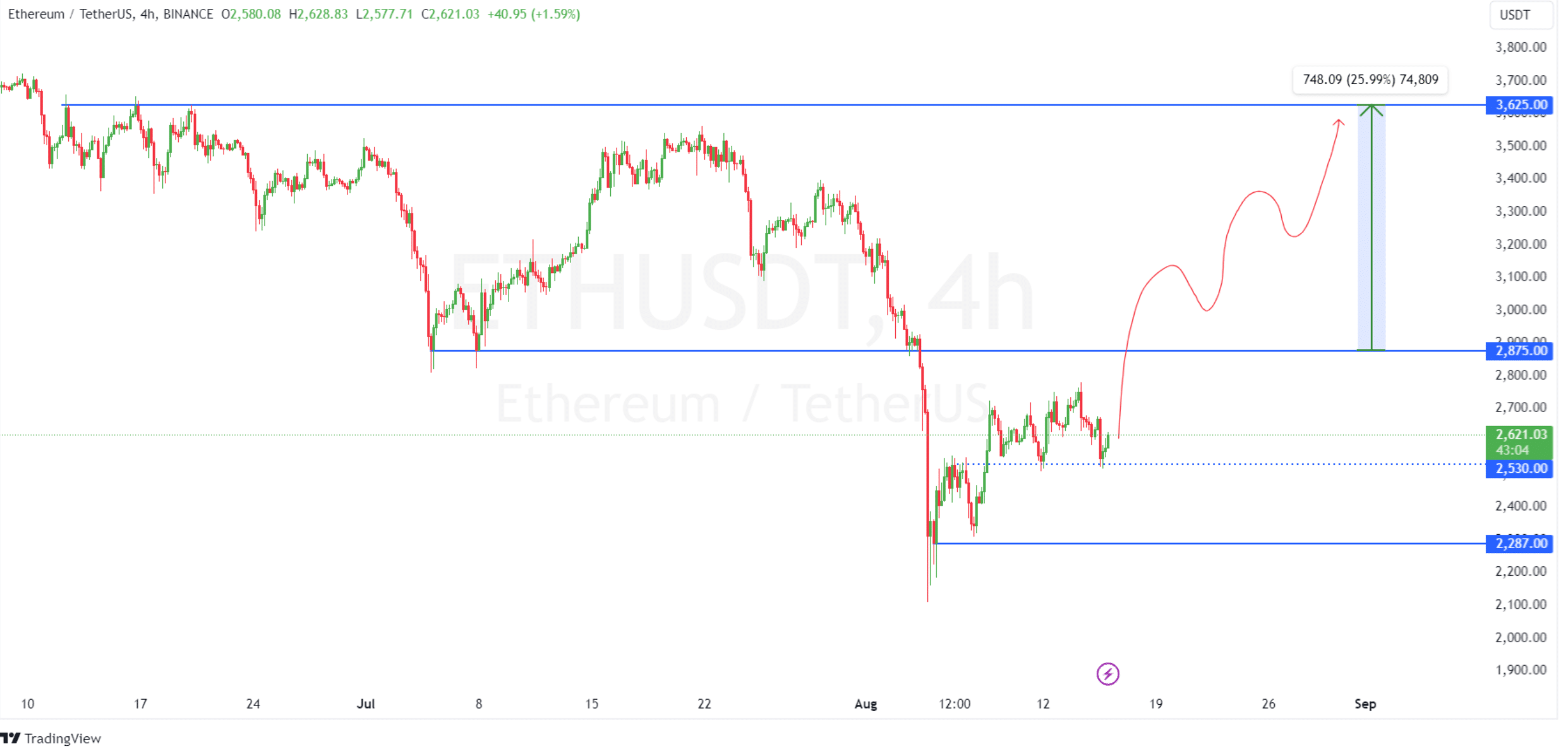

Price targets and key levels to watch

As an analyst, I’ve been observing the Ethereum price trend, and it seems to be pointing towards a potentially robust uptick. The charts indicate that we might see Ethereum reaching levels around 3,000 in the near future.

As a researcher studying cryptocurrency trends, I’ve noticed a positive trajectory in Ethereum’s price. If this upward trend persists, Ethereum could potentially reach a new high of around $3,625 – a 25.99% rise from its current value.

For the bullish trend to take shape, it’s crucial that Ethereum manages to surpass some significant barriers in its path.

As a crypto investor, I’ve noticed that there’s a significant barrier at around $2,875. Breaking through this level could pave the way for us to aim higher and potentially reach our desired price targets.

If Ethereum successfully surpasses its current resistance level, the next major hurdle it will encounter is around $3,000.

Beyond that, the $3,625 zone could be the final target for this potential upward movement.

Instead, a possible disadvantage is that the price could potentially reverse direction if it encounters resistance at $2,530 or $2,287, should the market experience a downturn.

Ethereum’s showdown

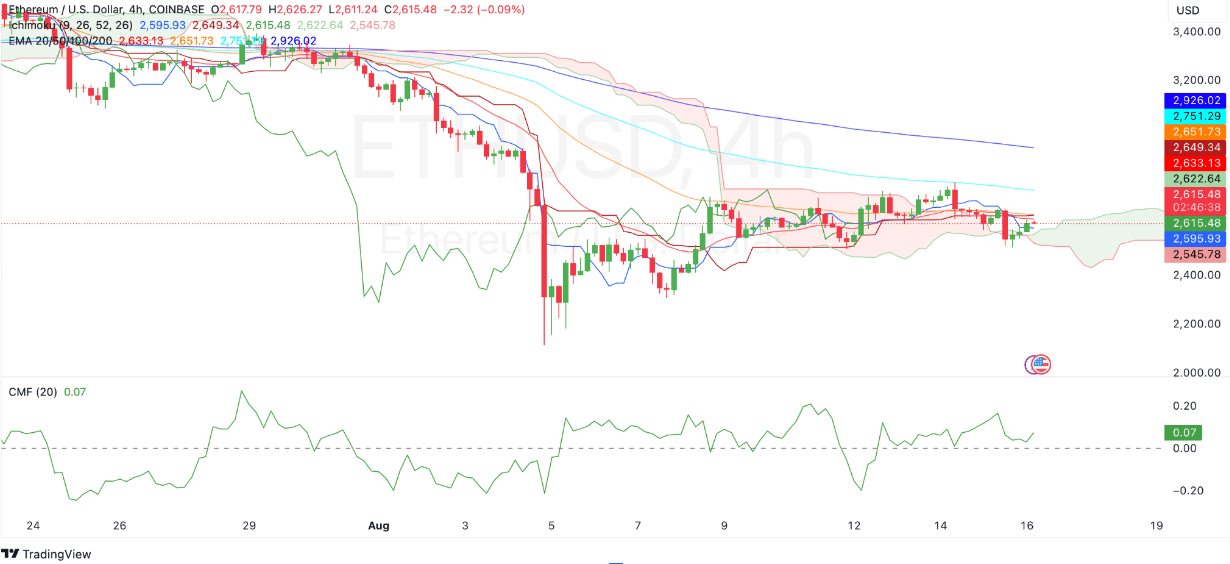

Technical indicators show Ethereum battling overhead resistance.

At the moment of publication, the cost stood at $2,617.03, but according to the Ichimoku cloud, Ethereum requires overcoming more resistance levels for a consistent uptrend to be established.

Furthermore, the 50-day Exponential Moving Average stands at approximately $2,633.28, while the 100-day Exponential Moving Average is around $2,751.32. These values could potentially act as further obstacles in moving forward.

For Ethereum to sustain a strong upward trend, it must exceed the specified thresholds. Should Ethereum successfully breach these Moving Averages (EMAs), it could potentially strive towards encountering the next level of resistance at approximately $2,926.04.

If this action isn’t taken, it might lead to a strengthening of the current situation (consolidation) or even a reversal (potential pullback), as Ethereum finds it challenging to sustain its upward trend.

Ethereum outflows surge

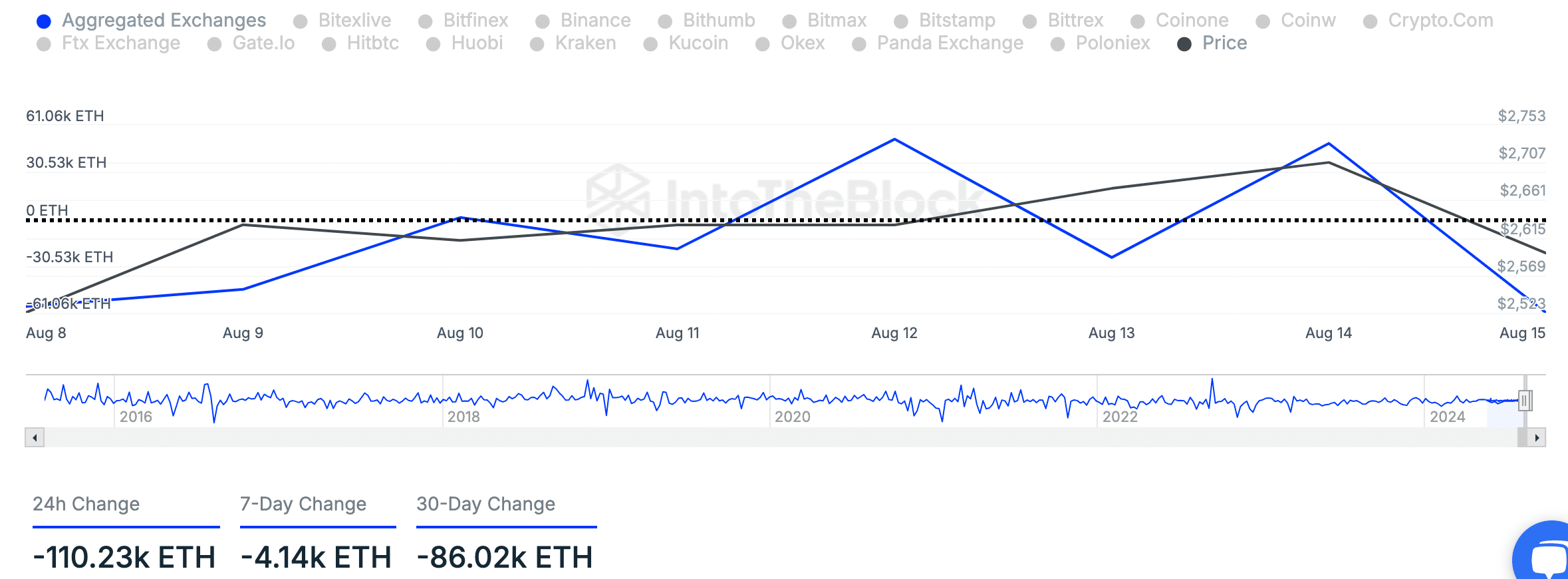

Recent netflow data from IntoTheBlock showed a consistent outflow of Ethereum from exchanges.

For the last week, there’s been an overall withdrawal of 4,140 ETH from trading platforms, suggesting that the amount of Ethereum available for trade has decreased.

As a long-time cryptocurrency investor with a keen eye for market trends, I’ve noticed that the recent shift in Ethereum (ETH) outflow of approximately -86.02k ETH over the past 30 days aligns with my own observations and experiences. It seems plausible to me that investors may be transferring their assets into cold storage or decentralized finance (DeFi) platforms, a strategy I’ve employed myself during periods of market uncertainty.

Over a 24-hour period, the netflow of Ethereum decreased by approximately 110,230 Ether, suggesting intense selling activity or accumulation. This trend might impact the way Ethereum’s price behaves.

As an analyst, I’m observing potential outflows that may cause a decrease in market liquidity. This reduction in liquidity could potentially trigger price fluctuations in the immediate term.

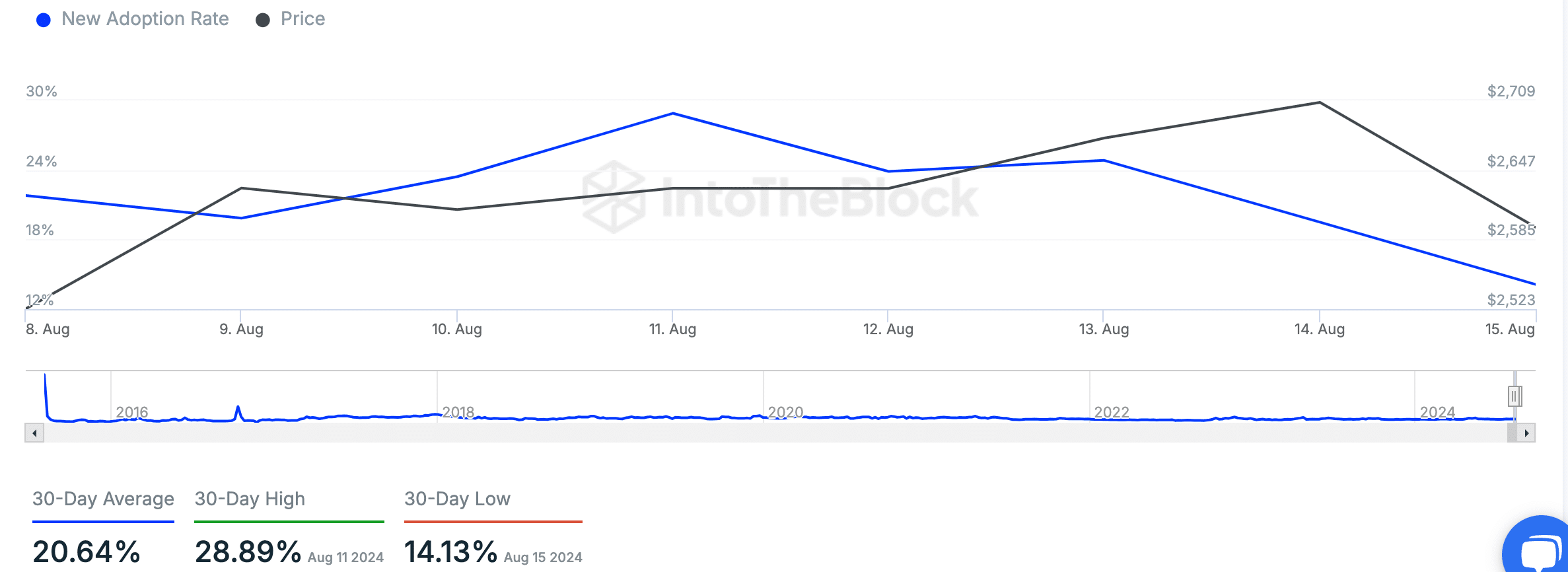

As a crypto investor, I’ve noticed that Ethereum’s popularity has been going up and down recently. It reached its highest point at 28.89% on the 11th of August, but then it dropped to a 30-day low of 14.13% just three days later on the 15th of August.

Read Ethereum’s [ETH] Price Prediction 2024-25

Even with a drop, the 30-day average continued to show robustness at 20.64%, suggesting that there’s still significant engagement with Ethereum’s network.

It appears that the cost of Ethereum and its level of adoption have been mirroring each other, climbing up together followed by a drop during the same timeframe.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-08-16 22:49