-

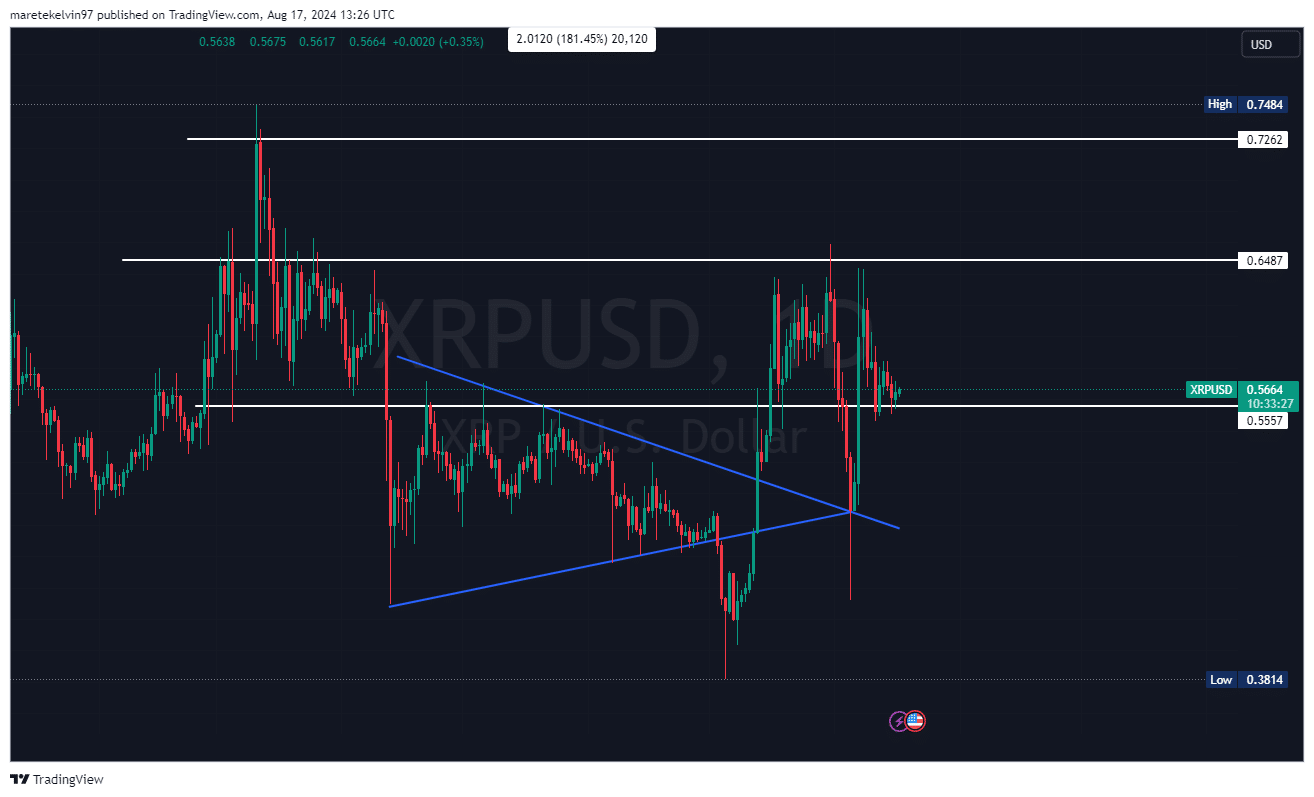

XRP’s price continued to hold on to the $0.5557 support.

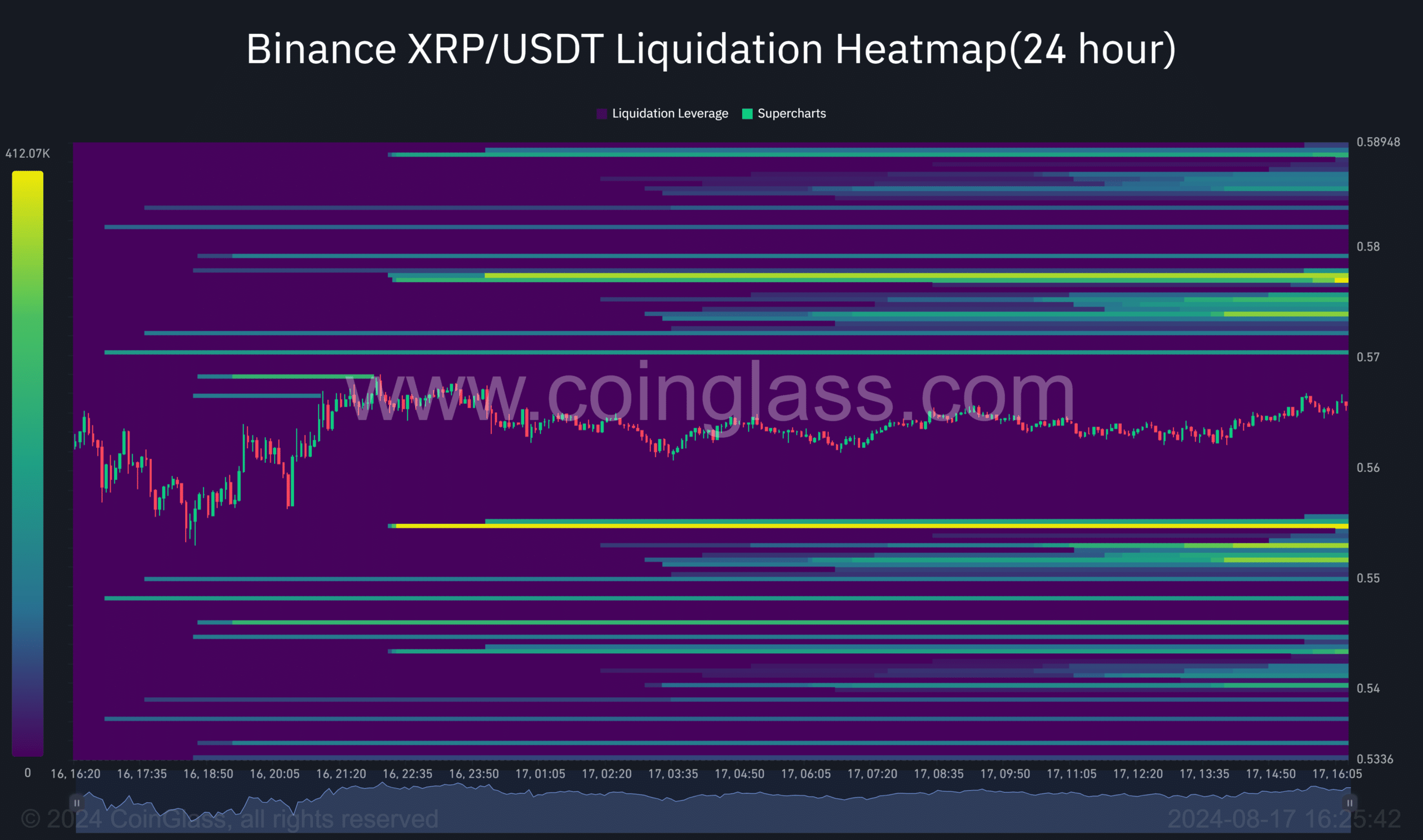

The liquidation heatmap indicated that there were consolidations around $0.56–$0.58.

As a seasoned crypto investor with battle-scarred fingers from navigating the treacherous seas of the digital asset market, I find myself observing XRP‘s current position with a mix of cautious optimism and intrigue. The price holding steadfast at $0.56, just above the key support level of $0.5557, is a comforting sight for those who have weathered the crypto storm before.

At the moment, Ripple (XRP) was slightly above a crucial support point of approximately $0.5664, as observed by AMBCrypto’s analysis of TradingView’s graph.

1) The price point slightly surpassed the notable $0.5557 barrier, serving as a strong foundation against potential additional drops. Meanwhile, XRP appears to be moving back and forth inside a limited bandwidth, indicating a phase of stability or accumulation.

At present, I’m observing a robust upward trend in the price action. It has gained a noteworthy 2.3% since it was previously rejected at the support level, indicating a potential bullish continuation.

XRP: Bulls vs. bears

Based on AMBCrypto’s examination of liquidation map statistics, most position concentrations were typically found in the range between $0.56 and $0.58.

Based on my years of experience in the financial markets, I have noticed that when investors start to cluster their positions cautiously, it often indicates a shift in market sentiment. In these situations, a slight bullish bias becomes evident just before or during a consolidation phase. This is usually a time when the market is uncertain and investors are trying to find a balance between being optimistic about future growth and being wary of potential risks. As someone who has witnessed multiple market cycles, I know that this cautious positioning can sometimes be a sign of an impending bull run, but it also means that we should remain vigilant and prepare for any unexpected events that may arise.

Exchange exodus

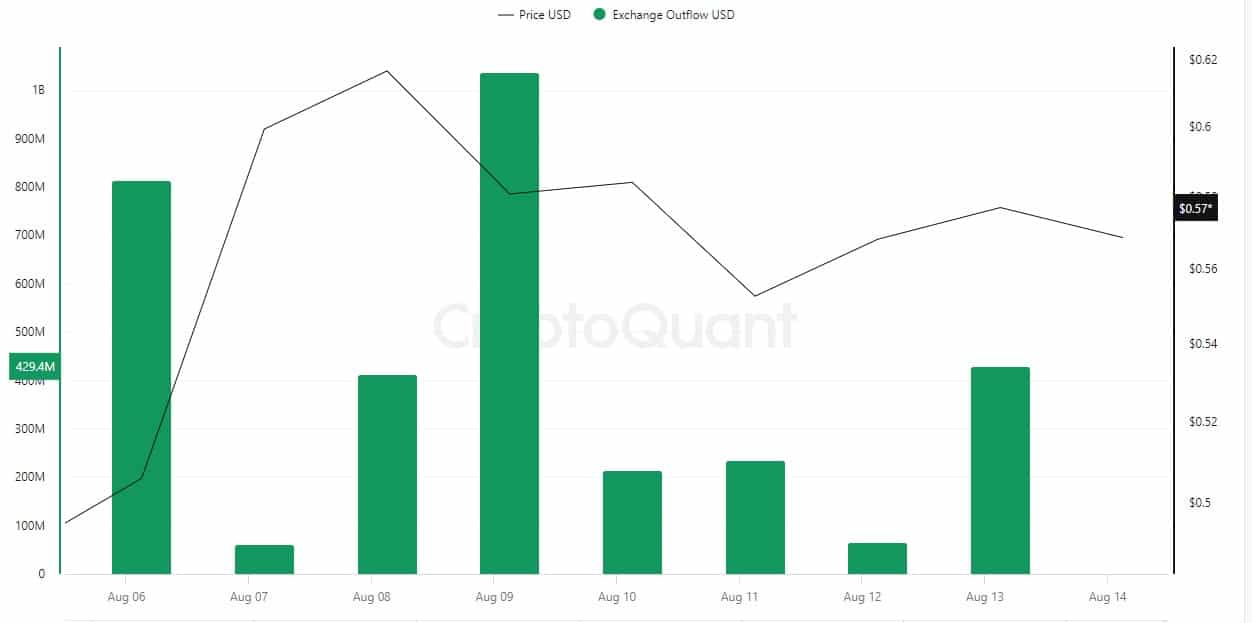

It’s worth noting that an analysis by AMBCrypto of CryptoQuant’s data showed a growing pattern related to exchange withdrawals. Specifically, there was a substantial withdrawal spike, particularly between August 6th and 9th.

When tokens leave exchanges, this action is frequently seen as an amassing process since it suggests that individuals plan on keeping these tokens rather than selling them.

On the other hand, the data on active addresses presented a somewhat contrasting image. It appears that the number of active XRP accounts has been decreasing since August 6th, suggesting that there could be less involvement in trading activities.

Read Ripple’s [XRP] Price Prediction 2024-25

Sluggish bullish momentum?

At the moment, RIPPLE (XRP) is holding steady above its current support level; increased outflows from exchanges hint at an accumulation stage. The slowdown in active addresses and narrow trading range suggest weakened bullish energy.

Based on the recent price fluctuations, it’s plausible that a potential bullish surge for XRP may occur, as suggested by its indicators. The projected price point to watch out for is approximately $0.6487.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-18 10:15