- Render has been in a downtrend for nearly three months.

- The short-term buy opportunity could be risky due to lack of demand.

As a seasoned crypto investor with over a decade of experience navigating market cycles and trends, I must admit that the current state of RENDER [RENDER] has me treading cautiously. The token’s downward trajectory for nearly three months coupled with the lack of demand is concerning, to say the least.

In July, the platform formerly known as RENDER underwent a rebranding and shifted its operations to the Solana (SOL) blockchain following a decision made by the community. However, data from the on-chain performance indicated troubling developments for those who had invested long term.

As a researcher examining the current cryptocurrency market, I’m preparing myself for a potential short-term price surge in the near future. The low demand for this particular token and the widespread market anxiety suggest that short-selling could yield greater returns compared to purchasing at this time.

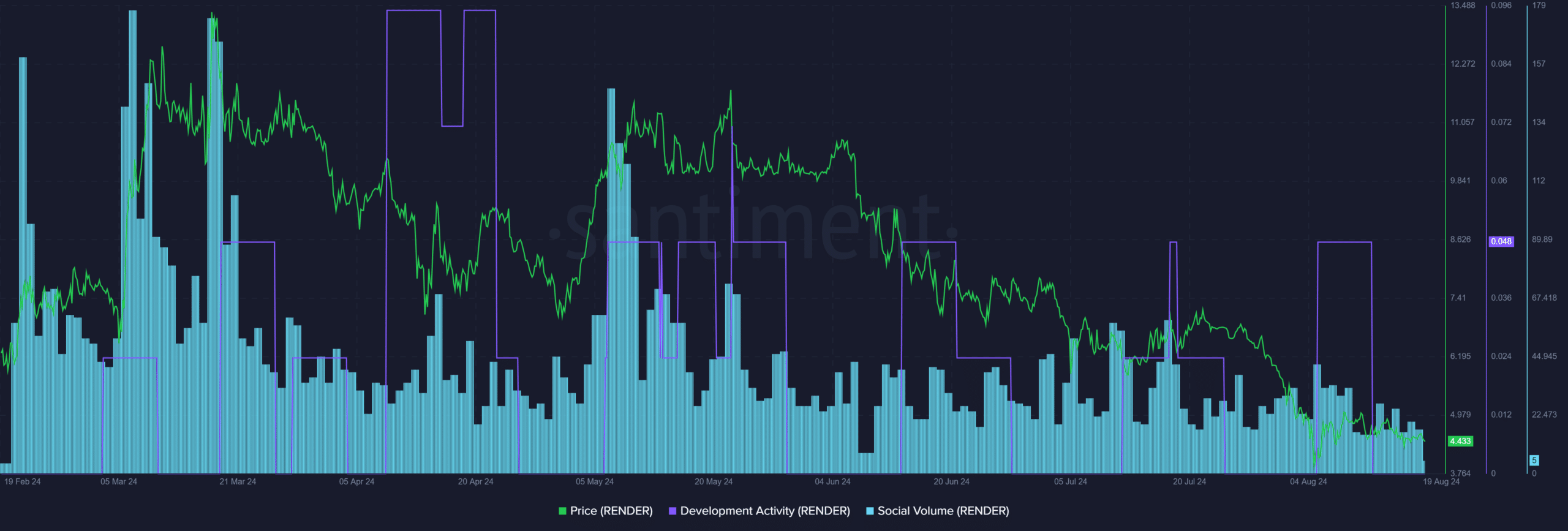

Woeful development activity and online engagement

1. “Development progress for RENDER was quite unpredictable and hovered near decimal points when last checked. In contrast, Cardano [ADA] consistently ranks high in this category, with readings typically around 80.”

1. Social media interaction remained minimal and dropped even more during August. Considering the big picture, these Santiment statistics might cause concern among long-term investors regarding their faith in the investment. (Paraphrased)

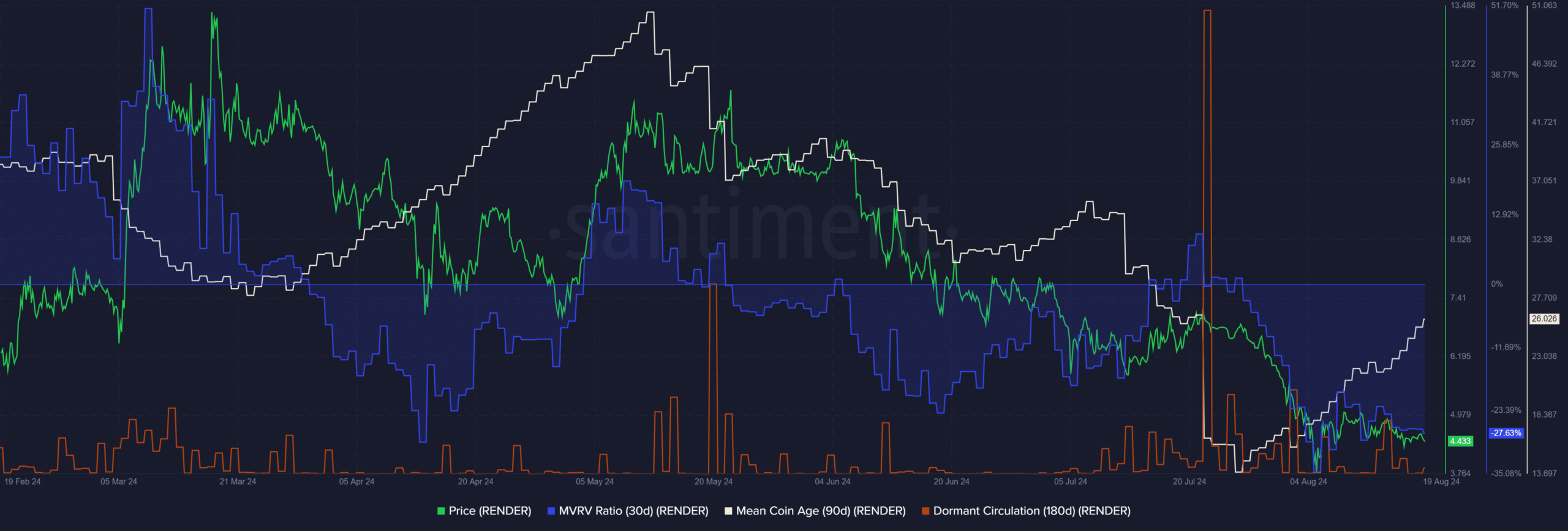

Conversely, it seems a trading chance could be on the horizon. Despite the significant drop in RENDER during early August, the Mean Coin Age (MCA) continued to rise, indicating a sense of conviction among the holders.

Based on the low MVRM ratio, it’s clear that short-term investors have incurred significant losses. Given this downtrend and the accumulation pattern observed, there seems to be a good chance for short-term purchases, indicating potential profitability.

In the past few days, this concept hasn’t seen a substantial increase in activity or movement, as indicated by the dormant flow.

Does the RENDER price action support the bulls?

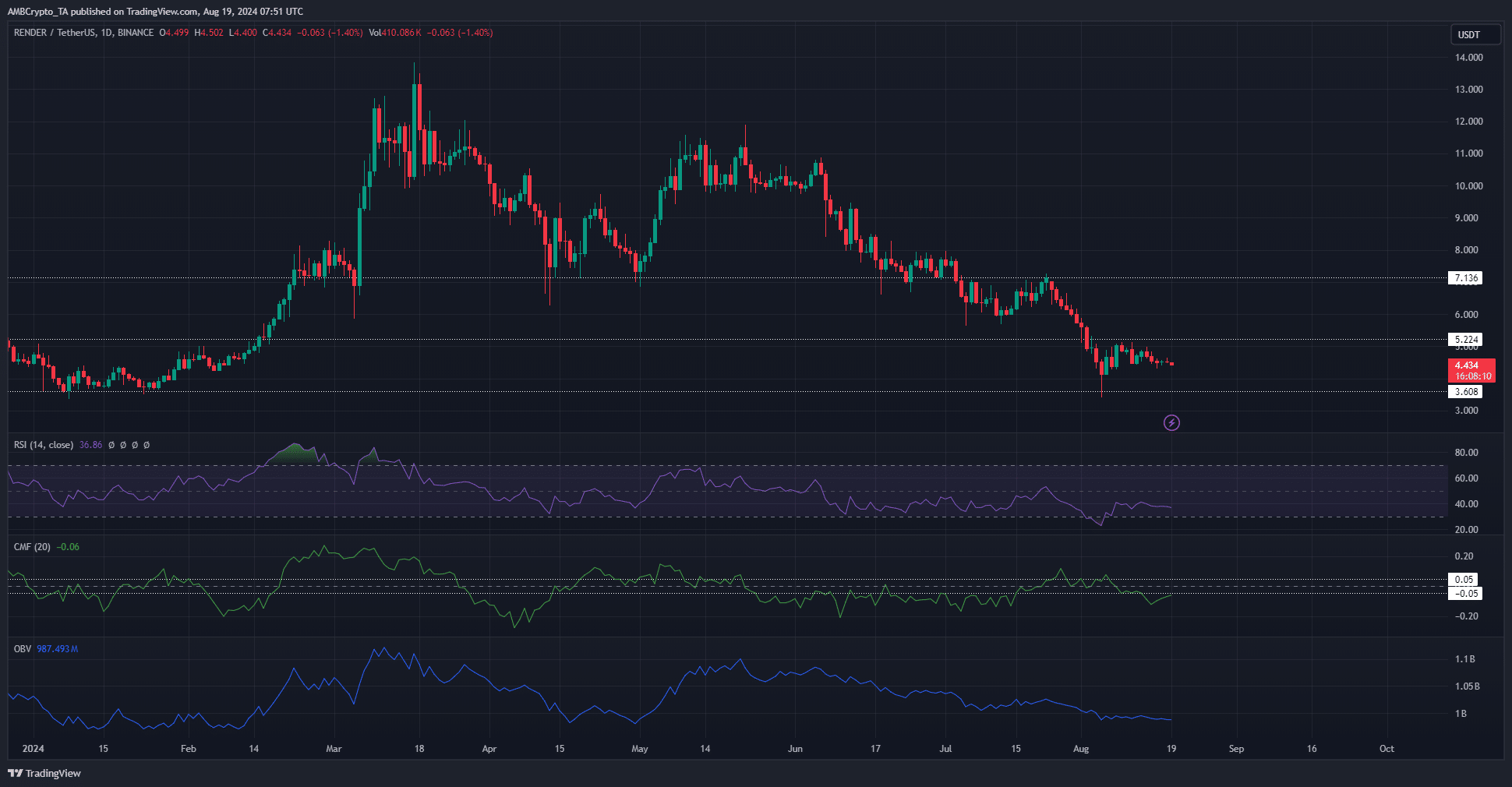

Over the past few months, specifically since June, the value of RENDER has consistently dropped and breached several significant support points. The $3.6 level was successfully held this month, yet the overall downward trend remains unabated. For a reversal to occur, it would require a surge in price beyond the $5.22 mark.

1. Based on the volume indicators, there was intense selling activity and a substantial withdrawal of funds from the market. On the daily chart, the RSI demonstrated robust downward trending momentum, suggesting a strong bearish influence.

Realistic or not, here’s RENDER’s market cap in BTC’s terms

Hence, even though the MVRV and MCA metrics gave a buy signal, traders should remain cautious.

Instead of attempting to move forward when prices approach the $5 – $5.22 resistance level, you might consider going short (selling), or simply holding back and remaining neutral in your position.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-20 04:07