- A market expert has pinpointed several factors to sustain FET’s status as a leading performer.

- Complementary data reinforces FET’s upward trajectory which strengthens its appeal.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find the recent performance of FET intriguing. The 11.92% price surge and the 138.25% spike in trading volume over the past 24 hours is nothing short of impressive.

In the last day, the value of FET crypto has risen by 11.92%, while its trading activity surged by an impressive 138.25%. This latest boost is a continuation of the optimistic perspective on FET that AMBCrypto shared earlier.

The noticeable rise in FET’s worth indicates a robust bullish trend, implying that the price might soon hit, or even exceed, the $3.48 level.

This outlook is supported by insights from analysts, who cite various key on-chain metrics.

Can FET trade past $3.48? Analyst weighs in

Based on insights from well-known crypto analyst Doctor Profit, FET appears poised for an upward trend. In a recent post, he highlighted four significant elements that could potentially boost FET, leading to a potential 312.43% surge within the coming days, assuming current market movements persist.

The diagram he shared makes it clear that his forecasts are particularly compelling for the current state of the cryptocurrency market, implying that this setup could be one of the best possibilities available right now.

He marked important price points for cashing out, calling the graph “one of the most appealing” in the present market setting.

While he holds a long-term optimistic outlook, with FET potentially trading at $3.48, this forecast is based upon several fundamental factors, including Bitcoin’s performance and other variables that could either hold up or hinder FET’s rise to new highs.

Instead, according to a brief examination conducted by AMBCrypto, it appears that FET may reach around $1 quite soon.

Rising interest among traders and growing scarcity

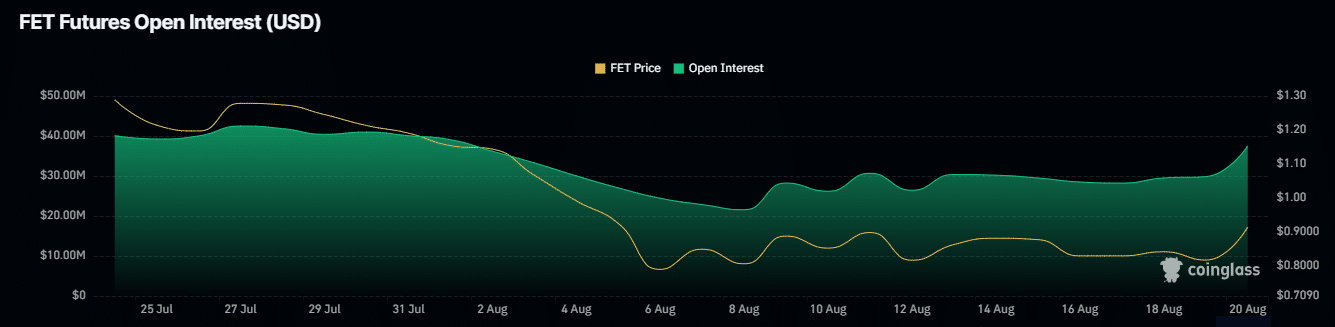

As an analyst, I’ve noticed a strong bullish trend in the market based on recent data from Coinglass. Both Netflow and Open Interest suggest that investors are optimistic about the market’s direction.

Over the last day, Open Interest surged by approximately 29%, which translates to a substantial boost of around $38.8 million. This sizable jump indicates that many traders are eager and ready to pay extra to keep their long-term investment stakes active.

Instead, it’s worth noting that when Netflow for spot exchange switches to a negative value, it means more FET is being taken out (withdrawn) from these exchanges than put in (deposited). This results in a decrease of the available FET supply on these exchanges.

The limited supply of FET tokens could potentially push up their prices, since fewer are readily accessible on the market for purchase.

FET scarcity meets growing market participation

Although there’s not much FET available on exchanges, the curiosity and engagement among traders is steadily increasing.

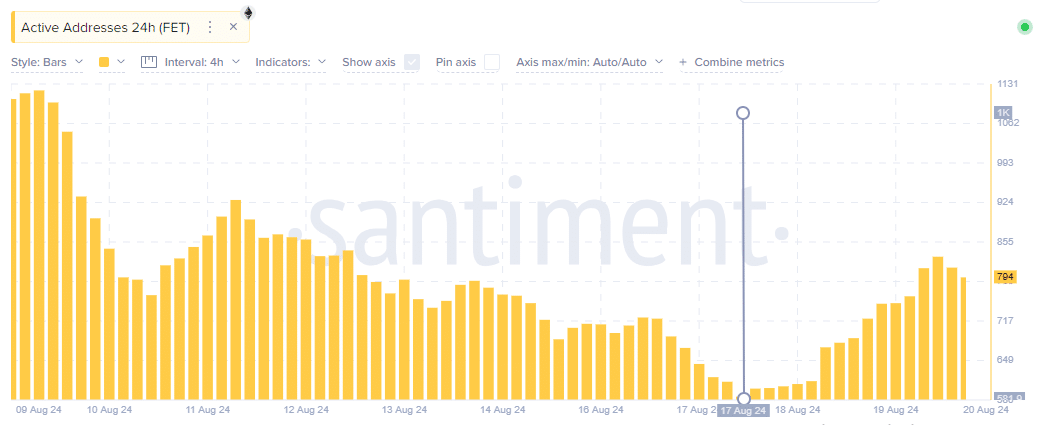

According to data from Santiment, there’s been a significant rise in the number of active wallets or addresses (represented by the gray line) since August 17, as shown in the attached graphic.

As a researcher, I’ve noticed an impressive surge in the number of active addresses associated with FET, accompanied by a decrease in its circulation on exchanges. This trend strongly implies a high probability of heightened demand for FET in the near future.

If the number of active FET addresses keeps increasing along with a large amount of FET being transferred out, it might act as an important trigger, possibly pushing the price towards its closest peak as shown on the analyst’s graph.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-08-20 19:36