-

Outflows from spot Ether ETFs have totaled $433M after three consecutive days of outflows.

The declining demand for ETH alongside a rising supply has hampered Ethereum’s efforts to gain.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself constantly amazed by the rollercoaster ride that is Ethereum [ETH]. The recent price action has been particularly intriguing, with ETH gaining around 2% during Tuesday’s Asian trading session but still losing 23% of its value since spot Ether exchange-traded funds (ETFs) launched in the US last month.

On Tuesday, the cryptocurrency market experienced a significant recovery during the Asian trading hours. At the moment of this report, Ethereum (ETH) was up nearly 2%, trading at approximately $2,678.

Nevertheless, even with the recent advancements, the leading altcoin has seen a 23% drop in value since U.S. spot Ether exchange-traded funds were introduced about a month ago.

So, what is weighing down Ethereum’s price?

Ethereum ETF outflows hit $433M

The cumulative net outflows from spot Ethereum ETFs stood at $433M at press time.

Since its debut with an initial value of $10 billion, the Grayscale Ethereum Trust ETF (ETHE) has consistently seen outflows. Currently, it retains approximately $4.84 billion in total assets, potentially increasing its vulnerability to additional losses.

Last week, Framework Ventures co-founder, Vance Spencer predicted that investors might eventually allocate their portfolios with a 50-50 split between Bitcoin and Ether ETFs.

However, over the last three trading days, Bitcoin ETFs have had consecutive inflows while Ethereum ETFs saw consecutive outflows.

Declining network activity increases ETH supply

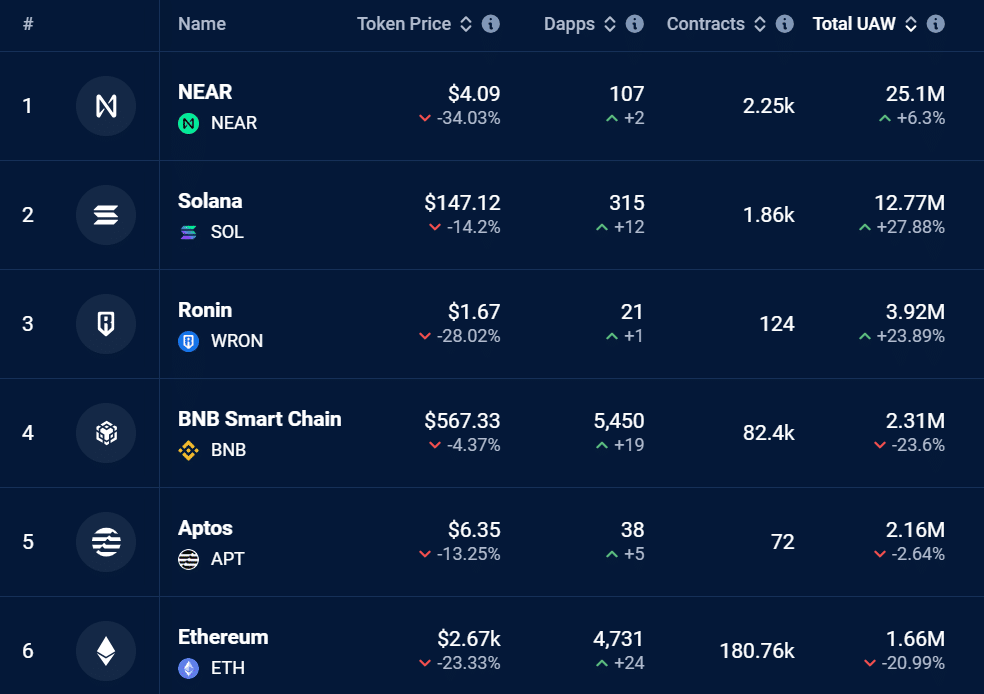

Ethereum’s network has also seen a decline in usage, as seen on DappRadar.

Over the past month, we’ve seen a decrease of about 20% in the number of distinct, active wallets on the Ethereum network. Currently, there are approximately 1.66 million unique users on Ethereum, placing it sixth in terms of this specific statistic.

The declining network usage has also affected the amount of ETH tokens burned, which has, in turn, increased supply, making Ethereum inflationary.

According to data from Ultrasound Money, approximately 18,000 Ether tokens have been minted over the past week, whereas just 1,500 tokens were destroyed or “burned”.

Over a span of seven days, the number of ETH tokens in circulation grew by more than 16,000 units, due to an increase in supply with concurrently decreasing demand. This excess supply has led to a pull on the price of ETH, causing it to potentially decrease.

Indicators signal weak demand

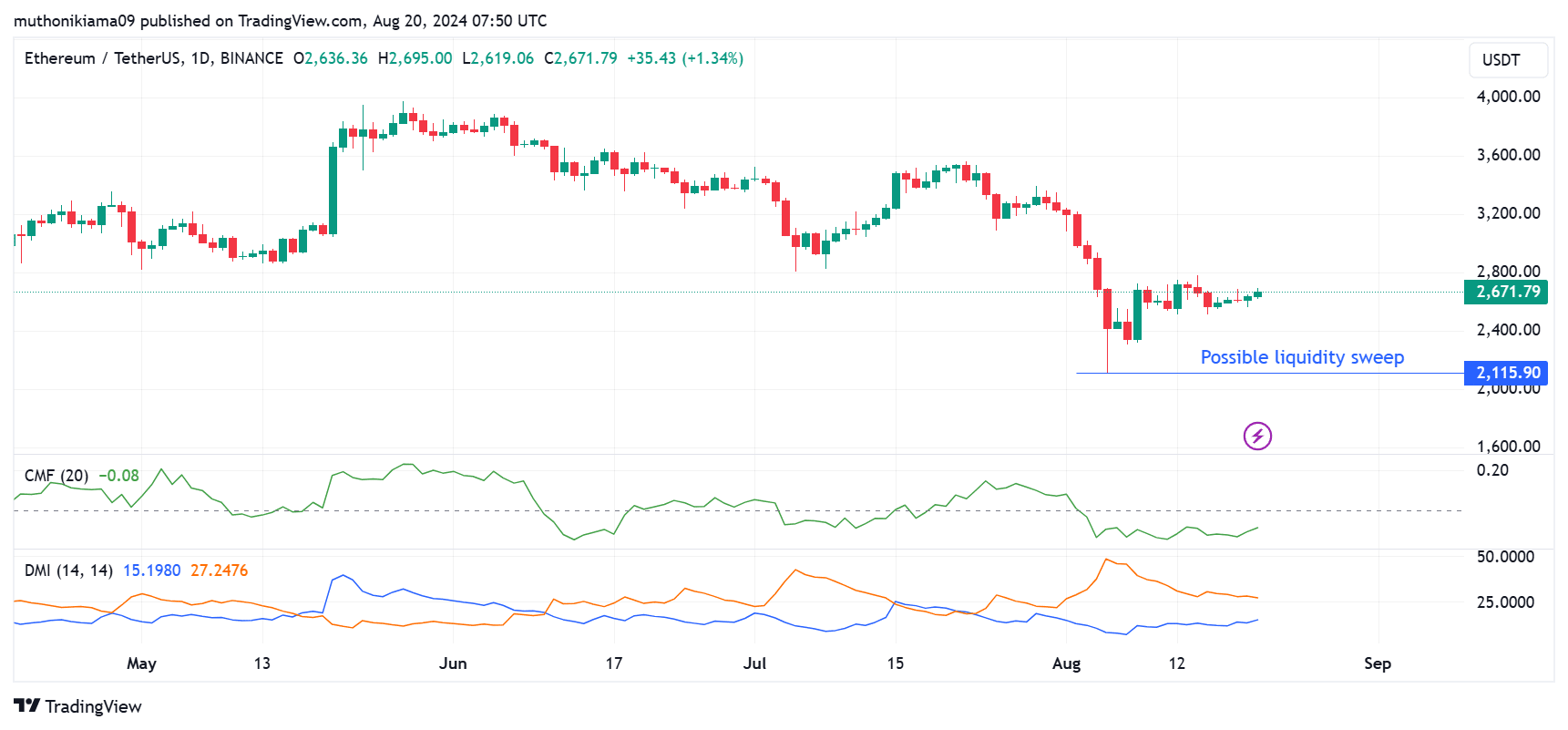

At the current moment, Ethereum (ETH) is experiencing low demand, a situation that might put pressure on its price. Notably, the Chaikin Money Flow indicator, which evaluates buying and selling pressure, showed a negative reading during this period.

So, selling pressure has outweighed buying pressure since early August.

As a crypto investor, I’ve noticed that the Directional Movement Index (DMI) has been pointing downwards since July. Specifically, the Positive Directional Indicator is consistently lower than the Negative Directional Indicator during this period, suggesting a bearish trend in the market.

Nevertheless, the gap between the two lines is becoming smaller, suggesting a possible change in direction. Investors might want to keep an eye on a potential surge in trading activity at $2,115, given the price’s significant upward momentum.

Realistic or not, here’s ETH’s market cap in BTC’s terms

According to AMBCrypto’s analysis using CryptoQuant, Ethereum may require the return of leveraged traders to initiate a positive price adjustment.

Furthermore, as reported by Coinglass, Ethereum’s Open Interest has decreased significantly, falling from a high of $17 billion in May to its present level of $10 billion.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-08-20 21:12