-

SOL looks bullish and could regain the $180 level in the coming days.

SOL’s trading volume has increased by 14%, indicating a higher participation from traders.

As a seasoned crypto investor with a knack for deciphering market trends and a penchant for spotting whale activity, I find myself intrigued by the recent events surrounding Solana (SOL). While the whale dump of 20,000 SOL might have caused a momentary ripple in the market, it appears that the bullish momentum is too strong to be swayed.

There’s been a fresh surge of growth in the cryptocurrency market as leading coins such as Ethereum, Binance Coin, and Solana have experienced significant increases in their prices.

Amidst this, a Solana whale was found dumping a notable 20,000 SOL worth $2.9 million, according to the on-chain analytic firm Lookonchain.

Whale offloads 20K SOL

As a crypto investor, I noticed that a significant player, often referred to as a ‘whale,’ recently offloaded approximately 20,000 Solana (SOL) tokens, valued at around $1.45 million each, split evenly between Binance and OKX exchanges.

From January 15th, 2024 onwards, this whale has transferred more than 614,000 SOL, equivalent to approximately $89 million, across various centralized cryptocurrency exchanges.

It seems that the latest drop in SOL prices might have taken place while the coin was holding steady within a narrow band of $142 to $144. Notably, this dip did not appear to influence the overall price of SOL.

Solana price analysis

Currently, Solana (SOL) is close to $148.5 in value due to a significant jump of approximately 4.5% in price over the past day. Furthermore, its trading activity has witnessed a rise of approximately 14% within this timeframe.

The rise in trading activity suggests a greater number of traders are getting involved, potentially signaling a market rebound.

In the past day, the Open Interest for SOL saw minimal change, climbing just 1% as reported by the on-chain analytics company Coinglass.

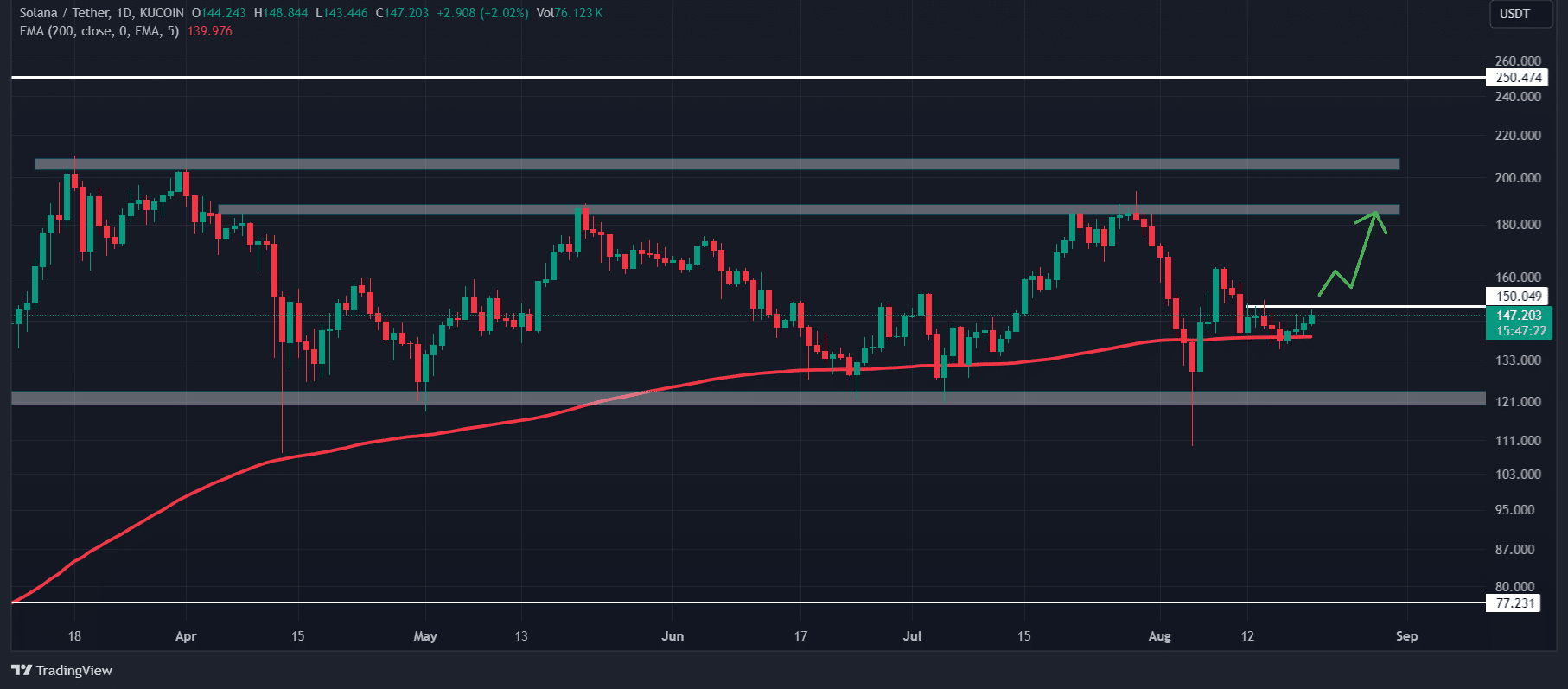

At the moment of analysis, I observe that SOL appears optimistic. It’s currently trading above its 200-day Exponential Moving Average (EMA), suggesting a bullish trend when viewed from a daily perspective.

On a 4-hour time frame, SOL was forming a bullish inverted head-and-shoulder price action pattern.

If Solana (SOL) ends its daily trading at a price above $150, it’s likely that it might reclaim the $180 mark over the next few days, given its past trend of price momentum.

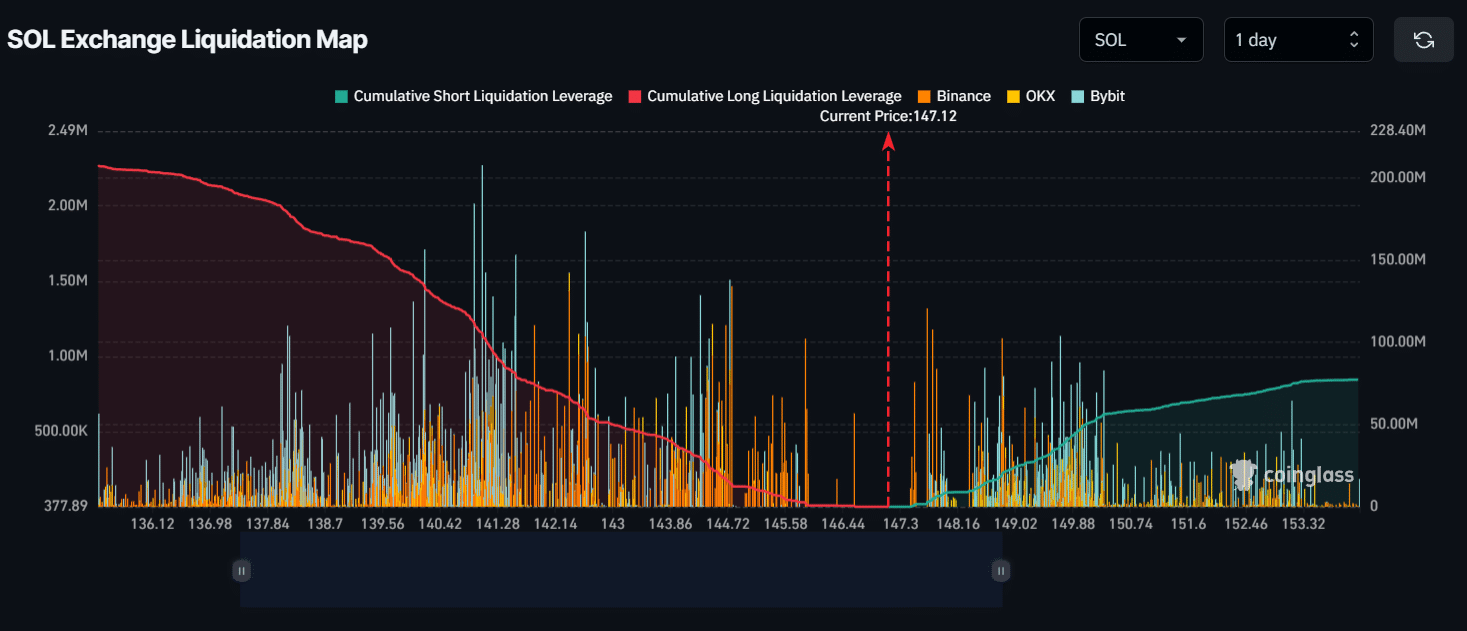

Major liquidation levels

Currently, the significant liquidation points for SOL are approximately $141 at the lower end and $150 at the upper end, as reported by Coinglass.

Should the market outlook continue to be optimistic and Solana (SOL) reaches the $150 mark, approximately $40.5 million worth of short positions could get closed out.

Realistic or not, here’s SOL’s market cap in BTC’s terms

If the sentiment reverses and the price drops to $141, approximately $103.4 million worth of long positions may have to be closed out.

It appears that traders are using large amounts of borrowed funds (leverage) when prices reach this point. This means they could potentially lose their positions if market prices shift substantially.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-08-20 23:04