- Ethereum demonstrated signs of recovery, though it remained below previous highs amid cautious market sentiment.

- Rising Ethereum exchange outflows indicated investor confidence, possibly pointing to a bullish trend ahead.

As a seasoned crypto investor with a decade-long journey through the ever-evolving digital asset landscape, I find myself intrigued by recent developments in Ethereum [ETH]. The modestly recovering price, though still below previous highs, is a welcome sight amidst the current cautious market sentiment.

Currently, Ethereum (ETH), the second most valuable digital currency as measured by market cap, is seeing a small bounce back in its value, with its current price being $2,661 as I write this statement.

This marked a 1.6% increase over the past day.

Prior to this, Ethereum had been on a downward trajectory, reaching a low of $2,545 last week.

Although it has seen a rise recently, Ethereum’s current price is still significantly lower than its peak in March at $4,070, and it’s roughly 45% lower than its record high of $4,878, which was set three years ago.

Is it possible that Ethereum’s current market situation signals a prolonged rebound, or could the latest price fluctuations just be a brief adjustment?

As a researcher, I’ve been closely examining the Ethereum market, and based on my analysis, it appears we might be nearing the end of its corrective phase. This conclusion is derived from on-chain indicators that suggest a possible change in market sentiment.

Market sentiment

According to a recent study by Burak Kesmeci, he pointed out two crucial data sets suggesting that Ethereum might be approaching the final stages of its correction period.

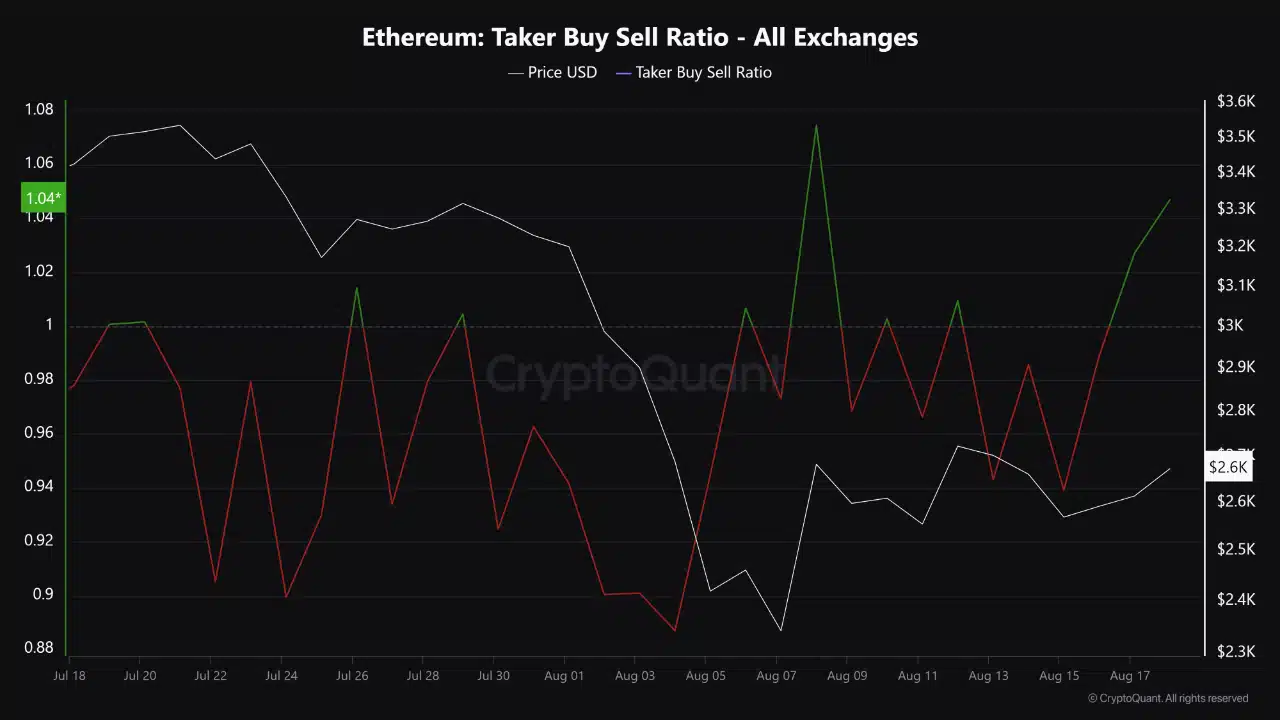

The first is the Taker Buy Sell Ratio, which measures the ratio of buyers to sellers across all exchanges.

As per Kesmeci’s findings, this ratio now shows a positive trend, suggesting that the buying power is gradually recovering.

The change in power between buyers and sellers might signal an approaching market upturn, provided this pattern persists into next week as well.

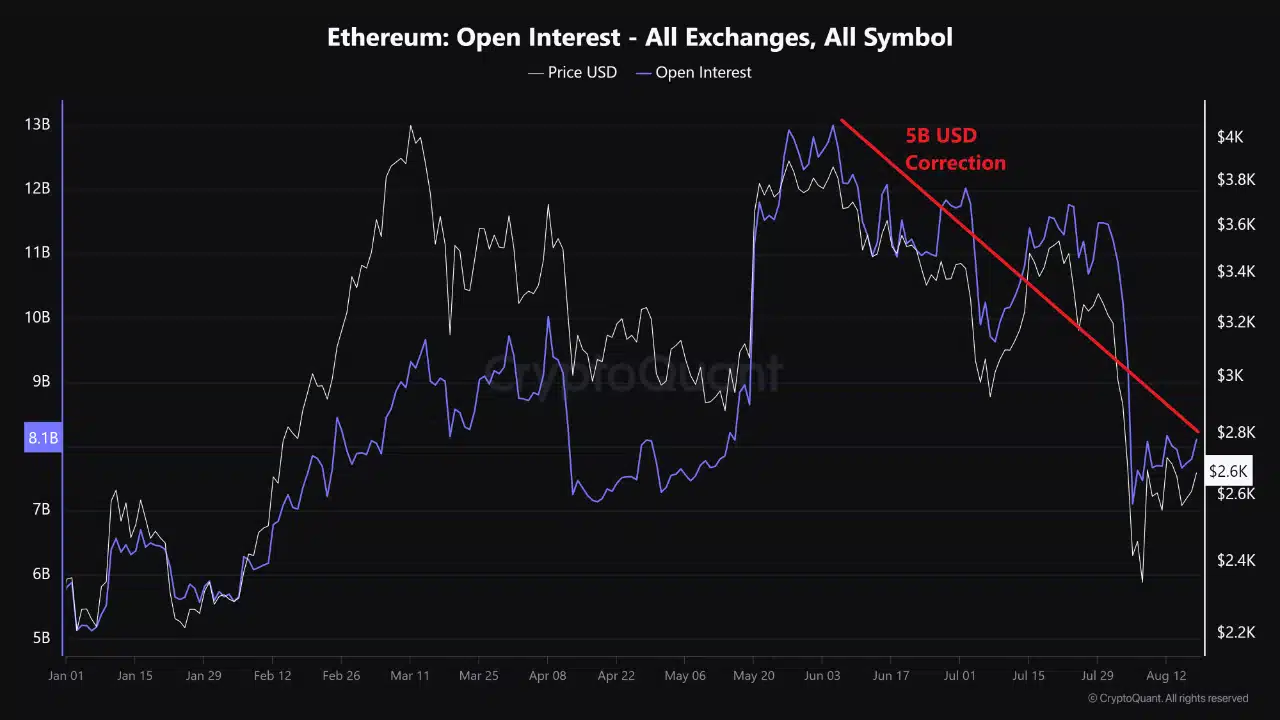

The second measure we’re looking at is called Open Interest (OI), which refers to the sum of all active long and short positions currently existing within the marketplace.

In my research findings from June 2024, I noted an intriguing development with Ethereum: when its price peaked at around $3,800, the Open Interest (OI) skyrocketed over $13 billion, a record high. This striking surge in OI suggested that a market correction might be on the horizon.

On the 5th of August, 2024, I observed a significant drop in OI’s value due to a major economic event that occurred, causing its market capitalization to shrink to approximately $7 billion.

Kesmeci pointed out that a substantial increase in Ethereum’s price could occur if investors who use leverage decide to return to the market, possibly triggering a fresh surge of purchasing actions.

Is Ethereum ready for a rally?

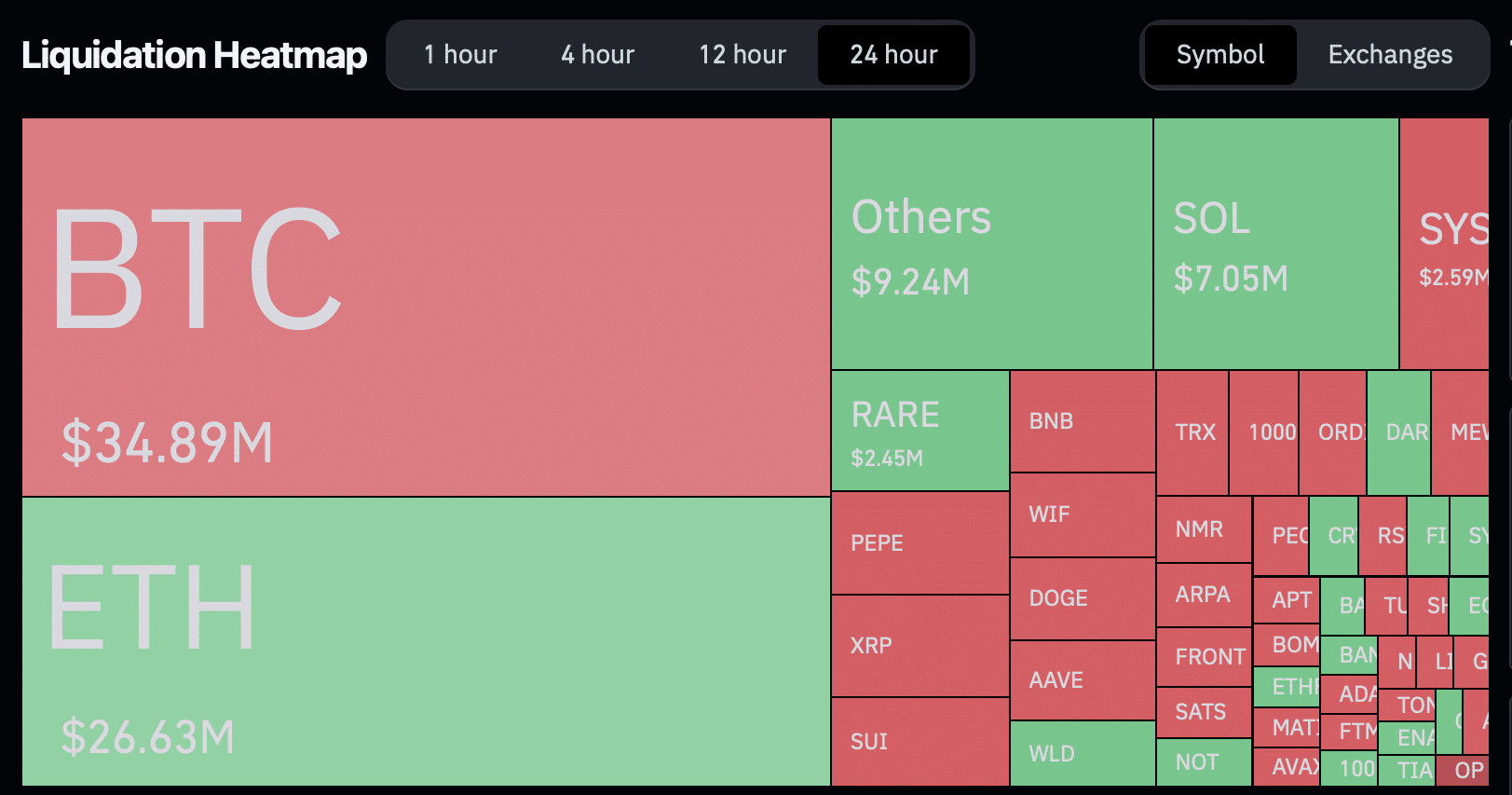

Although Kesmeci’s highlighted metrics suggest a positive future, it is important to note that Ethereum’s 24-hour recovery has primarily affected the larger cryptocurrency market.

During this span, a grand total of 43,521 traders faced liquidation, resulting in a staggering $111.52 million being wiped out. Out of this sum, Ethereum was responsible for approximately $26.63 million in losses, and the bulk of these liquidations were long positions.

It seems that some traders are hopeful, but the market still shows signs of instability and high-leverage positions continue to be quite risky.

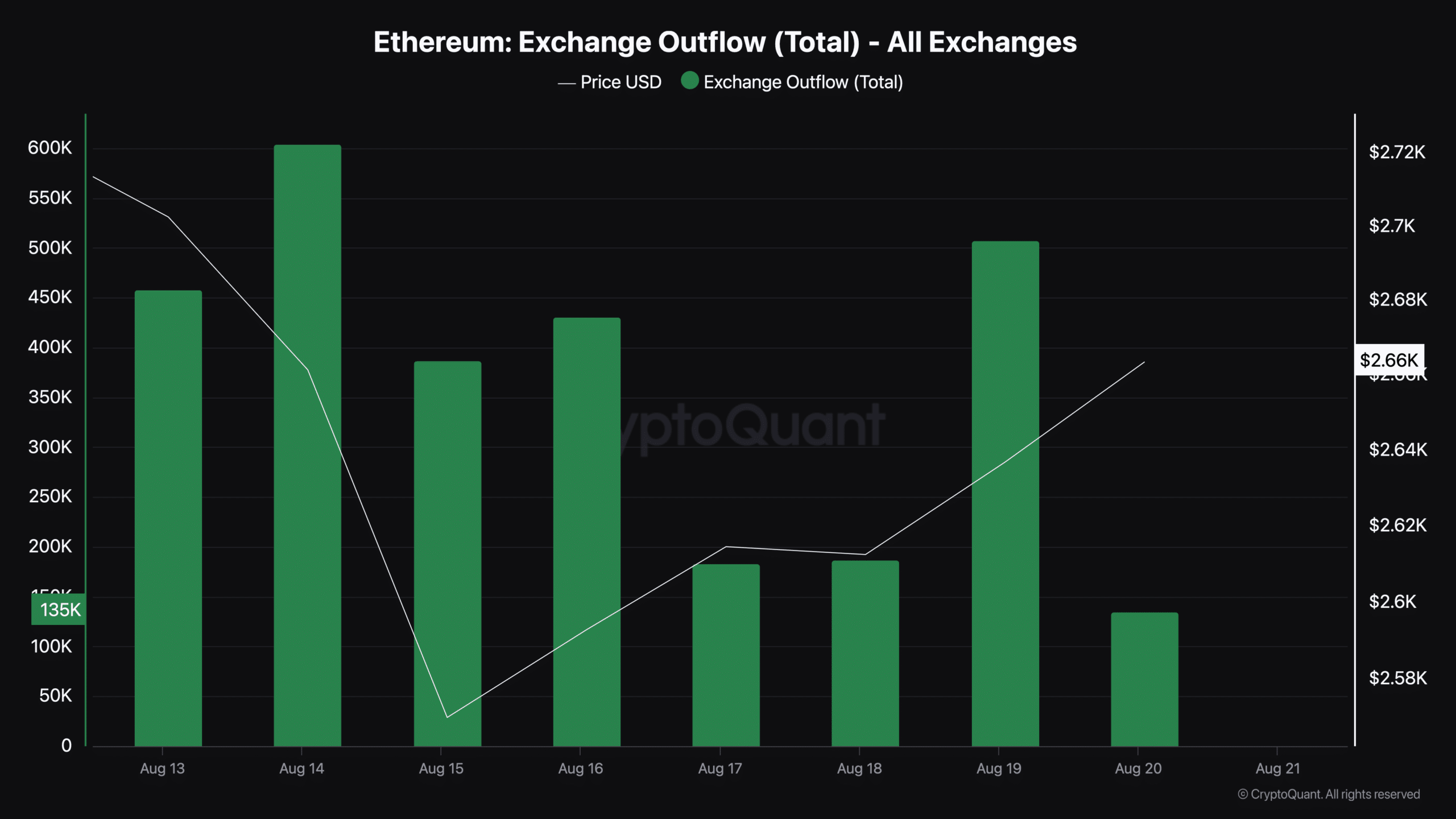

Beyond the on-chain metrics, another critical factor to consider is the movement of Ethereum out of exchanges.

According to data from CryptoQuant, there has been a steady rise in the number of Ethereum tokens being withdrawn from exchanges over the last seven days.

Since the 14th of August, over 600,000 Ether (ETH) were taken out of exchanges, with another 507,000 on the 19th. Currently, around 200,000 ETH have been withdrawn from these platforms already.

A rise in Ethereum being taken off exchanges usually indicates that investors are transferring their Ethereum holdings to long-term storage, thus decreasing the amount of Ethereum available for trade on these platforms.

Based on my years of investing experience, such behavior from investors typically indicates optimism about market trends. They seem to be expecting that prices will rise in the future, a perspective I have found to be particularly rewarding when it is based on sound analysis and research.

As a crypto investor, I’ve observed that when the supply of Ethereum on exchanges decreases while demand remains strong, it can lead to an increase in its price due to the natural market dynamics of scarcity and demand.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Yet, it’s uncertain whether this pattern will trigger a substantial surge or if Ethereum’s comeback will still face resistance from the existing market circumstances.

Kesmeci concluded the post by saying,

“It appears that the purchasing power in Ether is slowly recovering. But we’ll have to wait and see if this is just a brief recovery or the beginning of a robust bullish surge.”

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-08-21 03:36