-

Litecoin has been on a gradual and steady uptrend since the 5th of August, driven by buying activity.

LTC has made a bullish SMA crossover on the four-hour chart that could see it target the $79-$80 price.

As a seasoned researcher with a knack for deciphering market trends and analyzing cryptocurrencies, I find the current trajectory of Litecoin (LTC) particularly intriguing. The gradual uptrend since August 5th, driven by robust buying activity, is indeed a sight to behold. The bullish Simple Moving Average crossover on the four-hour chart adds credence to the notion that we might see Litecoin target the $79-$80 price range.

Litecoin’s [LTC] trading volumes were up by 16% at the time of writing according to CoinMarketCap, coinciding with rising buying activity around the token.

Due to the drop in the cryptocurrency market on August 5th, triggered by disappointing U.S. employment figures and underperforming tech stocks, Litecoin has consistently risen since then.

Its seven-day gains stood at around 7% at press time.

Previously known as Twitter, analyst Dann Crypto observed that LTC (Litecoin) has experienced a V-shaped rebound. This digital currency has been steadily climbing without significant price declines to disrupt its upward trend.

The analyst stated,

As a seasoned crypto investor with years of experience under my belt, I must say that the chart I’m currently analyzing is quite unusual and intriguing. Unlike most of the charts I’ve seen in the crypto world, this one has been steadily climbing without any significant dips since the correction earlier this month. This kind of price action isn’t something I encounter every day, which makes it worth noting. It’s a breath of fresh air to see such stability amidst the usual volatility that characterizes the crypto market. Keeping an eye on this trend could prove to be fruitful in the long run.

Buyers are driving Litecoin’s gains

The steady gains by Litecoin in the last two weeks could be attributed to consistent buying pressure around the token.

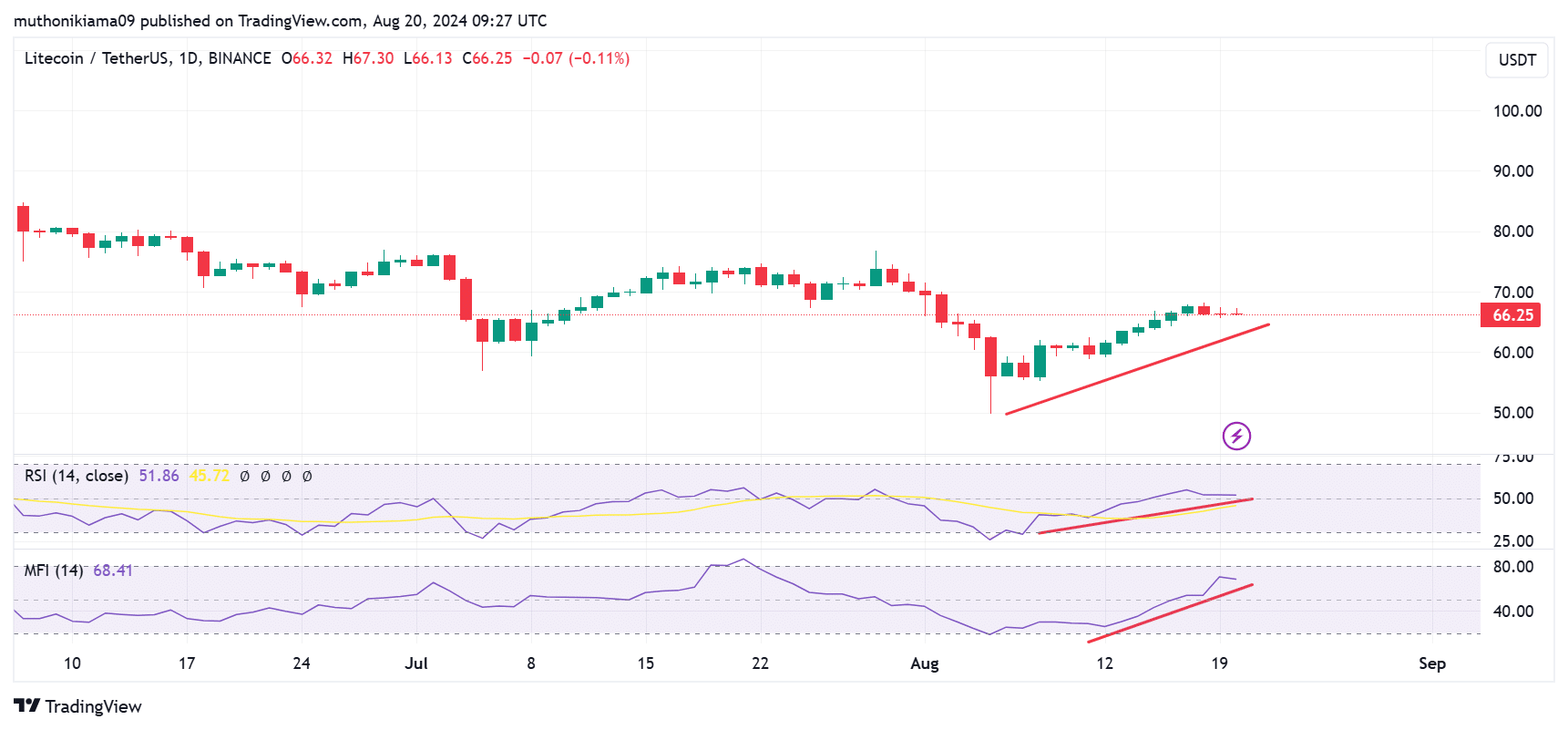

As a crypto investor, I’ve noticed an intriguing trend when looking at the Relative Strength Index (RSI) on my daily chart. It appears that there’s been a steady increase in buying activity, which is quite encouraging. In fact, since early August, the RSI line has been forming higher highs, suggesting a potential upward momentum in the market.

68 on the Money Flow Index (MFI) suggested that there was more money flowing into Litecoin than leaving it, signifying a greater number of purchases rather than sales. Typically, this pattern is considered a positive or bullish sign, indicating that buying activity has been driving the price movement.

On the other hand, since Litecoin’s surge seems to originate purely from buying actions, investors should exercise caution, as there might be potential for a turnaround.

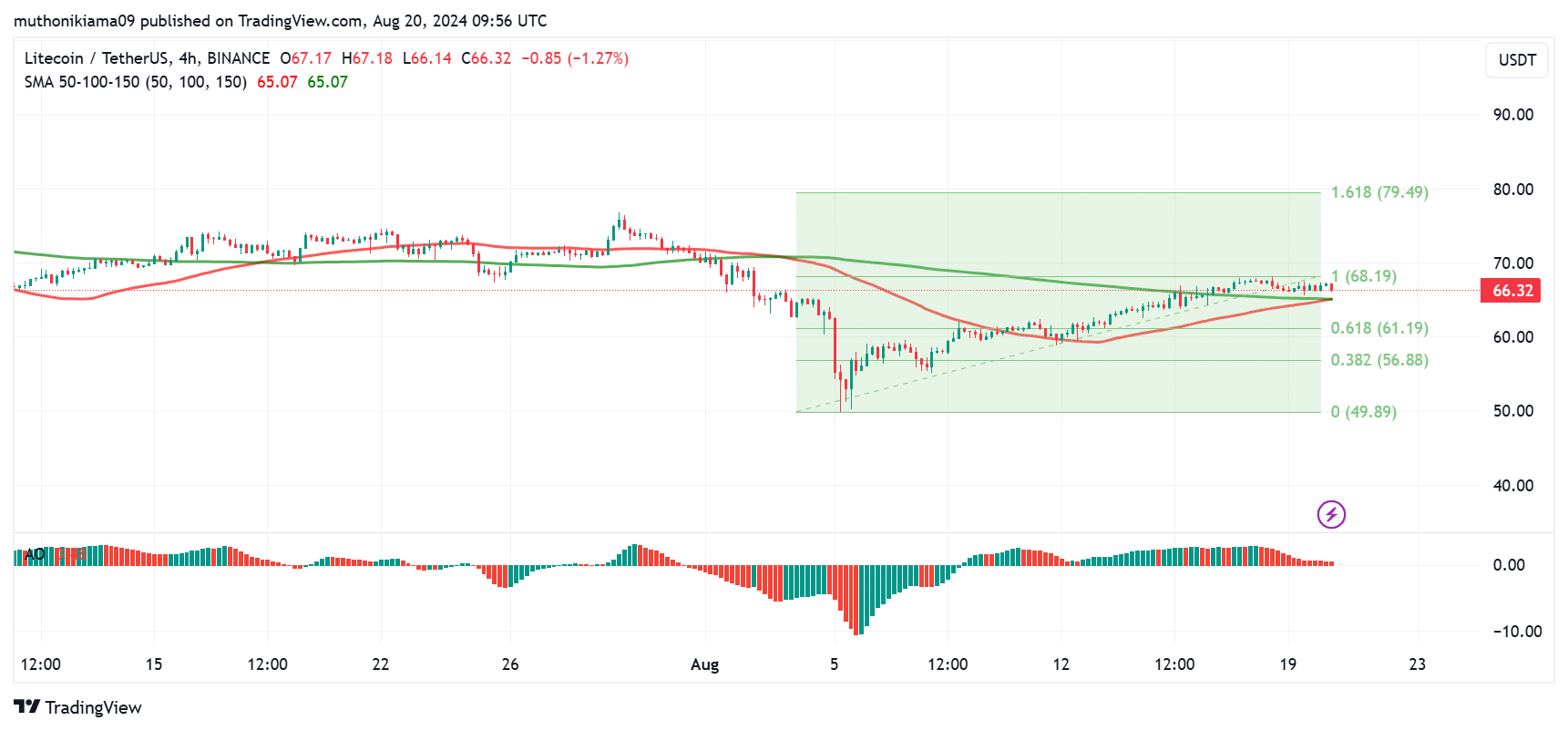

Despite being in a positive area, the Awesome Oscillator (AO) is displaying red bars in its histogram. Typically, this configuration suggests that the Long Term Coin (LTC) is still experiencing a strong bullish trend.

On the other hand, the momentum of the upward trend seems to be decreasing, potentially leading to a temporary halt or even a change in direction.

Nevertheless, the bullish thesis was reinforced by the Simple Moving Averages (SMAs). The 150-day SMA has shifted to below price, indicating that the long-term trend was positive.

Additionally, the Short-Term Moving Average (SMA) of 50 days was trying to break through significantly above the Long-Term Moving Average (SMA) of 150 days, suggesting a strong upward movement or bullish trend might be developing and sustaining.

Previously, Litecoin (LTC) has failed multiple times to break through the 100% Fibonacci level ($68). If it attempts to reach this resistance level once more and manages to surpass it, there’s a possibility that $79 could be within reach for Litecoin.

Is your portfolio green? Check the LTC Profit Calculator

According to data from IntoTheBlock, approximately 577,000 accounts purchased cryptocurrency in a price range of $65 to $69. If these traders choose to sell, the $68 resistance level could persist as it might continue to deter potential buyers due to the potential supply.

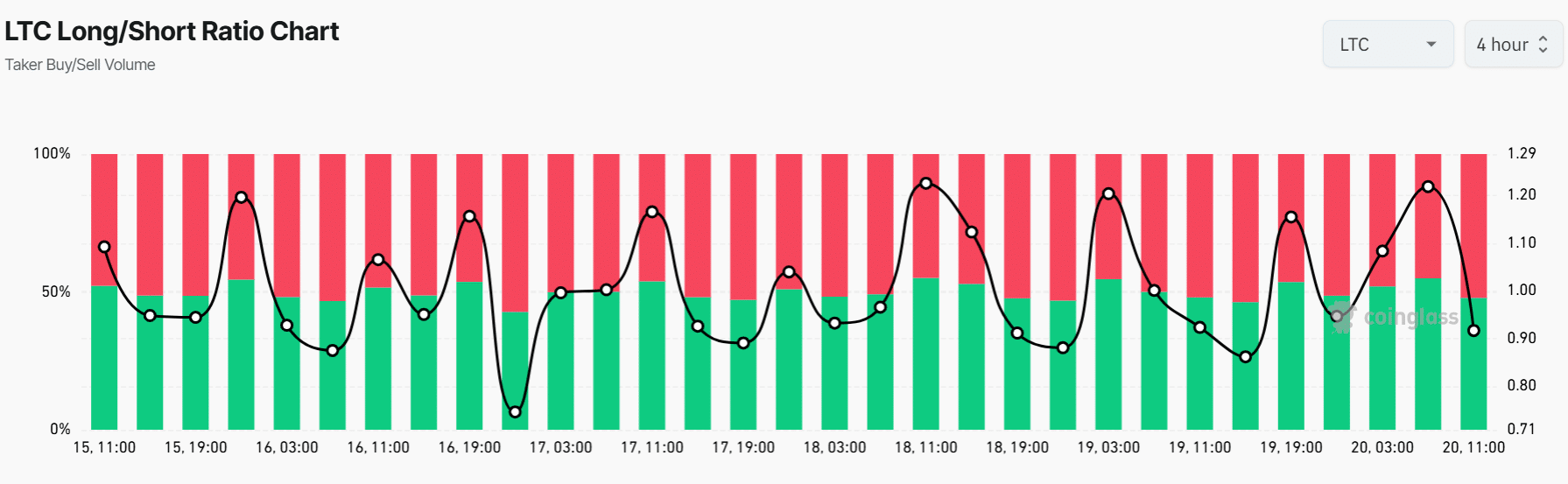

Examining the balance between long and short positions on Coinglass, it appears that the Futures market is leaning towards pessimism regarding Litecoin. At the current moment, this ratio has dipped to 0.91, suggesting a higher number of short positions compared to long ones, indicating bearish sentiment among traders.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-21 05:12