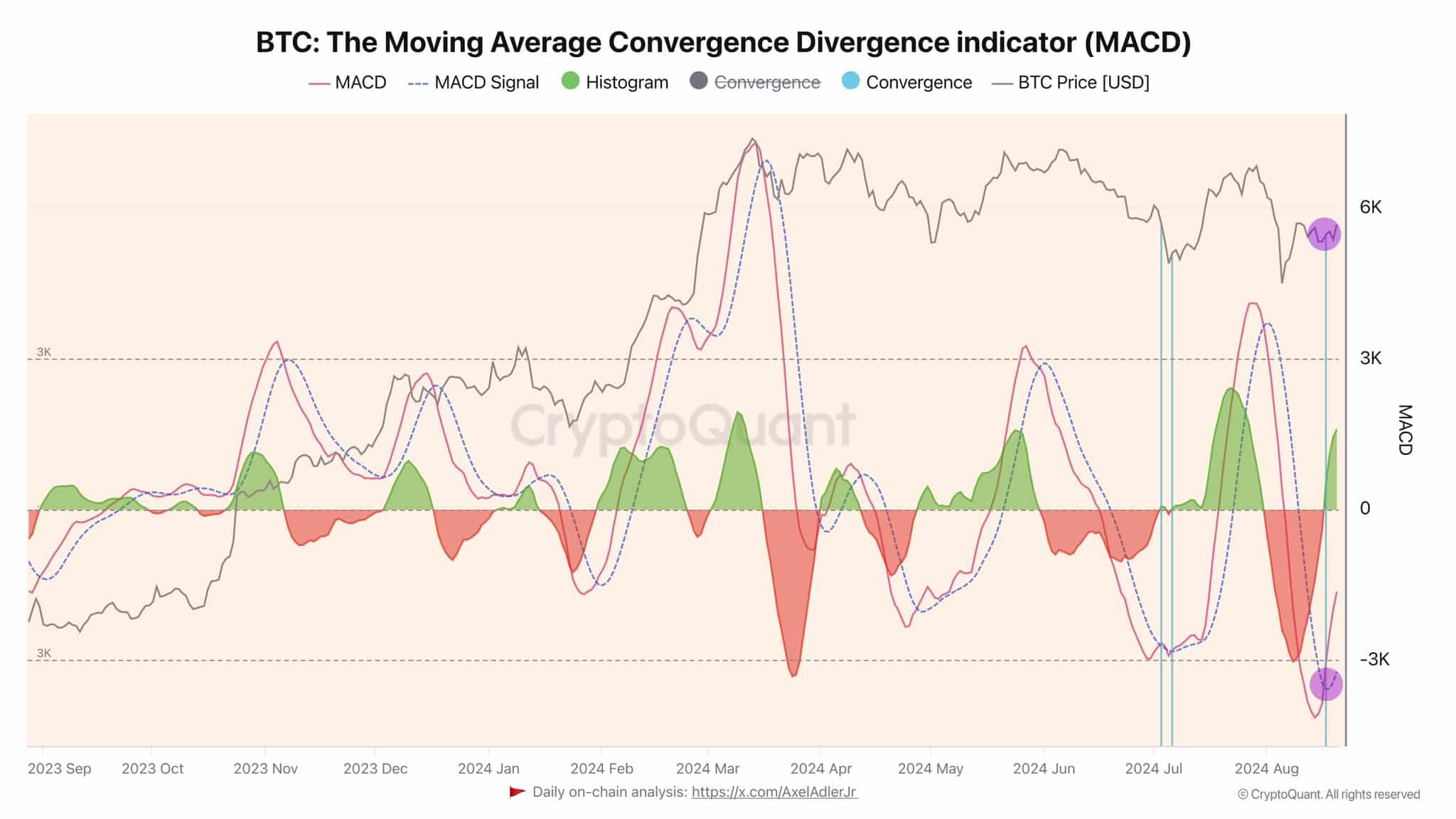

- Michael Saylor’s statement was in line with what the Bitcoin MACD indicator showed.

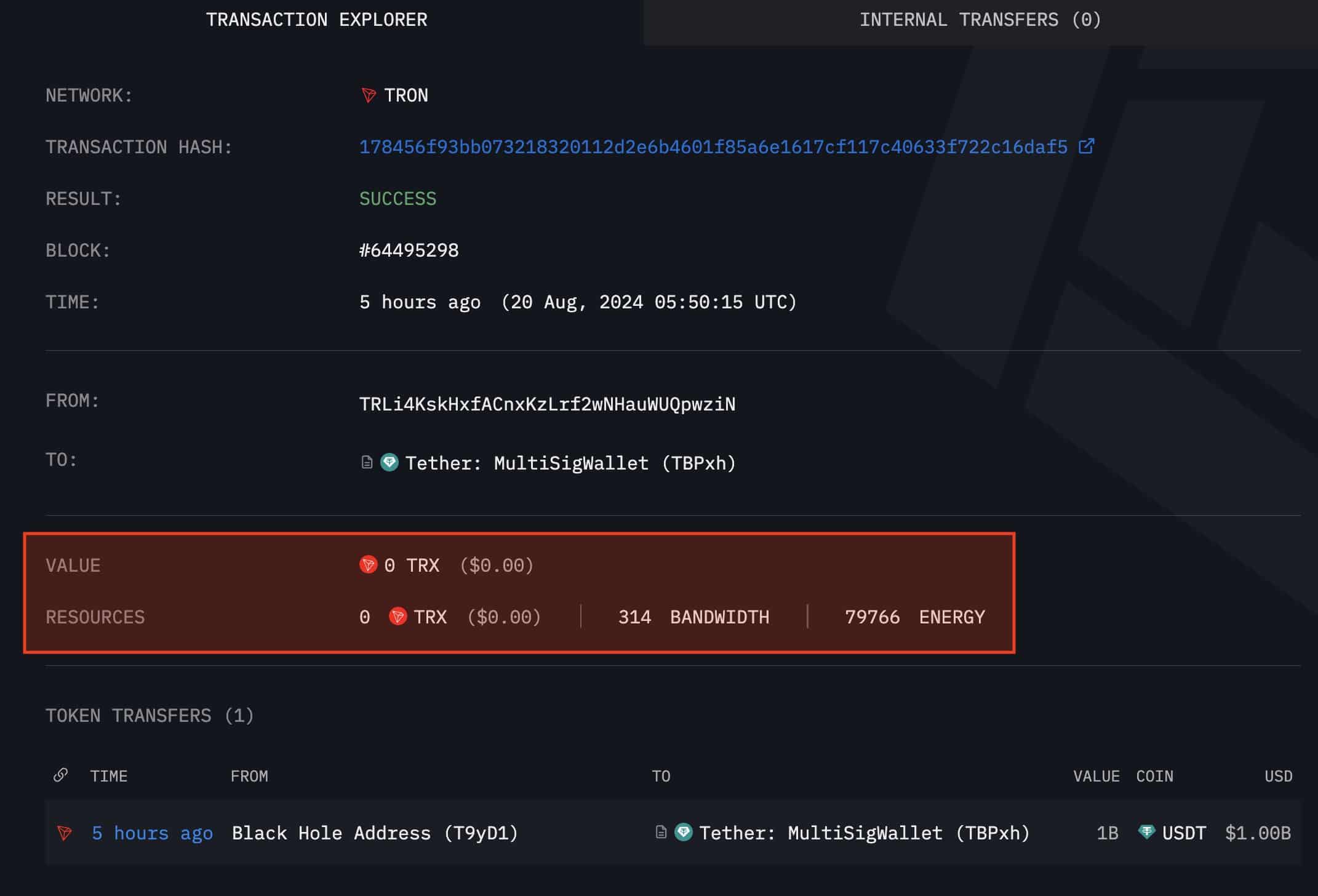

- Tether treasury mints $1B USDT with zero fees.

As a seasoned researcher with years of experience navigating the complexities of the crypto market, I find the current state of Bitcoin particularly intriguing. Michael Saylor’s prediction aligns with my own analysis, and the charts are painting a bullish picture that resonates with the broader community. The MACD indicator is a reliable tool in my arsenal, and its bullish pattern is a strong signal for potential upward momentum.

Michael Saylor, the previous CEO of Microstrategy, shared on Twitter his prediction that Bitcoin (BTC) will continue to rise indefinitely. This statement struck a chord within the cryptocurrency community, igniting excitement and speculation for a potential 2024 bull market rally.

In the opening months of 2024, Saylor’s remarks came at a time when approximately six out of ten leading U.S. hedge funds had started investing in Bitcoin. This wave of institutional involvement significantly boosted both the prices of Bitcoin ETFs and the value of Bitcoin itself.

According to the charts, Bitcoin appears poised for a rise as it has surpassed the 4-hour resistance level, and a bullish double bottom pattern is emerging on the 3-day chart, backed by a powerful engulfing candle, suggesting robust upward movement.

Additionally, the Bitcoin Moving Average Convergence Divergence (MACD) on the daily chart started showing a bullish trend five days back and has since completely transitioned into a bullish stance.

The market is gradually leaning towards a bullish alignment on the Moving Average Convergence Divergence (MACD), suggesting possible increasing trends ahead.

As a researcher, I’m observing an intriguing change in the Moving Average Convergence Divergence (MACD). This transition appears to indicate a reinforcing pattern that might potentially yield additional profits, given the growing attention it’s receiving from traders, who view this as a bullish sign.

Tether treasury mints another $1B USDT

Tether, functioning similarly to the Federal Reserve for cryptocurrencies, impacts market movements each time it creates a new USDT. Recently, Tether Treasury produced $1 billion worth of USDT on the TRON network without incurring any fees.

In the recent dip of Bitcoin, there was a significant increase in the production of Tether (USDT) as observed by Whale Alert. Specifically, about $85 million was sent to Bitfinex, while another $50 million went to an unidentified digital wallet.

In simple terms, it’s anticipated that the ongoing creation of USDT (Tether) will likely boost Bitcoin’s price during the next market uptrend.

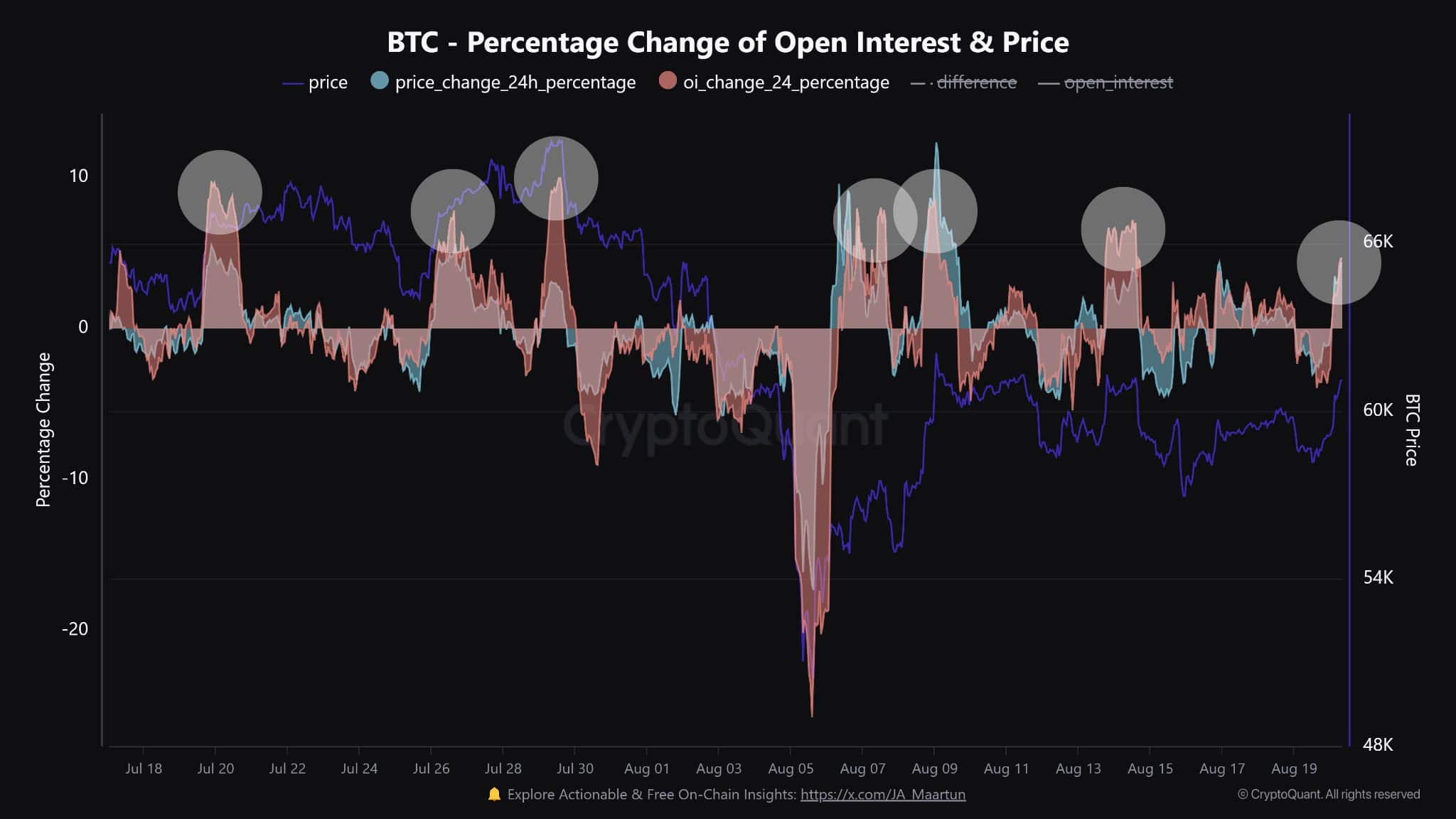

Strong accumulation as open interest rises

As a crypto investor, I’m observing that we’re in a robust accumulation phase for Bitcoin. Notably, Metaplanet has recently invested approximately $3.4 million, acquiring 500 million Yen worth of Bitcoin. This strategic move has boosted their holdings to a total of 360.368 Bitcoins, as Karan Singh reported on X.

With increasing institutional trust and optimism, Metaplanet shares have soared by 13%. Moreover, according to Glassnode, the Bitcoin Purchase Activity Index has reached 1.0, suggesting a significant increase in investors’ buying spree.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As the open interest in Bitcoin (BTC) rises by 5%, investors are progressively taking on additional holdings, a trend fueled by increased use of leverage.

Historically, price rises driven by excessive borrowing (leverage) have frequently resulted in market corrections or reversals, but it’s not guaranteed that this pattern will repeat itself in the future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-08-21 13:12