- Bitcoin shows signs of improving market confidence but short-term headwinds are still in play, influencing its performance.

- Can Bitcoin drum up enough momentum amid signs of declining dominance?

As a seasoned analyst with over two decades of experience in financial markets, I find myself intrigued by the dynamic nature of Bitcoin [BTC]. Despite the recent surge in market confidence, there are still short-term headwinds that could potentially sway its performance.

In recent times, the Bitcoin (BTC) investment environment has seen a renewed surge of trust, even though it’s been finding it challenging to maintain levels over $60,000. This can be observed in both retail involvement and mining activities, indicating a growing optimism among investors.

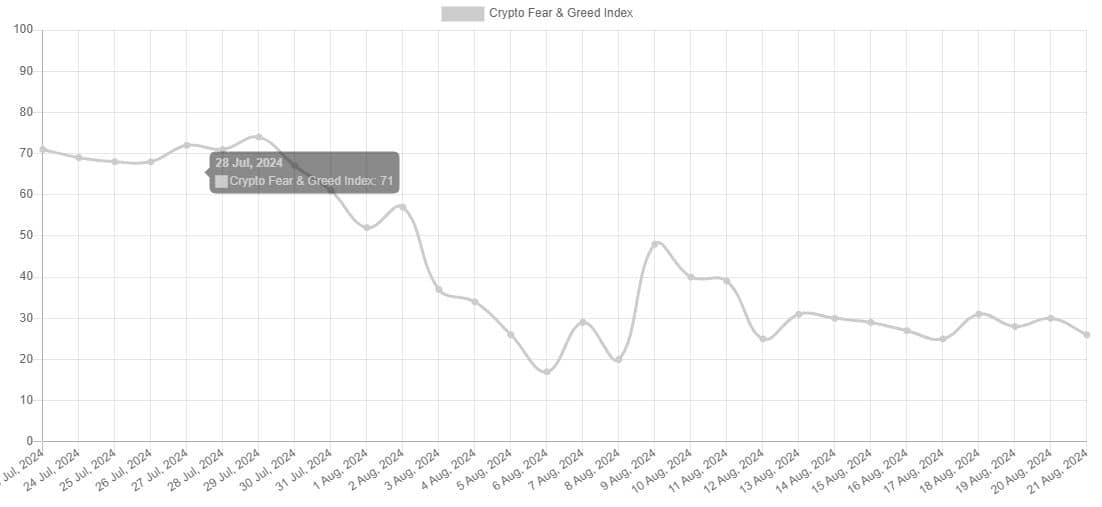

Currently, Bitcoin and the broader cryptocurrency market are showing signs of restored confidence, which contrasts with the circumstances earlier this month. At present, the Fear & Greed Index stands at 26, although it reached a high of 30 during the trading session on Tuesday.

Bitcoin’s confidence level seems to be more optimistic now compared to the beginning of the year, as indicated by the fear and greed index. Yet, it’s important to note that this positive outlook might not fully reflect confidence, given that the index dropped to 26 within the past 24 hours.

One plausible explanation for this is that Bitcoin dipped back under $60,000 yet again, a trend we’ve seen recurring frequently recently.

“The reason behind Bitcoin (BTC) falling below $60,000 this time might be due to the disclosure that Mt. GOX has transferred approximately 12,000 BTC, valued at over $700 million.”

Are miners accumulating Bitcoin?

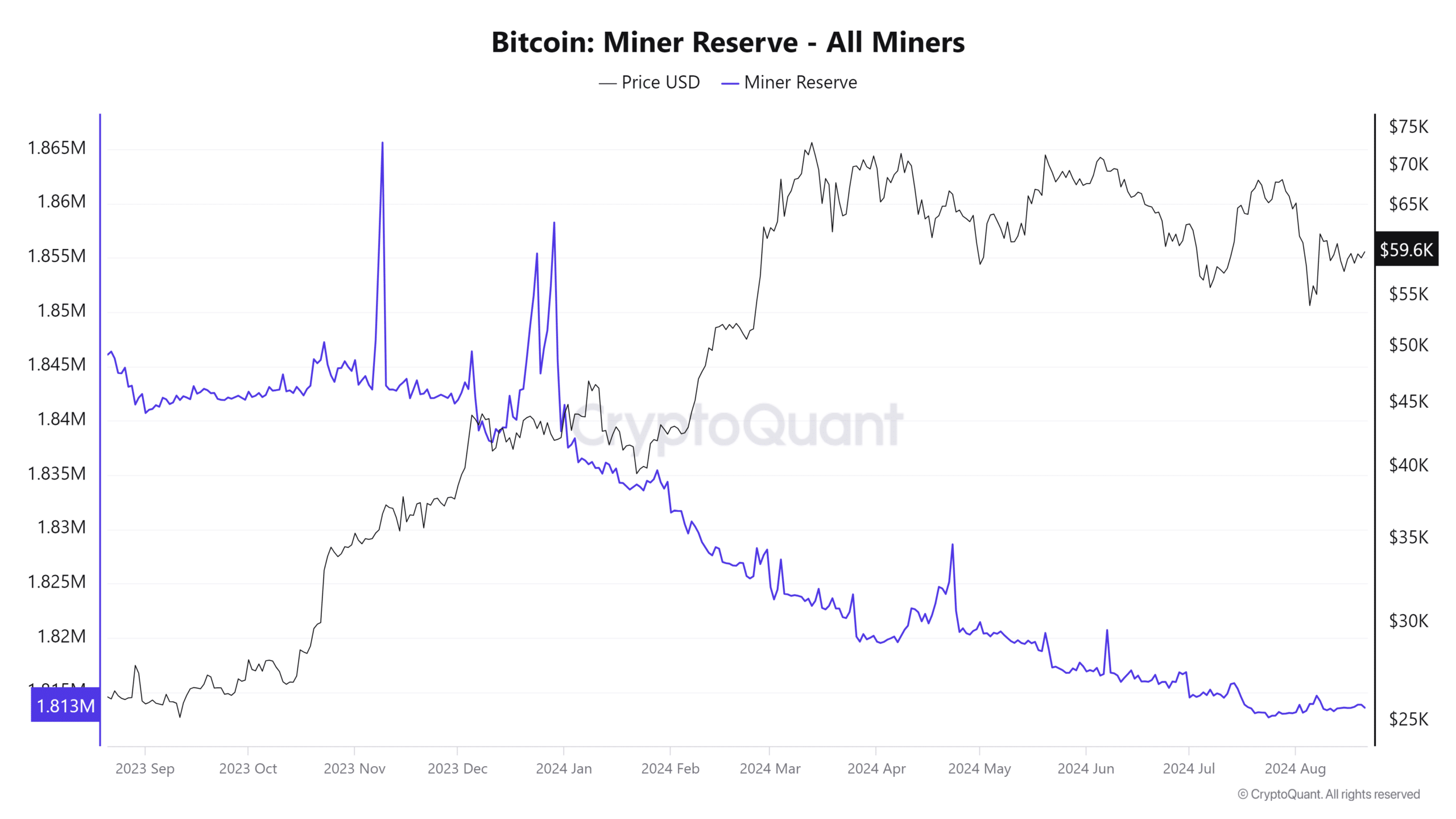

As a cryptocurrency investor, I’ve noticed that the reserves held by Bitcoin miners have generally decreased over the past year. This trend seems to reflect a high level of selling pressure, with miners appearing to offload their Bitcoin holdings more frequently, making them the predominant forces in the market.

Instead, the data on mineral reserves shows a reversal in the curve compared to the July lows this month. This implies that more miners have been holding onto their Bitcoin.

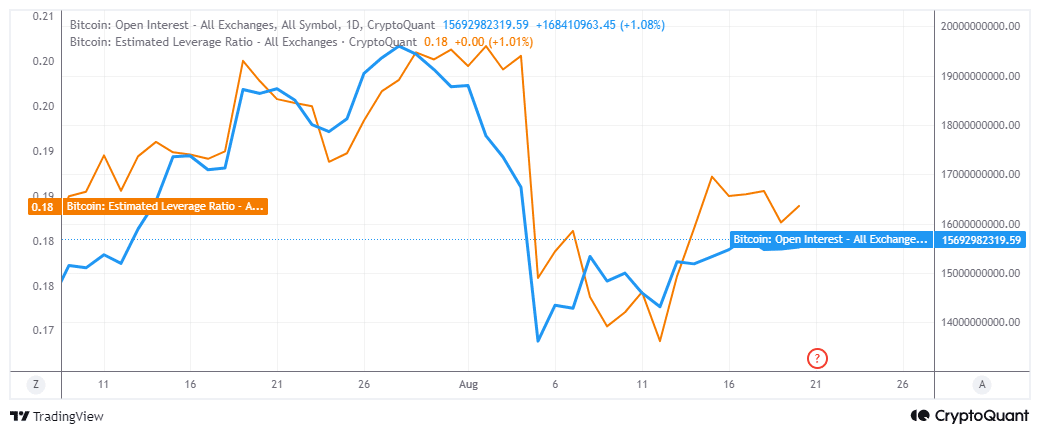

The interest in Bitcoin within derivative markets is showing signs of recovery, as suggested by the increasing open interest following a rocky beginning this month. Additionally, there’s been an emerging trend towards seeking more leverage and resurgence.

As a crypto investor, I can’t help but notice the surge in open interest and leveraged positions, yet I sense a cautious vibe permeating the market. The recent wave of liquidations has left me, along with many other traders, feeling apprehensive, given the uncertainty surrounding the current direction of the market.

Despite a noticeable increase in market optimism due to recent market trends, Bitcoin remains vulnerable to both known and unknown threats, such as the potential sell pressure stemming from the Mt. Gox incident.

On the other hand, it’s worth noting a less prominent risk: The dominance of Bitcoin over other cryptocurrencies has been decreasing steadily since the 10th of August.

As a researcher observing the Bitcoin market, I’ve noticed a minor pullback in its price following a robust rally in dominance since July 13. However, this slight retracement might signal the beginning of a more substantial correction that could unfold in the coming days.

In this scenario, I expect that the tide might shift towards altcoins, potentially causing a slowdown or even reversal in Bitcoin’s upward momentum due to increased liquidity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, a rising number of prominent institutions are showing increased interest in Bitcoin, which hints at intensifying competition. Take Microstrategy as an instance; it used to be the primary institutional investor, yet that position no longer holds true.

Recent data shows that Blackrock has been aggressively buying Bitcoin. Its BTC holdings are now almost twice the amount owned by Microstrategy.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-08-21 19:04