-

TRX’s price surged by more than 10% in the last 24 hours.

Selling pressure might increase, which can halt TRX’s bull rally.

As a seasoned researcher with years of experience in the ever-evolving crypto market, I find myself intrigued by Tron’s [TRX] recent surge of more than 10% within the last 24 hours. While it’s always exciting to witness such significant price movements, I can’t help but feel a bit like a rollercoaster passenger, bracing for potential twists and turns ahead.

While top coins like Bitcoin [BTC] face price correction, Tron [TRX] decoupled from the market. This was the case as the token’s price surged in double digits over the last 24 hours. Let’s have a look at TRX’s on-chain data to find out whether this trend will continue.

Bulls shift gears

Over the past week, the value of Tron tokens has significantly risen by 22%, marking a strong performance. Interestingly, within just the last day, the price of TRX has climbed over 11%.

Currently, TRX is being exchanged for approximately $0.16 each, and its market cap surpasses $13.8 billion, placing it as the tenth largest cryptocurrency. This recent price hike has propelled TRX to reach its highest value point this year.

One significant factor fueling this stock surge was the debut of a meme-based coin project on the Tron platform, specifically the launch of SunPump, as reported by AMBCrypto.

Based on data from Lookonchain, it’s been reported that the Tron Network has generated approximately 1.84 million TRX, which is equivalent to around $246,000, following the introduction of SunPump within a short period.

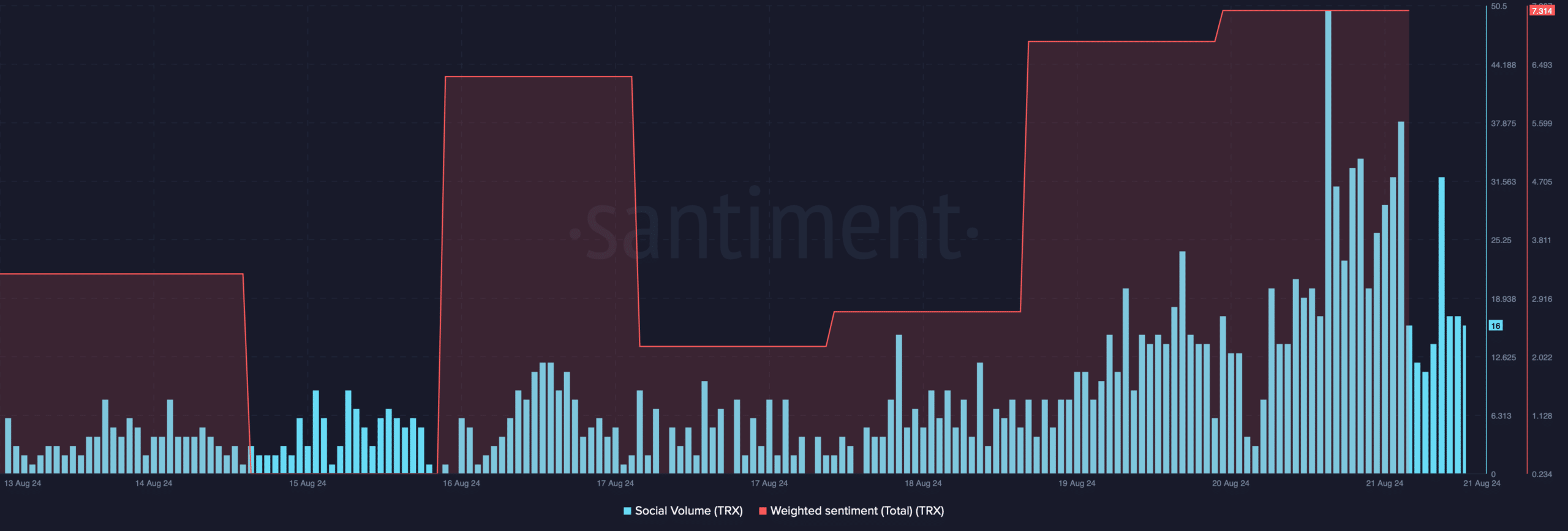

The increase in price additionally boosted the token’s social statistics, as shown by AMBCrypto’s examination of Santiment’s data. It was observed that TRX‘s overall sentiment significantly spiked up.

Based on my extensive experience in the cryptocurrency market and countless hours spent observing its trends, I can confidently say that a strong bullish sentiment surrounding a particular token dominates when its price is consistently rising and investors are optimistic about its future potential. Moreover, I’ve noticed that an increase in social volume, or discussions about the token on various platforms, often reflects growing interest and popularity within the crypto community. This was evident during my time as a moderator for several cryptocurrency forums where I witnessed a surge in conversations surrounding specific tokens when their popularity soared.

TRX has a problem though

As I delved into the analysis, it appeared that the recent price hike for Tron was promising. However, upon examining the data from AMBCrypto and IntoTheBlock, it’s evident that Tron has some challenges looming ahead. Interestingly, all Tron investors are currently in profit, which could potentially lead to a selling frenzy if the price trend reverses.

Based on my years of experience in the financial markets, I have often seen situations where investors cash out their holdings to secure profits. This strategy can be particularly tempting during a bull rally like TRX‘s, as it offers the opportunity for substantial gains. However, if a significant number of investors decide to sell, it could lead to increased selling pressure. In such cases, I have observed that the rally may come to an abrupt end, as the increased supply overwhelms demand and causes prices to correct. This is not a prediction, but rather an observation based on my personal experience and the behavior patterns I’ve witnessed in the market over time. It’s always important for investors to carefully consider their strategies and make informed decisions when managing their investments.

According to AMBCrypto’s examination of data from Coinglass, it was found that the long-short ratio for TRX experienced a decrease. This means that there are currently more investors taking short positions in the market compared to those holding long positions. Given this trend, it suggests a potentially bearish outlook for TRX.

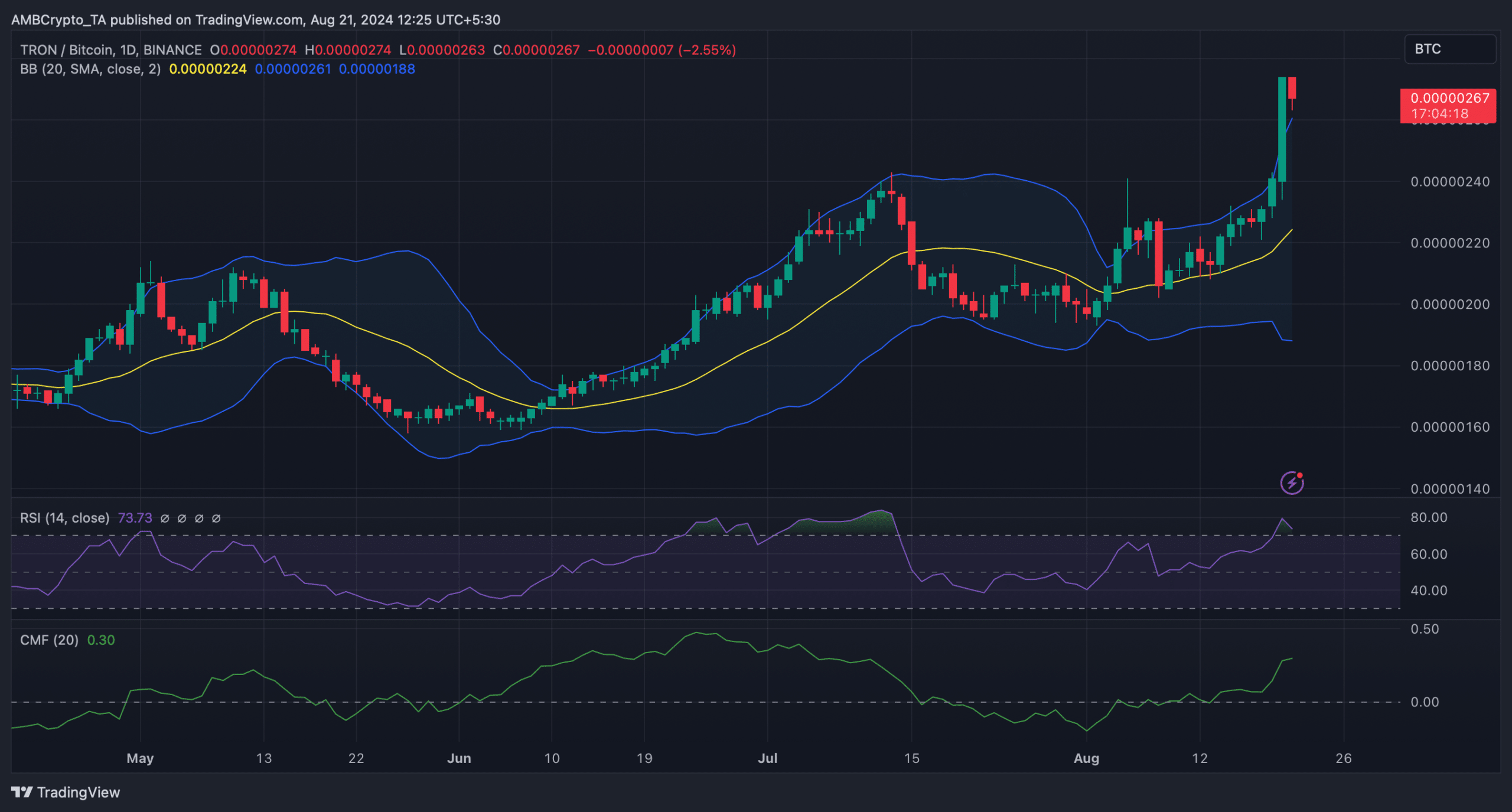

1. The token’s Relative Strength Index (RSI) moved into an overbought state, suggesting that there might be an increase in selling activity. According to Bollinger Bands analysis, TRX‘s price reached the upper boundary of the indicator, typically leading to price adjustments.

Nonetheless, the Chaikin Money Flow (CMF) registered an uptick, suggesting a continued price rise.

Realistic or not, here’s TRX market cap in BTC’s terms

If the bull market persists, there’s a good chance that Tron could reach around $0.17 in the near future. But if the bear market takes over, Tron’s price might drop down to about $0.13.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-08-22 04:08