-

ETH users turn to private transactions over frontrunning

Private transactions comprised 30% of the total volume, but consumed 50% of Ethereum’s gas.

As a researcher who has been deeply immersed in the dynamic world of cryptocurrencies for several years now, I find myself constantly amazed by the ever-evolving landscape of Ethereum [ETH]. The surge in private transactions is an intriguing development that underscores the need for MEV protection and the complexity of transactions on the network.

Over the course of the year, we’ve seen crypto markets undergo considerable transformations, growth, and heightened price fluctuations.

In light of the shifting market dynamics, Ethereum [ETH] has experienced an increase in network usage, earnings, and the number of unique addresses. Additionally, there’s been a significant upswing in the volume of private transactions over the last year.

Ethereum users prefer private transactions

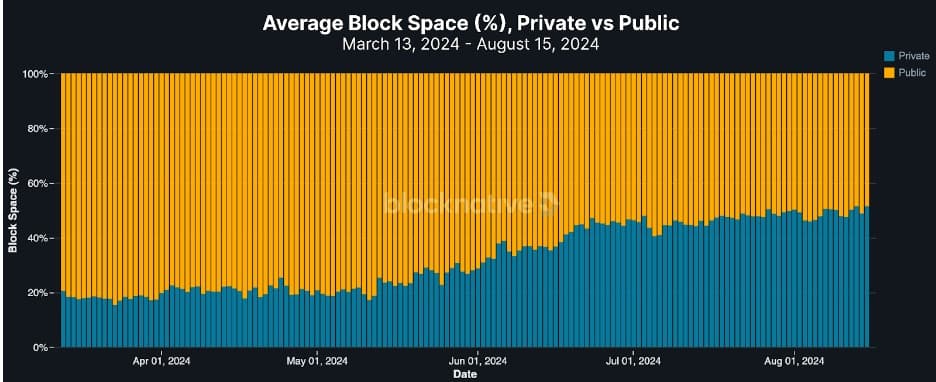

Based on findings by Blocknative, there’s been a significant surge in the number of private transactions being processed on the Ethereum network.

It appears that private transactions accounted for over half (50%) of Ethereum L1’s block space when considering gas usage. However, in terms of overall transaction volume, private transactions represent just about a third (30%) of all transactions within the Ethereum L1 block.

Users opt for confidential transaction transmission primarily to secure themselves against Miner Extractable Value (MEV) threats, particularly during intricate transaction processes.

These types of transactions, in essence, tend to be gas-heavy, meaning they use more gas for each transaction compared to those that don’t involve Maximal Extractable Value (MEV).

Fundamentally, the value of a block’s space is directly tied to the gas used within it. In other words, each gas unit signifies a portion of the block’s capacity and potential for economic expansion.

Base fees volatility increases

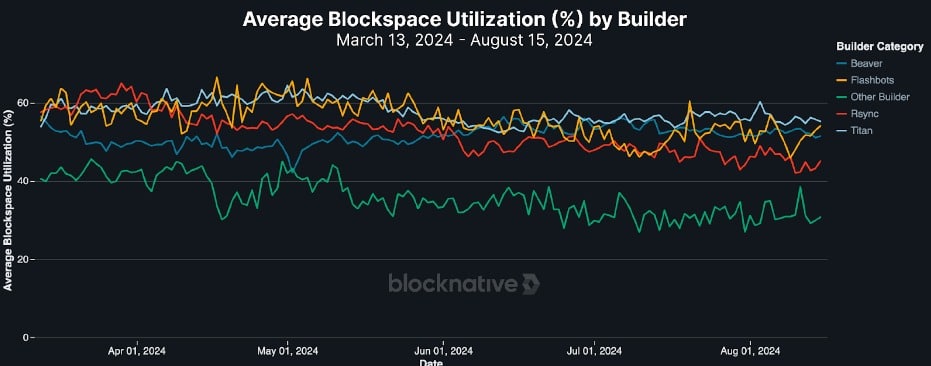

1) Rising private transactions and gas consumption have impacted the basic fees of Ethereum. With the EIP-1559 upgrade in 2021, the fundamental fees became adjustable depending on network congestion, meaning they fluctuate according to the amount of data being processed.

Consequently, a rise in private transactions impacts base fees, leading to heightened volatility. In other words, private transactions contribute to “standard blocks,” which in turn make base fees more volatile.

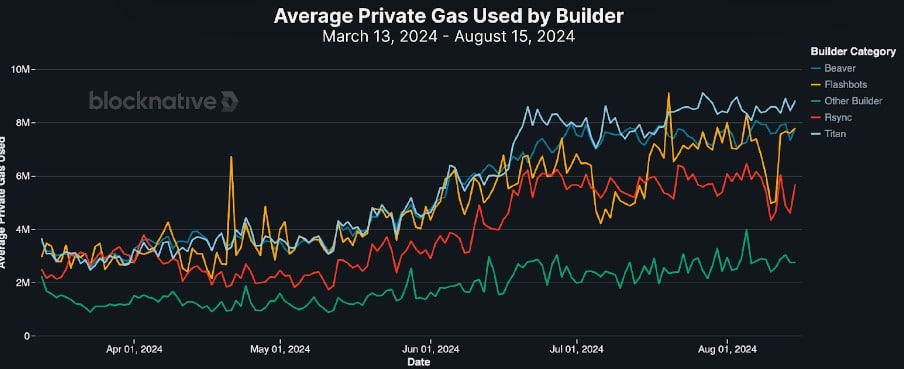

The unpredictability poses problems for network users because heightened private transactions can inflate base fees, particularly during interactions with prominent entities like Titan, Rsync, Beaver, and Flashbots.

For instance, top builders have increased their private transactions throughout the year.

According to the graph, Titan boosted their gas consumption from 3.5 million to 8.5 million, primarily via private deals, starting in March.

Leading competitors like Beaver and Rsync have significantly boosted their utilization – rising from 3 million to 7.5 million in the case of Beaver, and from 2.5 million to 6 million for Rsync.

As a long-time user of the crypto market, I have witnessed numerous fluctuations and changes over the years. The recent surge in gas prices has been particularly challenging for me and many other small builders like myself who are trying to navigate this complex ecosystem. The 2021 EIP-1559 upgrade set a goal of 15 million gas usage, but with the current market conditions, it seems like an unreachable target for most of us. This has led me to reevaluate my strategy and adapt to these new realities in order to stay competitive in this rapidly changing landscape.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-08-22 06:16