-

LUNC defies Gemini’s delisting with a price surge, eyeing a potential 600% breakout.

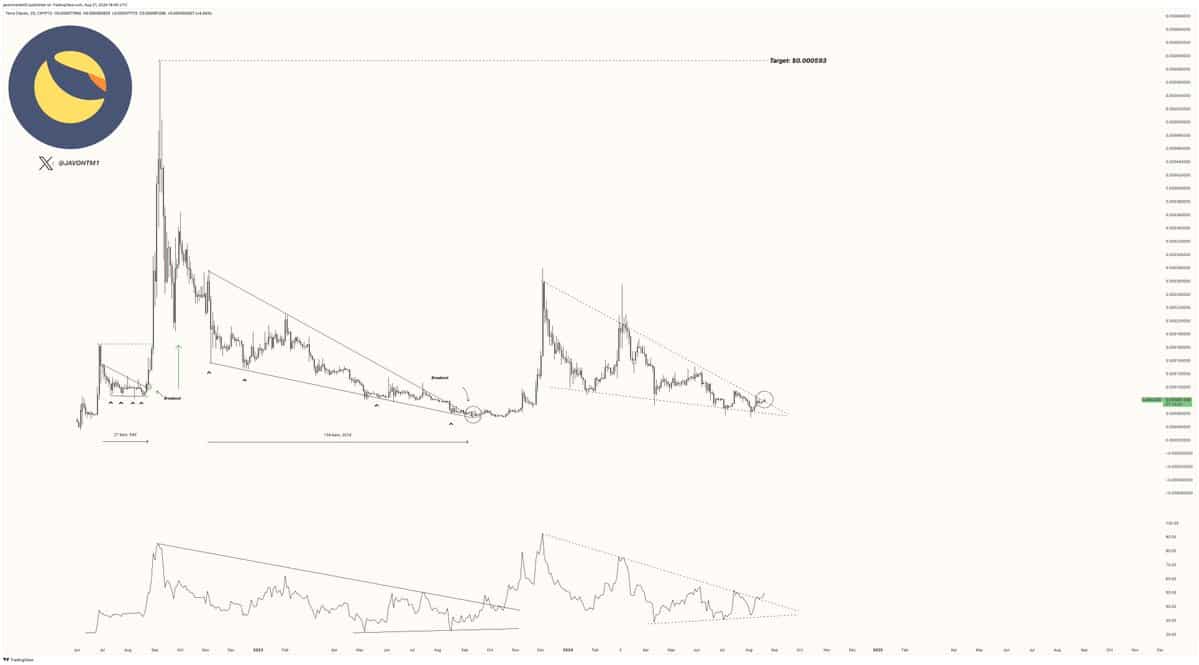

Tightening volatility signals a possible LUNC breakout toward $0.000593 despite delisting concerns.

As a seasoned researcher with over two decades of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by the current trajectory of Terra Luna Classic (LUNC). The recent delisting news from Gemini, while potentially concerning for some, has seemingly done little to deter the price surge and the anticipation of a potential 600% breakout.

At the moment of press, Terra Luna Classic [LUNC] was being traded at $0.00008363. In the past 24 hours, the trading volume for LUNC has amounted to approximately $25,259,192. Over the last seven days, the price of LUNC has risen by 8.55%. Within the last day alone, there’s been a significant jump of 3.75% in its value.

According to cryptocurrency expert Javon Marks, there’s a predicted surge towards approximately 0.000593 USD. If this forecast holds true, it would signify an increase of more than six times the current value, sparking interest among traders and investors within the digital currency market.

According to Javon Marks,

“Right now, Terra Classic ($LUNC) is surging with a new spike. If this trend continues, the price could potentially reach approximately $0.000593, which represents an increase of more than 612% from its current level.”

These forecasts are causing a buzz among traders, as they eagerly anticipate if LUNC will live up to these predictions.

Tightening volatility in LUNC: Will It trigger a major breakout?

Bollinger Bands suggest that volatility is decreasing, potentially indicating a change in the direction of prices. At present, the price is close to the mid-band, which could signal an impending upward breakthrough.

If LUNC manages to break its upper limit, it might lead to a bullish surge. However, if it fails to surpass this level, there could be more price stabilization near the current values.

Additional technical signals, like the Moving Average Convergence Divergence (MACD), seem to point towards a bullish trend as well. Recently, there appears to be a crossover where the MACD line crosses above the signal line, typically indicating an increase in market positivity and optimism.

Nevertheless, the power of this upward trend is only modest, suggested by the comparatively small MACD histogram figures.

Currently, the Relative Strength Index (RSI) for LUNC stands at 57.17, indicating a moderately optimistic market outlook. At this point, the RSI falls within a neutral range, offering potential for further growth without the danger of being excessively bought up.

Investors closely monitor these indicators to predict if Terra’s LUNC token might increase more significantly, with a specific focus on the predicted surge towards approximately $0.000593.

LUNC defies Gemini delisting news

As a seasoned crypto investor with over a decade of experience, I have witnessed numerous delistings and changes in the digital asset market. The recent announcement by Gemini Exchange to delist Terra Luna Classic (LUNC) on September 20, 2024, is not surprising but rather a reminder of the volatile and ever-evolving nature of this space.

As a holder of LUNC, I strongly recommend moving your coins to another wallet prior to the given deadline. The recent announcement notwithstanding, LUNC’s value has surprisingly surged by 3%, mirroring the broader market’s trend towards recovery.

According to Gemini, their decision was made after a standard evaluation process, finding that specific resources didn’t align with their requirements for listing. Although the details about why they were removed remain mysterious, this action hasn’t significantly affected LUNC‘s current status.

Traders are maintaining a balanced outlook, keeping an eye on immediate profits while also monitoring the overall trend of the market’s rebound.

In line with recent updates, it’s been announced that a hearing to confirm the Chapter 11 bankruptcy plans for both Terraform Labs Pte Ltd (TFL) and Terraform Labs Limited (TLL) will be held on September 19, 2024.

Is your portfolio green? Check the LUNC Profit Calculator

The hearing will focus on the company’s bankruptcy restructuring process.

Over the coming weeks, I find myself eagerly watching the unfolding of legal proceedings, knowing that their resolution could significantly impact my investments in LUNA and LUNC. The market sentiment surrounding these cryptocurrencies might swing based on the results, so I’ll be keeping a close eye on any updates.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

2024-08-22 17:12