-

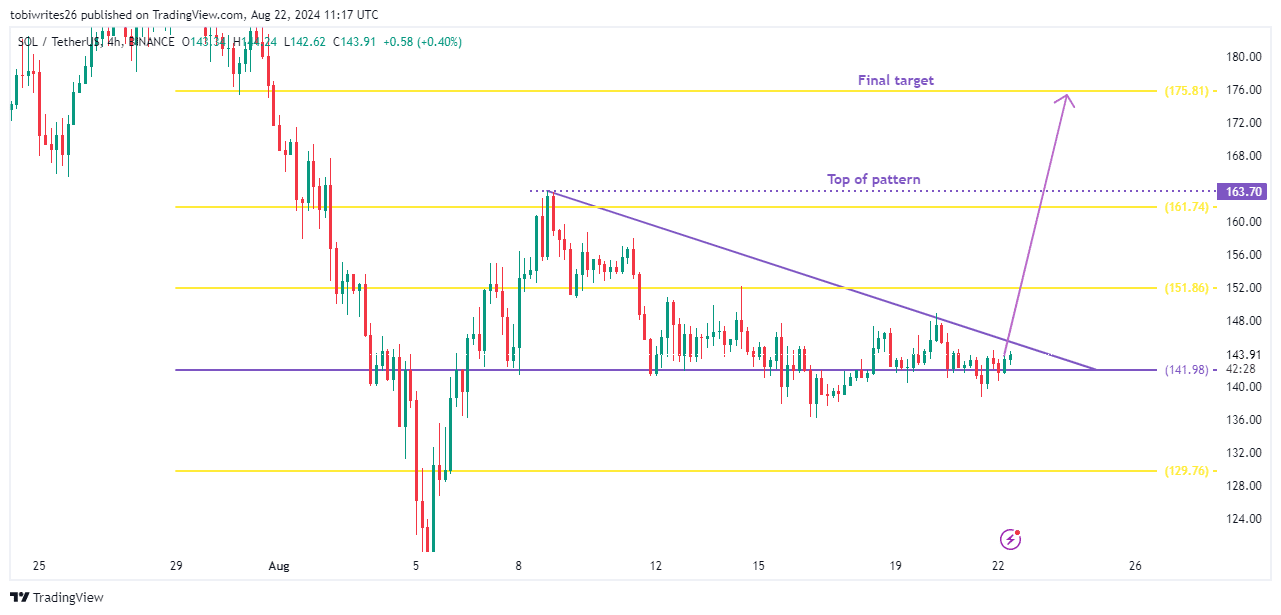

SOL’s pattern within a descending triangle suggested an impending bullish trend.

A bullish crossover, combined with increasing interest from retail investors, is likely to ignite this rally.

As a seasoned crypto investor with years of market experience under my belt, I’ve seen my fair share of bull and bear markets. The current analysis on Solana [SOL] has piqued my interest due to its potential for a significant rally. The descending triangle pattern on the 4-hour chart suggests accumulation by buyers ready to push the price upwards, with a target of $163.70 in the immediate term. If we break through this level and close the daily candle above it, the next target could be as high as $175.81, according to Fibonacci analysis.

Over the last seven days, Solana’s price has experienced minimal growth, rising by just 0.8%, but ongoing evaluations suggest a substantial surge could be imminent, potentially peaking at around $175.

As a researcher, I’ve noticed a convergence of several optimistic trends and patterns that are suggesting a potential market upturn. Insights into these developments have been valuable, thanks to the analysis provided by AMBCrypto.

Descending triangle signals potential rally for SOL

On the 4-hour chart, Solana (SOL) was moving inside a falling triangle, a trend that typically suggests buyers are amassing, readying to drive the price upwards.

If a rally occurs, it usually reaches its highest point at this pattern. For SOL, this coincides with the $163.70 price level.

As a crypto investor, I’ve been closely watching Solana (SOL) and noticed an intriguing pattern using the Fibonacci tool. A break above the resistance level at $163.70 with a daily close suggests that SOL could potentially aim for the next significant level around $175.81.

However, the realization of this rally depended on the presence of additional market catalysts.

According to AMBCrypto’s analysis, there appear to be several significant points of convergence, suggesting that an upward trend could soon occur.

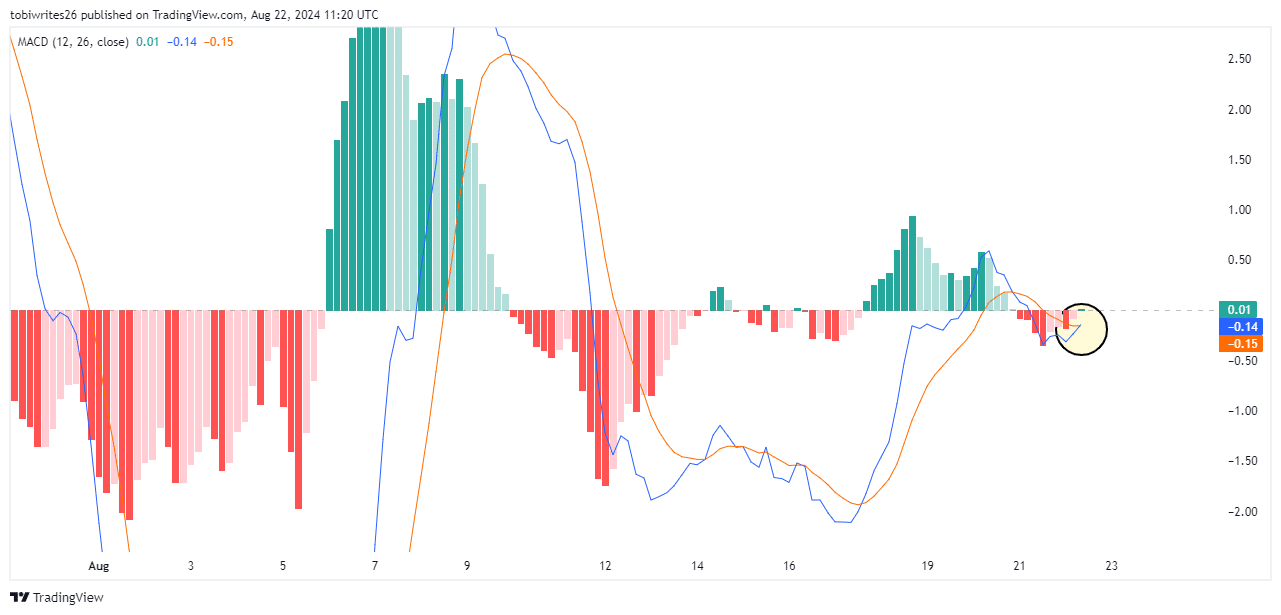

Golden cross could propel SOL toward $175

At the current moment, a ‘golden cross’ pattern is observable because the MACD line (initially blue) has moved above the Signal line (originally red), with the MACD line’s value being -0.14 and the Signal line’s value being -0.15, where the MACD line has crossed over the Signal line.

Based on my years of experience as a trader, I have observed that this particular formation tends to trigger a surge in trading volume and consistent price movements in the same direction. It’s like watching a well-oiled machine at work, where every component plays its part in driving the overall trend. This pattern has proven itself many times in my own trades, leading me to adjust my strategies accordingly.

Such an occurrence is keenly monitored by traders because it has the power to spark substantial shifts within the market, often prompting additional traders to purchase as well.

As a savvy crypto investor, I closely monitor the MACD – or Moving Average Convergence Divergence – which is my go-to tool for tracking the momentum of an asset’s price. By analyzing the 12 and 26 Exponential Moving Averages, it helps me anticipate promising buy or sell opportunities, thus informing my investment decisions.

Right now, the MACD is signaling a bullish trend, which means there’s a robust upward trend for Solana (SOL).

As a researcher, I’ve observed an upward trend in Solana (SOL) prices, signified by the “golden cross” formation, which has strengthened the belief that this upward momentum might continue. This optimistic outlook is reinforced by the surge in investor interest and market activity, contributing to a compelling narrative for further SOL price escalation.

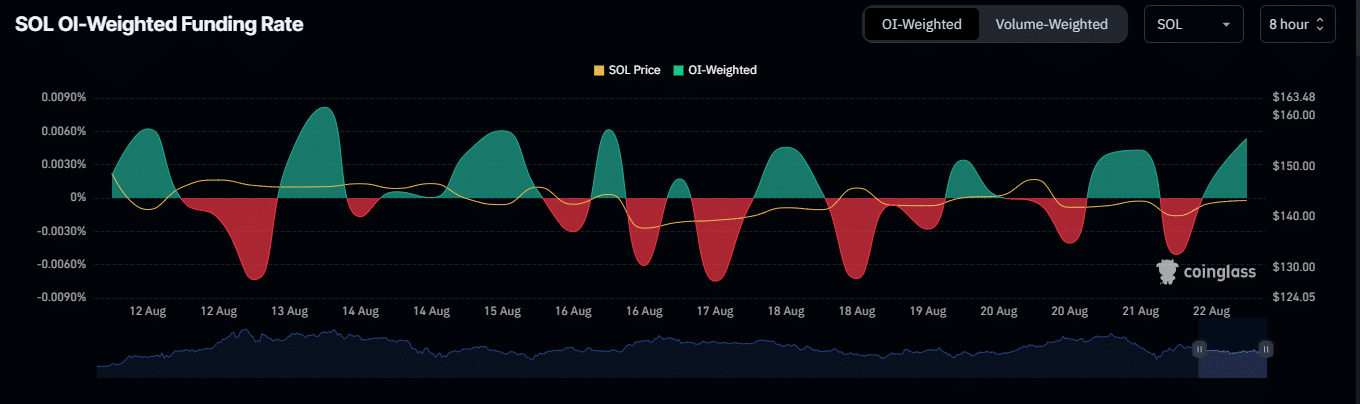

Retail traders take a front seat

Individual investors, often referred to as retail traders, significantly contribute to stock market surges by being actively involved and boosting prices. Two crucial indicators reflect their influence: trading volume (open interest) and a funding rate that takes this volume into account (OI-Weighted Funding Rate).

As a crypto investor, I noticed an uptick in Open Interest, which tells me fresh capital is flowing into the market. This surge suggests robust investor enthusiasm and high anticipation for potential price growth in the near future.

As a crypto investor, when I see a favorable OI-Weighted Funding Rate, it suggests that traders who are betting on the price to rise (long positions) are paying a higher premium to those who are betting against it (short positions). In simpler terms, long position holders are compensating the short sellers more generously.

At the moment of this writing, both the Open Interest and the OI-Weighted Funding Rates were showing a positive trend. This is advantageous in potentially pushing Solana’s (SOL) prices upwards, perhaps even towards the $176 zone, which was previously indicated by the Fibonacci line.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Approximately 4 hours prior to the deadline, a substantial upheaval occurred in the market, resulting in liquidations amounting to approximately $134,200. Most of these losses were suffered by short traders, who accounted for around $133,770 of this total.

From my personal experience as a trader, I’ve noticed that when retail traders get involved in the market and are confident about their positions, they can indeed drive prices higher. This was evident in my own trading journey with SOL, where I found myself on the losing end when I bet against the retail traders who were pushing up the price. It’s a humbling reminder of the power that retail traders possess in today’s market landscape and serves as a valuable lesson for any trader to respect their influence and adapt strategies accordingly.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-08-22 18:48