-

BTC might have topped in this cycle, per Peter Brandt.

However, other market analysts disagreed.

As a seasoned researcher with over two decades of market analysis under my belt, I find myself torn between two compelling viewpoints regarding Bitcoin’s (BTC) future trajectory. On one hand, Peter Brandt’s assessment that we might be witnessing the cycle top is intriguing, given his extensive experience and track record in the markets. However, other analysts like Benjamin Cowen and Ki Young Ju present a more optimistic outlook, aligning with historical trends and market cycles.

On August 21st, Bitcoin (BTC) experienced a rebound, possibly due to the release of the FOMC minutes in July suggesting that certain policy members were in favor of interest rate reductions.

The largest digital asset briefly retested $61K, but the overall sentiment has remained weak.

Actually, August marks the fifth consecutive month that Bitcoin’s price has remained stable, causing some uncertainty as to whether it will reach another record high.

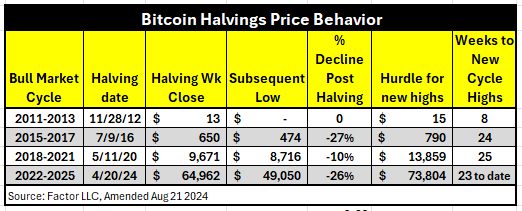

As per Peter Brandt’s perspective, the ongoing cycle could be stretching out more than expected before reaching a new All-Time High, potentially indicating that Bitcoin’s cycle peak may have already occurred.

Based on my extensive experience and observations of the Bitcoin market, I believe that the current bull market cycle may soon surpass the record for the longest time post-halving without setting a new All-Time High (ATH). While it’s important to acknowledge that past performance is not always indicative of future results, the prolonged period we’ve seen so far suggests that a new ATH might not be imminent. I’ve witnessed several market cycles in my time, and this one seems to be exhibiting characteristics unlike any other I’ve encountered before. Of course, this is just my analysis, and it’s always essential to do your own research and make informed decisions when investing in cryptocurrencies.

BTC is on track; Other analysts disagree

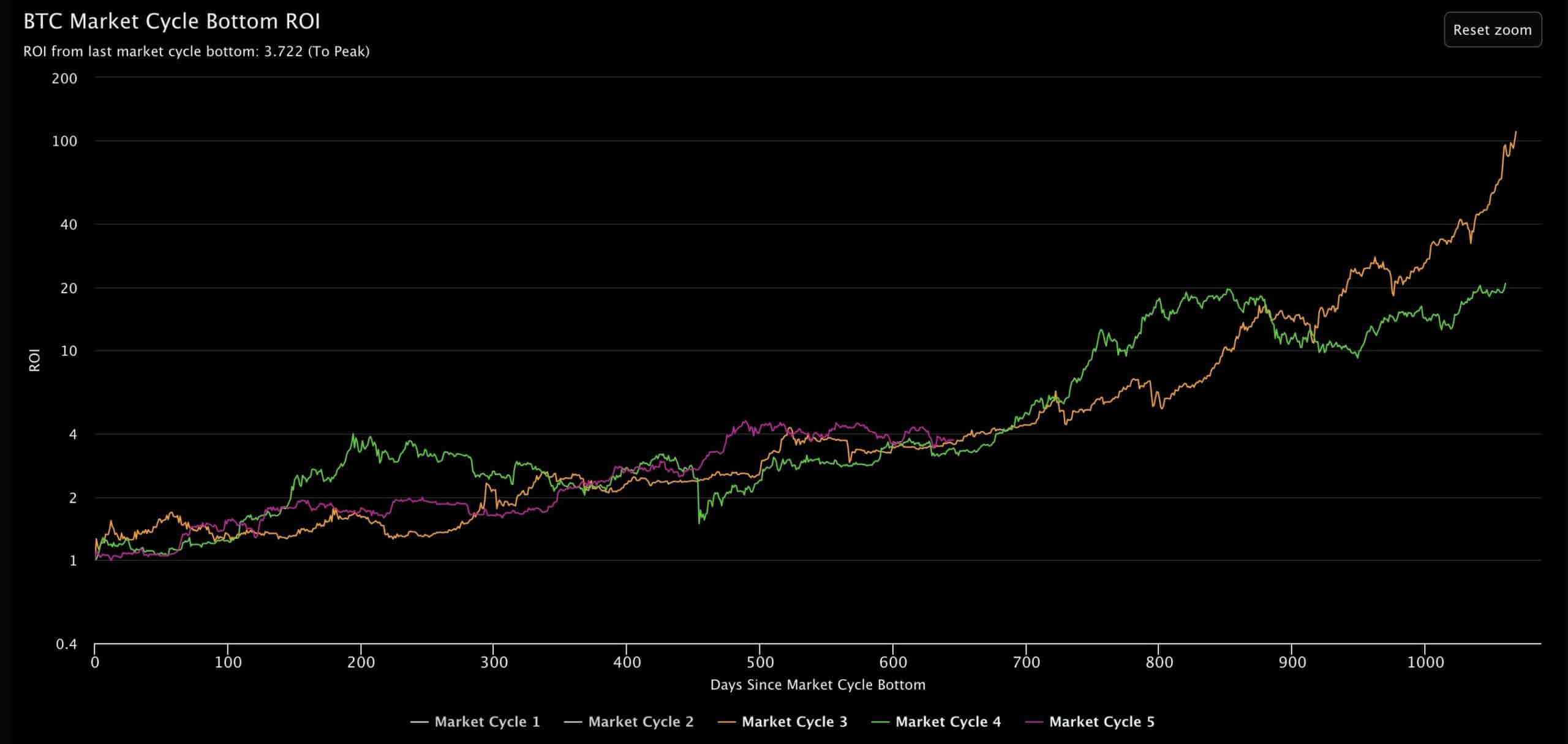

However, other crypto analysts have disagreed with Brandt’s bearish outlook. According to Benjamin Cowen, BTC was on track and in sync with other historical market cycle movements.

“Despite everything, #BTC is right around where it always is at this point in the market cycle.”

According to the provided graph, if past trends hold true, Bitcoin (BTC) appeared poised for its next surge in price.

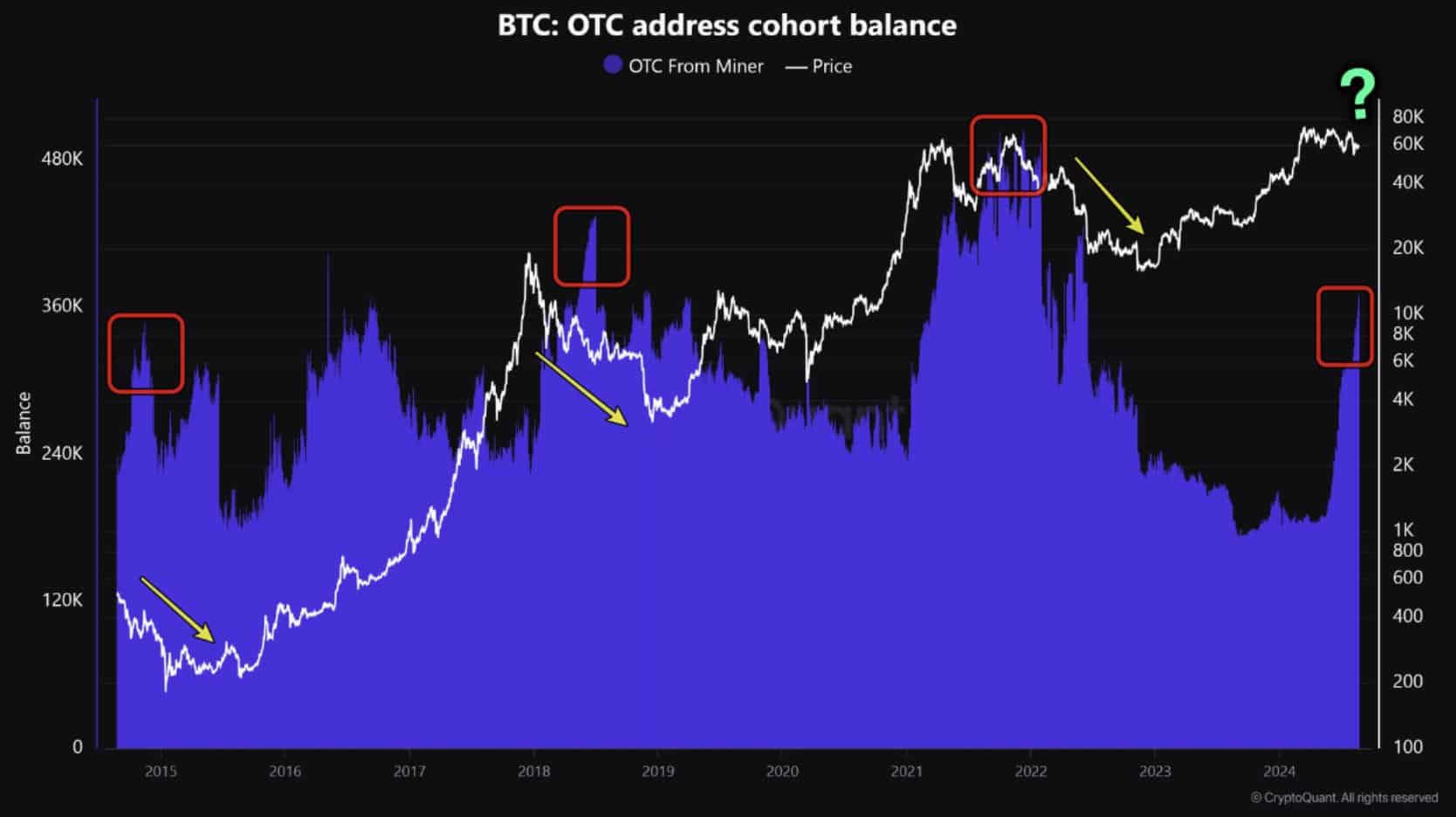

According to Ki Young Ju, the founder of CryptoQuant, it’s possible that the next surge in Bitcoin (BTC) prices might kick off during the final quarter (Q4) of this year. This prediction is based on anticipated activities by large Bitcoin holders, often referred to as “whales.”

In the previous Bitcoin halving period, the upward trend started in the fourth quarter. This time around, the big investors (whales) are likely to make Q4 an exciting quarter, rather than one with a flat year-over-year performance.

A recent decrease in Bitcoin (BTC) funding rates combined with a rise in open interest rates hinted at a possible BTC price surge, according to K33 Research. They stated that the current market conditions were favorable for a short squeeze.

“The current market situation seems to be favorable for a ‘short squeeze.’ The open interest in Bitcoin perpetual contracts (BTC perps) has risen by approximately 30,000 BTC since August 13, and this increase is accompanied by ongoing negative funding rates.”

Furthermore, it’s worth noting that according to Glassnode, there has been a decrease in Bitcoin’s Long-Term Holders (LTH) selling for profits. This trend, as seen in the past, often precedes a fresh increase in price.

On the other hand, as reported by CryptoQuant, the level of Bitcoin held on over-the-counter markets has risen to a two-year peak. This could potentially delay Bitcoin’s recovery in the immediate future.

“The balances at Bitcoin Over-the-Counter (OTC) desks are hitting a two-year high. Generally, when these balances rise, it’s often followed by a drop in the price of Bitcoin.”

In conclusion, BTC had more upside potential if the historical trend seen in post-halving repeats. However, the expected rally could face risks from the rising BTC balance on OTC markets.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

2024-08-23 05:12