Tom Lee has once again gazed into his crystal ball-probably made of discarded hard drives and expired HODL memes-and declared that Bitcoin could still soar past $100,000 before 2025 collapses into the digital abyss. 🚀🌕 It’s a bold claim, especially considering Bitcoin is currently behaving less like a rocket and more like a confused badger waddling sideways across a highway.

At first glance, the market looks about as enthusiastic as a sloth on sedatives. Big money isn’t flowing in, long-term holders are quietly panic-selling like it’s Black Friday at the crypto outlet, and the price is compressed tighter than a sardine in a yoga class. Yet, against all odds and reason, there’s still a path. Not a rational one. Not a safe one. But a path. And it involves the financial equivalent of setting fire to a pile of margin calls.

Big Money & Conviction Holders: The Party Poopers

The first hurdle? Turns out, “big money” doesn’t believe in fairy tales. Or Tom Lee. Or maybe just Tuesdays. The Chaikin Money Flow (CMF)-a fancy gadget that tells us whether whales are buying or sneaking for the exit-has been limping along like a robot with one dead battery.

TOM LEE: “I think it’s still very likely Bitcoin will be above $100,000 before year end and and maybe even to a new high.”

“Bitcoin makes its moves in 10 days every year.” 😲

– Fiat Archive (@fiatarchive) December 22, 2025

From December 17 to 23, Bitcoin’s price inched up-yawn-as politely as a polite thing inching. But CMF? It flatlined. Then flatlined harder. That’s a classic “smart money is ghosting you” move. And post-December 21? CMF plunged over 200%. Yes, over. Someone at Chaikin HQ probably fainted, then recalibrated their grammar.

It later bounced back around 68%, which sounds like a passing grade, until you remember: CMF is still under zero. That means capital’s not flowing in. It’s seeping out. Like a bathtub with existential dread.

Want more token tea? ☕ Sip on Editor Harsh Notariya’s Daily Crypto Newsletter-sign up here before it’s banned by Big Finance. 📨

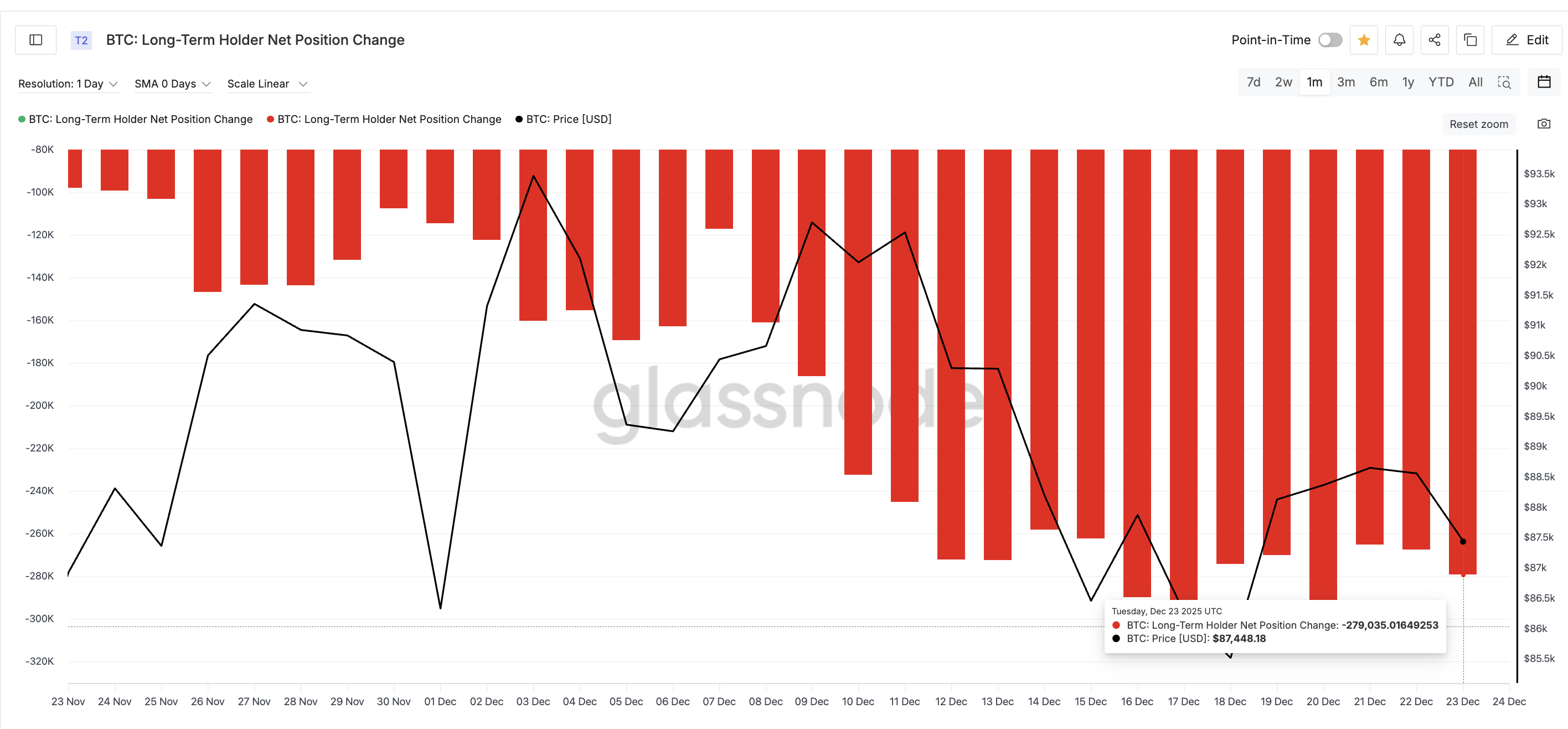

The second buzzkill? Long-term holders. You know, those stoic, “to the moon” types who have held since Satoshi mined block zero with a potato-powered laptop. Guess what? They’re selling. Not a little. Not “I need rent money.” More like “I’m cashing out my life’s delusion.”

On November 23, they offloaded 97,800 BTC. By December 23? A jaw-dropping 279,000 BTC vanished into the ether. That’s a 185% surge. If this were a horror movie, the long-term holders would be the final girl-except she’s just handed the killer the knife and said, “Here, have my life savings.”

When both whales and diehards are quietly edging toward the fire exit, you don’t need a PhD in economics to see the problem. You just need functioning eyes and a pulse.

The Last, Most Ridiculous Hope: A Short Squeeze From Hell

But wait. All hope isn’t lost. Just 98% of it.

There is one scenario in which Bitcoin still vaults to $100,000 without a single new believer buying in. It doesn’t involve adoption. It doesn’t need innovation. It just needs traders to be wrong-and spectacularly so.

Enter: the short squeeze. That magical moment when price moves up not because people want to buy-but because people have to.

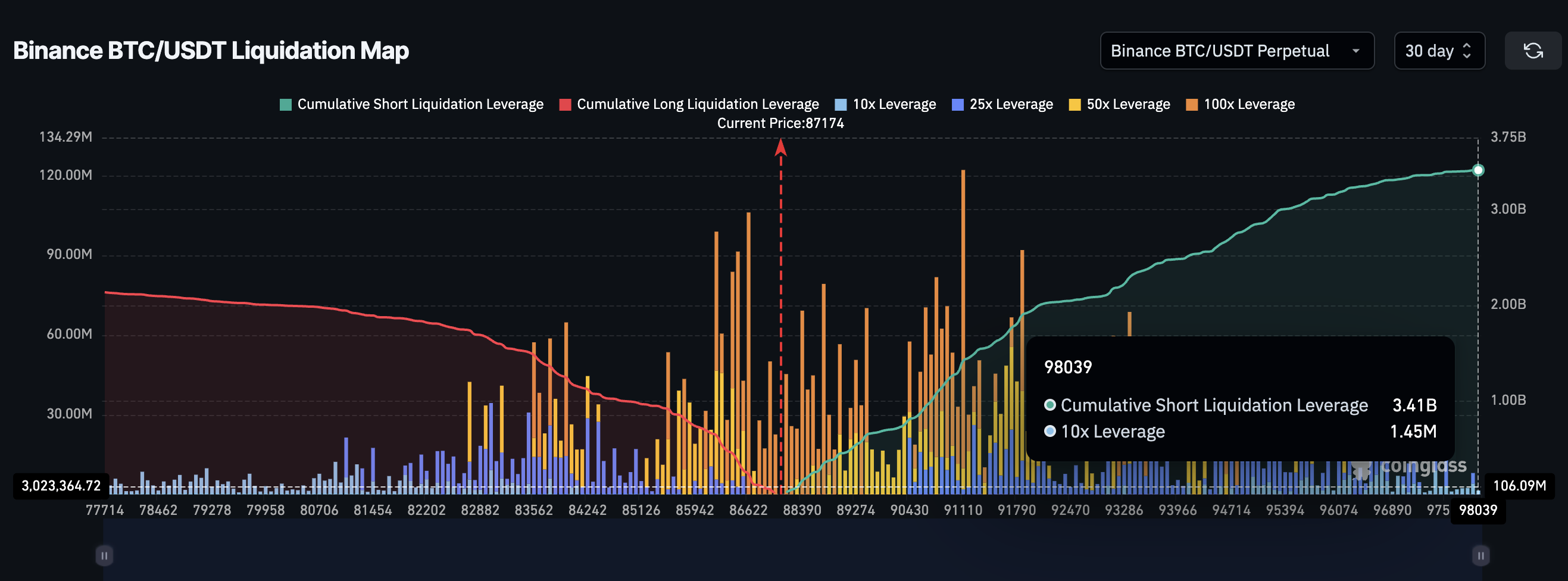

Right now, the market is tilted like a drunk giraffe. The 30-day liquidation map shows $3.41 billion in short leverage waiting to explode. Longs? A measly $2.14 billion. That’s over 60% of leverage betting on Bitcoin to fail. Which, in a twisted way, is the best news Bitcoin has had all month.

Because here’s the dirty secret: Bitcoin doesn’t actually need buyers. It just needs a spark. A little flicker. Enough to make those shorts blink. When price rises, short positions get liquidated-automatically buying BTC to close losses. That buying triggers more buying, like a financial chain reaction usually reserved for cartoons involving dominoes and exploding anvils. 🎯💥

The biggest booby trap for shorts? A cluster between $88,390 and $96,070. Step on it, and the whole minefield goes up. The market could rocket to $100,380 purely on panic and margin calls. No fundamentals required. Just human stupidity, leveraged 50x.

Key Levels: The Gates of Financial Valhalla

For this beautiful disaster to unfold, Bitcoin must first punch through two levels:

- $91,220 – The warm-up round. A sustainable break above here would start picking off the weak shorts. Momentum gets a tiny jolt. Twitter gets a caffeine drip.

- $97,820 – The Mjölnir of levels. It’s rejected price like an overprotective bouncer since November. It also sits right over the densest cluster of short liquidations. Smash through this, and $3.41 billion of short leverage goes “😱→💸→❌” in rapid succession.

If this cascade begins, Bitcoin could hit $100k faster than you can say “I told you so.” No robust demand needed. No long-term holder support. Just a stampede of traders running from their own bad decisions.

But fail to clear $91,220? Then drift sideways into oblivion? Back to snooze town? Then the CMF stays weak, the long-term holders keep selling, and the shorts sip margaritas, unbothered. The squeeze never happens. Tom Lee’s prediction becomes just another forgotten prophecy-filed between “Doge to the Moon” and “SegWit will fix everything.”

So here’s the truth: Tom Lee’s $100k dream hangs not on adoption, utility, or innovation. Oh no. It rests on one absurd, chaotic, utterly beautiful condition: that the traders betting against Bitcoin get absolutely wrecked. 🤡🔥

May the force of liquidations be ever in your favor. Or at least until the margin calls clear. ⚖️💸

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

2025-12-24 10:06