-

Why Bitcoin could be flashing signs of a volatility resurgence and a potential breakout.

BTC whale activity on the rise as exchange flows are expected to surge in the coming days.

As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent developments in Bitcoin [BTC]. The signs are flashing that we might be on the brink of a volatility resurgence and a potential breakout.

In the past two weeks, Bitcoin [BTC] has been moving in a limited price band due to relatively low market volatility.

During that period, it showed resilience around the $61,000 mark, causing it to retreat whenever it approached or surpassed this region.

In the past day, Bitcoin (referred to as “the king coin”) has surged past the $61,000 mark, and this latest surge is accompanied by a few significant observations that suggest increasing bullish sentiment might be developing.

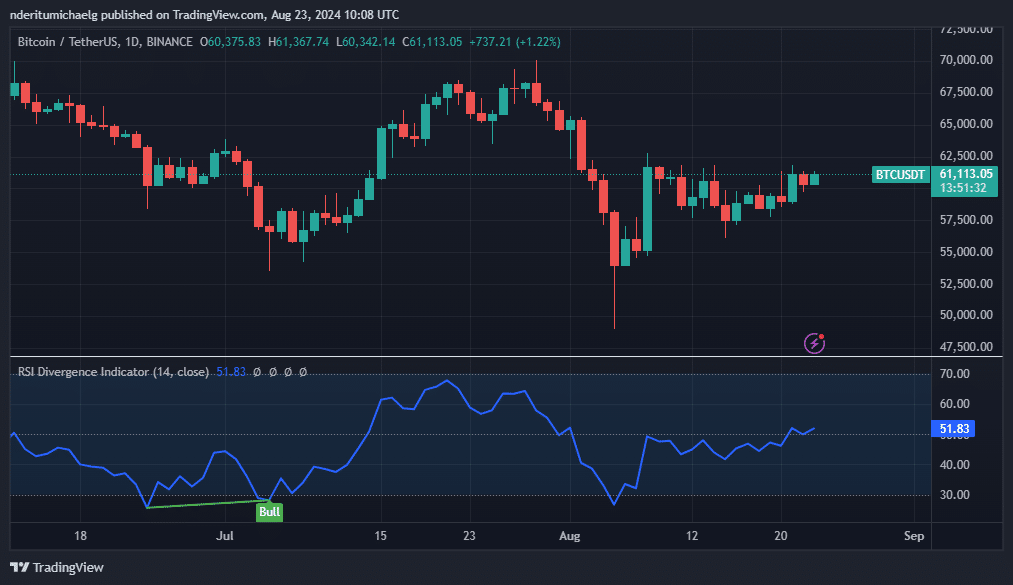

Initially, Bitcoin’s Relative Strength Index (RSI) has been finding it tough to surpass the 50% mark following the recent fall experienced this month.

Nevertheless, the robust surge in the middle of the week took it over the RSI midpoint, and its upward trend in the past 24 hours has shown strength in maintaining its position above this level.

Based on the RSI’s performance, it seems like Bitcoin might be slowly regaining its bullish strength, potentially boosting its market activity in the near future.

This could spill into the weekend, possibly allowing BTC to push outside the sideways range.

Bitcoin signs at pivotal moment

It’s possible that Bitcoin could experience an increase in liquidity, potentially leading to significant growth. Interestingly, the NASDAQ has developed a bearish divergence pattern, suggesting a surge in selling could cause funds to shift from stocks to Bitcoin.

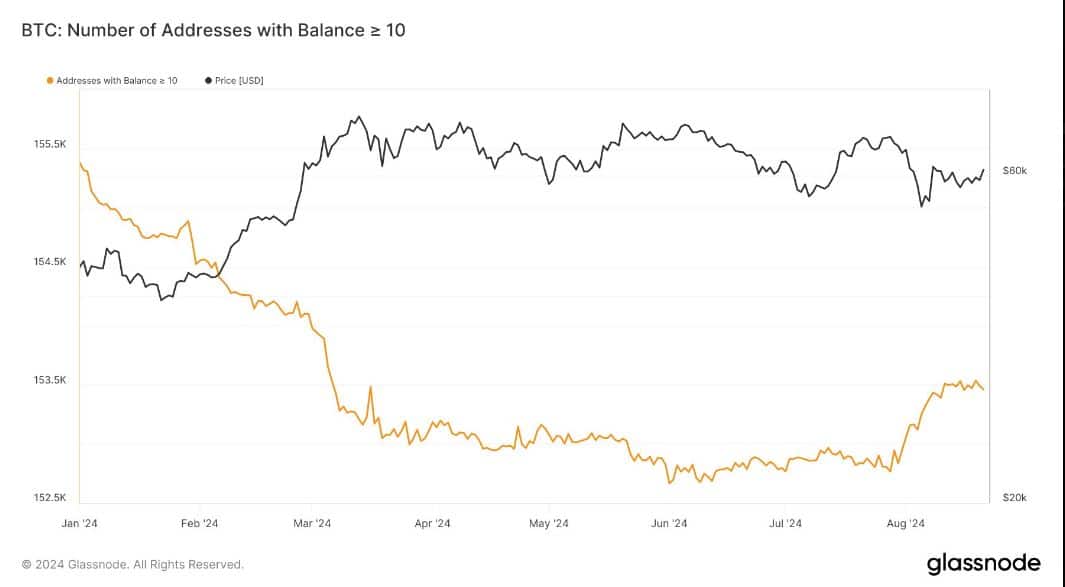

Lately, we’ve seen an uptick in large-scale Bitcoin transactions. Specifically, there’s been a growth in the number of addresses containing 10 or more Bitcoins over the past few days.

The increase in whale activity indicates that Bitcoin may be nearing the point of leaving its current low-volatility phase. Additionally, analyzing Bitcoin exchange flows provides another significant observation: it’s worth paying attention to.

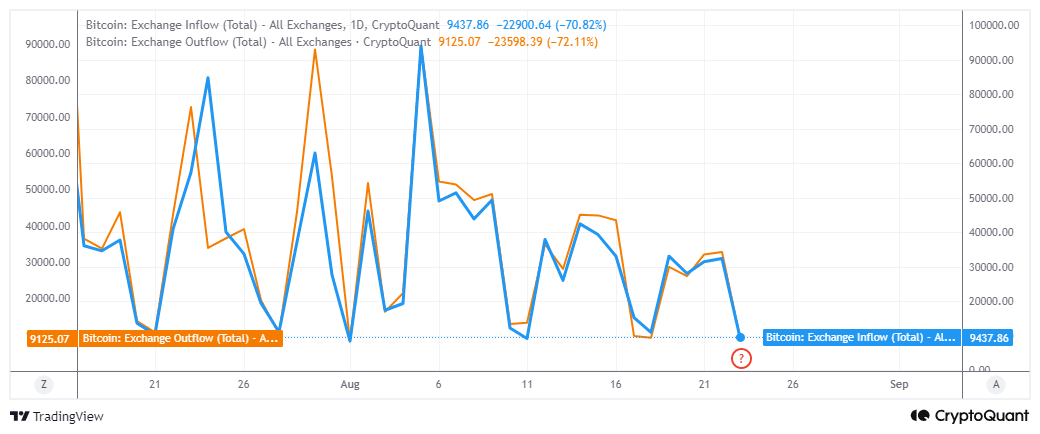

Its exchange flows have been quite cyclical over the last few months, with peaks and troughs.

For the majority of the period, the peak points in the exchange flow have varied, but the lower limits have remained fairly stable. In the past 24 hours, exchange flows dropped down to a similar low range.

Note that exchange outflows were slightly higher than inflows at press time.

Based on the graph, it appears that exchange flows are set to increase, indicating a potential shift upward. This suggests that we might witness an uptick in exchange activities over the coming days.

As a consequence, Bitcoin price volatility may be in favor of an uptick in the next few days.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’ve noticed an uptick in whale activity – a trend that historically has often signaled a potential shift in market dynamics. This renewed whale presence might hint at the possibility of Bitcoin bulls gaining more control in the upcoming days.

A stronger move is to be expected if the U.S. Federal Reserve announces interest rate cuts.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-23 14:47