-

XRP consolidated near its resistance, with analysts forecasting a breakout that could ignite a major bull run.

XRP’s liquidation data revealed growing short pressure, fueling bullish momentum and heightened market interest.

As a seasoned analyst with over two decades of experience under my belt, I must say that the current state of XRP has piqued my interest significantly. The potential breakout from its years-long consolidation is reminiscent of the market patterns we saw before the 2017 bull run.

Over the last seven days, Ripple (XRP) has demonstrated resilience, experiencing a 5% increase, even amidst difficulties faced by the overall cryptocurrency market.

Observers are keenly anticipating a potential burst of activity that might resemble the substantial surge observed in 2017.

Currently, each XRP is being traded for approximately $0.599. With a total circulation of 56 billion tokens, the current market value of this digital asset amounts to around $33.64 billion.

Over the next few weeks, it’s possible we might witness a major shift with XRP, given some technical indicators point towards it being on the brink of a substantial movement.

Potential breakout after years of consolidation

Crypto expert Javon Marks noted that the price of XRP was approaching a crucial level, hinting at a potential breakthrough from a persistent resistance barrier.

He noted that XRP has been consolidating for over 2,424 days, dating back to the post-2017 bull run, which saw XRP surge to record highs.

According to Javon, a 3-4% increase could break this trend and signal the start of another rally.

Moreover, on the 6th of August, Javon Marks predicted,

“Price action and RSI patterns are indicating a potential bullish breakout.”

He highlighted that the present technological structure appears similar to those observed in past bull markets, potentially indicating a robust upward price trend ahead.

If it turns out to be successful, this potential surge might widen an estimated price range between $15 and $18, which equates to approximately a 2,100% increase from the existing prices.

Technical indicators show bullish momentum

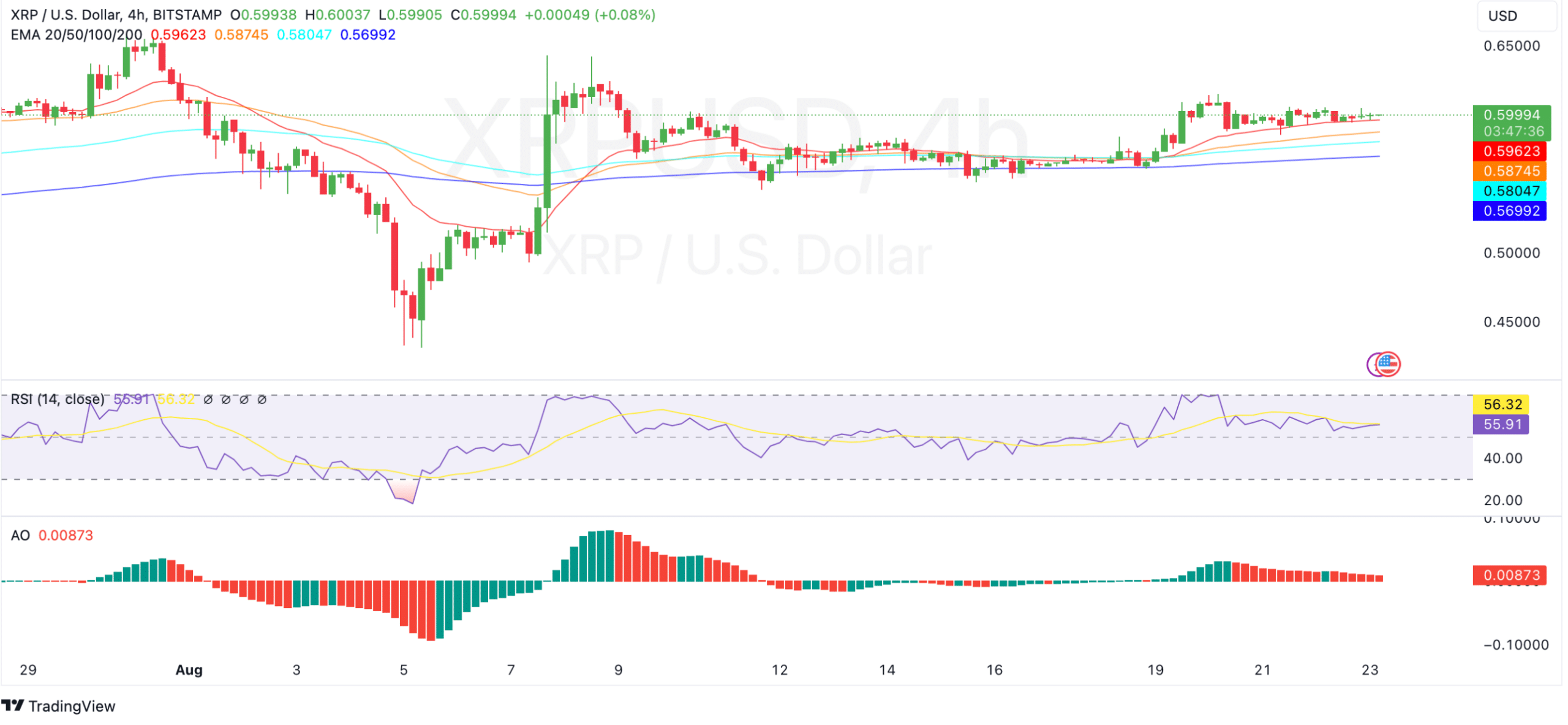

It appears that various technical markers hint towards an upcoming surge. Specifically, the RSI for XRP currently stands at 56.40, suggesting a gentle upward trend that’s not yet considered overbought, implying a potential increase in value.

This suggested that there was still room for price growth without immediate risk of a market correction.

As a crypto investor, I found the 100 and 200 Exponential Moving Averages (EMAs) to be particularly reassuring during this period, serving as a strong base between $0.58 and $0.56. This support could potentially contribute to XRP‘s continued upward trend.

The Awesome Oscillator (AO) indicated a strong, gradually intensifying upward trend, as evidenced by the appearance of mostly green bars.

Although the AO is still close to the zero line, an increase in green bars could confirm the start of a stronger upward move.

Investors are keeping a close eye on these indicators to determine if the path of XRP will continue its current trend.

Liquidation data suggests strong short pressure

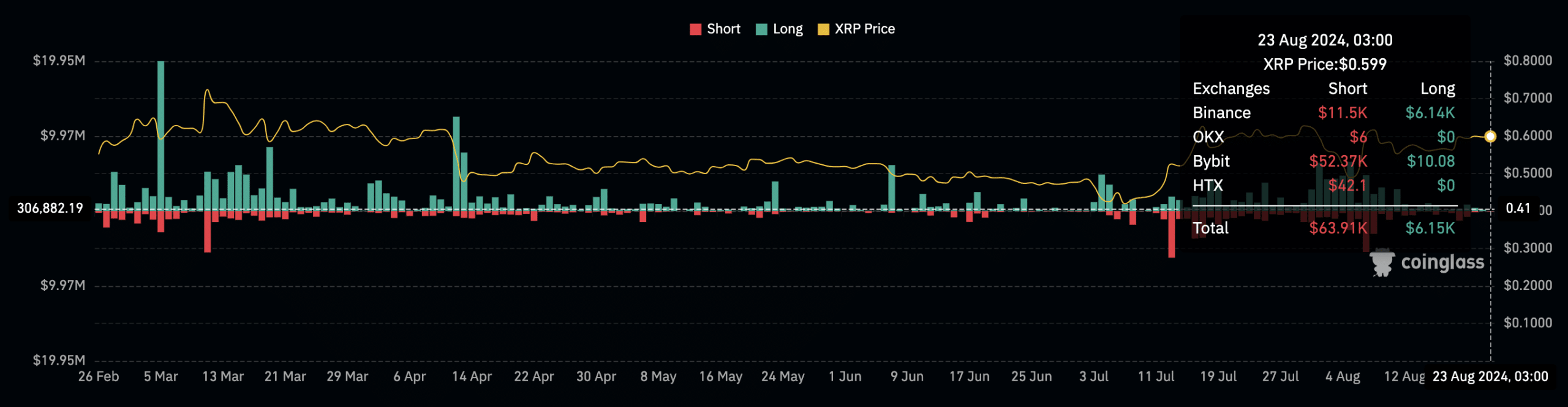

The latest movements in the value of XRP have triggered forced sales by short-term investors, lending credence to the idea that it could soon burst through its current price range.

On August 23rd, as per data from Coinglass, a significant amount of $63,910 in short positions was closed out, contrasted with only $6,150 in long positions being liquidated.

As a seasoned trader with over two decades of experience, I’ve seen countless instances where market imbalances can catch even the most skilled traders off guard. Recently, the unexpected upward movement in XRP has left many short-sellers scrambling to cover their positions, potentially adding fuel to the fire and pushing prices even higher. This serves as a stark reminder of the importance of adaptability and staying nimble in the ever-changing world of cryptocurrency trading. It’s always crucial to keep an eye on market conditions and be prepared for unexpected turns, as they can make or break your investment strategies.

Read Ripple’s [XRP] Price Prediction 2024 – 2025

Analysis of this liquidation data, along with the escalating number of open positions in XRP, suggests an uptick in trading actions and a possible surge toward a bullish market shift.

The increase in Open Interest climbed by 2.55% to hit $698.52 million, while options trading volume skyrocketed by 200.30%. This significant jump in activity suggests growing attention towards XRP, as it nears a critical price point.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-08-23 15:04