- Why has Bitcoin been selling off right before and at every U.S. market open?

- Bitcoin and its ETFs are set to surge.

As a seasoned researcher with years of experience studying crypto markets, I have witnessed numerous intriguing phenomena, but none quite as perplexing as Bitcoin’s behavior during U.S. market hours. The consistent sell-offs right before and during the U.S. market open are more than just a coincidence, they seem to be part of a well-orchestrated dance between pre-market trading, market sentiment, supply and demand dynamics, and institutional investors’ trading behavior.

The unusual activity with Bitcoin (BTC) as the U.S. stock markets opened has sparked interest among investors and experts.

In simpler terms, the value of King Coin tends to drop significantly just as the U.S. stock market is opening, first rising rapidly to force short-sellers out of their positions, and then gradually decreasing to push long-term buyers out. This happens before any significant market movement actually takes place.

The behavior observed in this pattern could potentially stem from various influences including early market trades, overall investor attitudes, the balance between availability and desire for a product or service, and the actions of large investment firms.

This phenomenon has notably impacted Bitcoin ETFs in the U.S.

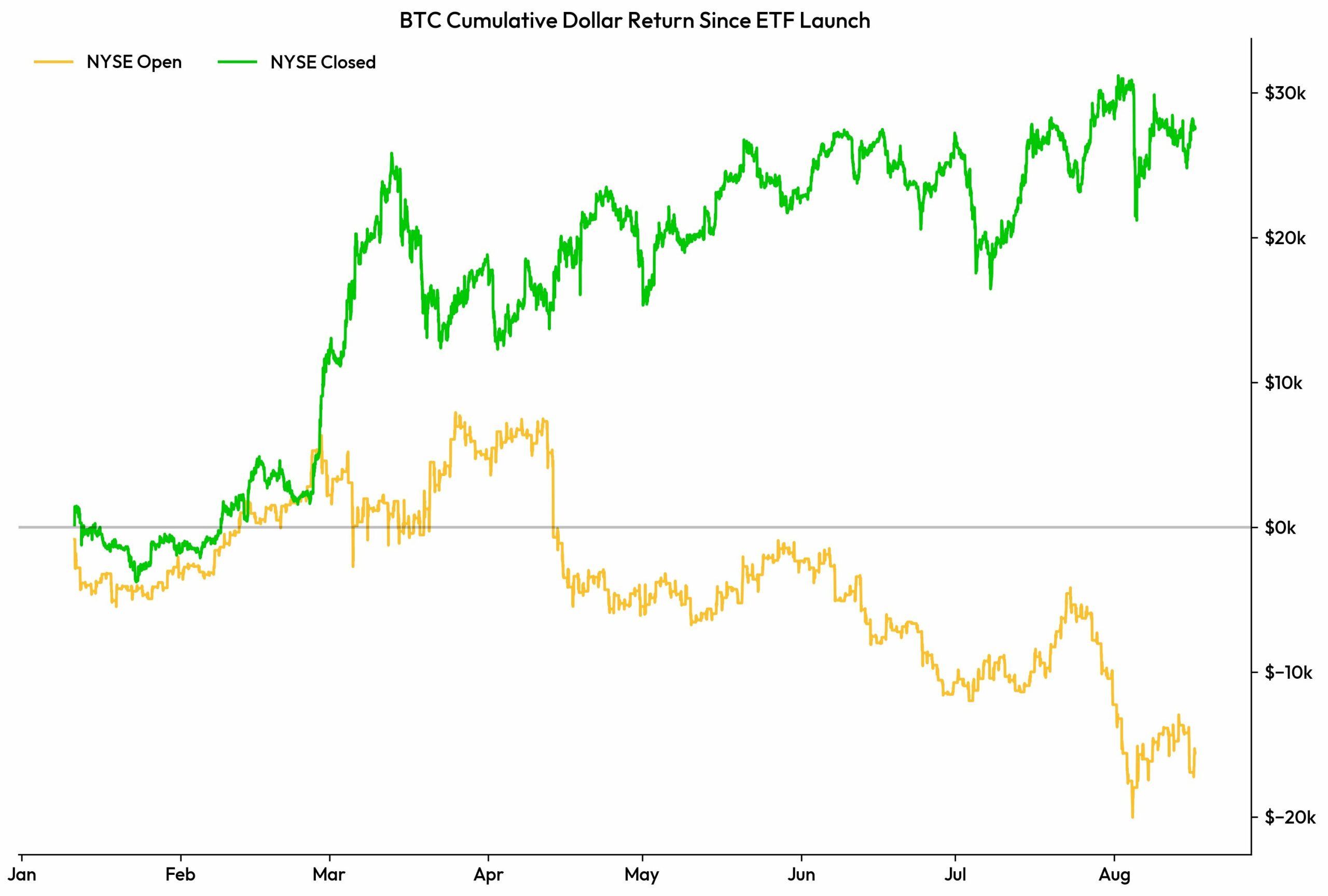

Bitcoin cumulative dollar return since ETF launch

Over the period since their introduction, Bitcoin’s overall return in U.S. dollars has exhibited a clear trend: its value typically decreases when the New York Stock Exchange (NYSE) is active, but increases when it’s not.

In simpler terms, the fact that conventional financial institutions have become active players in the cryptocurrency market may be a key factor behind the current trend, where fluctuations in the value of Bitcoin during regular trading hours can impact the returns of Bitcoin-related Exchange Traded Funds (ETFs).

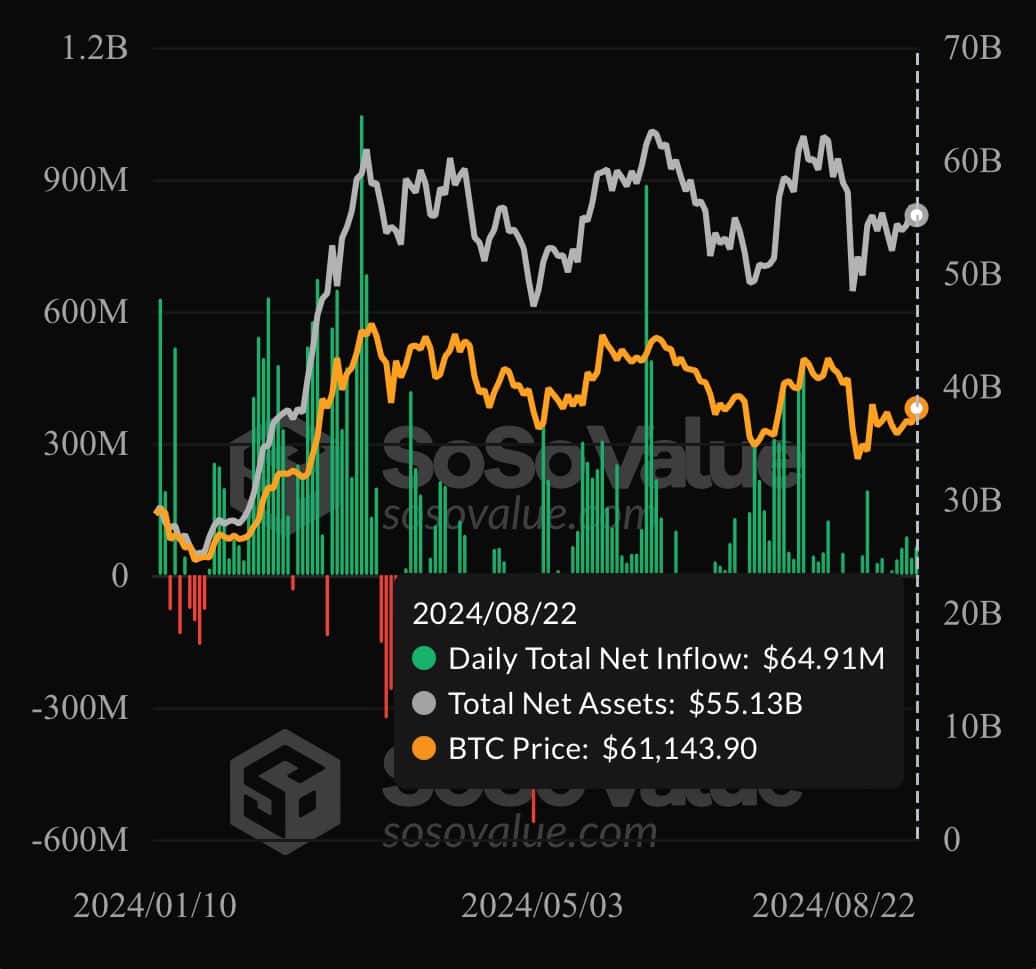

Bitcoin ETF flow & daily trading volume

Yesterday, I observed a significant influx of funds into Bitcoin Exchange-Traded Funds (ETFs), amounting to approximately $65 million. This marks the sixth consecutive day that these funds have experienced such positive net inflows. As a researcher, this trend underscores a growing interest in digital assets like Bitcoin.

As a seasoned investor with over two decades of experience in the financial markets, I’ve witnessed numerous trends come and go. However, this particular trend caught my attention because it demonstrated a significant surge in both net flow and daily trading volumes, with total net assets now reaching an impressive $55.13B. This is a clear indication that investors are becoming increasingly confident in the market, which bodes well for future growth. I’ve seen similar trends before, but I believe this one has the potential to outperform due to various underlying factors such as strong fundamentals and positive investor sentiment. It’s always exciting to see the market moving in a positive direction, and I’m optimistic about the prospects of this trend continuing to gain momentum.

For example, As Bitcoin Archive pointed out on its platform (previously known as Twitter), the Bitcoin ETF from BlackRock ($IBIT) had a trading volume of $758 million yesterday, which added to a total daily volume of $1.4 billion for all ETFs in the market.

An increase in Bitcoin trading has bolstered its value, enabling it to reassess significant points. If a lower high forms near $67,000, the leading cryptocurrency might persist in its ascent, aiming for $70,000.

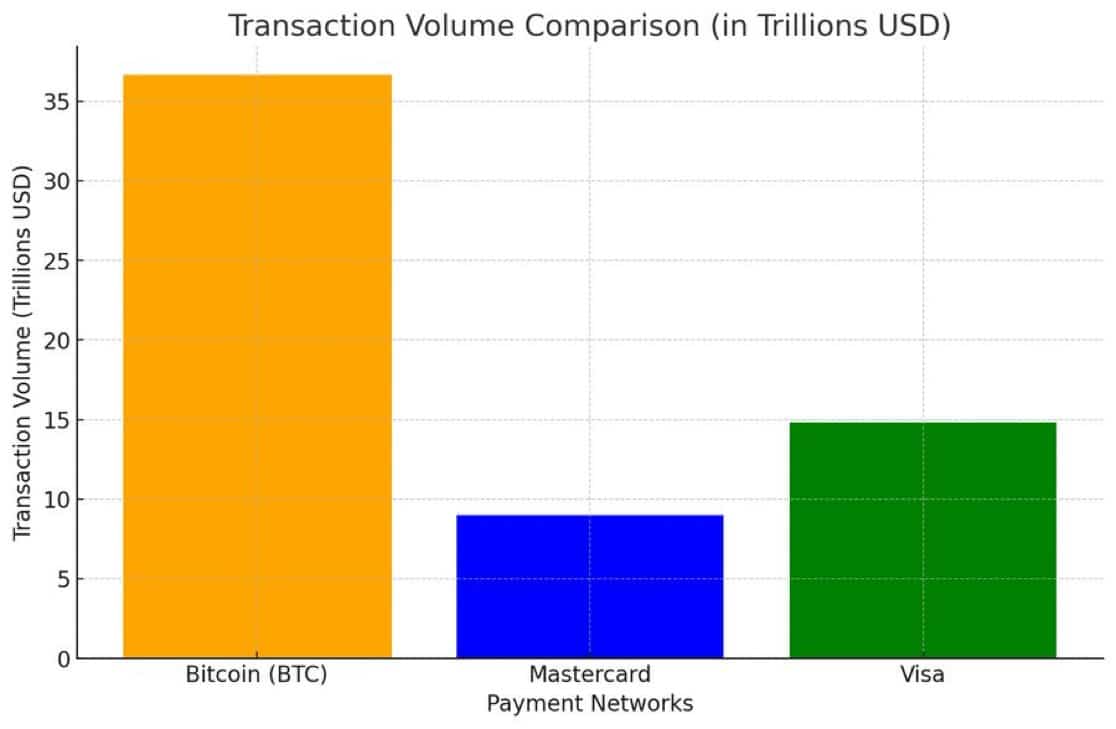

Transaction volume comparison

Furthermore, Bitcoin’s transaction activity stayed strong, handling approximately $36.6 trillion in transactions in the year 2023, outpacing the total of Visa and Mastercard combined.

On the other hand, ETF investors don’t have a direct involvement in Bitcoin’s transactional expansion since their holdings are linked to custodians and manifested as paper shares.

This limitation in ETF structures needs addressing, but it doesn’t diminish Bitcoin’s long-term prospects.

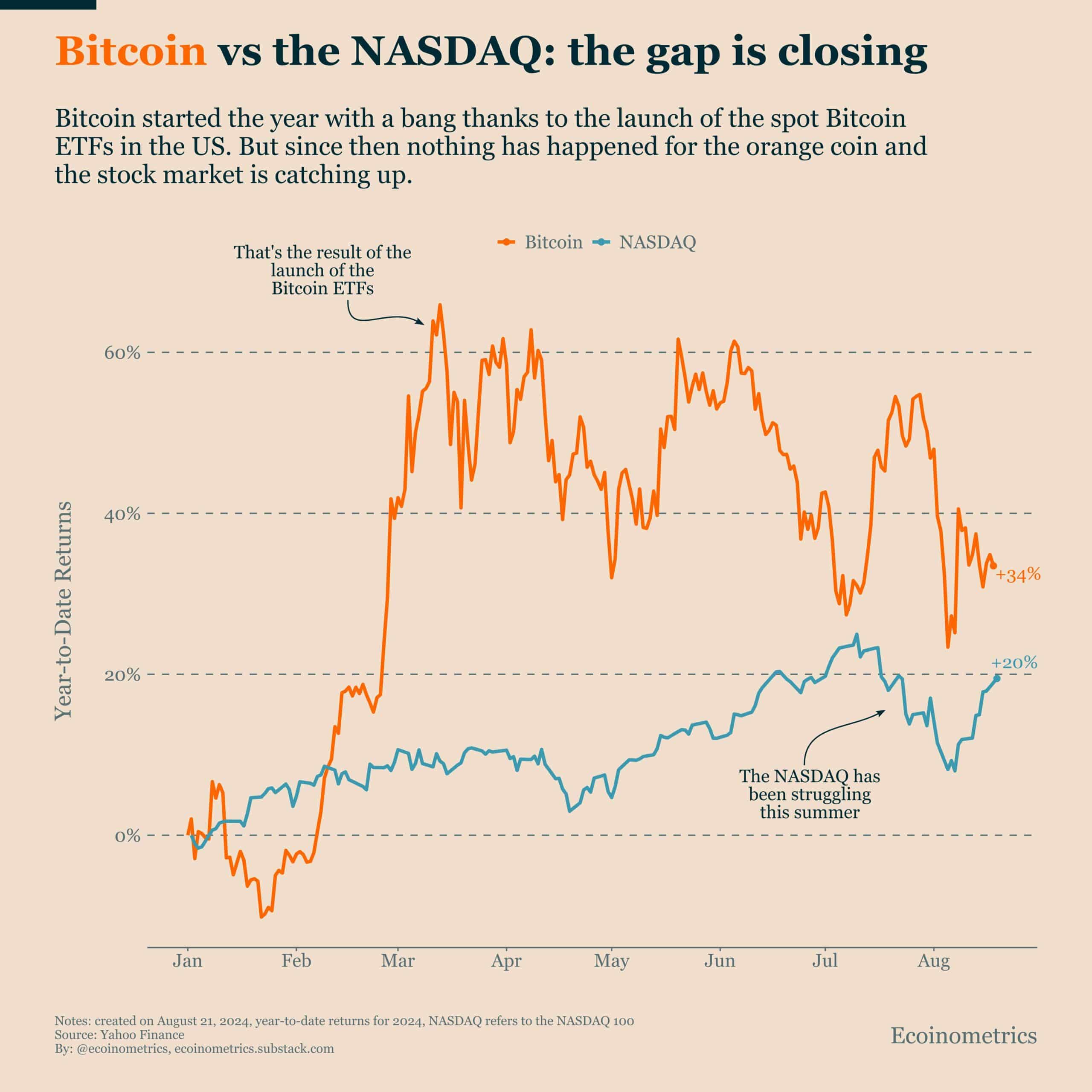

Bitcoin still outperforms stocks in year-to-date returns

Additionally, Bitcoin surpassed conventional stocks in year-to-date earnings, boasting a 34% increase as opposed to NASDAQ’s 20%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It appears that the cryptocurrency market is on an upswing, suggesting that Bitcoin’s potential growth may be significant in the near future, potentially even more so if there are further positive factors at play.

Even though this year has been rather subdued, the initial surge following the ETF’s launch and the possibility of additional market triggers suggest a strong likelihood of Bitcoin’s value increasing substantially in the coming months.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-23 21:12