-

Introduction of new ecosystem tokens is part of initiatives to refine decentralized governance and increase participation

Conversion of Maker (MKR) and Dai (DAI) to the yet-to-be-rolled-out tokens will be optional for holders

As a seasoned analyst with over a decade of experience navigating the intricacies of the blockchain industry, I find MakerDAO’s latest move to introduce NewStable (NST) and NewGovToken (NGT) an exciting development that underscores the dynamic nature of decentralized finance.

Recently, the Ethereum-based decentralized finance protocol, MakerDAO, has been undergoing a significant change as part of its previously announced strategic ‘endgame’ plan. This week, MakerDAO unveiled two new tokens, tentatively named NewStable (NST) and NewGovToken (NGT), which are enhancements of the existing ecosystem tokens DAI and MKR respectively.

The change intends to update the MakerDAO system, focusing on improving its governance structure and ensuring its protocol remains robust and reliable.

The future of MakerDAO

Launched back in 2017, DAI currently ranks as the third-largest stablecoin with a market cap of approximately $5.365 billion (as reported by CoinMarketCap). This digital currency serves as a dependable medium for decentralized finance (DeFi) lending and borrowing activities. It’s created through a process where collateral is secured in smart contracts referred to as Vaults, ensuring stability in its value and independence from centralized control.

In contrast, MKR plays a crucial role in fostering decentralized management by maintaining the system’s stability and self-regulation. Furthermore, MKR serves as a backup resource to correct imbalances, such as bad debt or insolvency, thereby encouraging participants in governance to prioritize the system’s overall stability.

As a researcher delving into the realm of digital currencies, I’m excited about the advancement of NewStable (NST), which builds upon DAI, MakerDAO’s crypto-backed stablecoin tied to the U.S dollar. The novelty lies in its refined stability mechanisms. For existing DAI holders, a seamless transition to this new stablecoin is promised on a 1:1 basis. What sets NST apart is its focus on compliance with real-world assets, a move that MakerDAO anticipates will boost its appeal among institutional investors, potentially widening its user base.

The NewGovToken (NGT) enhances the role of the MKR token by offering improved incentives for participation in governance decisions within MakerDAO. MakerDAO has designed a redemption system where MKR token holders can swap their tokens for NGT at a rate of 1 MKR to 24,000 NGT. This approach aims to increase user engagement in the governance of MakerDAO by allowing them to accumulate substantial amounts of NGT.

Endgame transformation

As a researcher, I’d like to share some insights about the evolution of the ‘Endgame’ plan. This strategic initiative was initially proposed in May 2022 and was officially approved following a governance vote in August of the same year. Fast forward to March 2024, MakerDAO Founder, Rune Christensen, offered the first substantial update regarding the three-phase transformation roadmap within the ecosystem governance forum.

According to its recent announcement this week, Maker has made it clear that both types of their tokens will coexist as long as governance doesn’t make a different decision in the future.

Maker’s team, in an August 22 post on X (Twitter), also said,

“In the future, the system may develop methods to distinguish between DAI and NewStable. DAI is likely to concentrate on applications specific to cryptocurrencies, while NewStable aims for broader acceptance across a wider audience.”

MakerDAO clarified that token conversions will be an option, enabling users to switch to the latest token pair if desired. If users opt for this change, they have the flexibility to revert back to the original tokens whenever they want. Unfortunately, the exact launch date for the new tokens has yet to be disclosed in Thursday’s announcement.

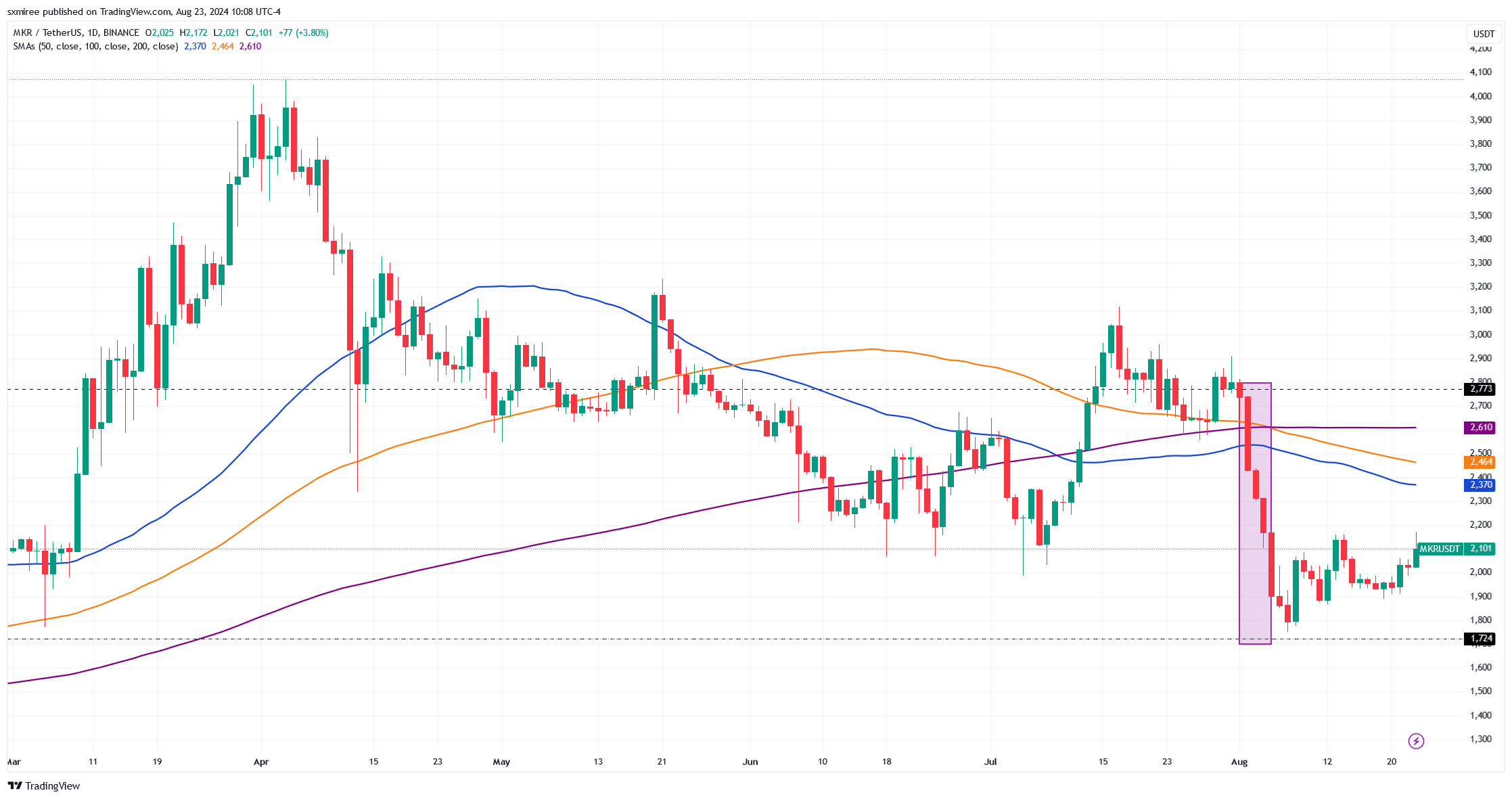

MKR’s price action

During the market downturn between August 3rd and 5th, MKR was one of the digital tokens that experienced significant setbacks. To be more specific, TradingView’s price chart shows MKR falling from $2,773 on August 1st to $1,724 on August 5th – This represented its steepest four-day decline since early April.

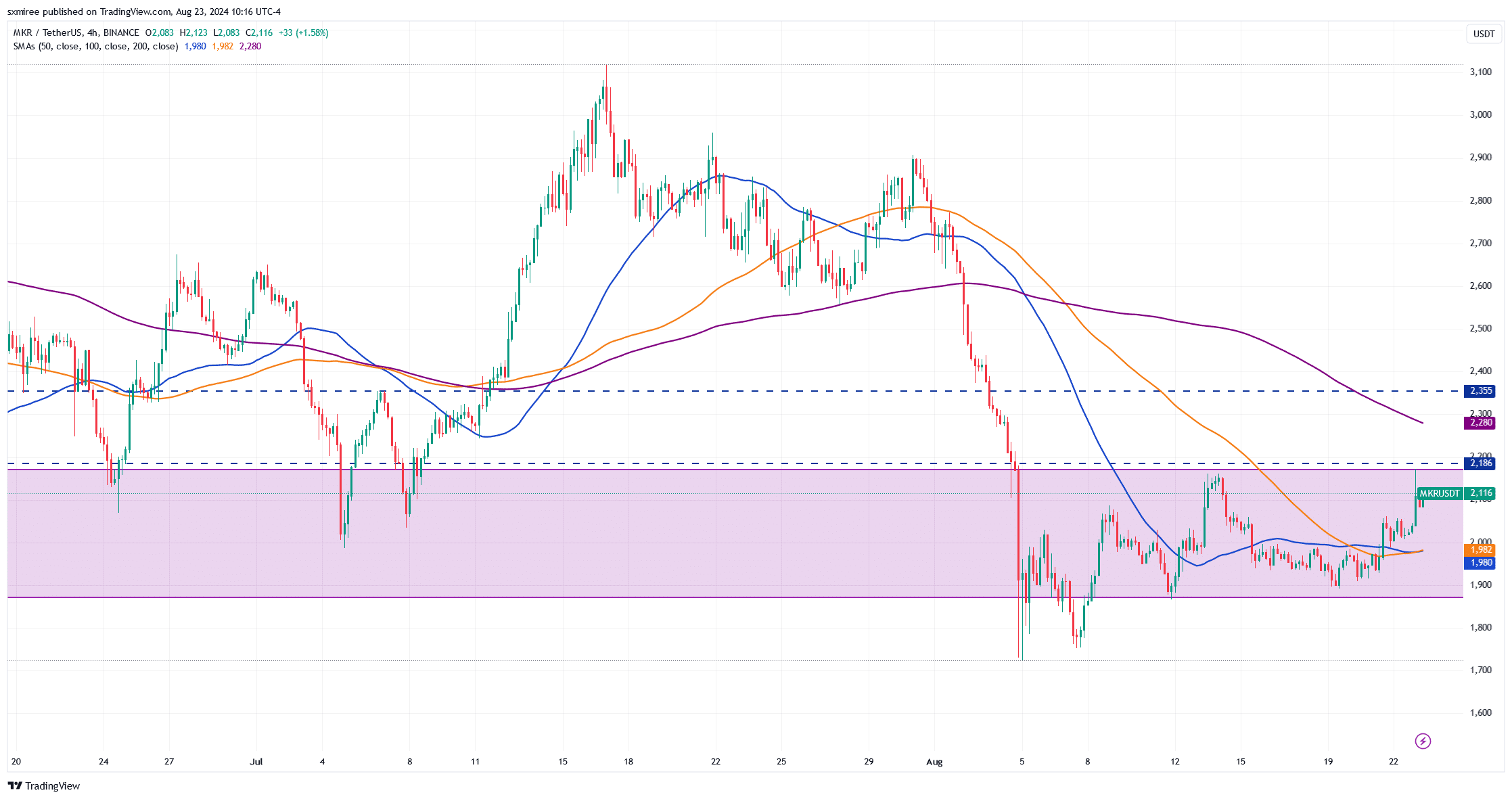

Despite MKRD/USDT climbing above $2,100 recently, it’s still stuck within a specific range – between approximately $1,870 to $2,170. Over the past fortnight, this is where the pair has predominantly traded.

In simpler terms, market optimists might aim for a potential resistance point slightly above its current price range, which is approximately $2,185. This is the same level where MKR encountered rejection back on August 14th.

Overcoming this obstacle will open up opportunities to take on our next goal of $2,354. In the past, this level presented difficulties back in June and July.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-24 12:08