-

A sustained bull rally might allow Aptos to retest its March highs

Metrics showed that APT whales have been receiving more exposure in the market

As a seasoned analyst with years of experience navigating the volatile crypto market, I must say that Aptos’ (APT) recent breakout from its long-standing bullish pattern is indeed intriguing. While the token’s weighted sentiment and social volume seem to be indicating bearish trends, the technical indicators suggest otherwise.

Over the past week, Aptos (APT) has shown exceptional performance, boasting double-digit gains. This stellar run has allowed the altcoin to surge past a prolonged bullish trend, potentially setting it up for a price increase that could potentially double its current value.

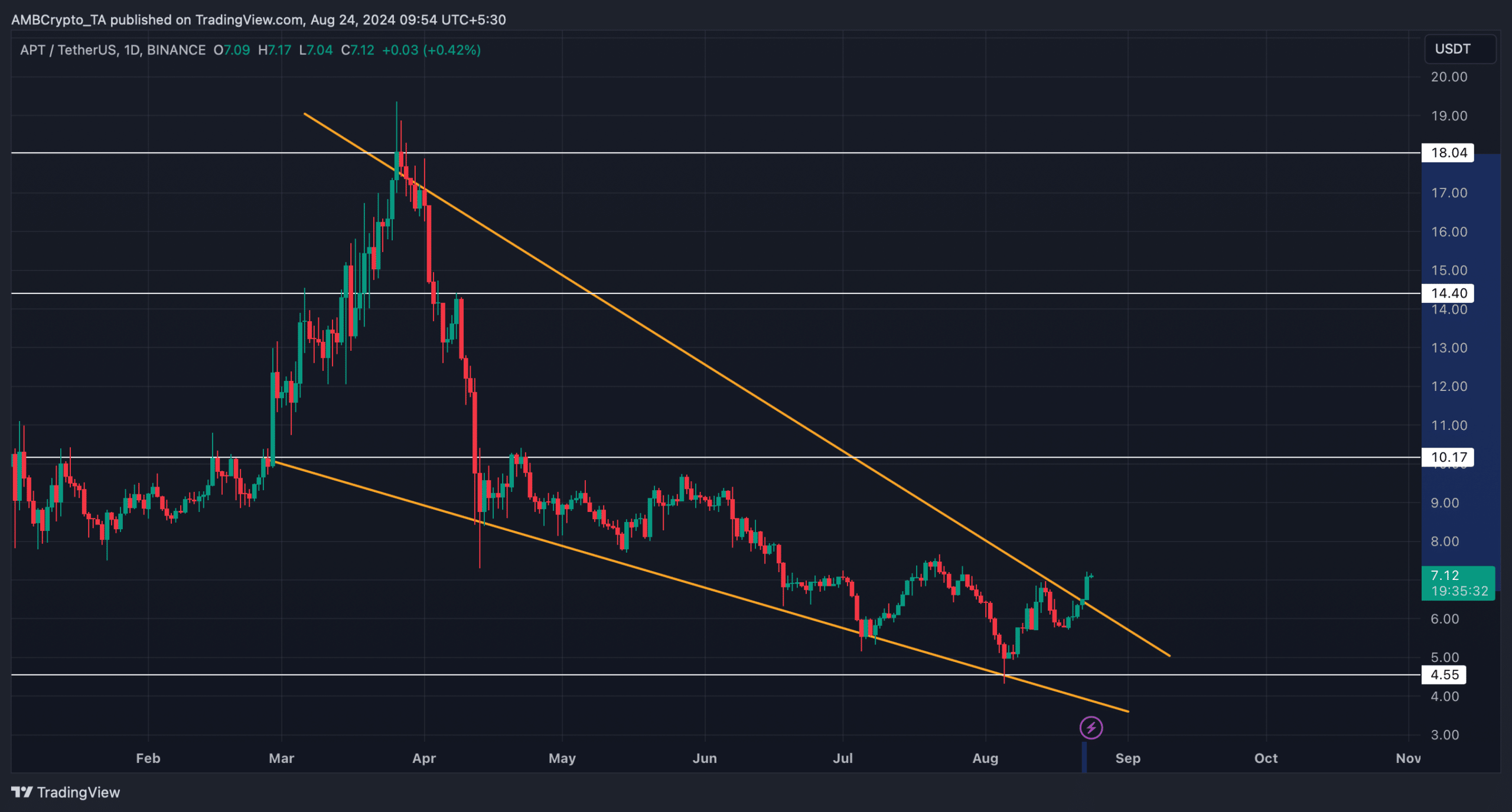

Aptos breaks above a pattern

As an analyst, I’ve observed a significant surge in the price of Aptos over the past seven days. The bulls have been quite active, pushing the token’s price up by more than 20%. This bullish momentum persisted even in the last 24 hours, with APT‘s value increasing by approximately 7%. At the moment I’m writing this, APT is being traded at $7.11, and its market capitalization stands above $3.44 billion.

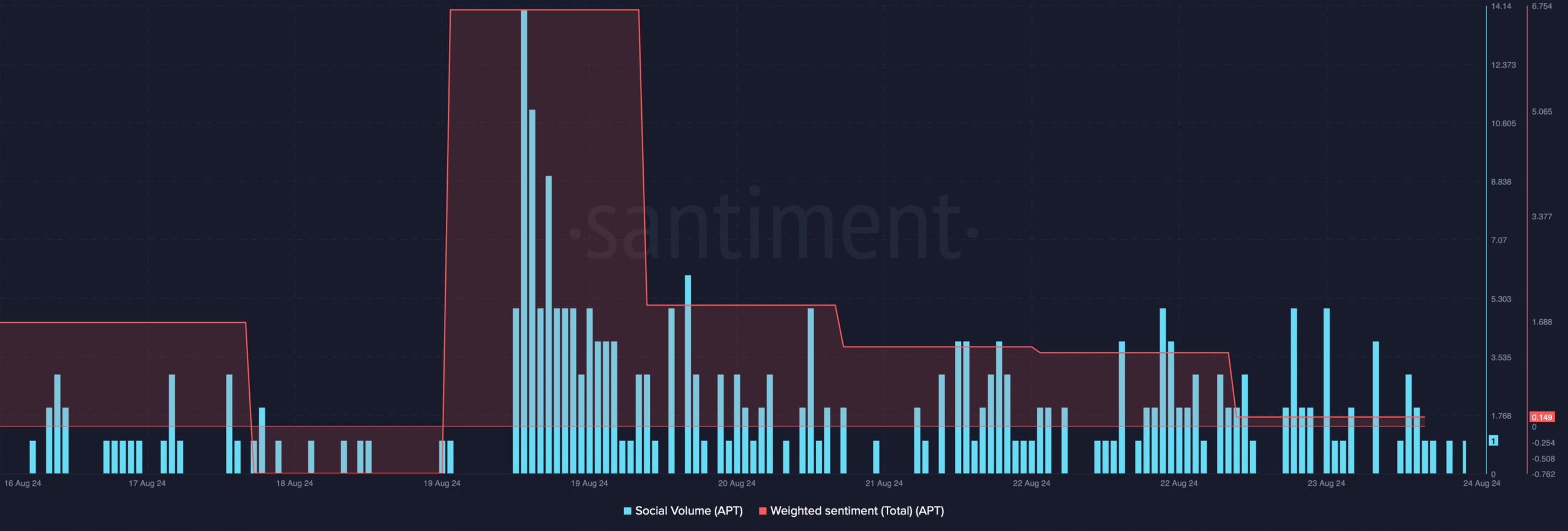

Interestingly, although I recently observed an increase in prices for Aptos, the overall sentiment towards the token seems to have dipped. This implies that negative sentiments regarding this token may be on the rise. Moreover, its social volume has decreased, indicating a drop in interest or popularity for this altcoin.

As this event transpired, the token surpassed a bullish falling wedge formation. This pattern was established in March, with the price of APT moving within it before making a breakout just a few days ago.

It appears this spike suggests that APT could double its growth and potentially reach the levels it attained in March in the near future. But before reaching those March highs, the token must first surpass its resistance points at approximately $10.17 and $14.4 within the coming weeks.

Will APT’s bull rally continue?

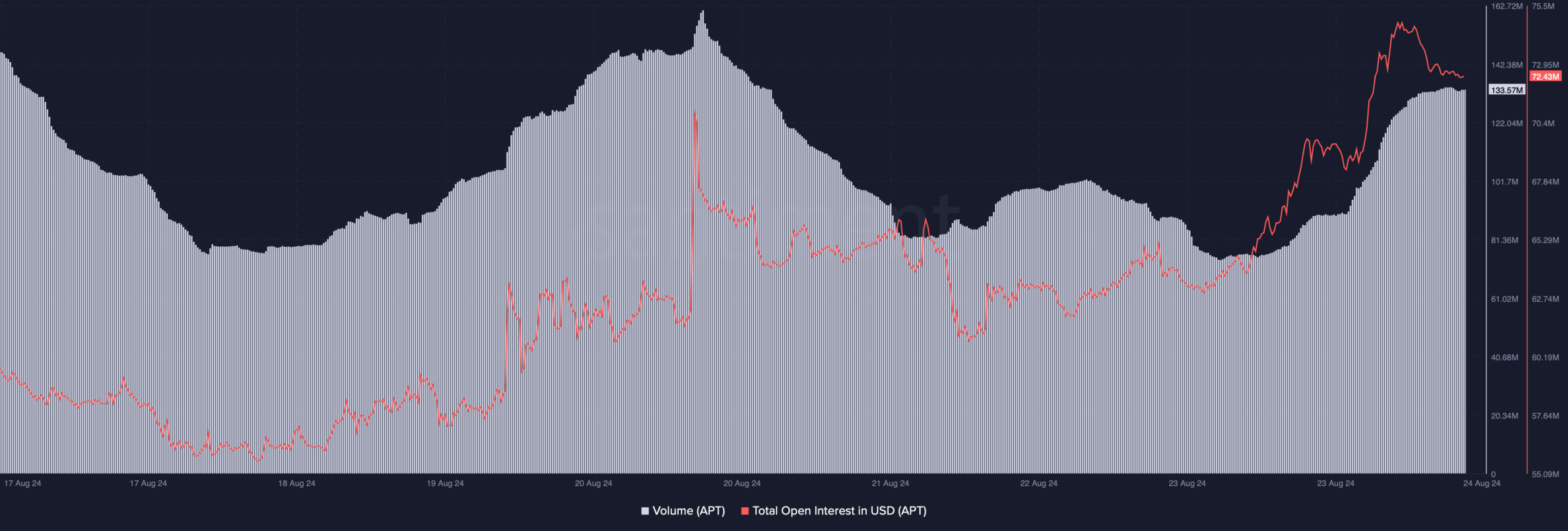

After examining Aptos’ on-chain activity, AMBCrypto observed some insights about potential long-term price increases. Notably, we noticed that the trading volume of APT tokens skyrocketed by an impressive 71%. This significant increase often sets the stage for a bull market.

1. As the token’s price went up, so did its Open Interest, suggesting a higher likelihood that the current price trend will persist.

Additionally, Coinglass’ data revealed that APT’s long/short ratio rose too.

As someone who has spent years analyzing market trends and investing in various assets, I find the current state of Aptos’ market intriguing. From my perspective, the fact that there are more long positions than short ones suggests a bullish outlook for the cryptocurrency. This is particularly noteworthy given my experience with similar situations in the past where such an imbalance has led to significant price increases.

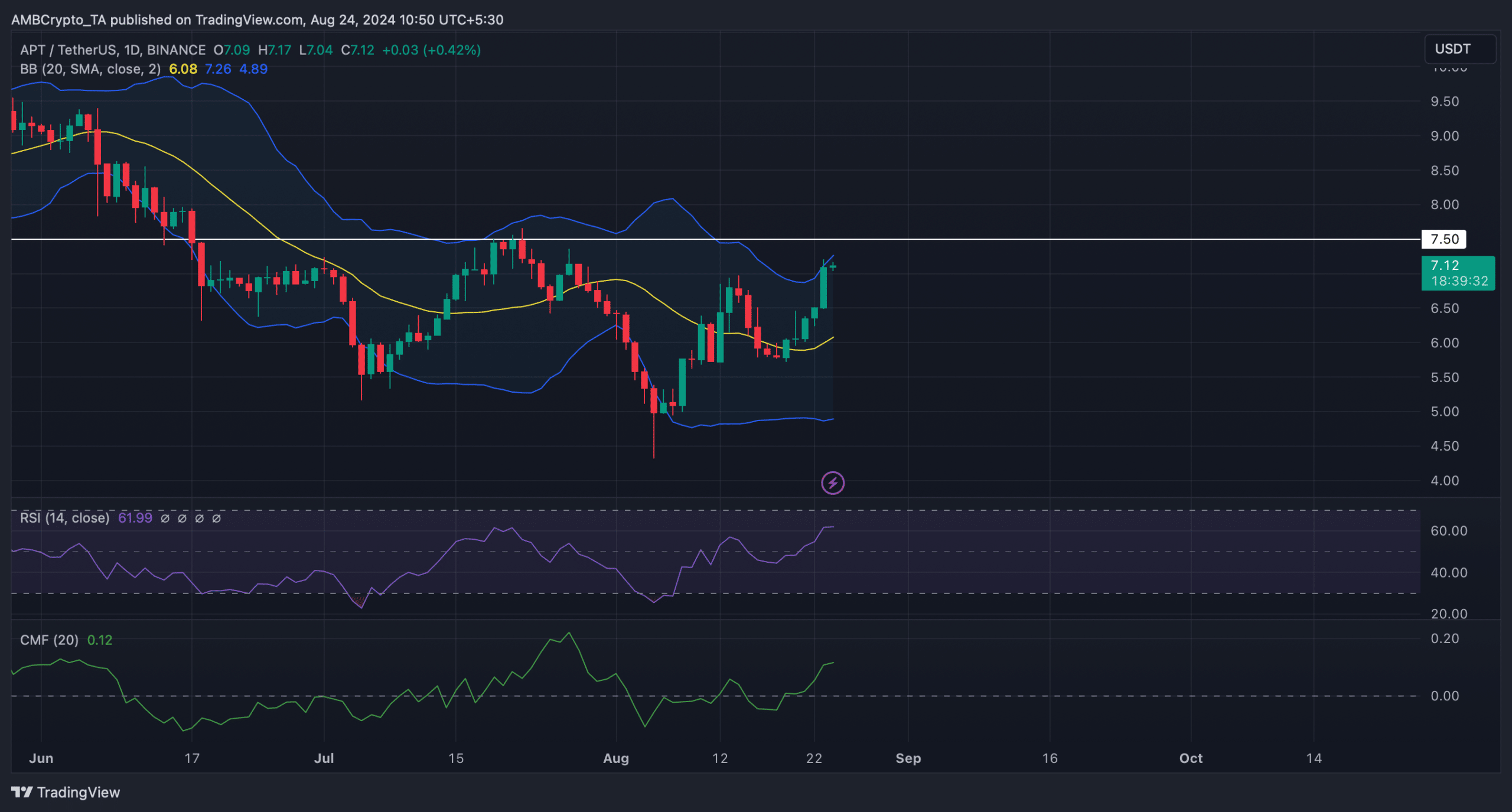

After examining the daily chart of APT, we have gained insight into potential movements for the token. Our analysis indicates that the Chaikin Money Flow (CMF) has significantly increased, which is a positive signal. Additionally, the Relative Strength Index (RSI) remains above the neutral level, suggesting a bullish trend.

Read Aptos’ [APT] Price Prediction 2024-25

Nevertheless, the token’s price reached the top boundary of the Bollinger Bands, a point that usually triggers price adjustments. Yet, if the bullish trend persists, it becomes essential for APT to surpass its resistance around $7.5.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-08-24 14:15