-

Dogecoin bulls enforced a bullish market structure break.

The lower timeframe sentiment could propel DOGE toward the nearby Fibonacci levels.

As a seasoned analyst with years of market observation under my belt, I must admit that Dogecoin’s [DOGE] recent surge has piqued my interest. The bullish break in the market structure, coupled with the potential for DOGE to reach nearby Fibonacci levels, suggests an optimistic outlook for the meme coin. However, it’s essential to remember the crypto market’s inherent volatility and the fact that the long-term trend remains bearish.

In recent cryptocurrency market activity, Dogecoin [DOGE] has demonstrated an upward trend. The 7.3% increase it experienced on Friday, August 23rd, suggests a strong buying interest, potentially leading to further gains of approximately 8%-18% in the near future.

More and more Dogecoin users found themselves in a profitable position. Given that the market has been downward trending since May, this suggests that the potential for profit-taking might reappear, possibly slowing Dogecoin’s advancement.

Dogecoin reclaims the local resistance zone as support

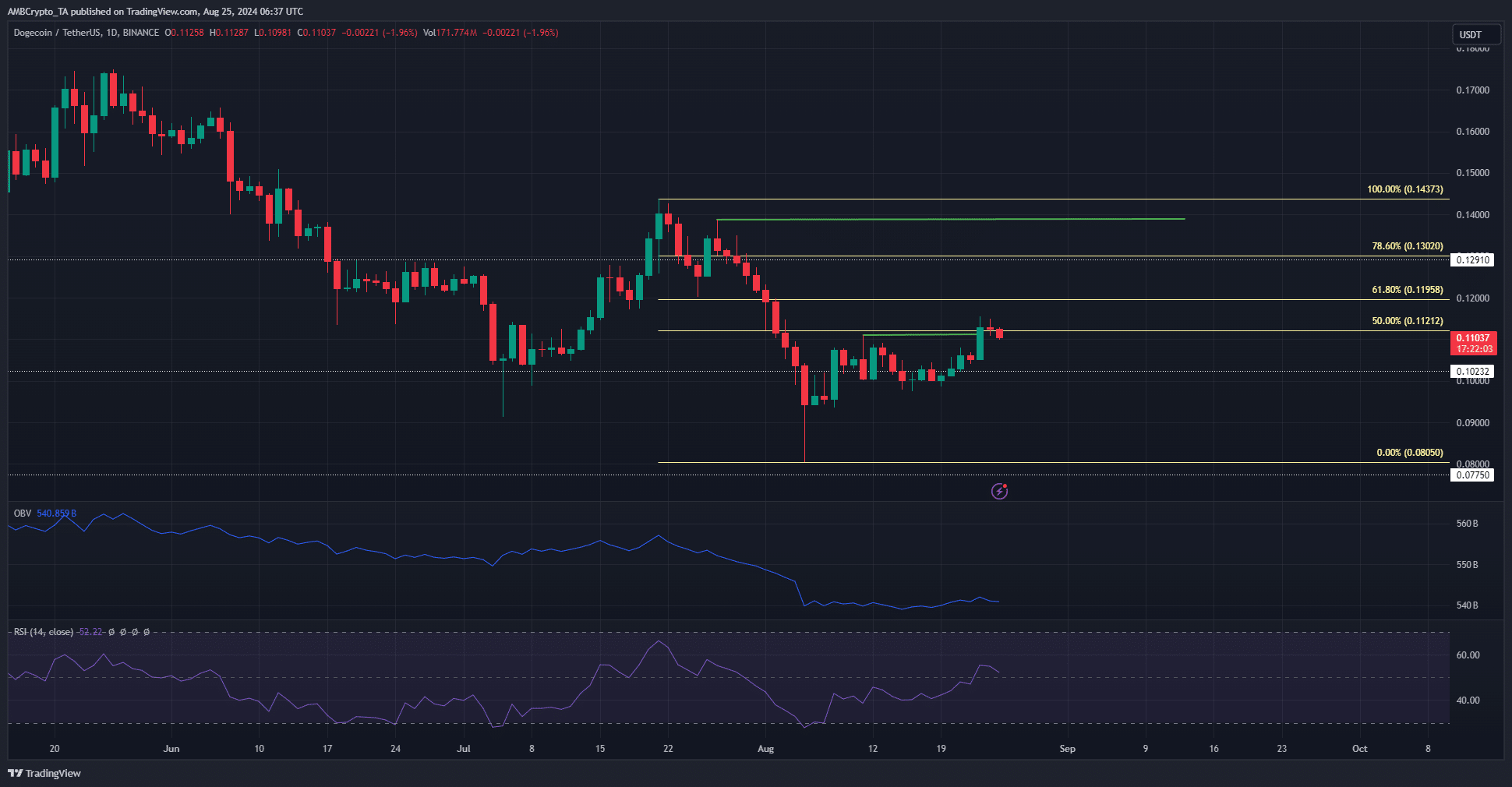

As a cryptocurrency investor, I observed a positive shift in the market structure on the daily chart when we closed above $0.111 on the 23rd of August, indicating a potentially bullish outlook. However, it’s important to note that the overall long-term trend has been bearish, with brief periods of bullish structures such as the one we’ve recently experienced.

As an analyst, I’ve observed that the Fibonacci retracement levels derived from the past month’s price decline point to $0.1196 and $0.13 as potential resistance zones ahead. Given the bullish structure Dogecoin is currently exhibiting, it seems plausible that we may see Dogecoin reaching one or both of these levels in the near future.

In simpler terms, when the Daily Relative Strength Index (RSI) exceeded 50, it indicated a positive or bullish trend. Yet, the On-Balance Volume (OBV) didn’t increase much. This suggests that while momentum was changing, there wasn’t enough demand to sustain Dogecoin’s growth, which might make its gains easy to reverse.

Short-term bullish, long-term not so hopeful

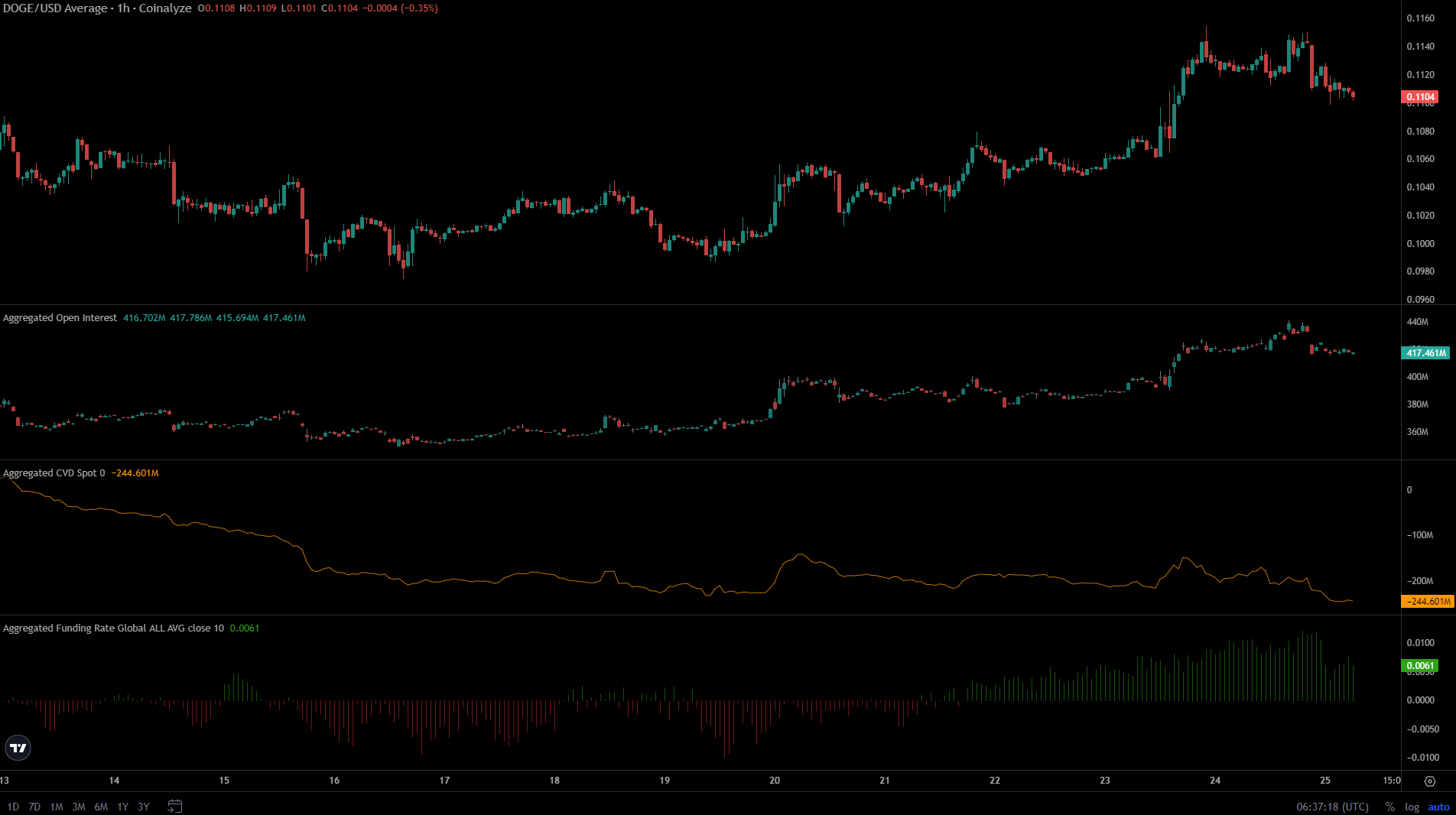

Over the last few days, the funding rate for Dogecoin decreased slightly but still indicated a favorable trend. Simultaneously, the Open Interest has been increasing along with the coin’s price, suggesting strong buying interest. However, there was a slight decrease in Open Interest within the past 24 hours.

During this time Dogecoin fell just over 4% from $0.1149 to $0.11.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Although the future’s data indicated that speculators were ready to buy (go long), the current market value (spot CVD) started falling once more.

The data indicated a low level of purchasing interest in the immediate markets, which further supported the notion that any advancements made by Dogecoin could quickly diminish if pessimistic views gained dominance.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-08-25 20:07