-

Market analyst notes that the decision by “whales,” to purchase 28,717 SOL was driven by the bullish accumulation phase.

Exchange netflow data for SOL also signaled a bullish run, suggesting increased investor confidence.

As a seasoned market analyst with over two decades of experience under my belt, I’ve seen my fair share of market trends and fluctuations. The recent moves by whales to buy and stake 28,717 SOL units worth $4.56 million is reminiscent of the strategic accumulation phase that often precedes a bull run. The consistency in negative exchange netflow for SOL, coupled with rising open interest, suggests a surge in buying pressure and increased investor confidence.

On both the day-to-day and weekly graphs, Solana (SOL) has maintained its upward trend, registering a 2.10% increase in the short term and an impressive 11.97% surge over the week.

The powerful upward pricing pattern, combined with whales actively holding onto their coins (staking), as well as significant technical indicators, points towards a substantial increase in Solana’s price within the coming trading sessions.

Whale staking of SOL could spur market rally

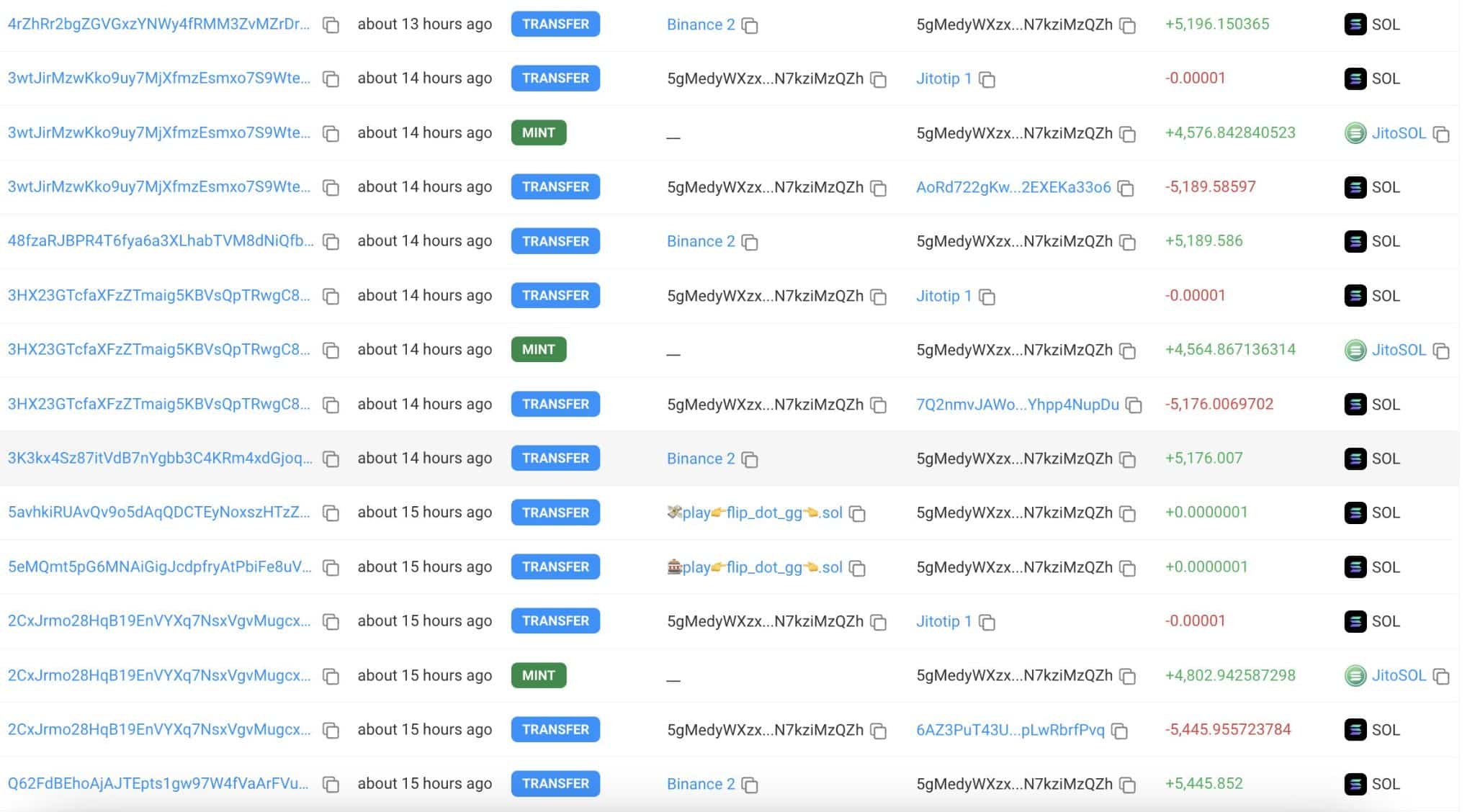

Recent findings from Lookonchain suggest that a significant investor, often referred to as a ‘whale’, has recently acquired and locked up approximately 28,717 units of Solana (SOL) in a staking pool. This substantial investment amounts to an impressive $4.56 million.

Locking up their SOL in a wallet for the purpose of bolstering Solana blockchain’s functions and security is known as staking. This action not only brings rewards, usually more SOL tokens, but also demonstrates increasing trust in the market.

These significant moves – buying and then holding onto cryptocurrencies like SOL – indicate that ‘whales’ are hopeful about the market’s future growth. This action decreases the amount of SOL available for trading, which could trigger a surge in the market due to increased scarcity.

Anticipated SOL rally on the horizon

crypto expert Ali posits that the current phase of Solana’s (SOL) price amassment has significantly impacted the investment choices made by large investors, or whales.

A build-up phase refers to a strategic time in the market where investors gradually acquire assets, such as SOL in this case, often when prices are relatively lower. The goal is to establish a significant holding, in anticipation of a projected price rise.

Based on Ali’s assessment, it seems that SOL may soon leave its accumulation period and could witness a significant jump in price, possibly rising by approximately 33.15%. This increase could potentially push the value of SOL back above $200 within a short timeframe.

AMBCrypto has identified recent market activities that align with the expected upward trend.

More bullish signals emerge

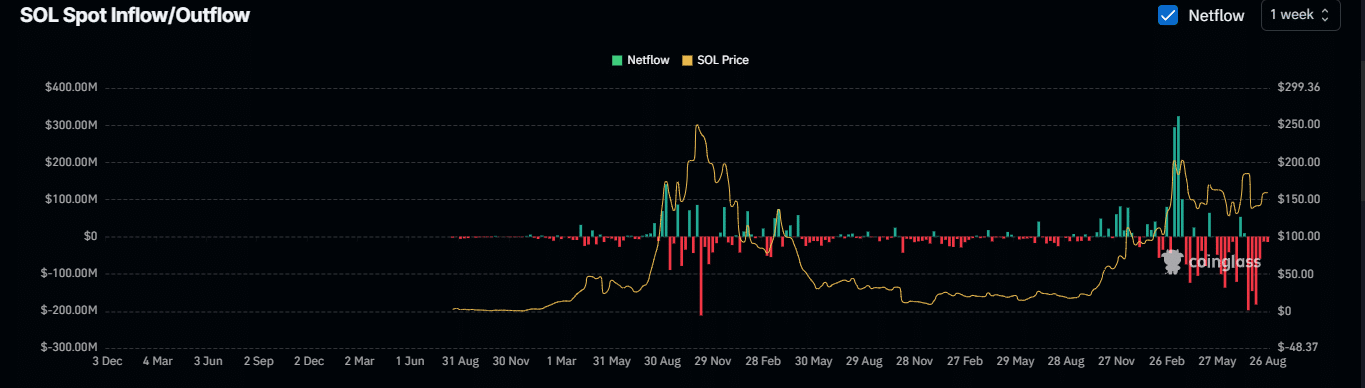

An examination of the flow difference in netflow, which is a measurement used in cryptocurrency transactions to show the gap between the amount of SOL going into and leaving exchanges, points towards a positive or bullish trend for Solana (SOL).

Based on data from Coinglass, the net exchange flow for Solana (SOL) was -$14.62 over the last 24 hours. A closer look by AMBCrypto shows that since July 22, this flow has consistently been negative, suggesting a continuous decrease in the amount of SOL available on trading platforms.

This trend indicates stronger demand for purchasing cryptocurrencies, with withdrawals surpassing deposits.

Is your portfolio green? Check the Solana Profit Calculator

Furthermore, it’s observed that the active positions (AP) for SOL have consistently grown, suggesting an increase in trading actions and investor enthusiasm among individual traders.

If the current upward trajectory persists, it’s likely that SO could scale new peaks. This growth rate could potentially be boosted even more if there’s a decrease in Bitcoin‘s market dominance.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-26 18:16