As a seasoned cryptocurrency enthusiast with over a decade of experience under my belt, it’s always fascinating to witness the rapid evolution of the digital asset space. The latest developments from Sony and Grayscale have caught my attention, signaling a significant leap towards mainstream adoption.

Over the past couple of weeks, there had been a lull in the crypto world, with minimal news coverage. However, the period between August 19 and August 26 was quite eventful. Last week was filled with surprising events, ranging from the arrest of Telegram’s CEO to an unexpected incident involving McDonald’s.

Additionally, recent developments such as unexpected turns in the U.S. elections and newly filed legal allegations have sparked interest, creating a commotion. Our comprehensive examination delves into these occurrences, providing you with insightful explanations to help you stay informed.

In this piece, we’ll provide a comprehensive overview of the latest developments in the cryptocurrency sector across the world from last week.

Top Crypto Industry News

1. Telegram CEO Arrested, Toncoin Plunges by 14%

A significant decrease (over 14%) was observed in Toncoin’s value following reports by the French media about the detention of Telegram CEO, Pavel Durov, who is connected to an ongoing criminal probe in France.

On August 25, 2024, French media disclosed that the CEO of Telegram, Pavel Durov, was detained at Le Bourget Airport.

The arrest stems from a warrant issued by the French police department OFIM, which focuses on combating minor-related violence. Authorities have charged Durov with failing to effectively regulate inappropriate content on Telegram, specifically illegal content such as drug trading and child abuse materials.

With word-of-mouth, the value of Toncoin (TON), the digital currency associated with Telegram, plummeted more than 14% as information circulated.

Despite this, the broader digital asset market remained stable. Some prominent figures, including Elon Musk, supported Durov’s release on social media.

The French officials have prolonged Durov’s custody; his detainment might continue for up to 96 hours as the investigators look into accusations of fraud, involvement in criminal activities, and negligence in regulating potentially damaging content on Telegram.

Telegram clarified that it adheres to European Union regulations and is consistently working to enhance its moderation practices.

Source: CoinDesk

2. McDonald’s Instagram Hacked, Scammers Steal $700K Promoting Fake Grimace Memecoin

Hackers managed to control McDonald’s main Instagram account and used it to advertise a false version of a meme-related currency based on their mascot, Grimace. This resulted in approximately $700,000 being stolen from unsuspecting investors.

On the 21st of August, 2024, unscrupulous individuals managed to gain control over McDonald’s authentic Instagram account and exploited it by advertising a questionable digital currency named “Grimace.”

The posts, which targeted McDonald’s 5.1 million Instagram followers, claimed the memecoin was a new experiment on the Solana blockchain.

In this incident, the hackers seized control of 75% of Grimace token’s total supply and dispersed it among various digital wallets. This sudden increase in the token’s circulation quickly boosted its market value to a whopping $25 million. However, the price plummeted shortly afterwards when the hackers sold off their tokens, leading to a loss for many investors. In the end, they managed to pocket an estimated $700,000 in Solana from this illicit operation.

McDonald’s has reclaimed ownership of the account after taking down the deceptive content. The corporation expressed regret for the occurrence, labeling it as a “one-off incident.”

Source: Cointelegraph

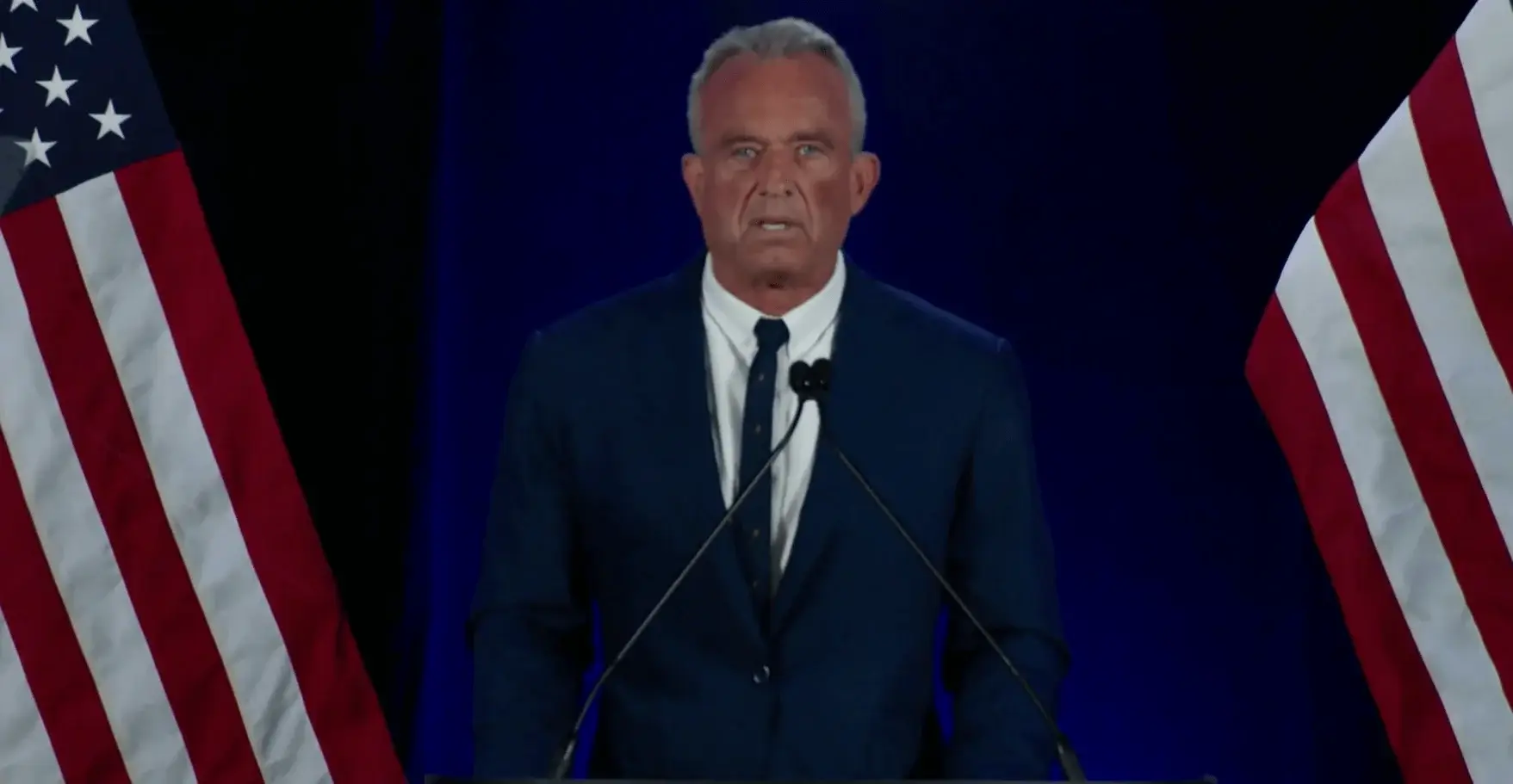

3. RFK Jr. Suspends Presidential Bid, Endorses Trump Amid Bitcoin Support

Summary: Robert F. Kennedy Jr. has announced he is suspending his independent presidential campaign and endorsing fellow Bitcoin supporter Donald Trump.

On August 23, 2024, the Bitcoin supporter and independent political candidate, Robert F. Kennedy Jr., announced that he was temporarily halting his presidential campaign.

In the city of Phoenix, Arizona, Kennedy clarified that he would remove his name from ballots in key or “swing” states, with the intention of not aiding the Democratic candidate Kamala Harris by keeping his own campaign alive.

Kennedy clarified that while he wasn’t completely withdrawing from his campaign, he was instead redirecting his efforts to back Donald Trump, another notable supporter of Bitcoin. He voiced worries that continuing to stay on the ballot in crucial swing states might unintentionally aid Harris, as they have contrasting views on significant matters.

Kennedy’s decision was made following Donald Trump expressing curiosity towards Bitcoin. Both candidates shared similar perspectives on cryptocurrency. This move was preceded by Kennedy’s previous comments regarding the possibility of a U.S. Bitcoin reserve and using blockchain for transparent government transactions.

Robert F. Kennedy Jr.’s decision to suspend his campaign has triggered a flurry of activity on Polymarket, with betting odds now shifting in favor of former President Donald Trump.

Source: Decrypt

4. Crypto Advocate Michelle Bond Charged of Illegally Accepting FTX Cash

Overview: Michelle Bond, a previous supporter of cryptocurrency, was recently charged with accepting unlawful political contributions from her past partner, Ryan Salame – a former FTX executive – during her 2022 bid for Congress.

Summary: In federal court, Michelle Bond, once prominent in D.C.’s crypto policy circle, has been charged with accepting illicit donations during her unsuccessful congressional bid in 2022. The money reportedly came from Ryan Salame, a former high-ranking executive at FTX who was then her boyfriend. Court records indicate that Bond falsified financial documents concerning the campaign. Previously, she worked as a lawyer for the U.S. Securities and Exchange Commission (SEC).

As a crypto investor, I found myself in an unexpected predicament when I was handed a 7.5-year sentence following my guilty plea to charges of campaign finance violations and other offenses. The indictment against me suggests that the funds used for my campaign were actually derived from another individual, whose description matches mine, but who remains unnamed in the accusation. The allegation is that I claimed self-funding for my campaign when in reality, those funds came from this unidentified source.

Regardless of collecting more than $1.5 million, a large portion said to be from Salame, Bond still failed to win the Republican primary.

Sources: CoinDesk

Latest Cryptocurrency News – Regulations

5. Australian Court Backs Regulator in Lawsuit Against Kraken’s Local Operator

In a court ruling, the Australian Securities and Investments Commission (ASIC) successfully prosecuted Bit Trade Pty Ltd., the Australian branch of Kraken, due to their failure to comply with necessary regulatory standards when providing financial services.

Summary: On August 23, 2024, the Australian Federal Court found that Bit Trade Pty Ltd had breached Section 994B of the Corporations Act by providing margin extension products to retail clients without first identifying their appropriate market segment. This “target market determination” is a necessary legal step before financial products can be sold to consumers. The Australian Securities and Investments Commission (ASIC) brought charges against Bit Trade to ensure adherence to these regulations.

From October 2021, Kraken’s margin extension service has been accessible on their platform, despite not adhering to specific regulatory requirements. However, the court understood the intricacies involved in applying existing regulations to novel cryptocurrency technologies. Nonetheless, they decided in favor of ASIC (Australian Securities and Investments Commission).

Kraken voiced their displeasure over the court’s verdict, yet pledged to adhere to its mandate. Additionally, they emphasized that the decision underscored Australia’s murky regulatory guidelines for cryptocurrency goods. On the other hand, ASIC has signaled its intention to impose financial penalties on Bit Trade.

Source: CoinDesk

6. SEC Alleges Securities Fraud Against Solana’s Top Decentralized Exchange

Overview: The prominent decentralized trading platform, Mango Markets, is under scrutiny by the United States Securities and Exchange Commission (SEC), as they accuse it of violating securities regulations.

Overview: Mango Markets, once a leading decentralized exchange on the Solana platform, is gearing up for a resolution with the Securities and Exchange Commission (SEC) due to several infractions of securities regulations.

The plan put forth by Mango DAO, who oversee Mango Markets, proposes imposing fines and removing MNGO tokens. This resolution might bring unpredictability to Mango Markets’ future, as MNGO tokens play a vital role in their day-to-day activities.

According to the Securities and Exchange Commission (SEC), Mango DAO allegedly offered unregistered investment contracts, and Mango Labs potentially functioned without a required broker’s license.

As a crypto investor, I’ve learned about the ongoing scrutiny by both the Department of Justice and the Commodity Futures Trading Commission into Mango Markets. It’s essential to stay informed and vigilant as we navigate this dynamic market landscape.

Source: CoinDesk

Top of the Latest Cryptocurrency News – Markets

7. Bitcoin Price Rises After a Quiet Week

On Friday, Bitcoin saw a substantial rise in value following a relatively quiet week, primarily due to positive sentiment surrounding the possibility of the Federal Reserve reducing interest rates and other influential market updates.

Initially, the crypto market was rather tranquil; however, things picked up on Friday when Bitcoin’s value significantly increased. This jump in price followed Federal Reserve Chair Jerome Powell suggesting a potential interest rate reduction in September, which instilled confidence among investors. The price of Bitcoin surpassed $64,600, representing a 7% rise over the previous week, before stabilizing around $63,500 as the weekend drew near. This is the highest Bitcoin has been since early August.

Ethereum also saw gains, rising 6% to $2,750 by the end of the week despite ongoing withdrawals from its newly approved exchange-traded funds (ETFs).

Furthermore, Solana’s coin value surged by almost 10%, reaching a price point of $153. Meanwhile, meme tokens like Dogwifhat and Floki, built on the Solana blockchain, witnessed substantial growth, with gains of up to 30%.

Source: Decrypt

8. Stablecoin Market Cap Hits a New All-Time High

Over the past 11 months, the combined worth of non-algorithmic stablecoins has soared to an unprecedented peak of $168 billion.

As a researcher delving into the realm of digital currencies, I’ve noticed an unprecedented surge in the market capitalization of stablecoins, reaching an all-time high of $168 billion. This growth trajectory has been steadfast over the past eleven months, outpacing even the peak of $167 billion achieved in March 2022.

As a researcher, I’ve observed an upward trend in the crypto market, and it seems that this surge could be attributed to fresh capital influx from new investors. The substantial market cap of stablecoins suggests a significant injection of funds into the cryptocurrency sphere.

The new record does not include algorithmic stablecoins, which are maintained by algorithms rather than being backed by assets like cash or gold.

By August 2024, USDT (Tether) had taken the lead in the stablecoin market, with its worth escalating to more than $117 billion – an increase from its initial year value of $91.69 billion. Meanwhile, Circle’s USD Coin (USDC) also expanded, surpassing a market capitalization of over $34 billion in 2024, though it remained below its previous high of $55.8 billion, which was reached in June 2022.

Although the total market value increased, the trading volume of stablecoins decreased by 8.35%, reaching $795 billion in July. This decrease is primarily due to reduced trading on centralized platforms and apprehensions about potential regulatory changes impacting stablecoins within Europe.

Source: Cointelegraph

Top of the Latest Cryptocurrency News – Altcoins

9. Sony Launches Soneium Blockchain Network

In simple terms, Sony, known for inventing the Walkman, has unveiled a blockchain network they’ve named Soneium, which operates using the Ethereum framework.

On the 25th of August, 2024, Sony Block Solutions Labs – a partnership between Sony Group and Singapore’s Startale Labs – unveiled their blockchain venture, which they named Soneium.

On the Ethereum blockchain, Soneium functions as a Layer 2 solution, leveraging Optimism’s OP Stack technology for quicker and more affordable user transactions.

Dreamscape (name assumed) is set to debut in trial phase shortly, targeting Web3 fanatics as its initial audience. Over the following two years, Sony aims to gradually assimilate blockchain technology across multiple sectors of their business, such as Sony Music and Sony Pictures.

The project aims to bring aboard other businesses and decentralized apps (dApps) within the next three years, expanding its reach beyond just Sony-related products.

Sony’s action underscores a widespread development where established firms are investigating blockchain technology. Launching their own network implies an increasing curiosity about how decentralized systems could revolutionize the landscape of future digital services.

Source: CoinDesk

10. Grayscale Launches New Avalanche Trust for AVAX Token Investment

Grayscale Investments recently introduced a fresh financial offering, known as the Grayscale Avalanche Trust. This trust offers investors an opportunity to invest in the AVAX digital token, playing a role in the underlying Avalanche blockchain network.

On August 22, 2024, it was disclosed that Grayscale Investments had unveiled a new product for cryptocurrency investment: the Grayscale Avalanche Trust.

With this fresh trust setup, investors can now channel their funds into the AVAX token, essential for transaction charges and safeguarding the Avalanche blockchain. Notably faster and more scalable than Ethereum, the Avalanche blockchain has garnered recognition for these attributes.

Grayscale, a prominent figure in the world of crypto asset management, currently provides more than 20 distinct investment options. Lately, the company has been broadening its portfolio, particularly in the realm of decentralized artificial intelligence (AI). New funds like the Grayscale Bittensor Trust and the Grayscale Sui Trust have been introduced, with these funds focusing on investing in TAO and SUI tokens.

Under the guidance of its newly appointed CEO, Peter Mintzberg (previously from Goldman Sachs), Grayscale has been spearheading these expansions. The Avalanche Trust, which is an integral part of Grayscale’s broader strategy, aims to offer investors diverse investment opportunities within the rapidly developing crypto market.

At this moment, the AVAX token is approximately valued at $27, as indicated by the information from CoinMarketCap.

Source: CoinDesk

11. Brazil Approves Second Solana ETF

As a dedicated researcher, I’m excited to share that I recently learned about the approval of a second Solana-based exchange-traded fund (ETF) by Brazil’s Securities and Exchange Commission (CVM). This innovative ETF, which I follow closely, is set to be launched through a collaborative effort between Hashdex and BTG Pactual.

The Brazilian Securities Commission (CVM) has given its approval for another exchange-traded fund (ETF) based on Solana (SOL).

As a crypto investor, I’m excited to learn that the new product is being jointly managed by Hashdex, a well-established Brazilian asset management firm boasting more than $962 million in assets under management, and BTG Pactual, a renowned local investment bank. This partnership promises a solid foundation for the growth and success of our investments.

Hashdex boasts a rich history within the Exchange Traded Fund (ETF) sector, having unveiled various cryptocurrency-focused ETFs on Brazil’s B3 stock market. These include ETFs linked to Bitcoin, Ethereum, and the Nasdaq Crypto Index.

Based on a previous decision made by the CVM on August 8, 2024, this approval now stands for the debut Solana ETF in the country, a product that was brought forth by QR Asset, a local asset management company.

Source: CoinDesk

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-08-26 18:51