-

Solana was experiencing a slowdown in network activity which may impact demand for SOL.

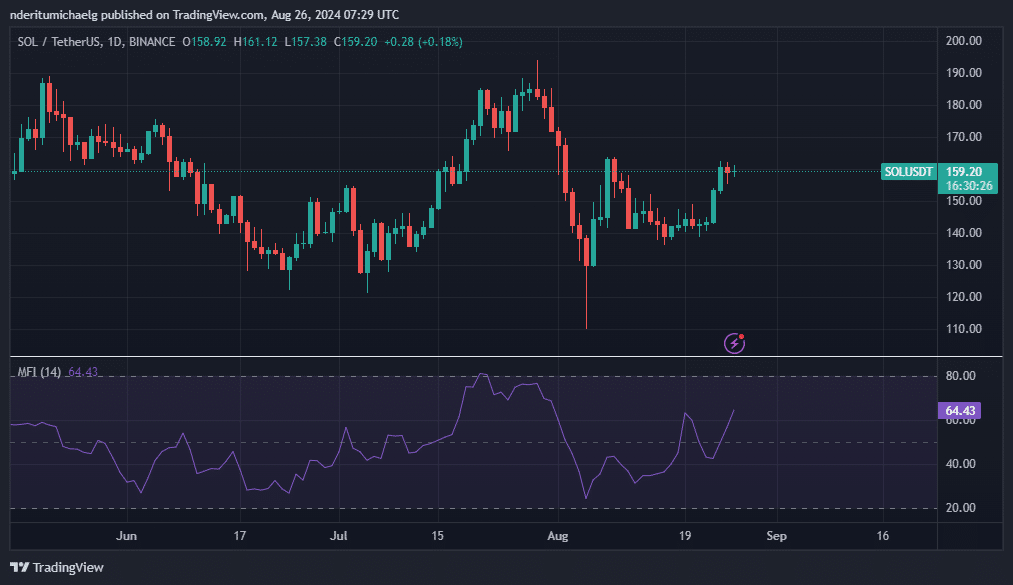

SOL struggles to maintain above $160 after its recent bullish recovery.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself observing Solana [SOL] with growing concern. The recent slowdown in network activity, as evidenced by the 5-month low on-chain revenue, is certainly troubling. It’s been quite some time since we last saw such low figures, reminding me of the chilly March days.

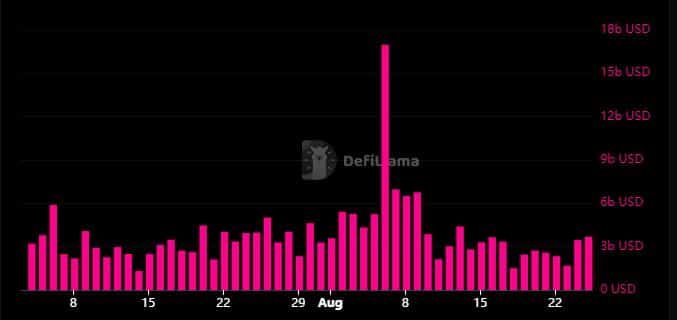

So far in August, Solana’s [SOL] network activity has noticeably decreased, and this reduction is quite apparent when looking at the network’s on-chain earnings, which have seen a substantial decline over the past four weeks.

According to data from DeFiLlama, the Solana network’s daily income has dropped to levels not seen since March, marking a five-month low.

For context, the network generated $234,000 in on-chain revenue in the last 24 hours.

Over the past five months, Solana consistently generated more than half a million dollars in daily income, often exceeding the one million dollar threshold. This frequent achievement underscores the strong demand for the network, a trend we’ve noticed since the beginning of the year.

In spite of the ongoing financial deficits, Solana’s Total Value Locked (TVL) has been steadily rebounding following the dip experienced earlier in the month. This could suggest a renewal of investor trust.

However, the declining revenue reflects the state of the Solana network in terms of utility.

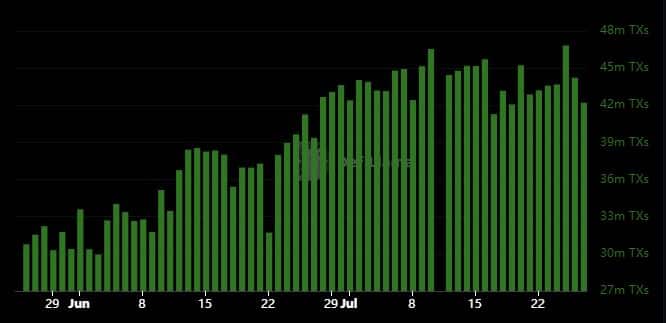

In the past four weeks, activity on the Solana network has noticeably decreased. The average was approximately 42 million transactions per day during the last week of July. Yet, the number of daily transactions fell beneath 40 million in August.

In the course of writing this, the network recorded a total of approximately 32.8 million transactions over the past 24 hours. However, over the past two days, daily transaction numbers have dipped below 35 million. Interestingly, there are indications that the network’s on-chain volumes are showing signs of recovery.

Over the past two days, daily trading volume surpassed $1 billion once more. Prior to this, it had decreased below that amount last week due to a period of market instability and reduced activity.

In simpler terms, this implies that decreased transactions and income might suggest less activity within the network. Such a trend is typically associated with reduced demand for Solana (SOL) within the network as well.

Last week, there was an increase in the need for SOL on trading platforms, primarily fueled by a surge of optimistic anticipation regarding potential interest rate reductions.

Over the weekend, SOL temporarily surged beyond the $160 price mark. At the moment of reporting, it was trading at $159.16, having given bulls a pause in their recent price movement.

Is your portfolio green? Check the Solana Profit Calculator

In simpler terms, it appears that Solana (SOL) has been seeing an influx of money recently, as suggested by its Money Flow Indicator. However, due to the recent decrease in activity on the Solana network, there’s a possibility that any potential rebound for SOL may be constrained.

Periods of heavy utility demonstrated sharp bounce backs in the recent past.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-26 22:15