- The recent price action suggested that the bulls gained control, but strong resistance at $162 could prevent an immediate rally.

- Traders should closely monitor the $162 resistance, as a break above this level could signal a stronger recovery.

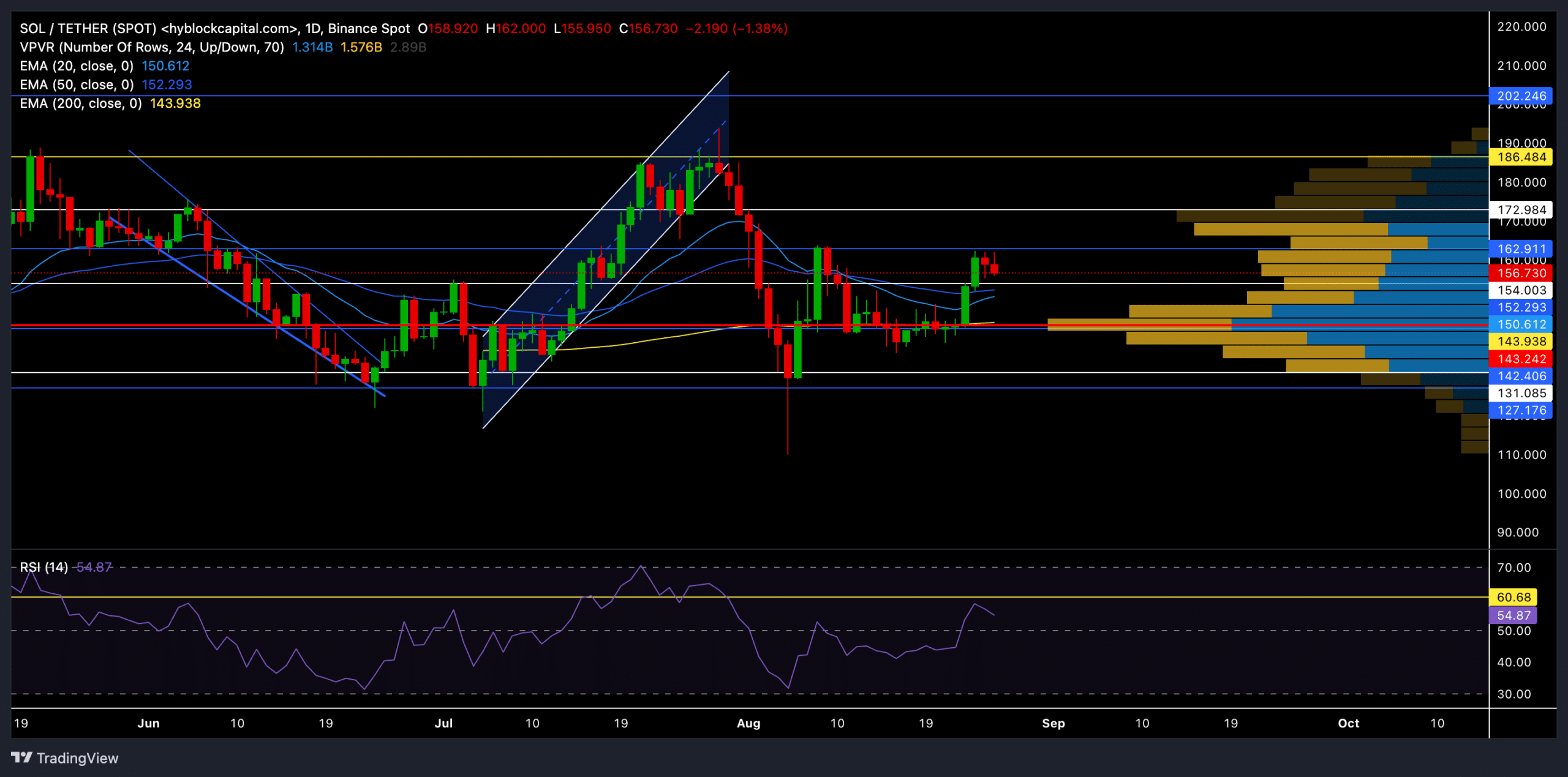

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself intrigued by Solana’s current price action. After witnessing a brief rally that saw SOL surge past critical resistance levels, it seems we are once again at a crossroads. The bulls have reentered the market, but the formidable $162 barrier remains unyielding, leaving us in limbo.

Recently, the price of Solana (SOL) has seen a drop following a breakdown from an upward-sloping trendline (ascending channel) and falling beneath significant support points. The uncertainty lies in whether the bulls will reassert their strength or if we’ll see more price decreases ahead.

Solana bulls re-entered the market

Initially in August’s early days, Solana (SOL) struggled under a bearish trend as it couldn’t maintain its position above the significant $172 mark. At present, it trades at approximately $156.7, experiencing a decrease of about 1.26% over the past day.

Following a dip below the $142.15 support on August 6th, SOL experienced a significant increase of approximately 20% within about three weeks. Yet, this positive trend didn’t last as the price encountered resistance at $162, a level that has proven challenging for bulls to surpass during this month.

Despite a dip, the price has found essential points of resistance and remained above its 20, 50, and 200-day Exponential Moving Averages (EMA) at this moment.

It’s important to mention that when the altcoin hit the $162 resistance, it experienced a mild downward push, and its value has been fluctuating in an area that might witness increased volatility.

Currently, the Relative Strength Index (RSI) has risen above 50, indicating a slightly optimistic trend. But, prospective buyers should keep an eye out for a possible close above the RSI’s resistance level at 60 to better assess the likelihood of a price surge in the near future.

Key levels to watch

Keep an eye on the $150 area (around the 20-day Exponential Moving Average) as a crucial point of support. Should Solana manage to stay above this point, there’s a possibility it could challenge the $172 resistance region within the upcoming period.

If the bears persist with their efforts and the price of SOL drops beneath $150, there’s a possibility it might revisit the significant control level (marked red) on the VPVR indicator around $143.

Over the last 24 hours, the total volume jumped by 13%, reaching a level of $6.73 billion, while open interest grew by 3.15% to reach $2.43 billion. This indicates that traders remain active, yet the overall feeling among them seems to be bearish.

Over the past 24 hours, the balance between long and short positions taken by traders slightly favored the bears, as evidenced by a long-to-short ratio of approximately 0.9249.

Is your portfolio green? Check the Solana Profit Calculator

On Binance, the long/short ratio for SOL/USDT was tilted towards buying at 1.7917, indicating that many traders continued to hold a bullish stance.

It would be wise for buyers to monitor both Bitcoin‘s general mood (sentiment) and broader economic trends, as these factors might influence the price movements of Solana (SOL) over the next few weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-08-27 11:04