- Polymarket gains prominence in predicting U.S. elections despite regulatory scrutiny.

- Vitalik Buterin and Cameron Winklevoss defend Polymarket’s value and integrity against critics.

As a seasoned crypto investor with a keen interest in the intersection of technology and politics, I find Polymarket’s rise to prominence as a predictor for U.S. elections quite intriguing. Having been through several market cycles and witnessing the evolution of blockchain-based platforms, I see the potential in Polymarket, especially given the current administration’s perceived stance on crypto.

In 2021, Polymarket has gained prominence as a key influencer in forecasting the upcoming U.S. presidential crypto candidate, notably in an environment where the preceding administration under President Joe Biden was often seen as unfavorable towards cryptocurrency.

Polymarket election prediction

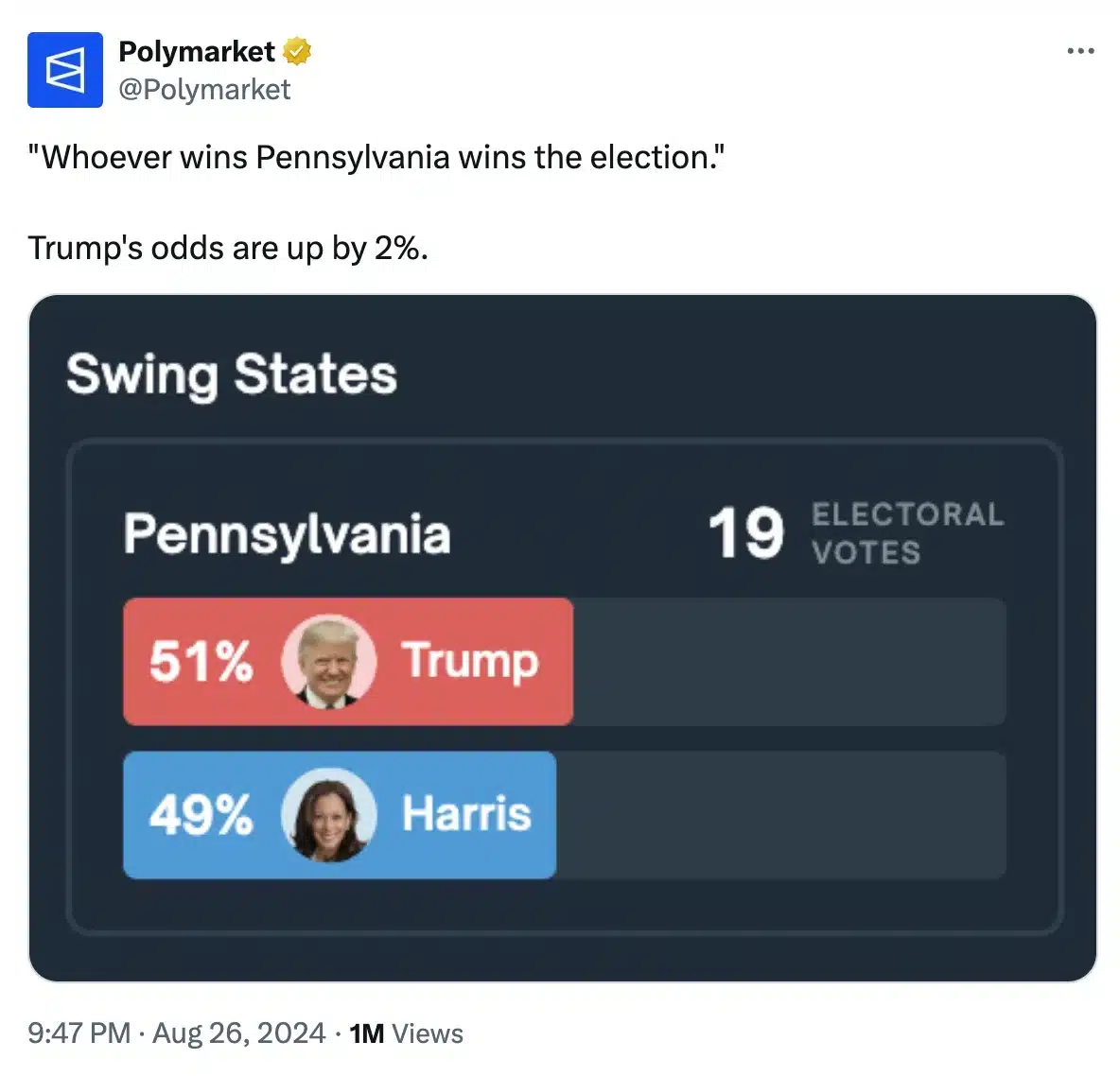

Indeed, the latest data from Polymarket highlights the significance of Pennsylvania in the approaching election, given its considerable number of electoral votes. As such, Pennsylvania could play a pivotal role in shaping the final result of the election.

In their recent update, they pointed out that the contender who clinches Pennsylvania’s votes is most probably going to claim the presidency.

Regardless of these attempts, the platform still encounters criticism from some quarters who view it merely as a gaming service, leading to demands for more stringent oversight.

Vitalik Buterin backs Polymarket

Nonetheless, Ethereum co-founder Vitalik Buterin has voiced his support for Polymarket.

He admitted that the platform played a significant role in supplying useful data for making well-informed decisions, and added,

“Categorizing Polymarket as ‘gambling’ is a significant misconception, as it fails to grasp the essence of prediction markets and the enthusiasm they generate among economists, policy thinkers, and others.”

Further explaining his stance he noted,

“Prediction markets are interesting because they’re a social epistemic tool.”

In simpler terms, the “social epistemic tool” part signifies that prediction markets allow society to determine which events are deemed significant by a large group of people and estimate their probability of happening, collectively.

According to Buterin, unlike conventional media or social platforms that may be influenced by biases and specific agendas, prediction markets offer a more impartial perspective on the probability of various outcomes.

He also talked about “conditional prediction markets” and says,

“In certain situations, predictive markets that operate based on conditions could prove useful for decision-making within government structures. We’re beginning to witness this potential application.”

In summary, he highlighted that forecasting markets provide a more objective, evidence-based viewpoint about upcoming events, which could be valuable for enhancing decision-making processes in government.

On the other hand, it’s important to acknowledge that these prediction markets have faced criticism for their potential drawbacks.

CFTC against Polymarket

For those who might not be aware, back in May, the U.S. Commodities and Futures Trading Commission (CFTC) suggested some fresh rules designed to limit platforms similar to Polymarket, which are known as prediction markets.

According to the Commodity Futures Trading Commission (CFTC), these markets might potentially conflict with the general welfare, particularly when they’re connected to wagers related to elections.

As a researcher expressing my personal viewpoint, I stand in agreement with U.S. Senator Elizabeth Warren, who has passionately advocated for prohibiting prediction markets linked to U.S. elections. My reasoning is rooted in the apprehension that these markets might potentially undermine the democratic process by introducing unwanted disruptions.

Nevertheless, although facing some regulatory hurdles, Polymarket has been receiving substantial backing from the community, particularly during this electoral period.

Buterin not alone

As anticipated, many individuals who disagree with the CFTC’s position have also expressed support for Buterin’s stand on the platform.

Cameron Winklevoss, a co-founder of Gemini, praised decentralized prediction markets as offering “authentic public benefit,” stating that they do so.

Instead of relying on surveys, analyst predictions, or professional views, they demand that individuals show commitment by risking their assets – demonstrating a vested interest. This ‘proof of stake’ principle lends them a credibility that other data providers can’t boast.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- WCT PREDICTION. WCT cryptocurrency

2024-08-27 14:16