-

If XRP falls to $0.575, nearly $18 million of long positions will be liquidated.

The altcoin could soar by 40% to the $0.90 level if it closes a daily candle above the $0.645 level.

As a seasoned analyst with over a decade of experience in the volatile world of cryptocurrencies, I find myself intrigued by the current state of Ripple [XRP]. The market is red, yet whales are accumulating XRP tokens at an impressive rate. This could be a sign of things to come or simply a temporary respite amidst the bearish sentiment.

In simpler terms, the total value of cryptocurrencies has dropped following a significant price increase and the recent news about interest rate reduction.

In the midst of the turbulent cryptocurrency landscape, large Ripple investors (often referred to as ‘whales’) have amassed substantial amounts of XRP tokens over the past day, according to a well-known crypto analyst’s report.

XRP whales on a buying spree

On the platform that used to be known as X (previously Twitter), there’s been a news update stating that large XRP investors, or ‘whales’, have amassed more than 50 million tokens in the past day. This accumulation has resulted in an increase of around $29.5 million in their holdings.

This suggested that whales were taking advantage of the recent price drop.

The buildup occurred after the revelation that a Los Angeles-based film studio, Fruition Production, was planning to produce an XRP documentary.

Major liquidation levels and market sentiment

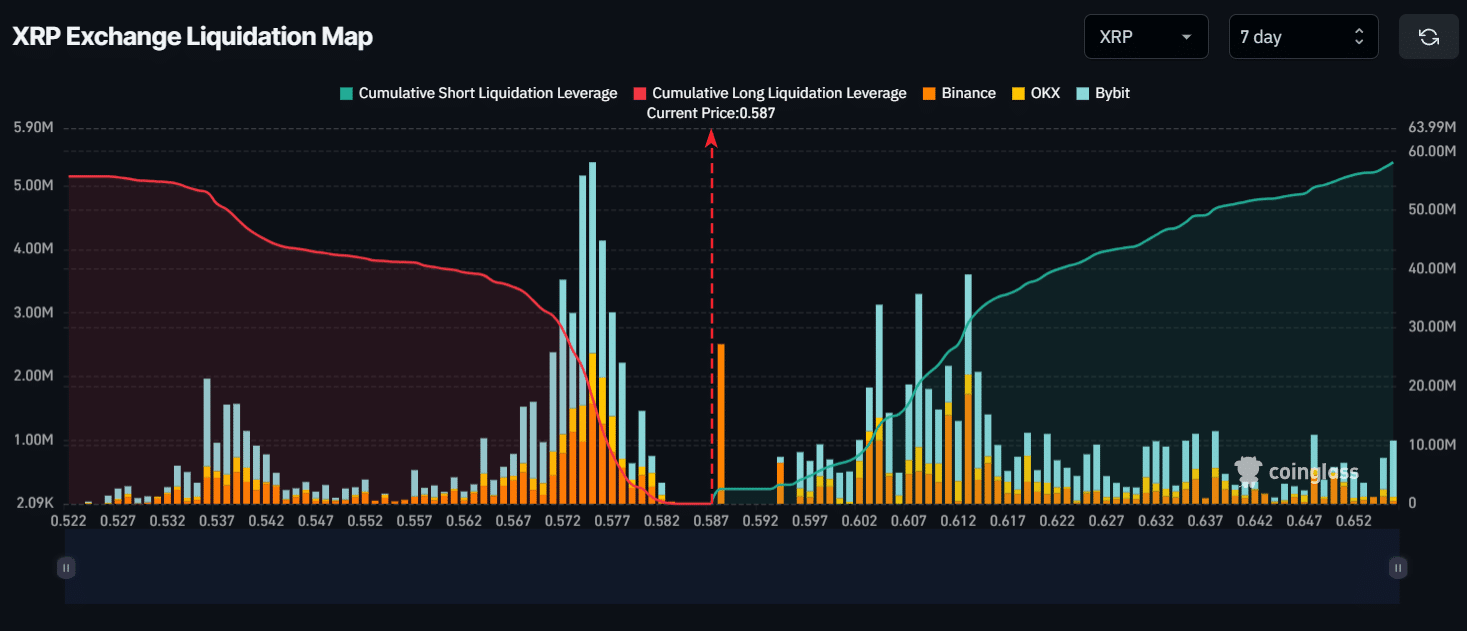

Based on data from the analytics company Coinglass, there has been a higher tendency among investors and traders during the past week to take long positions rather than short ones.

Currently, significant selling points stand around $0.575 (on the downside) and $0.604 (on the upside), as traders have taken on too much debt or borrowed capital at these price ranges.

As a researcher observing the current market trends, I find that the prevailing sentiment seems bearish. If the price of XRP were to drop to $0.575, approximately $18 million worth of long positions might face liquidation due to their inability to maintain the required margin levels.

In other words, should the sentiment reverse and the price climb up to $0.604, approximately $13.3 million in short positions would need to be closed out.

XRP technical analysis

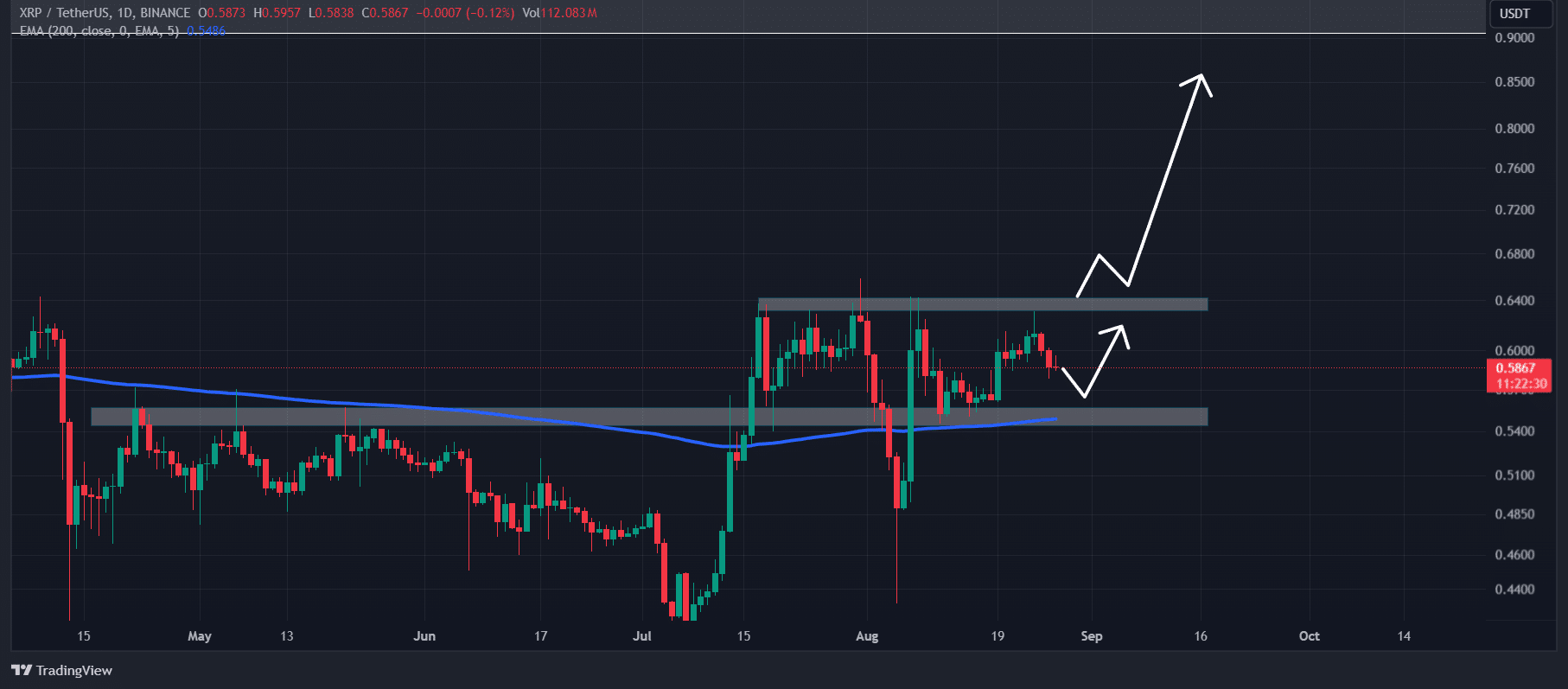

From my perspective as an analyst, based on the technical analysis I’ve been studying, it appears that XRP has been experiencing an upward trend. This is due to the fact that its current trading price lies above the 200 Exponential Moving Average (EMA) when considering a daily time frame.

Moreover, the daily chart of XRP appears optimistic following the development of an inverse head and shoulder pattern in its price movement.

In the near future, it’s likely that the XRP price will drop down to around $0.558. Contrastingly, over a longer period, XRP appears to be on an uptrend.

Should the daily candle finish above the $0.645 mark, it’s likely that we could witness a substantial increase of approximately 40%, potentially reaching the $0.90 level, within the upcoming period.

Price analysis

Currently, XRP is close to $0.586 per token. In the past 24 hours, its value decreased by more than 1.6%, an unexpected dip, even as large investors (whales) have been amassing it.

Read Ripple’s [XRP] Price Prediction 2024–2025

During this timeframe, there’s been a 34% rise in trading activity, indicating that more traders are getting involved as the price declines, suggesting increased participation.

Over the past 24 hours, I’ve observed a 5% decrease in the Open Interest of the altcoin, as reported by Coinglass. This suggests that the current turbulent market may be causing a wane in investor enthusiasm.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-27 16:40