-

BTC’s open interest also dropped by 3% in the last 24 hours, reflecting lower interest or fear among investors.

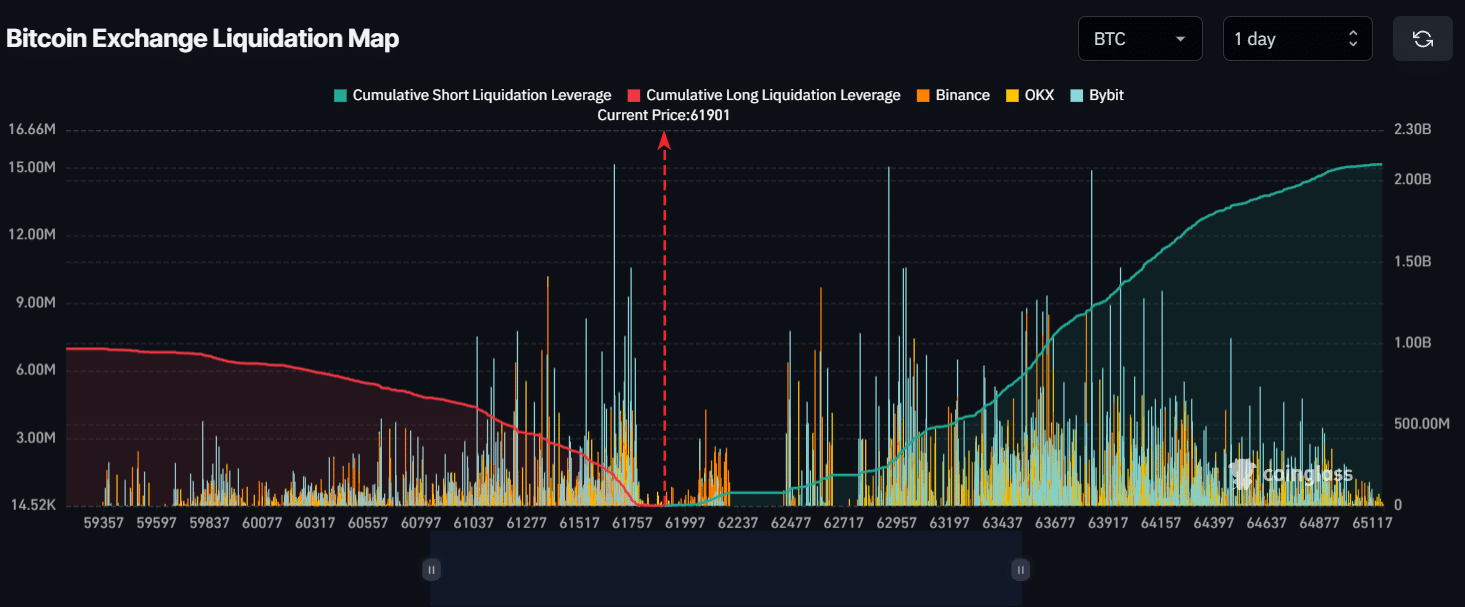

If BTC price falls to $61,670, nearly $192 million of long positions will be liquidated.

As a seasoned researcher who has witnessed the cryptocurrency market’s rollercoaster ride for years, I find myself observing another intriguing chapter unfold. Binance’s recent transfer of 75,177 BTC raises eyebrows, especially amidst the ongoing money laundering controversy in Nigeria. The technical analysis suggests a bearish outlook, with the crucial breakout level at $61,850 being a pivotal point.

On August 27th, it was discovered that Binance, the globe’s leading cryptocurrency trading platform, implemented some internal changes within its operations.

As per the latest report, approximately 30,000 Bitcoins from Binance’s cold storage wallet (containing a total of 75,177 Bitcoins) were moved to their hot wallet. The remaining 45,177 Bitcoins were transferred to a different wallet address labeled as “3PXB”.

Binance transfers 75,177 BTC

At the moment, Binance hasn’t provided an explanation for the significant Bitcoin transfer they recently processed. This transaction took place after the recent update regarding the money laundering allegations against Binance and its executives in Nigeria.

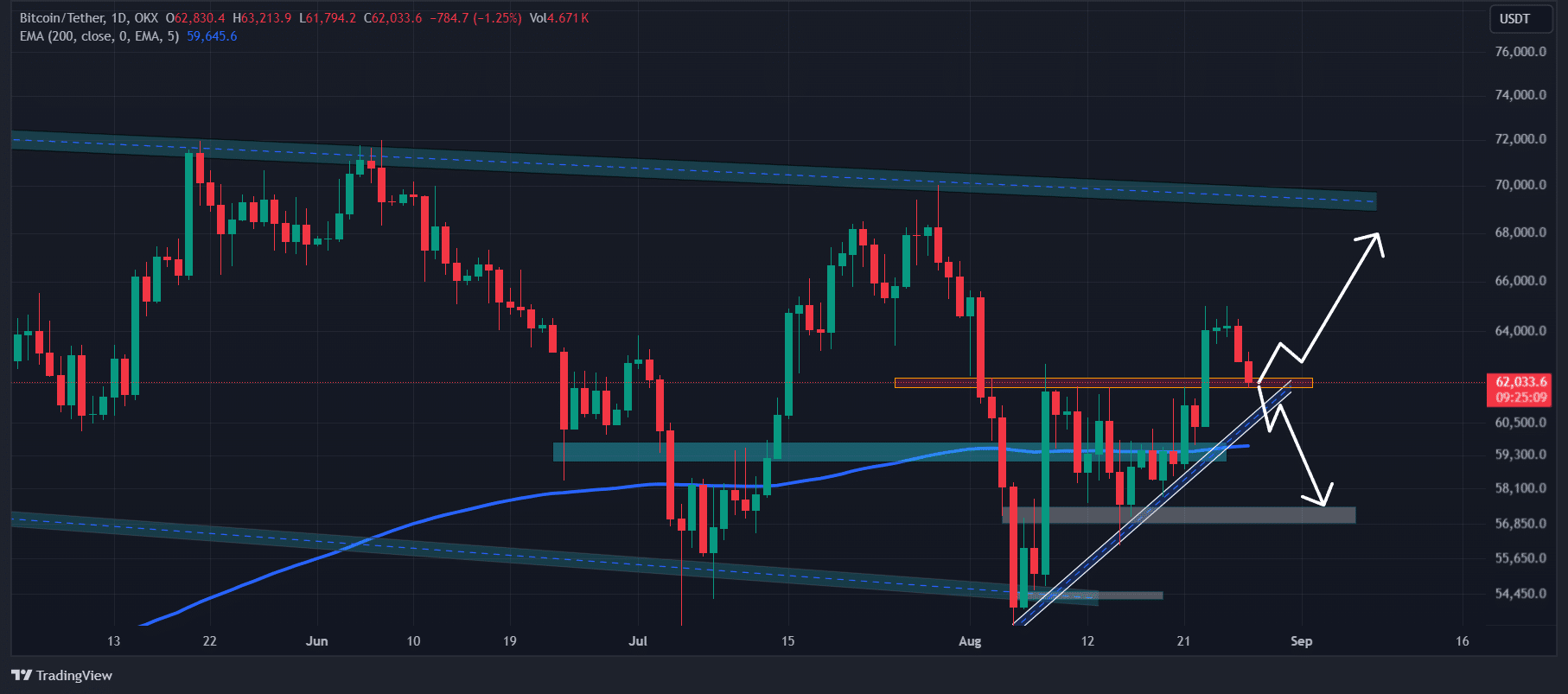

As a researcher delving into the intricacies of Bitcoin, I’ve noticed some substantial transactions that, according to technical analysis expertise, point towards a bearish forecast for BTC. Interestingly, at present, Bitcoin seems to be climbing as it consistently hovers above the 200 Exponential Moving Average (EMA) on a daily timeframe, suggesting an uptrend.

In addition to its current upward trajectory, the price has reached an important turning point at approximately $61,850, having previously surpassed this level after the interest rate reduction announcement.

As a researcher analyzing Bitcoin’s price dynamics, I’ve noticed that we’re currently at a pivotal point based on past price movements and trends. Should BTC exhibit a reversal from this critical price level, there’s a strong likelihood of a substantial rally propelling the price towards approximately $68,000 in the near future.

Conversely, if BTC continues to fall, we may see a major crash in the coming days.

As I write this analysis, Bitcoin (BTC) is hovering around the $61,900 mark, experiencing a dip of approximately 2.6% over the past 24 hours. Interestingly, despite the price drop, trading volume has surged by 33%, suggesting heightened interest from traders in this period of market fluctuation.

Moreover, there was a 3% decrease in Bitcoin’s open interest over the past day, indicating a decline in investor engagement or apprehension related to the continuing price fall.

Major liquidation levels

As a crypto investor, I’m keeping a close eye on the market right now, with crucial liquidation points situated around $61,670 and $63,900. These levels seem to be over-leveraged based on data from the analytic firm CoinGlass, which suggests that traders might need to offload their positions if the price reaches these thresholds.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Should the outlook continue to be negative and the price drops to around $61,670, approximately $192 million worth of long contracts may need to be sold off.

If the sentiment changes and the price increases to reach around $63,900, approximately $271 million in short positions will need to be closed out.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-08-28 13:11