- Bitcoin has historically been bearish for the most part in September, but this time could be different.

- NASDAQ embracing Bitcoin and improving global liquidity conditions could favor a bullish outcome in September.

As a seasoned researcher with years of experience studying the volatile world of cryptocurrencies, I can confidently say that September has traditionally been a challenging month for Bitcoin. However, this year might just be an exception.

If Bitcoin (BTC) fails to surge beyond its current weekly high within the next three days, it is likely to end August with a decline compared to its initial monthly price.

This means the burden of delivering positive monthly gains will push forward into September.

Given its historical performance, it might be surprising to anticipate a bullish trend for Bitcoin in September. Typically, this month has been quite bearish for the digital currency.

The king coin delivered a bearish performance in eight out of 11 Septembers since 2013.

Is it possible that Bitcoin could exhibit a bearish trend in September as it did last year, or might there be an unexpectedly bullish twist this time around? Some crucial elements hint at the potential for BTC to display exceptionally bullish behavior in the upcoming months.

New findings show that worldwide liquidity levels are rebounding and currently reaching record heights. So far, Bitcoin hasn’t significantly benefited from this increased liquidity, but the overall uptrend in liquidity is good news for the market.

An increase in worldwide liquidity, combined with anticipated interest rate decreases in September, may offer the push Bitcoin requires to generate favorable gains throughout the month.

According to an assessment by CryptosRus, circumstances such as interest rate decreases, expanding liquidity, the halving event, and the U.S. elections seem to mirror Bitcoin’s behavior in 2016 and 2020. In both cases, Bitcoin experienced a strong surge.

Bitcoin is breaking into mainstream markets

The availability of Bitcoin has reached unprecedented heights, notably due to the introduction of ETFs this year. It’s possible that this increased access may soon extend to the stock market, given the recent NASDAQ filing.

They plan to introduce Bitcoin options trading, potentially increasing investor enthusiasm even more.

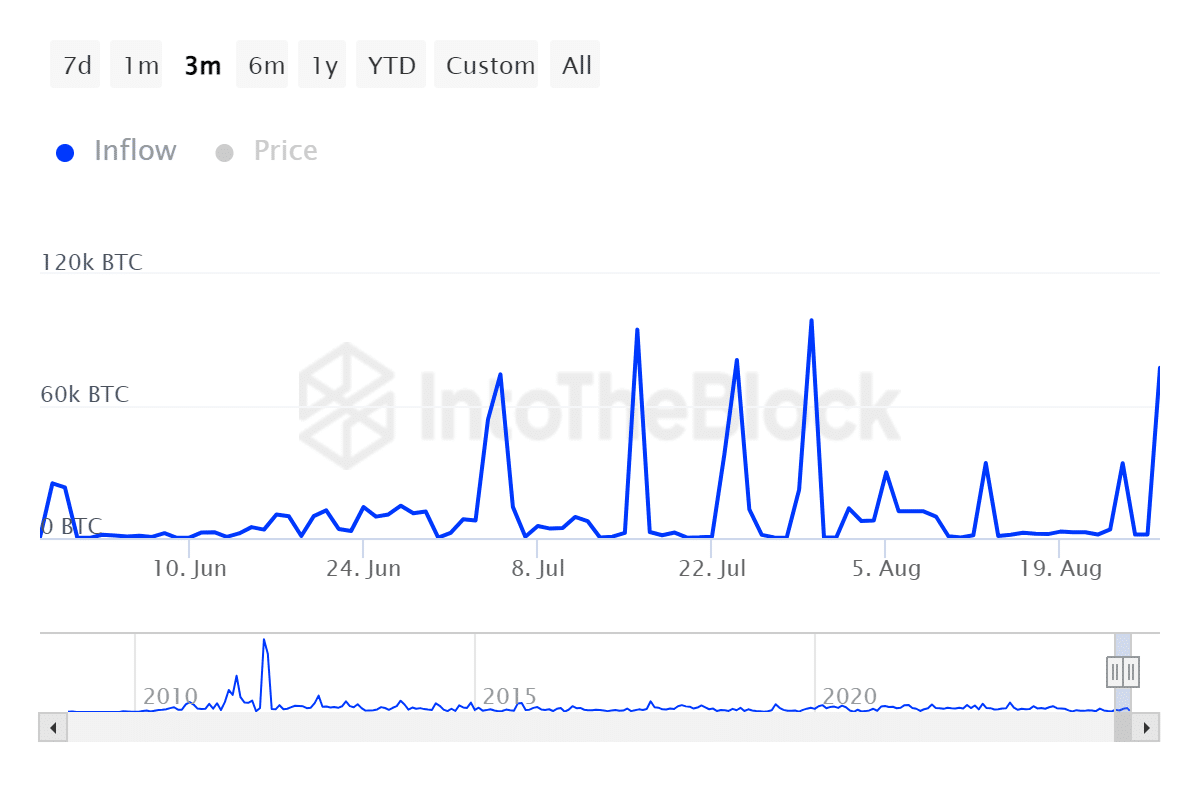

As a crypto investor myself, I’m gearing up for potential price surges in September. In fact, within the past day, large-scale inflows have soared to the fourth highest we’ve seen over the last three months.

During that timeframe, there were inflows totaling 77,400 Bitcoin, while outflows amounted to just 11,240 Bitcoin over the same period.

After Bitcoin dropped below $60,000 yet again, many had hoped it would rise to $70,000. However, despite this setback, investor enthusiasm persisted, as indicated by the aggressive buying activity observed at reduced price levels.

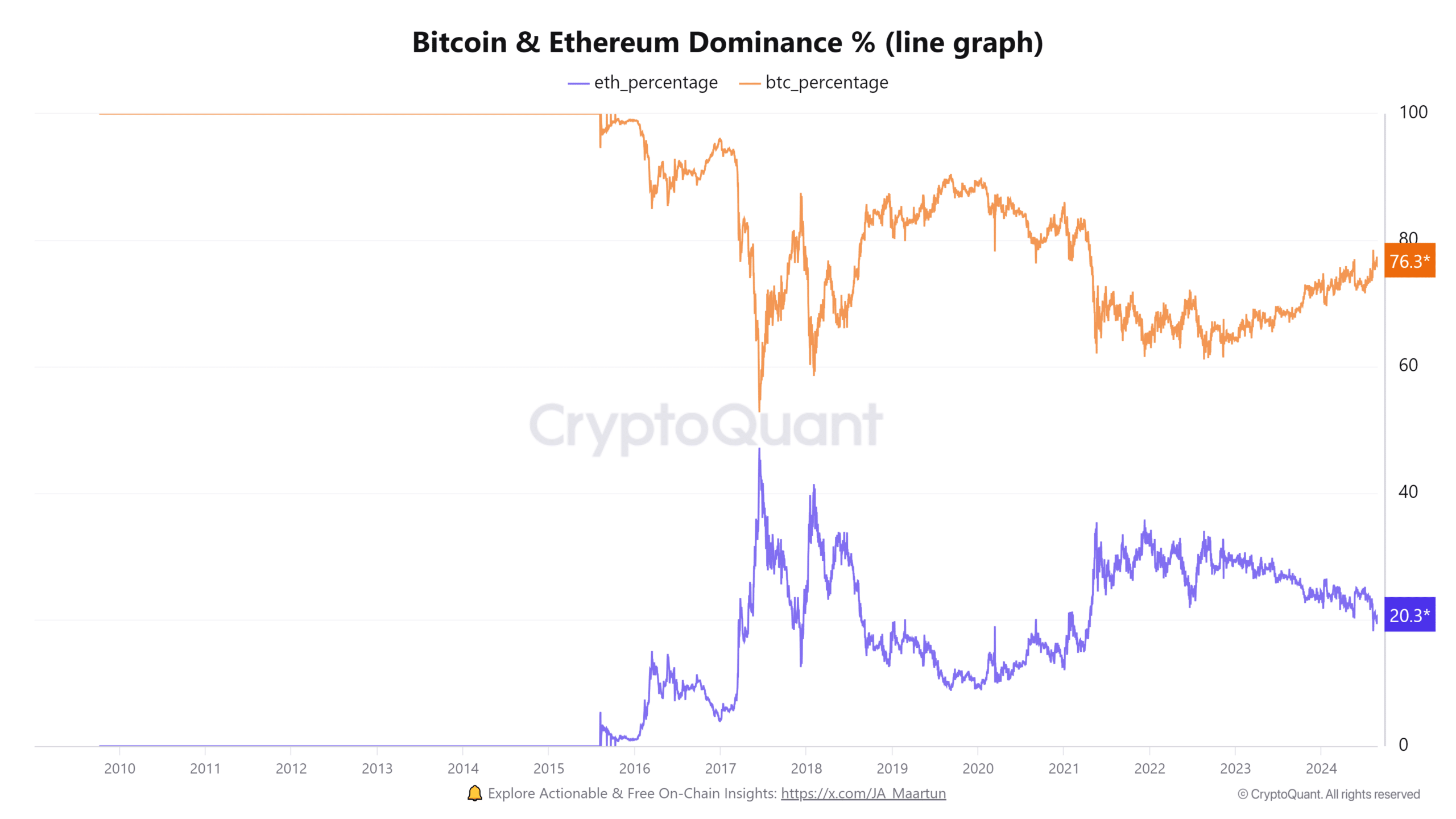

Bitcoin continues to hold a substantial lead over Ethereum [ETH] and other alternative cryptocurrencies, indicating that it’s well-placed to capitalize on the majority of the funds entering the digital currency market.

Thus, Bitcoin still commanded most mainstream attention despite the presence of many altcoins.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In conclusion, Bitcoin is set for a potentially bullish September if interest rates come down.

As a researcher, I am optimistic that advancements in global liquidity and increased acceptance within traditional markets could potentially boost Bitcoin’s performance before this year comes to an end.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2024-08-29 05:12