-

STX surged by 17.88% in the last seven days as an analyst eyed $2.78.

Stacks’ anticipated Nakamoto upgrade drove STX’s trading volume by 136.23%.

As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent surge of Stacks (STX). While the broader market has been grappling with volatility, STX seems to be bucking the trend, much like a well-timed sleight of hand in a high-stakes poker game.

Over the past day, there’s been a lot of ups and downs in the crypto market. The price of Bitcoin [BTC] dipped from around $60,000 to about $58,000. Even major alternative coins haven’t done great, with higher-than-usual sell-offs occurring over the last 24 hours.

Despite the broader market trending downwards, STX has remarkably maintained its upward momentum, recording steady price increases over the last three weeks.

Currently, the price of STX stands at $1.74. In the last hour, this represents a 1.15% increase, while over the past day, it has risen by 1.62%.

Before now, the price of STX altcoin had been on a significant upward trend. Over the past week, its value has risen by approximately 17.88%.

Although it has made some progress, STX is currently falling short of its previous month’s peak at $2.04 and remains a significant 55.61% lower than the all-time high it reached five months back.

Consequently, this recent increase suggests some uncertainty about the factors influencing STX‘s ongoing market situation.

What’s driving STX’s surge?

One significant influencer shaping STX‘s present market scenario is the much-awaited Nakamoto update, which, as per Stacks’s official announcement on their former platform (Twitter), is slated for August 28th.

In simpler terms, the confirmation time for transactions and block creation in Stacks currently takes about 10 minutes when it comes to Bitcoin. However, with the Nakamoto update, we’re expecting the process to be significantly faster, down to just 5 seconds.

Additionally, the ecosystem will benefit from improved scalability, reduced transaction costs, and quicker transaction confirmations. Consequently, this update will enhance the efficiency, speed, and security of the Stacks ecosystem, all of which are crucial factors for traders.

Market sentiment

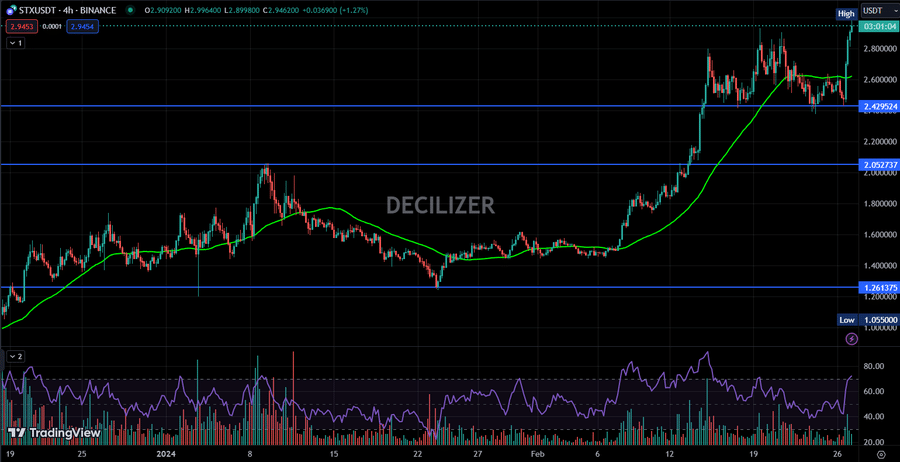

With the impending Nakamoto update, there’s growing optimism within the Stacks community about the potential success of STX. In fact, crypto expert Decilizer has forecasted a possible all-time high for STX if the current market trends persist.

In his analysis, he posited that the altcoin will likely reach the $2.78 target, noting,

” After establishing support at $1.46, It is all set to cross our next target of $2.78.”

Based on current projections, STX is anticipated to see an impressive increase of approximately 59.77%. This prediction is backed by its remarkable 570% growth during the last bull market.

What price charts suggest

While Decilzer’s analysis appears optimistic about the future, it’s crucial to explore other key performance indicators as well.

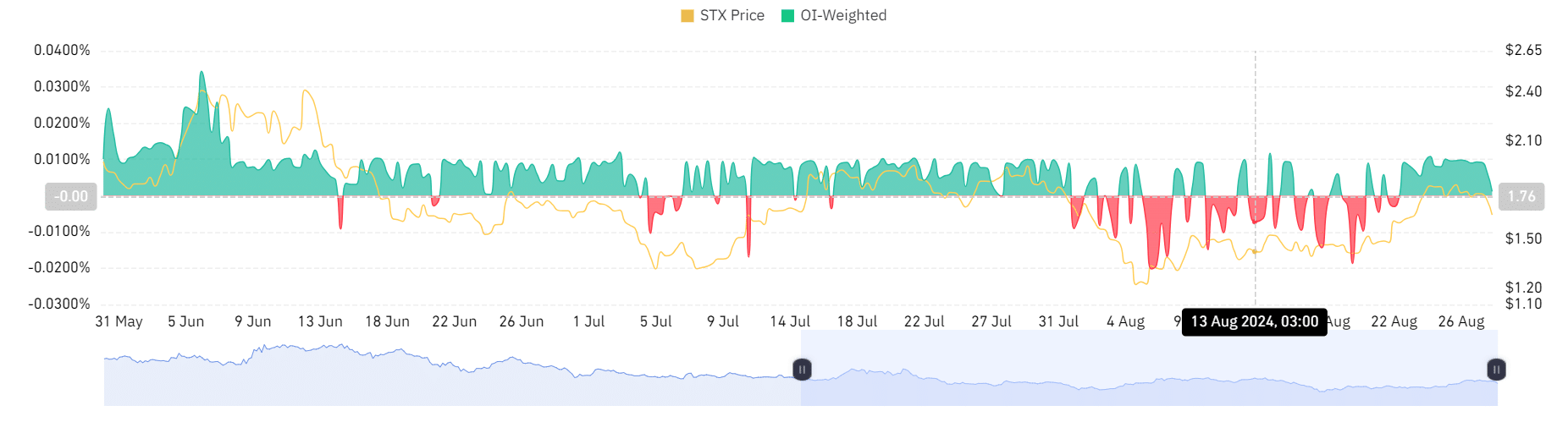

To begin with, the OI-Weighted Funding Rate by STX has stayed above zero for the last seven days. This indicates a greater interest in long positions, as numerous investors are placing wagers that altcoin prices will increase rather than decrease for those taking short positions.

This is a bullish market sentiment, which reinforces investor confidence.

As a researcher, I’ve found that the funding rate, compiled by the exchange over the last week, has been favorable according to my analysis in conjunction with data from AMBCrypto.

This added evidence to the preference for holding long positions, implying that most market participants were hopeful regarding the potential increase in STX‘s price.

Read Stacks’ [STX] Price Prediction 2024–2025

Consequently, given its robust uptrend signaled by the DMI’s positive index exceeding the negative one, Stock X (STX) looks poised for additional growth.

Under the present market circumstances, if STX manages to surpass the $2.0 barrier, it could potentially move forward to test the $2.5 resistance level.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Daredevil: Born Again Spoiler – Is Foggy Nelson Alive? Fan Theory Explodes!

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- BERA PREDICTION. BERA cryptocurrency

- Final Destinations Bloodlines – TRAILER

- Sabrina Carpenter, Bad Bunny, Pedro Pascal Star in Hilarious Domingo Remix

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-08-29 08:08