-

Monero’s focus on privacy — a double-edged sword — has been its greatest strength and deterrent to price appreciation

XMR has shown resilience in the spot market despite recent delisting from major exchanges

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of projects rise and fall based on their unique propositions and market circumstances. Monero (XMR), with its strong focus on privacy, has always been an intriguing project for me.

On Tuesday, many cryptocurrency prices experienced a dip late in the day, with Bitcoin (BTC) falling below $59,000 and leading the way. Ethereum (ETH), however, saw more significant drops, sliding under $2,500 by the end of the trading day. The market maintained a downtrend 24 hours later as most cryptocurrencies struggled to regain their footing following an unexpected sell-off.

On Wednesday, Toncoin (TON) saw a slight increase in value compared to its price on August 27th. Yet, it continued to be relatively calm after the significant drop caused by the news about the arrest of Telegram’s founder – Pavel Durov.

Apart from Toncoin, the tech founder’s arrest has drawn attention to privacy-centric cryptocurrency initiatives, notably Monero (XMR), which prioritize both anonymity and security.

Can Monero (XMR) benefit from the social buzz?

As a dedicated crypto investor, I’ve noticed that Monero has experienced numerous network updates aimed at boosting efficiency and reinforcing privacy. Despite these significant advancements, I find myself still waiting for the anticipated price surge these milestones promised.

Over the past period, the price movement of XMR has remained fairly flat, and there’s been little exchange activity – An indication that investor enthusiasm might be diminishing.

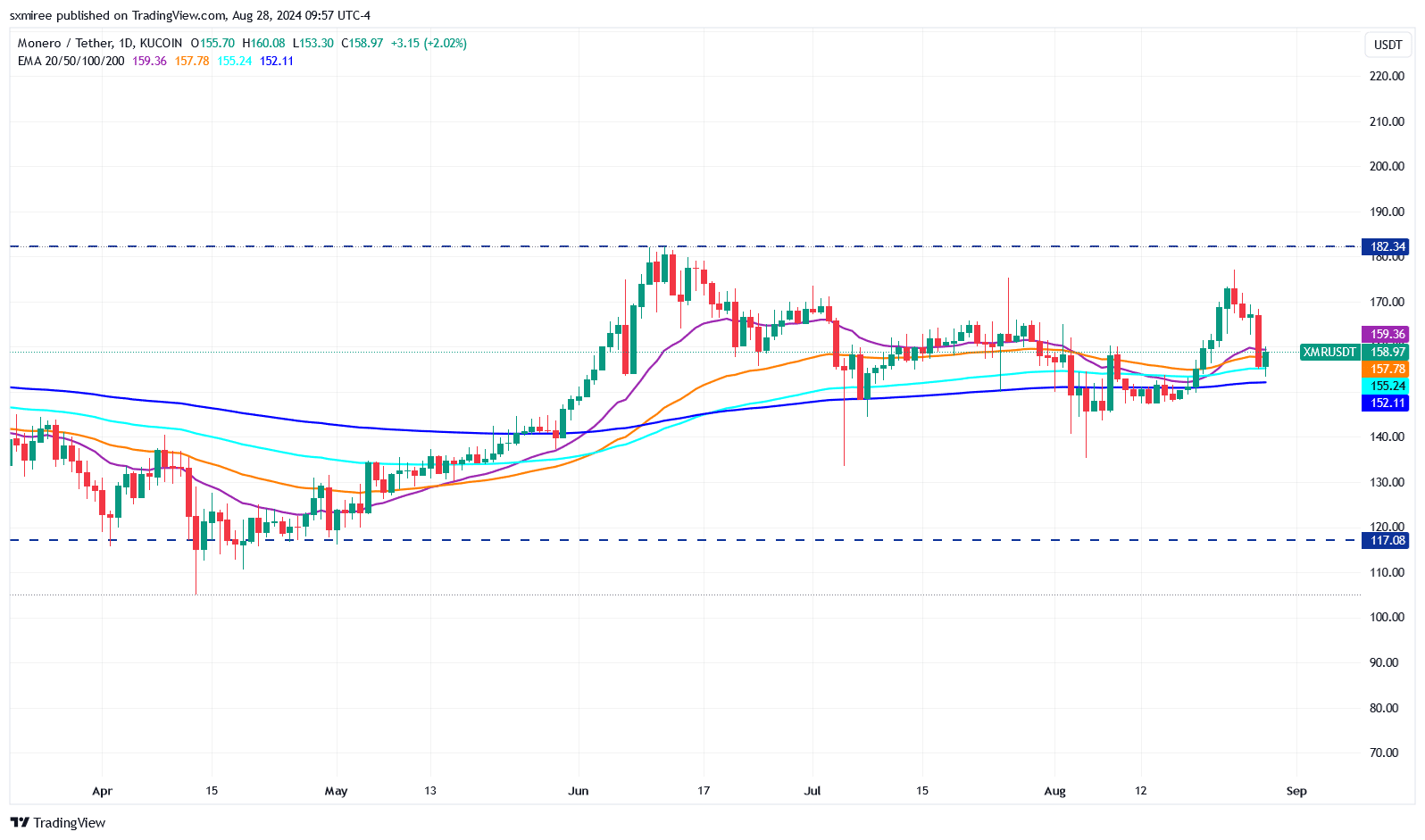

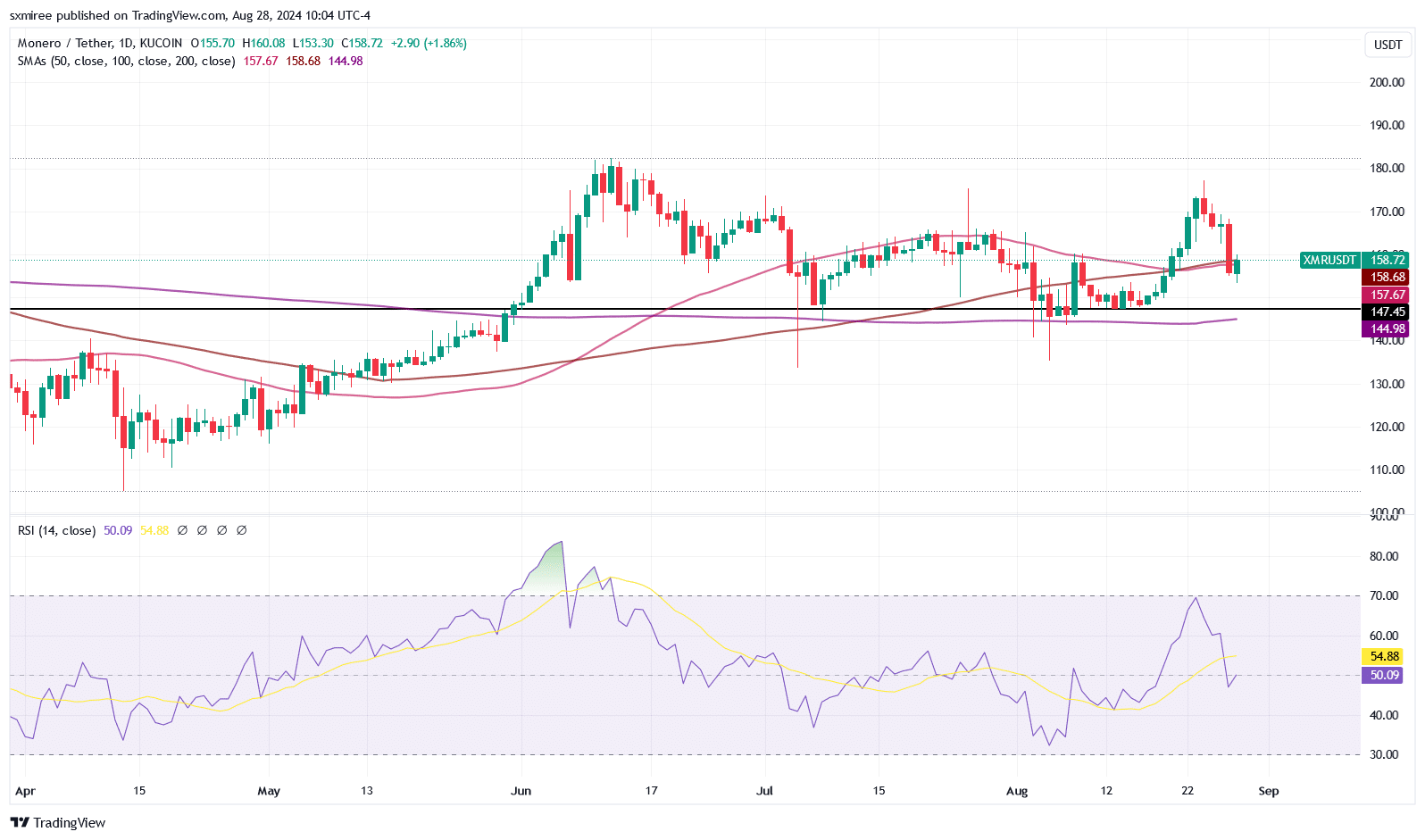

Over the past four months, Moreno’s (XMR) price has remained relatively stable, fluctuating between approximately $117 and $182. Despite broader market surges within the sector, XMR hasn’t seen a significant breakout. This trend can be verified by observing the consistent linear movement of the 200-day simple and exponential moving averages for XMR/USDT during this period.

At the point of this writing, Monero (XMR) was maintaining positions slightly above its 20-day, 50-day, and 100-day Exponential Moving Averages (EMA), indicating a robust stance within its current pricing zone.

If Monero (XMR) falls below its 50-day and 100-day Simple Moving Averages (SMAs) on the daily chart, this pair could potentially dip towards approximately $147 in the short term.

Hurdles outside the market

Even though XMR offers a distinct advantage, it has encountered numerous hurdles in the marketplace, finding it difficult to increase its worth and earn widespread recognition.

Initially, Monero’s privacy functions that conceal transaction information have been a point of interest for regulatory bodies globally. Consequently, trading platforms like Bittrex and ShapeShift have taken XMR off their listings due to concerns about anti-money laundering (AML) regulations and customer identification (KYC).

Starting from February, Binance declared they would remove Monero (XMR) from their listings, a decision that’s been executed this month. Similarly, Kraken announced in June that they would cease trading XMR in Ireland and Belgium. These actions have reduced the accessibility and trading volume of XMR on significant platforms, potentially hindering its price increase.

The usefulness of Monero has sometimes posed a challenge for wider acceptance due to its link with illegal activities, damaging its standing and making it less attractive to institutional investors and everyday users who prefer more transparent transactions.

Is Monero (XMR) still worth exploring?

Although a renewed emphasis on privacy might spark curiosity about Monero (XMR), there are still challenges ahead when it comes to maneuvering through regulatory environments, boosting user adoption, and reshaping public opinion about the cryptocurrency.

Despite facing the challenges of delistings this year, Monero (XMR) has shown remarkable resilience in its recovery. Its steadfast determination and forthcoming ecosystem advancements may well position it for lasting triumph in the long term.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-29 09:12