-

BTC may be mirroring its 2020 price trend, Is a post-COVID pump scenario on the cards?

QCP Capital analysts projected that the recent BTC dip could be short-lived

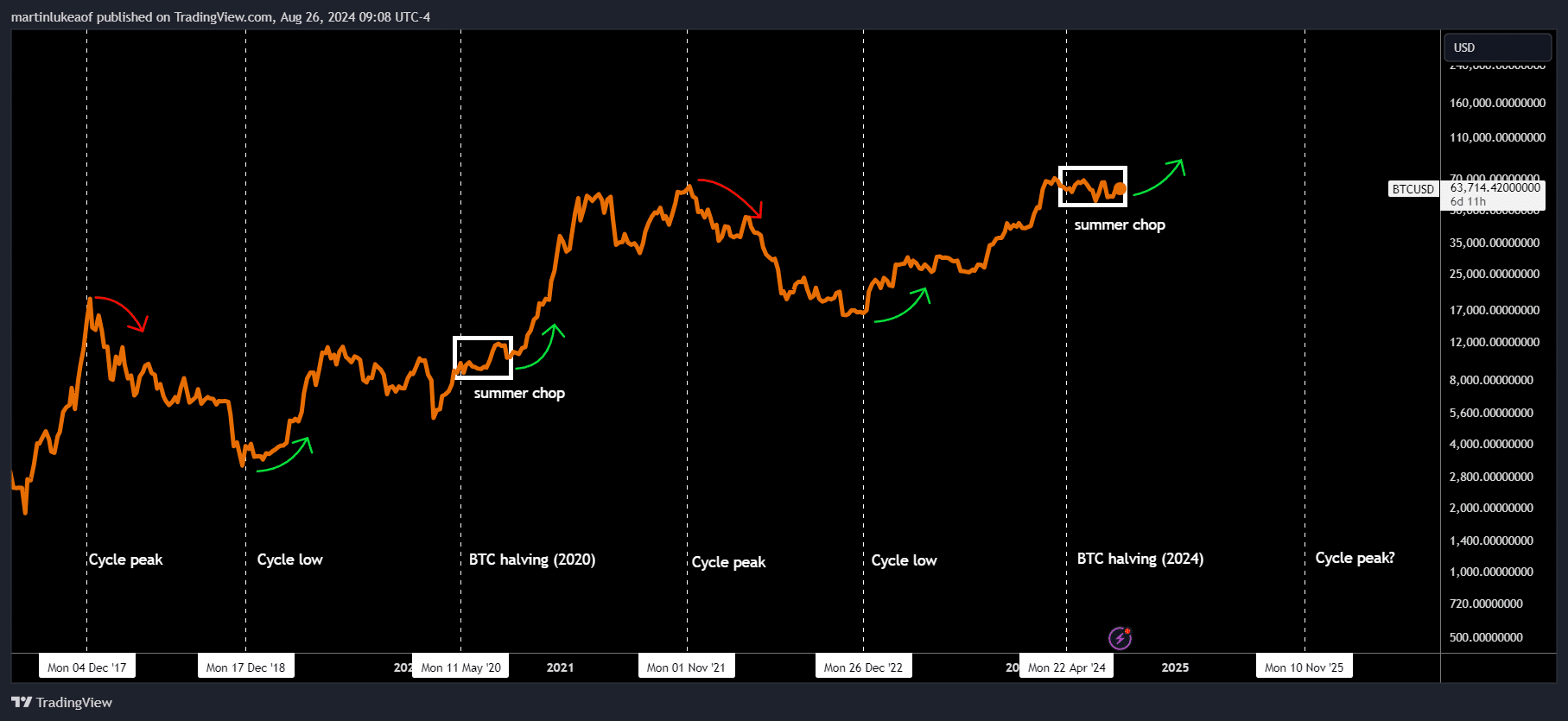

As a seasoned crypto investor with a keen eye for market patterns and cycles, I find the recent parallels between 2020 and now quite intriguing. The way BTC is consolidating around $50k-$70k reminds me of its $7k-$10k range in mid-2019 to early 2020, a period that preceded a significant rally. If history rhymes as they say, we might be on the cusp of another post-halving pump, potentially leading to BTC prices surging beyond $200k by 2025.

Over the past six months, Bitcoin (BTC) has fluctuated between roughly $50,000 and $70,000 after reaching a high of around $73,000 in March, according to James Seyffart, an analyst at Bloomberg ETF. Interestingly, this current price behavior seems to resemble its pattern from 2020.

“Currently, Bitcoin ranges between $50,000 and $70,000, which is somewhat similar to its trading price between $7,000 and $10,000 from the middle of 2019 up until mid-2020.”

Following a surge past the $7,000 – $10,000 price point in 2020, Bitcoin ended the year just shy of $30,000, representing a triple increase in value. By 2021, Bitcoin reached an all-time high of $69,000, more than doubling its worth compared to its closing value at the end of the previous year.

2020 and 2024 aren’t just alike in terms of pricing trends; they both feature Bitcoin halving events, historically linked to significant market surges.

Is a parabolic rally likely for BTC?

Although historical performance doesn’t dictate future outcomes, history always rhymes. Most market cycle analysts still maintain that BTC’s post-halving rally is still on the cards.

Luke Martin, one of the analysts, presented an analysis comparable to Seyffart’s and forecasted a potential price surge following the turbulent market conditions during the summer.

Absolutely! The market situation now seems quite reminiscent of summer 2020. After the halving, we’ve seen some turbulence, followed by a period of consolidation during an upward trend. The lowest point in this cycle was roughly 1.5 years back.

Similar post-halving projections have been made too, the latest being a price target of $200k per BTC by 2025.

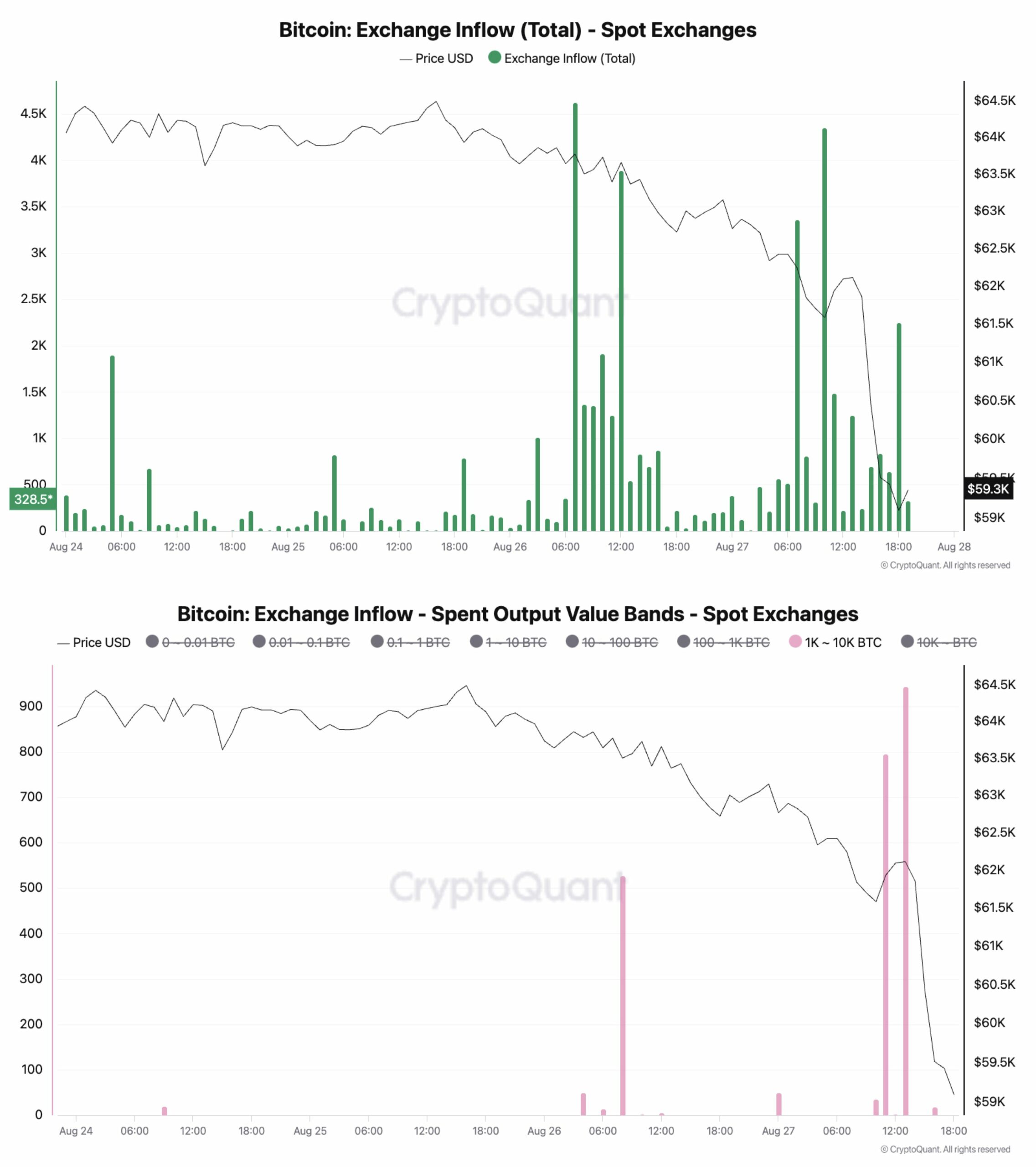

Over the last few days, Bitcoin has seen significant volatility, climbing over $64k before dropping back down to around $60k, causing uncertainty among investors and experts due to its inconsistency, even with positive indications from the Federal Reserve about potential interest rate reductions.

According to Julio Moreno, who leads research at CryptoQuant, a significant sell-off of Bitcoin from large wallets into centralized exchanges was likely the cause behind the mid-week price drop.

“Spot exchanges saw a rise in Bitcoin deposits prior to today’s drop in price, as indicated by the first chart.”

Instead, QCP Capital analysts predict that despite the current downward pressure, a positive trend may quickly resume once it subsides, leading to another upward movement.

We’re optimistic that any downturn in stocks (and cryptocurrencies) will be temporary. Given that Jerome Powell and the Federal Reserve are prepared to initiate a period of interest rate reductions, an influx of liquidity should ultimately drive up the value of riskier assets.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-08-29 13:12