- High-yield credit rates turn bullish after breakout.

- Bitcoin price action sitting on crucial support.

As a seasoned analyst with over two decades of experience under my belt, I’ve seen markets ebb and flow like the tides. The recent developments in high-yield credit rates and Bitcoin are particularly intriguing.

Discussions about Bitcoin (BTC) have been central lately, especially following its dip on August 28th.

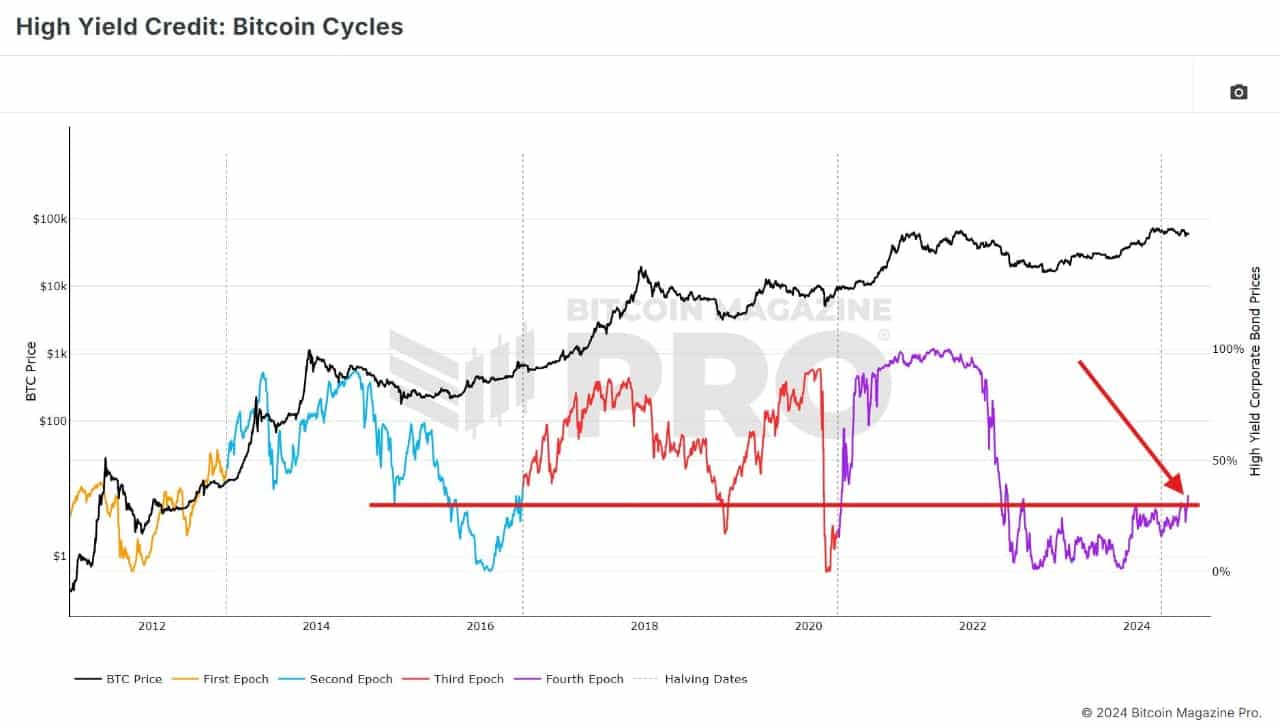

Investigating the interest rates on high-earning credits shows a strong surge above the previous low points, suggesting growing confidence among investors regarding the global economy’s future performance.

The change in attitude is leading to an increasing preference for investments with higher risk, such as Bitcoin. This pattern could boost Bitcoin’s value, possibly causing it to rise even more.

Keeping an eye on changes in high-yield credit rates is crucial since they can have a considerable influence on market trends. Understanding how these shifts affect Bitcoin and other assets is vital for informed decision-making.

Given that Bitcoin is now at a critical 4-hour support level, it’s worth considering if the current surge in optimism will lead to Bitcoin regaining its recent losses.

Critical support holding

On a 4-hour scale, the Bitcoin price, when compared to the U.S. Dollar (BTC/USDT), is at present holding steady between approximately $59,000 and $60,000. This suggests a period of stability or consolidation in its current price range.

For nine straight 4-hour periods, Bitcoin hasn’t dipped below its crucial support line, fueling theories that it might be accumulating sufficient trading volume within this price band. Yet, the weekly chart gives cause for concern.

Keeping a close eye on Bitcoin’s behavior in September is crucial due to the rising optimism and the possibility of interest rate reductions. The movements in September might serve as a guide for Bitcoin’s trajectory during the following months.

Bitcoin RSI approaches extremely oversold levels

Additionally, the Relative Strength Index (RSI) of Bitcoin is approaching exceptionally low points. Although a quick recovery might not happen straight away, it’s worth noting that in the past, these RSI levels frequently signaled upcoming substantial price changes.

As the indicator gets near the changeover point, a growing sense of optimism among investors might assist Bitcoin in recovering from its recent declines and possibly target the $70,000 price mark.

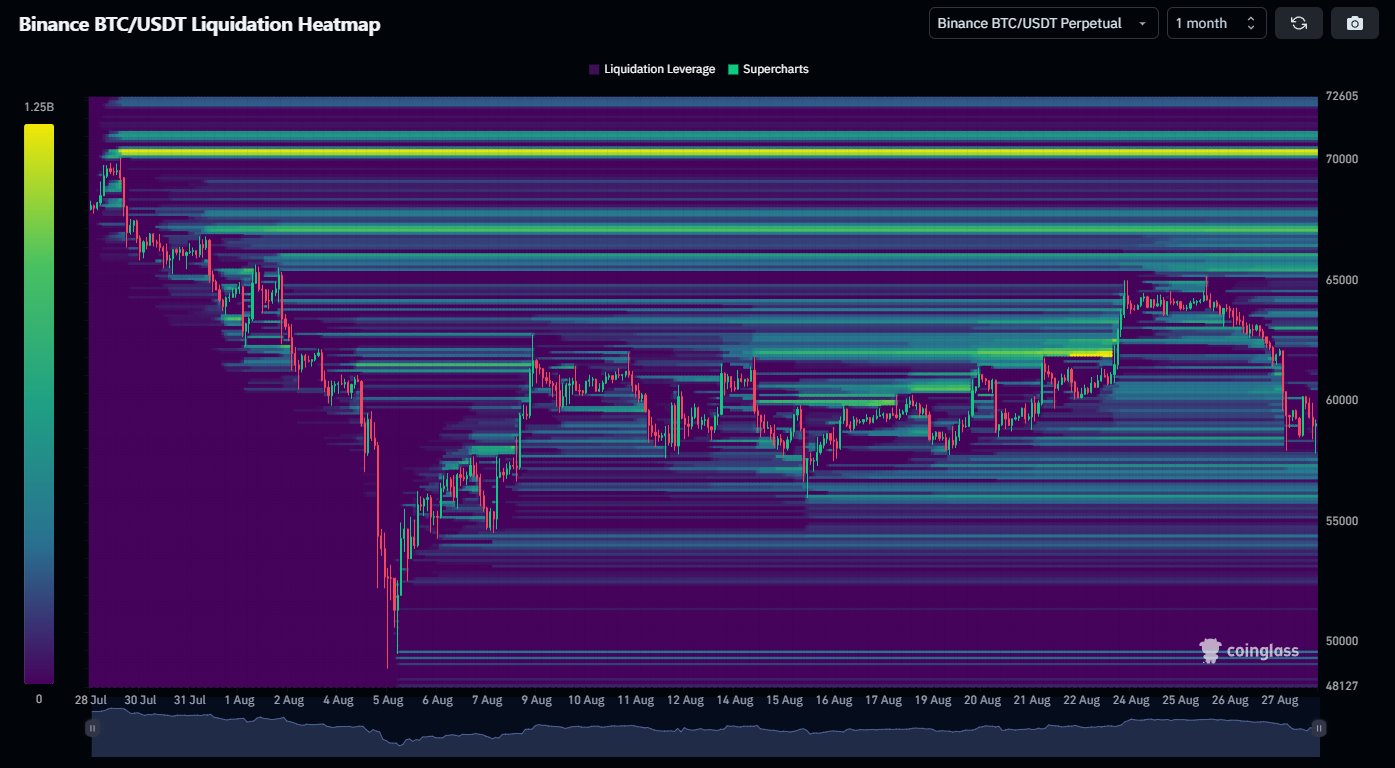

Liquidity analysis

Bitcoin’s liquidity assessment indicates a significant influx of liquidity under the $60,000 threshold, causing temporary price drops as low as $58,000.

Yet, a substantial price range or resistance area is found around the $70K mark. If Bitcoin doesn’t fall below its present support, it’s likely to return to this higher price range.

If Bitcoin’s price gets close to this value (within a few percentage points), there’s a growing possibility that significant liquidity could be withdrawn from the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, Bitcoin is hanging around the lower part of its current price range, which means it’s important to stay alert. The fluctuation in Bitcoin’s price, driven by increasing investor optimism, might lead to a rebound from recent declines, provided that crucial support levels remain intact.

It’s clear that Bitcoin might rise further, but keeping a close eye on crucial signs and market trends is essential before making any moves.

Read More

2024-08-29 17:12