-

Evaluating the possibility of an extended Bitcoin downside as fear continues to grip the market.

Bitcoin’s exchange flows suggest that there is strong demand every time BTC drops below $50k.

As a seasoned crypto investor with a decade of experience under my belt, I must admit that the current market conditions have me on edge. The fear that is gripping the Bitcoin market is palpable, and it’s hard not to feel a bit uneasy when looking at the charts.

The confidence of Bitcoin [BTC] investors, particularly those in the retail sector, seems to be waning, leading to a potential phase where sellers may panic and offload their holdings, which could result in a bearish trend.

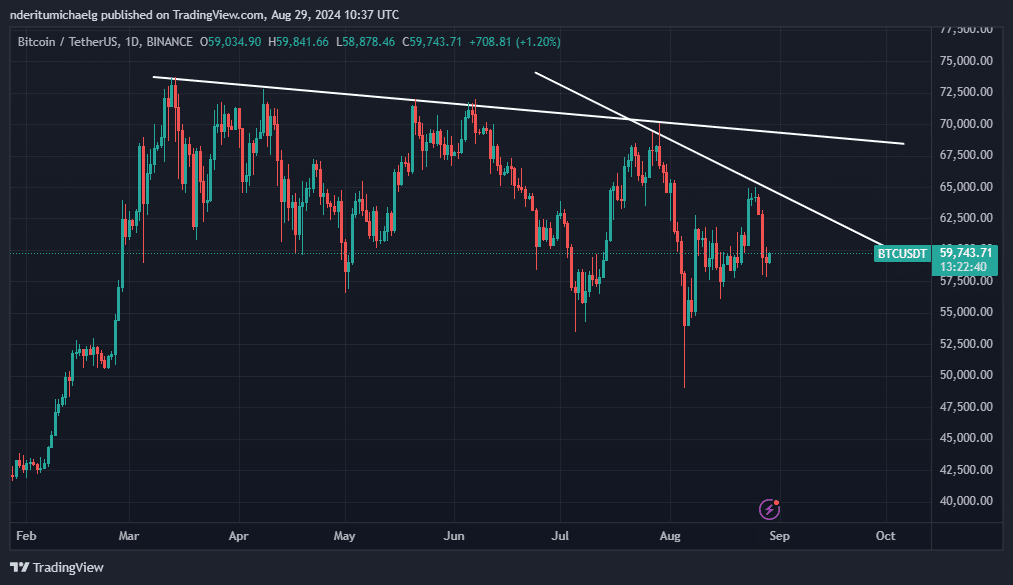

The latest positive surge has resulted in a lower peak, continuing a trend that’s been noticeable in Bitcoin since it reached its highest point in March.

Each time Bitcoin has made a positive push since its record high in March, the peaks have been progressively lower, suggesting decreasing strength in upward movement.

This significantly impacts the decline in faith that Bitcoin can reach unprecedented heights.

Recently, efforts to surpass $60,000 triggered increased selling activity, causing the market mood to worsen even more. As a result, the Bitcoin Fear and Greed Index dropped from 39 a week earlier to 29 as we speak, indicating growing fear among investors.

As worries about the worldwide economy grew more intense, so did the sense of fear. This fear had the potential to disrupt the entire global investment market.

In situations like these, investors often become cautious about taking risks. This could lead to a decrease in the flow of funds towards high-risk assets such as Bitcoin due to sell-offs.

Bitcoin indicators flash different signals

Conversely, the decline of Bitcoin in 2022 was mainly driven by the evaporation of liquidity due to governments increasing interest rates. However, recent indications lean towards the possibility that interest rate reductions could lead to a positive, or bullish, trend.

On-chain data also supported these expectations.

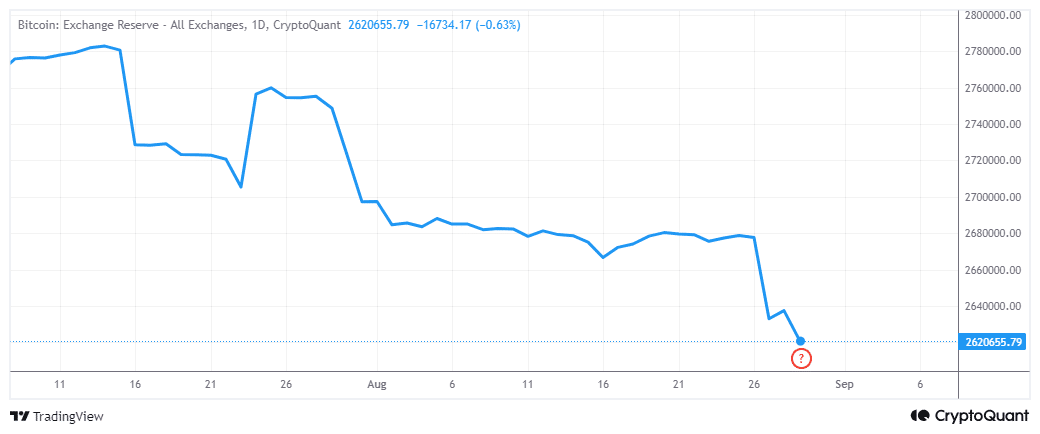

Despite the recent downturn in the Bitcoin market, reserves at exchanges have persistently decreased. This suggests that there remains strong long-term interest, implying that the current market trends are mostly influenced by short-term fluctuations rather than a decline in overall demand.

In an otherwise anxious market, it was quite unexpected for exchange reserves to decrease. This hinted that Bitcoin holders might be transferring their BTC from exchanges to personal wallets, a practice often referred to as “HODLing.”

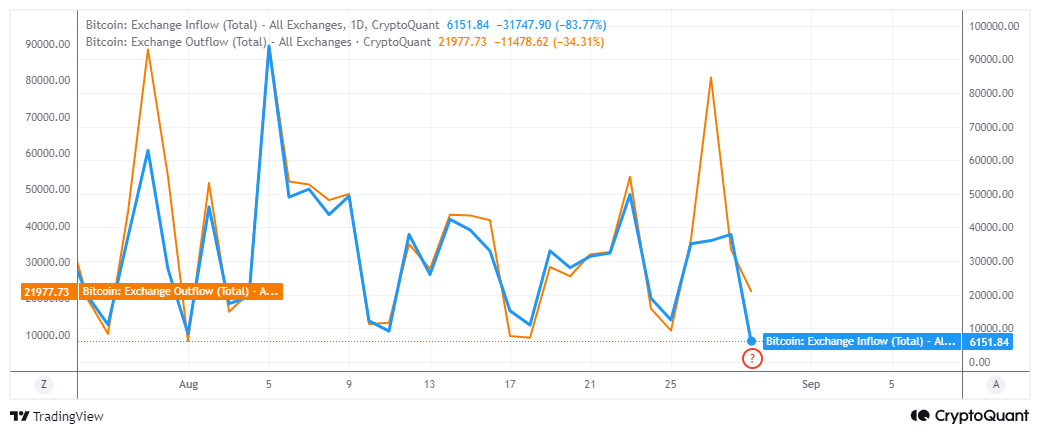

Let’s discuss the recent trend in exchange data. It appears that outgoing data, or outflows, have significantly surpassed incoming data, or inflows.

On August 27th, there was a significant increase in Bitcoin exchanges, with outgoing Bitcoin reaching a high of 80,740 units. Conversely, during the same trading period, incoming Bitcoins peaked at 36,071 units.

In the past 24 hours, the pattern of Bitcoin movement remained consistent. Outflow from exchanges amounted to approximately 21,977 Bitcoins, which is significantly more than the 6151 Bitcoins flowing into exchanges as inflow.

This signaled a strong demand for Bitcoin every time it dips below $60,000.

The prevailing demand does not negate the fact that Bitcoin has been hitting lower highs.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a crypto investor, I can’t help but acknowledge the potential danger lurking ahead as we approach the $50,000 price range and potentially even dip below it. This risk looms large, particularly if a powerful selling wave – or ‘capitulation event’ – triggers massive influxes into exchange reserves.

Instead, let me put it this way: Meanwhile, the available data indicates that there’s still an impact from a disruption in supply, which might lead to increased prices in the future.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Solana – Long or short? Here’s the position SOL traders are taking

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

2024-08-30 01:44