- The market sentiment soured, and liquidity pockets attracted prices lower.

- Bitcoin and Ethereum faced rejections at their respective resistance zones.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I have seen market fluctuations like this before – it’s a rollercoaster ride that never fails to surprise me! The recent drop in the total crypto market cap from $2.216 trillion to $2.041 trillion was quite a shock, especially considering how quickly it happened.

On the 26th of August, the overall value of all cryptocurrencies decreased from approximately $2.216 trillion to around $2.041 trillion within the next day. This represented a decrease of about $215.87 billion, which equates to a market-wide drop of nearly 9.7%.

Certain tokens were affected more than others.

Over the past 24 hours, I’ve observed a promising rebound in the market prices. Specifically, Bitcoin [BTC] and Ethereum [ETH] have experienced gains of 3.84% and 6.82% respectively. However, my analysis suggests that the overall crypto market has been on a downtrend since the 26th. I’m currently investigating potential factors that could be contributing to this trend.

Market participant behavior

The Tether dominance chart measures Tether’s market capitalization as a share of the total crypto market cap. The chart above showed USDT.D rose by 10.91% from Monday, running into a resistance zone at 5.9%.

Since then, it has declined. The Tether dominance and crypto price movements are inversely related.

When the value of USDT.D increases, it suggests that more investors and market participants are trading their cryptocurrencies for Tether, indicating a decrease in confidence and an increase in selling pressure.

In the last few hours, there’s been a significant decrease in this issue, and as a result, we’ve observed a rebound in prices for most prominent altcoins and Bitcoin as well.

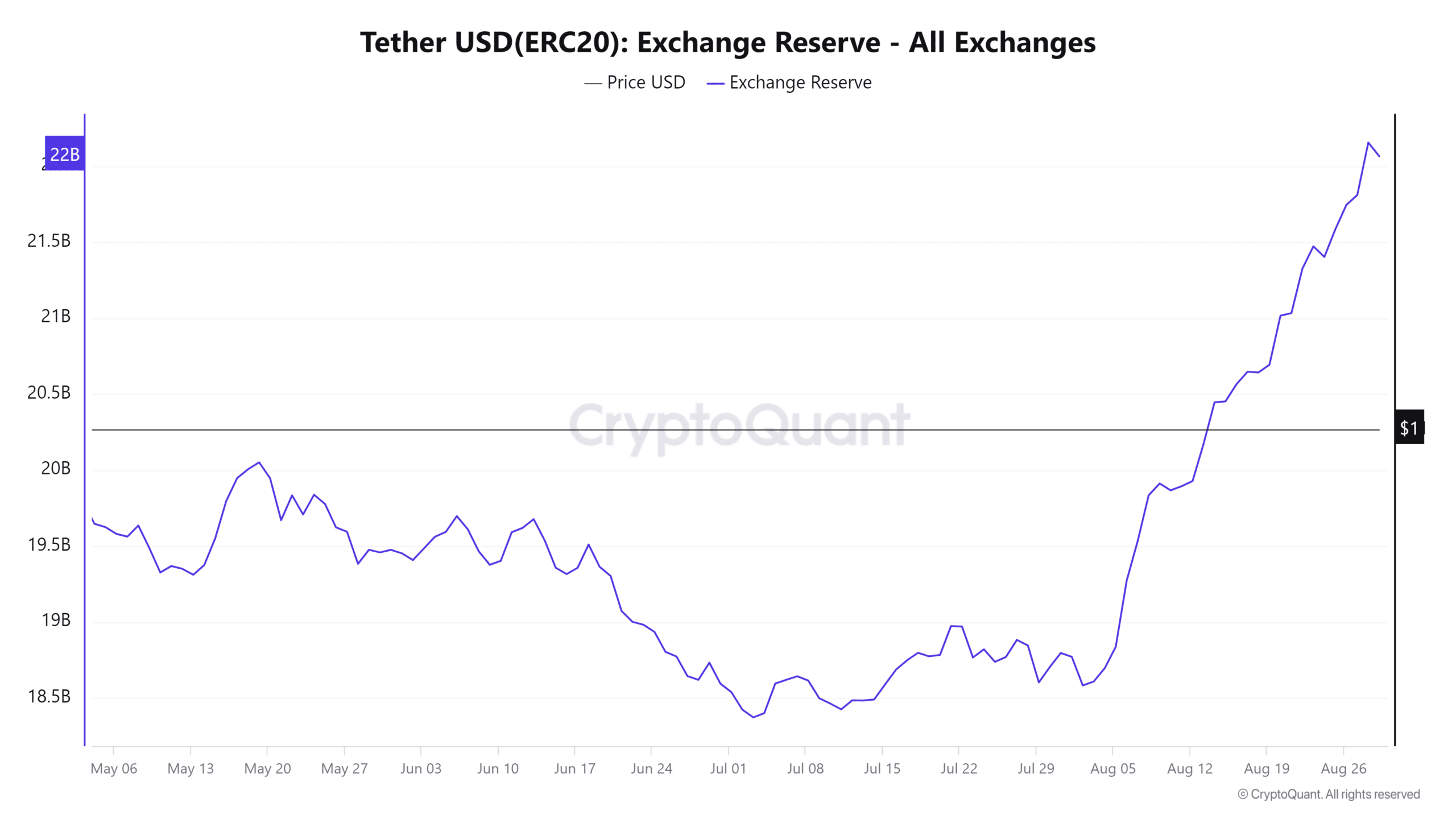

Since early August, the reserve on the Tether exchange has been consistently increasing. This suggests a growing purchasing strength within the market.

Nevertheless, it’s challenging to predict exactly when the cryptocurrency market prices will surge, yet the data suggests potential growth opportunities ahead.

Liquidity explains why crypto is down

1. The movement of investors toward stablecoins can serve as an indicator of market feelings. Alternatively, you can predict future price trends by studying liquidation graphs.

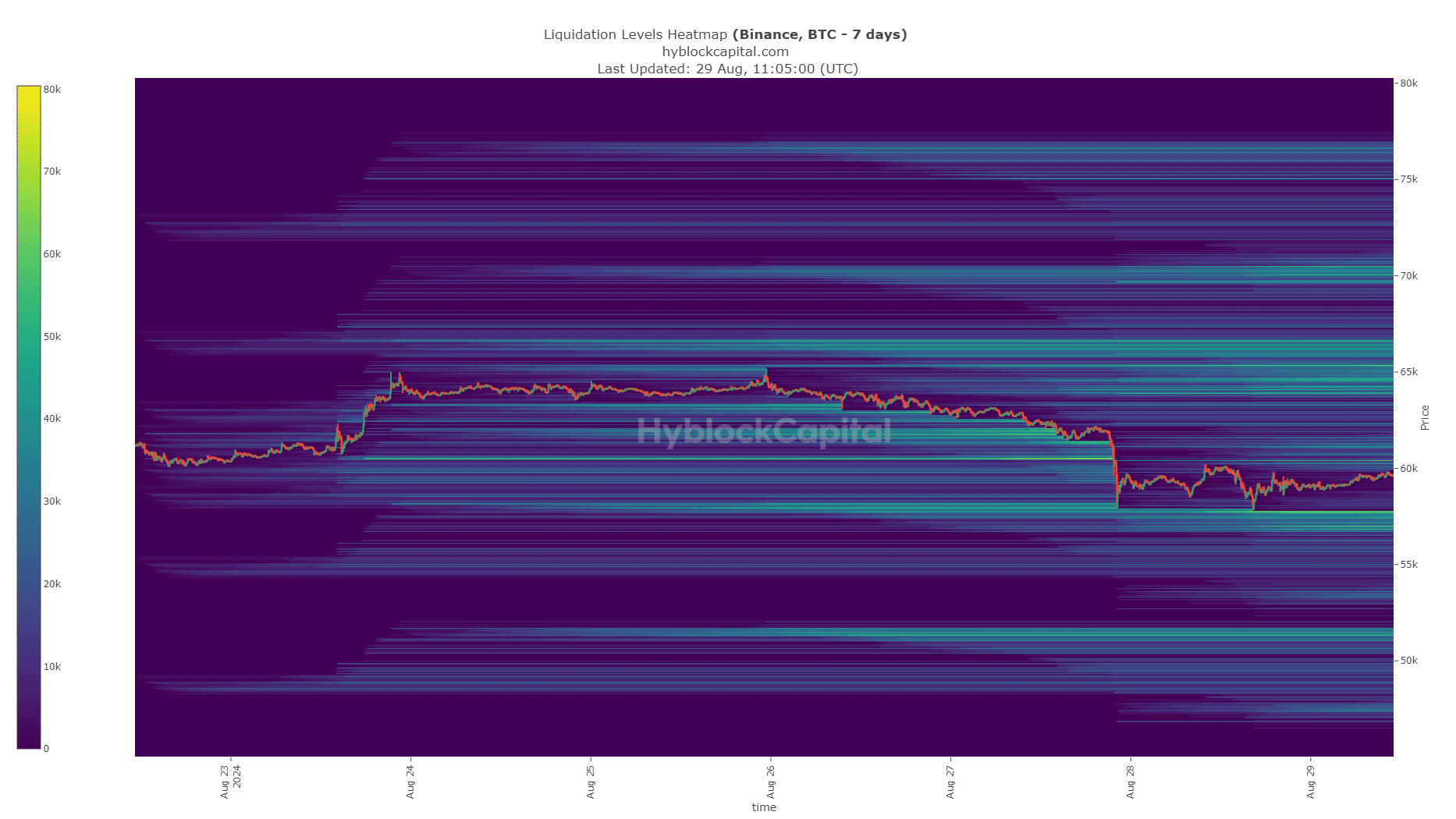

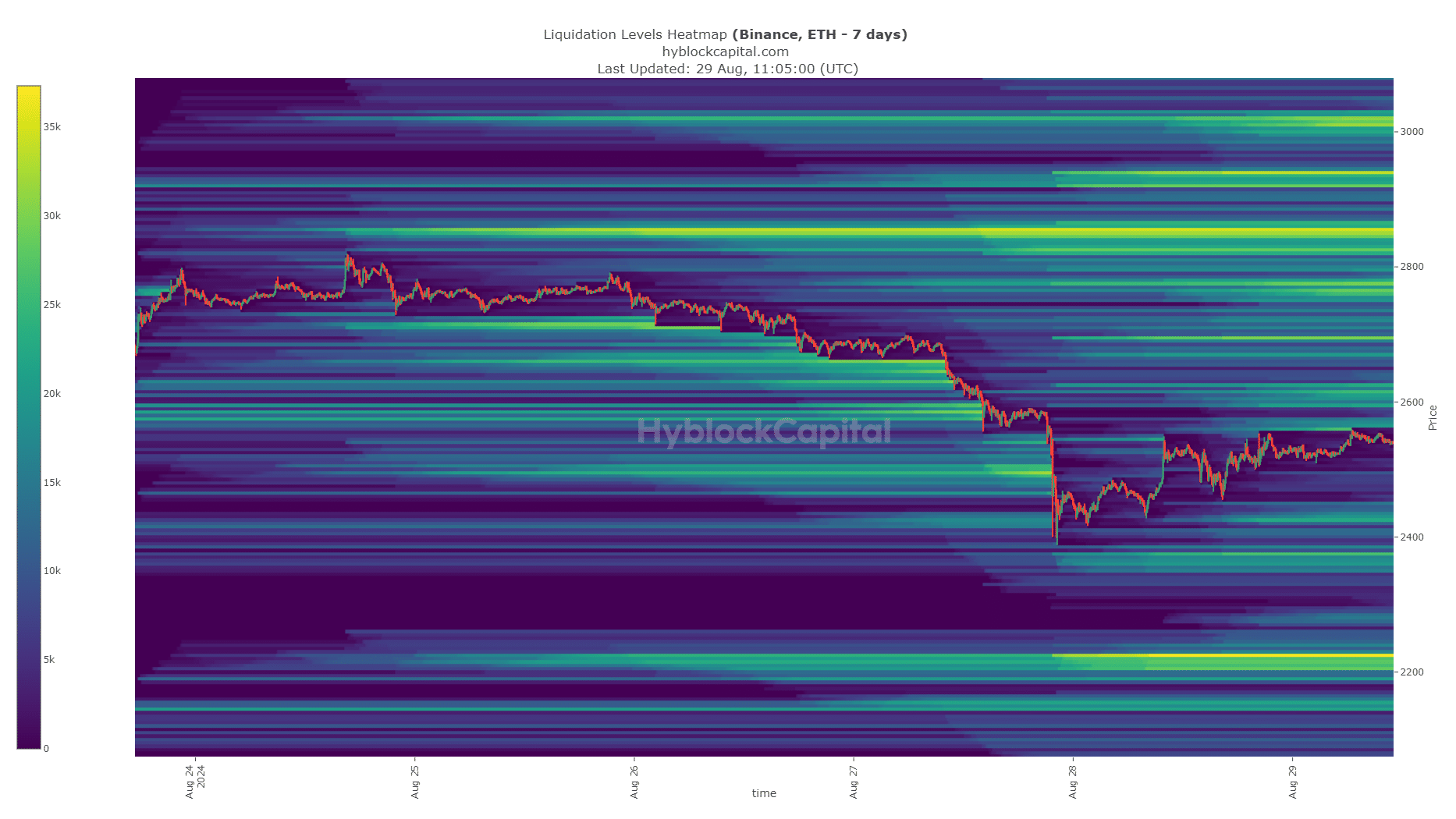

As Bitcoin and Ethereum are the dominant players among cryptocurrencies and their prices tend to move in sync with other significant altcoins, AMBCrypto chose to analyze their liquidation maps.

On the 27th of August, Bitcoin experienced a rapid drop, passing through several temporary market pockets, and eventually hitting the $58k support level. Since then, it has maintained its position, but it’s important to note that liquidity plays a crucial role in driving price fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simpler terms, the price of Ethereum encountered heavy concentration of sell orders (liquidation levels) at approximately $2490, yet Ethereum’s value kept falling and touched the level of $2415. At the moment, it seems to be moving towards the $2.6k area where a significant amount of buyers and sellers are waiting.

The primary reasons for the drop in cryptocurrency values are linked to liquidity conditions and overall market sentiment. This downturn resulted in significant liquidation losses worth millions of dollars, and it’s likely that the crypto market may experience a period of stability or consolidation during the coming days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-08-30 08:07